Modular Data Center Market Size, Share, Trends, Industry Analysis Report

: By Component (Solutions and Services), Enterprise Size, Form Factor, Build Type, Deployment Type, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 129

- Format: PDF

- Report ID: PM3084

- Base Year: 2024

- Historical Data: 2020-2023

Modular Data Center Market Overview

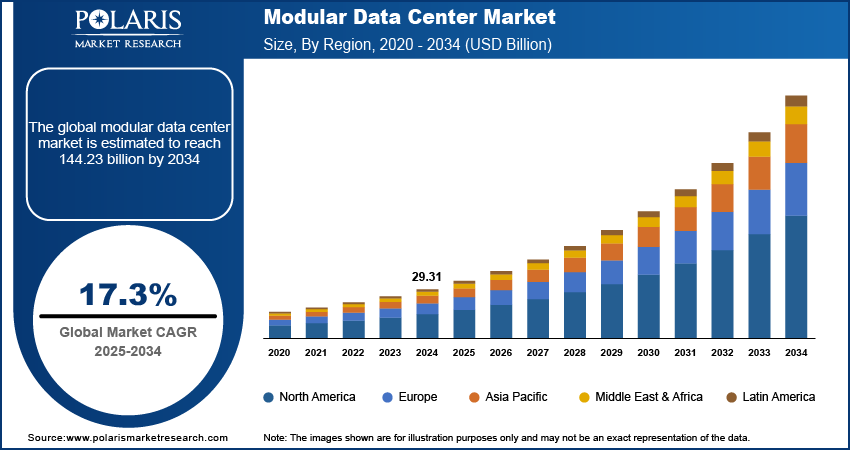

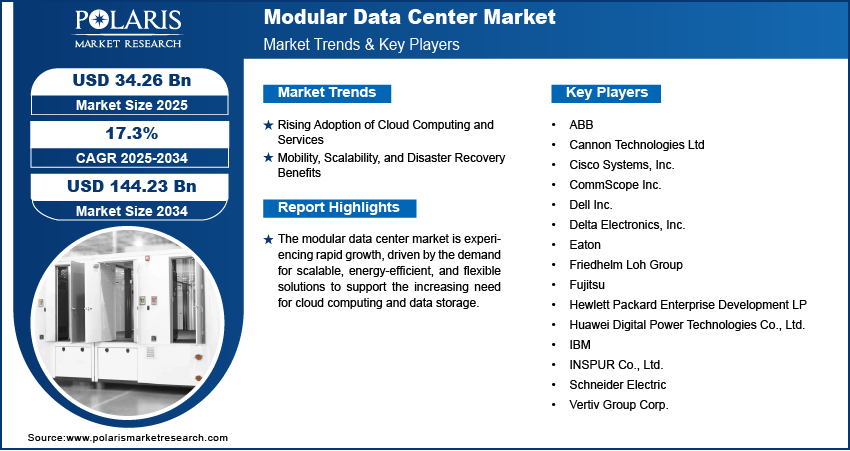

The global modular data center market was valued at USD 29.31 billion in 2024. It is expected to grow from USD 34.26 billion in 2025 to USD 144.23 billion by 2034, at a CAGR of 17.3% from 2025 to 2034.

A modular data center (MDC) is a portable data system made from prefabricated components, providing additional computing power wherever needed. The modular data center market focuses on prefabricated, portable facilities that are assembled on-site to meet growing demands for scalable, energy-efficient, and cost-effective data center solutions. These centers are designed for rapid deployment and consist of modular components, such as IT, power, and cooling modules. Modular data centers find applications across various sectors, including IT & telecom, healthcare, government, and BFSI.

The increasing adoption of edge computing is one of the key factors driving the modular data center market expansion. Organizations are shifting towards modular data centers to process data closer to its source, ensuring low latency and faster response times with the expansion of IoT and 5G networks. A report published by 5G Americas stated that global 5G connections reached nearly 2 billion in 2024, with 185 million new connections. Additionally, the demand for sustainable data centers is propelling innovation in modular solutions with advanced cooling technologies, energy-efficient designs, and renewable energy integration. For instance, in October 2024, Nautilus Data Technologies launched the EcoCore COOL Data Hall Cooling Distribution Unit. This system is specifically designed for AI-driven data centers, providing cooling solutions for entire data halls rather than relying on traditional in-row cooling systems. These combined factors contribute to the robust modular data center market growth and global expansion.

To Understand More About this Research: Request a Free Sample Report

Modular Data Center Market Dynamics

Rising Adoption of Cloud Computing and Services

The demand for data centers capable of handling high-performance workloads has surged, with businesses increasingly relocating their operations to the cloud to improve operational efficiency and reduce IT costs. Modular data centers are ideally suited for cloud environments, offering rapid deployment, cost-efficiency, and scalability. Governments and enterprises worldwide are investing in cloud infrastructure to support digital transformation initiatives. For instance, in May 2024, Microsoft announced an investment of USD 2.2 billion over the next four years to support Malaysia’s digital transformation, in collaboration with the Government of Malaysia, to build cloud and AI infrastructure. These investments significantly boost the modular data center market size. Additionally, multi-cloud strategies and hybrid cloud models require adaptable data center solutions that modular designs deliver efficiently. Moreover, the ability to expand capacity on-demand without disrupting operations solidifies the role of modular data centers in supporting cloud growth.

Mobility, Scalability, and Disaster Recovery Benefits

Organizations are increasingly facing challenges from natural disasters, cyberattacks, and growing data loads, necessitating resilient and flexible solutions. For instance, in January 2025, the WEF reported that generative AI is boosting cybercriminal capabilities, with 72% of organizations noting increased cyber risks. In 2024, phishing and social engineering attacks surged, affecting 42% of organizations, driven by GenAI-enabled refined and scalable threats. Modular data centers can be transported, deployed, and expanded quickly to ensure business continuity during emergencies or to meet surging data demands. Their prefabricated design allows seamless integration into existing IT ecosystems, minimizing downtime. These centers are widely used for disaster recovery operations due to their portability and ability to function as backup sites. This flexibility has made them a preferred choice for enterprises prioritizing operational resilience and future scalability. As a result, the inherent mobility, scalability, and disaster recovery capabilities of modular data centers make them indispensable for modern IT infrastructures and drive the modular data center market revenue.

Modular Data Center Market Segment Insights

Modular Data Center Market Assessment by Component Outlook

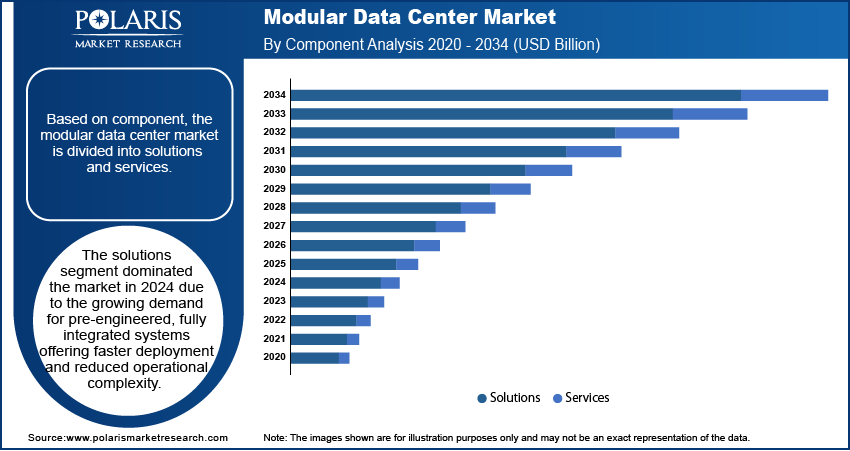

The global modular data center market segmentation, based on component, includes solutions and services. The solutions segment dominated the modular data center market in 2024 due to the growing demand for pre-engineered, fully integrated systems offering faster deployment and reduced operational complexity. Enterprises are increasingly adopting modular solutions due to their ability to address scalability needs while ensuring optimal performance for cloud, IoT, and edge computing applications. These solutions, including IT, power, and cooling modules, provide wide functionality tailored to diverse industry requirements, such as efficient cooling solutions, uninterrupted power supply, and others. Additionally, their ability to integrate advanced energy-efficient technologies and support high-density computing workloads contributed significantly to their dominance. The rising adoption of sustainable infrastructure has further strengthened the demand for modular solutions, making them a preferred choice globally.

Modular Data Center Market Evaluation by Deployment Type Outlook

The global modular data center market segmentation, based on deployment type, includes indoor and outdoor. The outdoor segment is expected to witness the fastest growth during the forecast period due to its suitability for edge computing and remote site operations. Outdoor modular data centers offer improved flexibility and are designed to resist harsh environmental conditions, making them ideal for industries such as telecom, energy, and defense. Their ability to reduce latency by being deployed closer to data sources aligns with the growing edge computing trend. Furthermore, advancements in thermal management technologies and sustainable cooling systems have made outdoor deployments more reliable and cost-effective. This capability to enable real-time data processing at remote or rugged locations positions the outdoor segment for accelerated growth.

Modular Data Center Market Regional Analysis

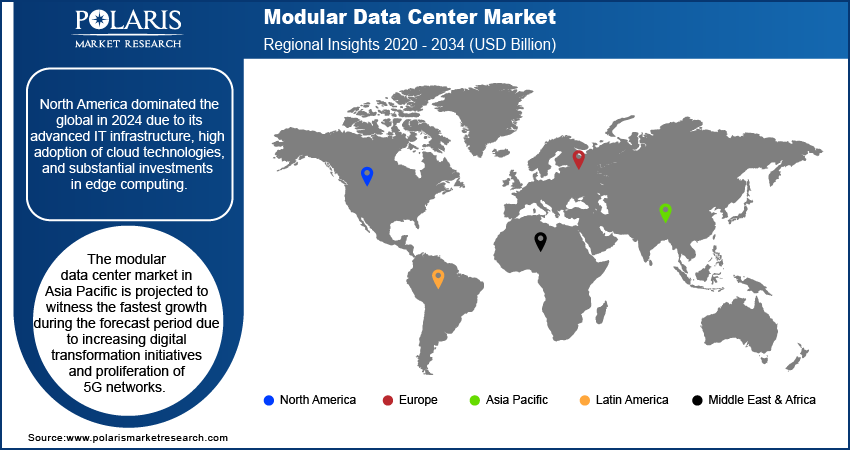

By region, the report provides the modular data center market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the modular data center market revenue in 2024 due to its advanced IT infrastructure, high adoption of cloud technologies, and substantial investments in edge computing. The presence of leading tech companies, such as Vantage Data Center, Amazon Web Services, and others, coupled with government initiatives to enhance data center efficiency, has driven market growth. For instance, in January 2024, Vantage Data Centers secured a USD 6.4 billion equity investment from DigitalBridge Group, raising total investments to USD 8 billion, enhancing its capacity to meet surging cloud and AI demands to deliver more than three gigawatts of additional data center capacity. Additionally, the region’s focus on sustainability and energy efficiency has accelerated the adoption of modular solutions equipped with renewable energy integrations. The expansion of 5G networks is strengthening the region's leadership by increasing the need for scalable and efficient data centers. For instance, according to 5G America, in 2024, 312 million 5G connections boosted demand for modular data centers.

The Asia Pacific modular data center market is projected to witness the fastest growth during the forecast period due to the increasing digital transformation initiative and proliferation of 5G networks. Countries such as China and India are heavily investing in data center infrastructure to support cloud computing and IoT applications. According to the Ministry of Commerce and Industry, India's data center sector has been rapidly expanding, with over 80 facilities and a capacity of 499 MW. It was projected to reach 1007 MW by 2023. Additionally, annual investments are expected to reach USD 4.6 billion by 2025. Government policies, such as India's Digital India initiative and China’s New Infrastructure Plan, have significantly boosted market growth. Additionally, the region’s growing e-commerce, fintech, and gaming industries demand scalable and low-latency data solutions, which modular data centers provide. Furthermore, rising investments in disaster-resilient infrastructure positions Asia Pacific for rapid growth in the global market.

Modular Data Center Market – Key Players and Competitive Insights

Major market players are investing heavily in research and development in order to expand their offerings, which will help the modular data center market grow even more. The market is highly competitive, with leading players focusing on innovation and strategic partnerships. Schneider Electric and Vertiv are leveraging sustainable technologies, while Huawei dominates with cost-effective modular solutions tailored for emerging markets. Collectively, these companies command significant market share through regional expansions and R&D investments.

Huawei is an international organization in information and communications technology (ICT) infrastructure and smart devices. The company's solutions cater to a user base of over three billion individuals worldwide, with a presence in over 170 countries and regions. Huawei's core business spans a wide range of products and services, including mobile network equipment, enterprise networking solutions, consumer devices, and cloud computing. The company's consumer business includes a diverse portfolio of smartphones, tablets, and wearables. Additionally, Huawei has developed its operating system, HarmonyOS, which has been deployed on over 220 million Huawei devices and has a growing ecosystem of over 2.2 million developers. In the enterprise and cloud computing space, Huawei offers a wide range of solutions, including cloud services, enterprise intelligence, and industry-specific applications. The company has established partnerships with over 2,000 cloud service providers and has deployed its cloud services in more than 170 countries and regions. Huawei provides modular data center solutions, including prefabricated facilities, intelligent cooling, power management, and high-speed networking. Its offerings ensure scalability, energy efficiency, and reliability for cloud, enterprise, and edge computing applications.

Cisco Systems, Inc. is a global technology leader specializing in networking hardware, software, and telecommunications equipment. Founded in 1984 and headquartered in San Jose, California, Cisco is renowned for its innovation in developing solutions that enable connectivity and digital transformation across various industries. The company’s core products and services include networking infrastructure, cybersecurity solutions, collaboration tools, and data center technologies. Cisco’s networking portfolio encompasses routers, switches, and wireless systems that form the backbone of modern Internet and enterprise networks. In addition to hardware, Cisco offers a range of software solutions for network management, security, and cloud computing. Their cybersecurity offerings are designed to protect against evolving threats, ensuring the integrity and privacy of data across networks. Cisco is also a key player in the realm of collaboration technology, providing tools such as WebEx for video conferencing and teleconsultation, which are integral to remote work and virtual meetings. The company's focus on innovation, combined with its broad product and service portfolio, positions Cisco as a pivotal player in shaping the future of networking and communications technology. Cisco Systems, Inc. offers modular data center solutions, including scalable networking, security, and cloud infrastructure. Its products enable efficient data management, automation, and high-performance computing for enterprise, cloud, and edge environments.

List of Key Companies in Modular Data Center Market

- ABB

- Cannon Technologies Ltd

- Cisco Systems, Inc.

- CommScope Inc.

- Dell Inc.

- Delta Electronics, Inc.

- Eaton

- Friedhelm Loh Group

- Fujitsu

- Hewlett Packard Enterprise Development LP

- Huawei Digital Power Technologies Co., Ltd.

- IBM

- INSPUR Co., Ltd.

- Schneider Electric

- Vertiv Group Corp.

Modular Data Center Industry Developments

January 2024: Digital Realty launched its MAA10 data center in Chennai to support emerging technologies such as AI. The facility features high-density power capabilities of up to 70 kilowatts per rack, along with tailored cooling and interconnectivity solutions.

March 2024: Eaton launched a new modular data center solution, which aims at decreasing the time and cost associated with deploying critical infrastructure.

Modular Data Center Market Segmentation

By Component Outlook (Revenue – USD Billion, 2020–2034)

- Solutions

- Services

By Enterprise Size Outlook (Revenue – USD Billion, 2020–2034)

- Large Enterprises

- Small and Medium Enterprises (SMEs)

By Form Factor Outlook (Revenue – USD Billion, 2020–2034)

- ISO Containers

- Skid-Mounted Systems

- Enclosures

By Build Type Outlook (Revenue – USD Billion, 2020–2034)

- Semi Prefabricated Data Centers

- Fully Fabricated Data Centers

- All-In-One Data Centers

By Deployment Type Outlook (Revenue – USD Billion, 2020–2034)

- Indoor

- Outdoor

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- BFSI

- Healthcare

- Retail & Consumer Goods

- Information Technology (IT) & Telecom

- Media & Entertainment

- Government & Defense

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Modular Data Center Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 29.31 billion |

|

Market Size Value in 2025 |

USD 34.26 billion |

|

Revenue Forecast by 2034 |

USD 144.23 billion |

|

CAGR |

17.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global modular data center market size was valued at USD 29.31 billion in 2024 and is projected to grow to USD 144.23 billion by 2034.

• The global market is projected to register a CAGR of 17.3% during the forecast period.

• North America dominated the modular data center market revenue in 2024.

• Some of the key players in the market are ABB; Cannon Technologies Ltd; Cisco Systems, Inc.; CommScope Inc.; Dell Inc.; Delta Electronics, Inc.; Eaton; Friedhelm Loh Group; Fujitsu; Hewlett Packard Enterprise Development LP; and Huawei Digital Power Technologies Co., Ltd

• The solutions segment dominated the market in 2024.