Modified Atmosphere Packaging Market Size, Share, Trends, Industry Analysis Report: By Packaging Material [Polyvinyl Chloride (PVC), Polyethylene (PE), Polypropylene (PP), and Others], Packaging Gas Type, Application, Machinery, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025-2034

- Published Date:Apr-2025

- Pages: 129

- Format: PDF

- Report ID: PM5542

- Base Year: 2024

- Historical Data: 2020-2023

Modified Atmosphere Packaging Market Overview

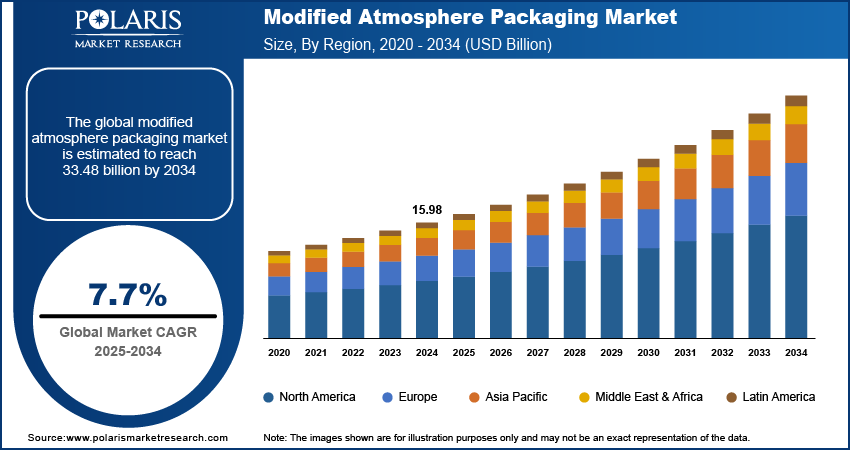

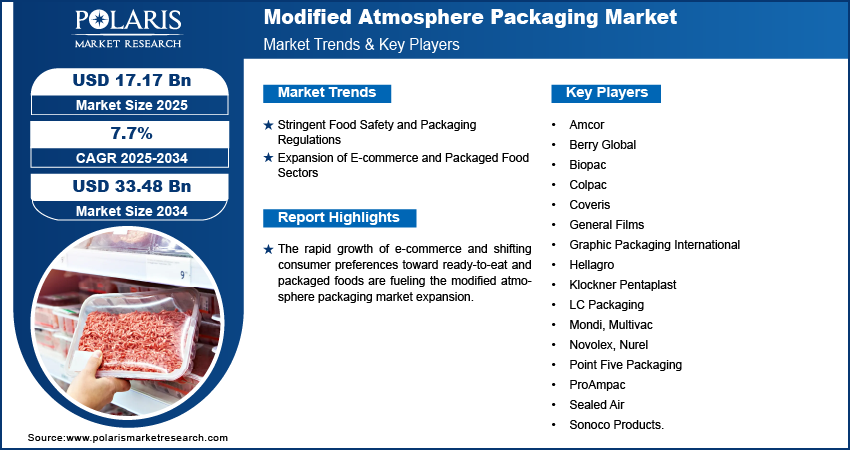

Modified atmosphere packaging market size was valued at USD 15.98 billion in 2024 and is expected to reach USD 17.17 billion by 2025 and USD 33.48 billion by 2034, exhibiting a CAGR of 7.7% during the forecast period.

The modified atmosphere packaging (MAP) market focuses on advanced packaging solutions that help extend the shelf life of perishable products such as food, beverages, and pharmaceuticals. This technology modifies the internal atmosphere of a package by controlling levels of oxygen, carbon dioxide, and nitrogen, which helps slow microbial growth, oxidation, and spoilage. By maintaining optimal gas composition, MAP ensures freshness, quality, and safety for longer periods, reducing food waste and improving product appeal.

The market is growing due to rising consumer demand for fresh, organic, and minimally processed foods. MAP enables food producers to avoid artificial preservatives while still maintaining shelf stability, making it an attractive choice for health-conscious consumers. Additionally, advancements in smart packaging materials and sustainability initiatives are further driving market expansion.

The modified atmosphere packaging (MAP) market is expanding due to continuous innovations in high-barrier films, smart packaging, and gas-flushing techniques. These advancements improve product stability, extend usability, and enhance food safety, making MAP a preferred choice for perishable goods. High-barrier films help regulate gas exchange, preventing moisture loss and oxidation, while smart packaging integrates sensors to monitor freshness and detect contamination.

The growing adoption of MAP in meat, seafood, and dairy packaging is a key market driver, as it helps prevent spoilage, discoloration, and microbial growth, ensuring longer shelf life and better product quality. With increasing consumer demand for fresh, natural, and preservative-free food, coupled with stringent food safety regulations, MAP technology is playing a crucial role in the global food packaging industry.

Modified Atmosphere Packaging (MAP) Market Dynamics

Stringent Food Safety and Packaging Regulations

Regulatory mandates focused on food safety, contamination prevention, and longer product shelf life are driving growth in the modified atmosphere packaging (MAP) market. Governments and food safety authorities worldwide are enforcing strict packaging regulations to minimize microbial contamination, improve traceability, and uphold hygiene standards. These regulations are pushing manufacturers to adopt advanced MAP technologies that preserve product quality while reducing the need for chemical preservatives. High-barrier films, antimicrobial packaging materials, and controlled gas compositions are becoming more popular as companies strive for compliance.

The demand for regulatory-compliant and sustainable packaging solutions is also encouraging innovation. Companies are introducing recyclable materials, biodegradable options, and advanced technologies such as lightweight MAP to enhance sustainability. In January 2025, Rottneros Packaging AB unveiled its NATURE range of eco-friendly food packaging trays at Packaging Innovations & Empack 2025. This initiative reflects the growing industry shift toward sustainable packaging that meets both environmental goals and consumer expectations.

Expansion of E-commerce and Packaged Food Sectors

The rapid growth of e-commerce and shifting consumer preferences toward ready-to-eat and packaged foods are fueling market growth. For instance, according to the government of Canada, grocery e-commerce saw robust annual retail sales growth of 26.4% from 2019 to 2023, reaching USD 206.8 billion. Online grocery platforms require advanced packaging solutions that preserve freshness, prevent spoilage, and ensure product quality throughout extended supply chains. MAP technology plays a crucial role in maintaining food integrity, extending shelf life, and reducing food waste. Increasing reliance on home delivery services, coupled with the globalization of food supply chains, is boosting modified atmosphere packaging market expansion.

MAP Market Segment Insights

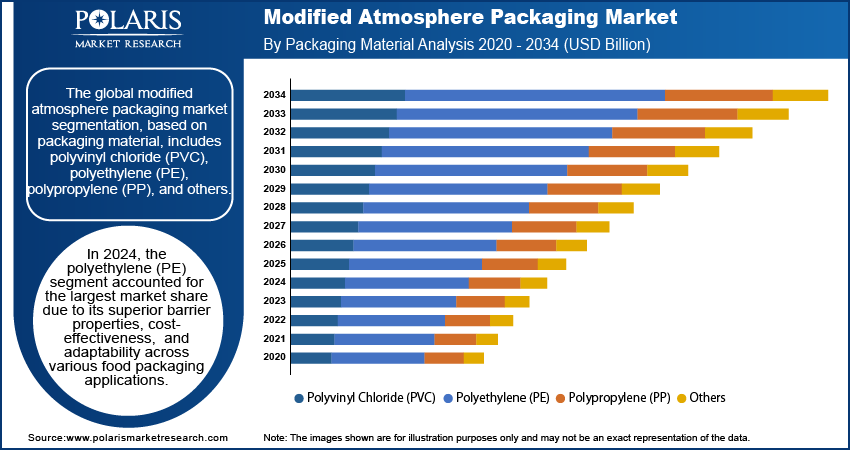

Modified Atmosphere Packaging Market Assessment by Packaging Material

The global modified atmosphere packaging market segmentation, based on packaging material, includes polyvinyl chloride (PVC), polyethylene (PE), polypropylene (PP), and others. In 2024, the polyethylene (PE) segment accounted for the largest market share due to its superior barrier properties, cost-effectiveness, and adaptability across various food packaging applications. The ability to maintain an optimal gas composition, preventing oxygen infiltration while preserving product freshness, is contributing to market expansion. Growing consumer demand for extended shelf-life food products, coupled with increasing regulatory compliance for food-grade materials, is boosting demand. Advancements in multilayer PE films and sustainable PE-based packaging solutions are positioning PE as the preferred choice for MAP applications.

The polyvinyl chloride (PVC) segment is also expected to witness the highest modified atmosphere packaging market CAGR over the forecast period due to its exceptional clarity, moisture resistance, and ability to create an effective modified atmosphere. Increasing adoption of high-barrier PVC films in perishable food packaging is driving segment growth, particularly in meat and dairy applications where extended freshness is crucial. Rising investments in flexible and rigid PVC packaging formats, alongside advancements in bio-PVC formulations, are supporting segment expansion. The demand for lightweight, recyclable, and cost-efficient MAP materials is accelerating innovation in PVC-based packaging.

Modified Atmosphere Packaging Market Evaluation by Application

The global modified atmosphere packaging market segmentation, based on application, includes fruits and vegetables; poultry, seafood, and meat; bakery and confectionery; and others. In 2024, the fruits and vegetables segment accounted for the largest market share due to the rising demand for fresh produce with extended shelf life. The ability of MAP to slow down respiration rates, reduce moisture loss, and maintain nutritional integrity is driving market demand in this segment. The rapid expansion of supermarkets, online grocery platforms, and fresh produce exports is further contributing to segment growth. Increasing investments in sustainable packaging solutions, including biodegradable films and intelligent MAP technologies, are ensuring long-term adoption in the fresh produce industry.

The bakery and confectionery segment is also expected to register significant growth over the forecast period due to the need for moisture-resistant, oxygen-barrier packaging that prevents spoilage and maintains product texture. Growing consumer preference for preservative-free baked goods is increasing market demand for MAP solutions that extend shelf life without artificial additives. The rise of premium bakery products, gluten-free alternatives, and global bakery exports is supporting segment expansion. Advances in active packaging technologies, including oxygen scavengers and antimicrobial films, are ensuring optimal preservation and distribution efficiency.

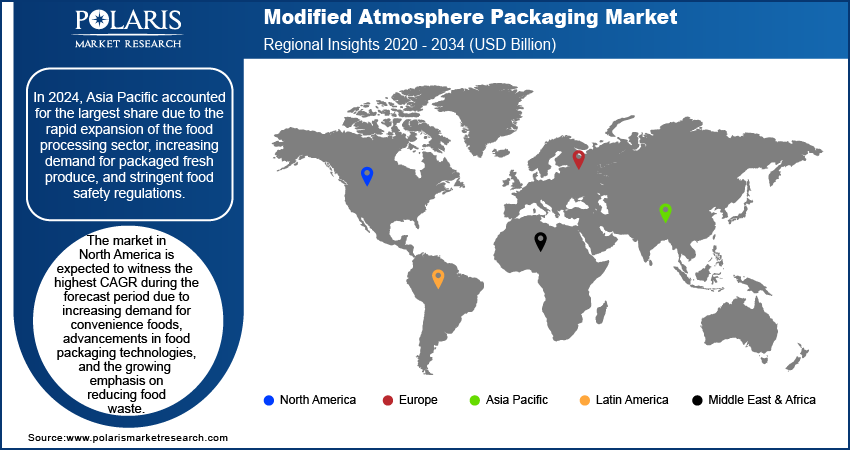

Modified Atmosphere Packaging Market Share by Regional Analysis

By region, the study provides modified atmosphere packaging market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, Asia Pacific accounted for the largest market share due to the rapid expansion of the food processing sector, increasing demand for packaged fresh produce, and stringent food safety regulations. Rising urbanization, coupled with evolving consumer preferences for minimally processed and longer shelf-life food products, is contributing to market growth in the region. The rise of modern retail formats, including supermarkets and online grocery platforms, is further driving demand. Investments in sustainable and biodegradable MAP solutions, particularly in countries such as China, India, and Japan, are reinforcing market’s dominant position in the region.

The modified atmosphere packaging market in North America is expected to witness the highest CAGR during the forecast period due to increasing demand for convenience foods, Advancements in food packaging technology and efforts to reduce food waste are driving the growth of the modified atmosphere packaging (MAP) market.

For example, in January 2025, StePacPPC introduced new modified atmosphere/modified humidity (MA/MH) packaging solutions that are improving the U.S. food service industry by reducing waste and increasing efficiency. In partnership with Windham Packaging Ltd., Inc. the company is helping to preserve food quality and extend shelf life, making food services more sustainable.

More consumers are choosing organic and clean-label products, and MAP helps keep food fresh without artificial preservatives. Smart packaging with sensors for real-time quality checks is also becoming popular. With strong regulations and more investments in sustainable and recyclable MAP materials, North America is emerging as a key market for growth.

Modified Atmosphere Packaging Key Market Players & Competitive Analysis Report

The competitive landscape features global leaders and regional players competing for modified atmosphere packaging market share through innovation, strategic partnerships, and regional expansion. Global players leverage advanced R&D capabilities, material science innovations, and automation-driven packaging technologies to deliver high-performance solutions, addressing the rising modified market demand for extended shelf-life, food safety, and sustainable packaging alternatives. Modified atmosphere packaging market trends indicate a surge in bio-based packaging films, smart packaging solutions with real-time freshness indicators, and advancements in gas-permeable films, driven by increasing consumer preference for preservative-free food, regulatory mandates for food safety, and the growth of the global food supply chain.

Strategic investments, mergers and acquisitions, and joint ventures remain pivotal, allowing firms to enhance their technological capabilities and broaden their market footprint. Post-merger integration and cross-industry collaborations are key strategies to improve competitive positioning and accelerate market growth. Competitive benchmarking involves market entry strategies, compliance with evolving food packaging regulations, and partnerships with food manufacturers, logistics providers, and retail chains to align with shifting modified atmosphere packaging market dynamics.

The market is witnessing rapid technological innovations such as recyclable multilayer films, active packaging that releases antimicrobial agents, and smart sensors that monitor gas composition inside packaging, reshaping market value and operational efficiencies. Companies are investing in biodegradable barrier materials, automation-driven packaging lines, and advanced gas-flushing techniques to meet growing modified atmosphere packaging market demand, industry trends, and sustainability goals. Pricing strategies, revenue growth analysis, and strategic intelligence remain critical for identifying long-term profitability and scalability opportunities in the market. Major players emphasize technological leadership, market penetration strategies, and regulatory adaptability, ensuring sustained market expansion in an increasingly competitive global ecosystem.

Amcor plc is engaged in the development and production of packaging solutions for various industries, including food, beverage, pharmaceutical, medical devices, and personal care. The company was founded in 1896 and headquartered in Zürich, Switzerland. The company specializes in flexible packaging, rigid containers, specialty cartons, closures, and related services. Amcor's product portfolio includes PET bottles, multi-layer films, and aluminum cans designed to meet diverse customer needs. The company operates globally with manufacturing facilities in over 40 countries. Amcor also plays a significant role in the modified atmosphere packaging (MAP) market, offering solutions that extend the shelf life of fresh produce by tailoring the internal atmosphere of packaging to match respiration rates. This technology helps preserve freshness and nutritional value while reducing food waste.

Berry Global Group Inc. is engaged in manufacturing and marketing plastic packaging products for industries such as healthcare, consumer goods, and industrial applications. The company was established in 1967 and headquartered in Evansville, Indiana. Berry Global specializes in engineered materials, consumer packaging, and health and hygiene products. The company portfolio includes aerosol caps, containers, films, and closures used by major brands worldwide. The company operates over 265 facilities across six continents. Berry Global is also active in the modified atmosphere packaging sector, providing solutions that enhance food safety and extend shelf life through advanced technologies that regulate the internal atmosphere of packaging for fresh produce and other perishable items.

Key Companies in Modified Atmosphere Packaging Market

- Amcor plc

- Berry Global

- Biopac

- Colpac

- Coveris

- General Films

- Graphic Packaging International

- Hellagro

- Klockner Pentaplast

- LC Packaging

- Mondi

- Multivac

- Novolex

- Nurel

- Point Five Packaging

- ProAmpac

- Sealed Air

- Sonoco Products.

Modified Atmosphere Packaging Market Developments

January 2025: Cirkla launched the world's first fiber MAP (Modified Atmosphere Packaging) trays, innovatively crafted from renewable plant-based materials, specifically utilizing sugarcane bagasse. This advancement enhances sustainability in packaging and also leverages the properties of natural fibers to improve product preservation and environmental impact.

April 2024: ProAmpac partnered with Sammi to launch a fiber-based modified atmosphere packaging (MAP) solution for sandwiches. This design enhances shelf life and minimizes food spoilage costs through advanced gas-flushing technology.

December 2022: BASF collaborated with StePac to innovate sustainable packaging solutions aimed at enhancing the shelf life of fresh produce. This partnership focuses on leveraging advanced materials and technologies to reduce spoilage and maintain freshness during transportation and storage, thereby contributing to a more sustainable supply chain in the fresh produce sector.

Modified Atmosphere Packaging Market Segmentation

By Packaging Material Outlook (Revenue USD Billion 2020 - 2034)

- Polyvinyl Chloride (PVC)

- Polyethylene (PE)

- Polypropylene (PP)

- Others

By Packaging Gas Type Outlook (Revenue USD Billion 2020 - 2034)

- Oxygen

- Nitrogen

- Carbon Dioxide

- Others

By Application Outlook (Revenue USD Billion 2020 - 2034)

· Fruits and vegetables

· Poultry, Seafood, and Meat

· Bakery and Confectionery

· Others

By Machinery Outlook (Revenue USD Billion 2020 - 2034)

- Tray-Sealing Machine

- Horizontal & Vertical Flow Packaging Machine

- Deep-Drawing Machine

- Vacuum Chamber Machine

- Bag-Sealing Machine

- Others

By Regional Outlook (Revenue USD Billion 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Modified Atmosphere Packaging Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 15.98 billion |

|

Market Size Value in 2025 |

USD 17.17 billion |

|

Revenue Forecast in 2034 |

USD 33.48 billion |

|

CAGR |

7.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD billion, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |