Mobility as a Service Market Share, Size, Trends, Industry Analysis Report, By Solution; By Service; By Transportation Type; By Payment Type; By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 116

- Format: PDF

- Report ID: PM4132

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

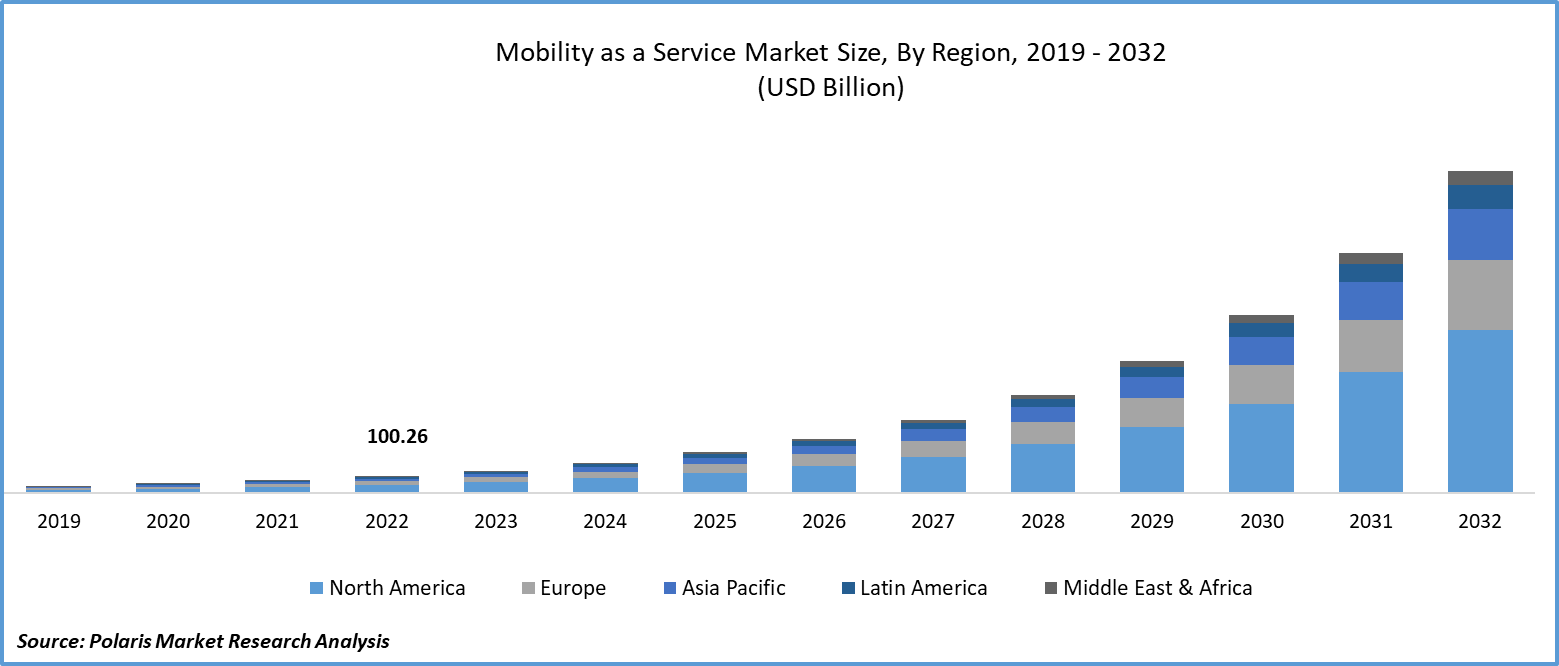

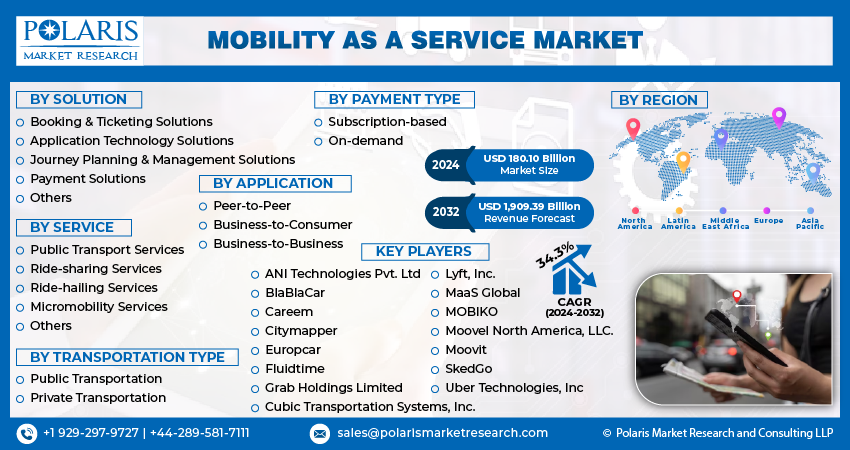

The global mobility as a service market was valued at USD 134.34 billion in 2023 and is expected to grow at a CAGR of 34.3% during the forecast period.

The evolution of mobile technology, data analytics, and smart city initiatives has facilitated the development of MaaS platforms. These technological advancements enhance the user experience by providing real-time information and streamlined services.

To Understand More About this Research: Request a Free Sample Report

Governments worldwide are supporting MaaS through funding, regulatory frameworks, and incentives. These initiatives promote the growth of MaaS by providing the necessary infrastructure and financial backing.

In addition, several companies are introducing new solutions to cater to the growing mobility as a service market demand.

- For instance, in November 2022, NTT DATA officially launched the beta edition of Mobicomma, a Mobility as a Service (MaaS) Solution tailored for tourists, and it is now accessible to the major car-sharing firm, Honda Mobility Solutions Co., Ltd.

Expanding the range of transportation modes within MaaS platforms broadens user choices and encourages higher adoption rates. This includes integrating options like micromobility, including scooters & bikes, and emerging modes of transport. Enhancing first-and-last-mile solutions bridges the gap between transit hubs and final destinations, making MaaS more comprehensive and attractive to users. MaaS platforms generate a wealth of data. Capitalizing on this data by offering insights and personalized services is expected to create new revenue streams for providers.

For Specific Research Requirements: Request for Customized Report

The post-COVID era has prompted changes in the mobility as a service market. MaaS providers have adapted by emphasizing hygiene and safety, offering contactless experiences, and aligning with changing commuting patterns influenced by remote work. Public transit is undergoing a revival with added safety measures. The pandemic accelerated digital transformation in transportation, benefiting MaaS platforms that offer contactless payment, mobile ticketing, and real-time updates. Sustainability and environmental concerns also drive the integration of eco-friendly transportation modes. Regulatory changes and flexible pricing models further shape the post-COVID MaaS landscape, fostering resilient, adaptable, and user-centric mobility solutions.

Growth Drivers

- Urbanization, traffic congestion, and environmental concerns are driving the market

Rapid urbanization is transforming the MaaS landscape. As more people move to cities, the demand for efficient, sustainable, and convenient mobility solutions escalates. MaaS addresses urban mobility challenges by offering integrated transportation options.

Rising traffic congestion in urban areas is a major driver. MaaS alleviates congestion by encouraging the use of shared and public transportation, ultimately reducing road congestion and improving overall traffic flow.

Growing environmental consciousness is a significant driver of MaaS adoption. Users are increasingly making eco-friendly transportation choices, aligning with MaaS's focus on sustainability and reduced carbon emissions.

Report Segmentation

The market is primarily segmented based on solution, service, transportation type, payment type, application, and region.

|

By Solution |

By Service |

By Transportation Type |

By Payment Type |

By Application |

By Region |

|

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Solution Analysis

- Application technology solutions segment accounted for a significant share in 2022

The application technology solutions segment accounted for a significant share in 2022. Central to MaaS, mobile applications empower users to seamlessly plan, book, and pay for various transportation services. These apps offer real-time data, enabling travelers to access information on service availability, traffic conditions, and estimated arrival times. Integrated payment methods provide secure and convenient transactions, while transparent pricing aids in cost-effective choices. The apps foster accessibility for all users and encourage eco-friendly travel options. Through data analytics, they continually optimize services and safeguard user data with robust security measures.

By Service Analysis

- Ride-hailing services segment accounted for a significant share in 2022

The ride-hailing services segment accounted for a significant share in 2022. They serve as on-demand, point-to-point transportation and play several key roles in MaaS. Ride-hailing services offer seamless first-and-last-mile solutions, bridging the gap between transit hubs and final destinations. MaaS platforms seamlessly integrate these services, enabling users to plan, book, and pay for rides alongside other transportation modes. They provide real-time travel information, accessibility for diverse user needs, and cost flexibility. Additionally, they encourage shared, eco-friendly options by offering ridesharing and pooling, contributing to sustainable urban mobility.

By Transportation Type Analysis

- Public transportation segment accounted for a significant share in 2022

The public transportation segment accounted for a significant share in 2022. Public transportation integrates diverse transportation modes into one user-centric platform. MaaS recognizes public transit, encompassing buses, trains, subways, and trams, as a fundamental element. It is a cost-effective and sustainable core mode, offering broad accessibility in urban areas. Integrated within MaaS platforms, public transit is seamlessly joined with other travel options like ride-sharing and bike-sharing. It facilitates last-mile connectivity, reduces traffic congestion, aligns with sustainability goals, and provides real-time data integration for users.

By Payment Type Analysis

- On-demand emerged as the largest segment in 2022

The on-demand emerged as the largest segment in 2022. On-demand payment refers to a flexible payment model where users are charged for transportation services based on their actual usage without requiring upfront commitments or fixed plans. This approach offers convenience, transparency, and control over transportation expenses. Typically conducted through digital platforms and mobile apps, on-demand payments are seamlessly integrated into MaaS systems, allowing users to access and pay for various transportation modes collectively. Pricing flexibility, sustainability incentives, and challenges related to security and standardization are notable aspects of on-demand payments, making them a user-centric and integral feature of integrated transportation solutions.

By Application Analysis

- Business-to-Consumer segment accounted for a significant share in 2022

The business-to-consumer segment accounted for a significant share in 2022. The business-to-consumer mobility as a service market is a sector within the transportation industry that focuses on providing consumers with integrated, user-centric mobility solutions. B2C MaaS platforms offer digital applications that allow individuals to seamlessly plan, book, and pay for a range of transportation services through one interface. These platforms typically include various modes of transport, such as public transit, ride-sharing, and bike rentals.

Regional Insights

- Asia-Pacific expected to experience significant growth during the forecast period

Asia-Pacific is expected to experience significant growth during the forecast period. The market showcases robust potential due to factors like rapid urbanization, population growth, and escalating traffic congestion. These challenges have heightened the demand for integrated, sustainable, and efficient transportation options. Governments across the Asia Pacific region have recognized MaaS as a solution for urban mobility issues. They are actively introducing policies and regulations to incentivize the development and adoption of MaaS platforms. Partnerships between public transportation agencies, private companies, and technology providers mark the MaaS ecosystem in Asia Pacific. These collaborations are aimed at creating seamless, multimodal transportation experiences that can address the diverse needs of urban commuters.

North America accounted for a considerable market share in 2022. The Mobility as a Service market in North America is dynamic, driven by urbanization and the need to combat traffic congestion. Innovative startups and established technology companies are offering integrated MaaS solutions, combining ride-sharing, public transit, micromobility, and more on digital platforms. Sustainability and environmental concerns are influencing MaaS adoption, with green transportation options gaining prominence.

Key Market Players & Competitive Insights

The mobility as a service sector exhibits a fragmented landscape, and competition is expected to intensify due to the active participation of numerous players. Prominent firms in this industry consistently introduce innovative strategies to bolster their market position. These key players prioritize strategies like forming partnerships and fostering collaborations to gain a competitive edge over their peers and establish a significant market presence.

Some of the major players operating in the global market include:

- ANI Technologies Pvt. Ltd

- BlaBlaCar

- Careem

- Citymapper

- Cubic Transportation Systems, Inc.

- Europcar

- Fluidtime

- Grab Holdings Limited

- Lyft, Inc.

- MaaS Global

- MOBIKO

- Moovel North America, LLC.

- Moovit

- SkedGo

- Uber Technologies, Inc

Recent Developments

- In March 2022, Tummoc revealed its expansion strategy, intending to extend its operations to an additional 10 cities, including Delhi and Mumbai, by the close of 2022. This proactive approach to bringing together Mobility as a Service (MaaS) providers in various Indian cities aligns with the nation's broader goals of embracing electric vehicle mobility solutions in the short term.

- In February 2020, Münchner Verkehrsgesellschaft (MVG), Munich's primary public transport provider, selected Trafi to launch a city-owned Mobility as a Service (MaaS) solution.

Mobility as a Service Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 180.10 billion |

|

Revenue forecast in 2032 |

USD 1,909.39 billion |

|

CAGR |

34.3% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019-2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Solution, By Service, By Transportation Type, By Payment Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The global mobility as a service market size is expected to reach USD 1,909.39 billion by 2032

Key players in the market are Grab Holdings Limited, ANI Technologies Pvt. Ltd, Moovit, Lyft, Inc

Asia-Pacific contribute notably towards the global Mobility as a Service Market

The global mobility as a service market is expected to grow at a CAGR of 34.3% during the forecast period.

The Mobility as a Service Market report covering key segments are solution, service, transportation type, payment type, application, and region.