Mobile Wallet Market Share, Size, Trends, Industry Analysis Report, By Technology (Remote, Proximity), By Application (Retail & E-commerce, Vending Machine, Banking, Hospitality & Transportation, Others), By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Jan-2024

- Pages: 116

- Format: PDF

- Report ID: PM4208

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

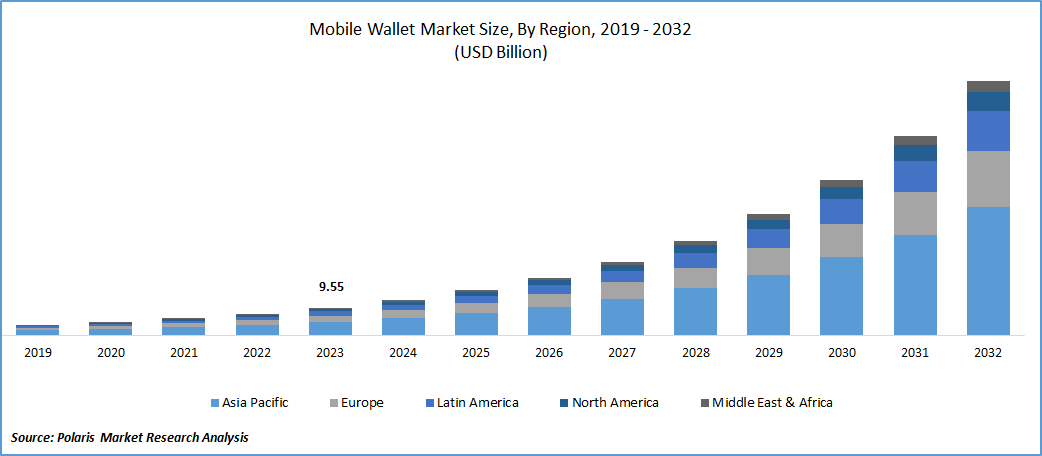

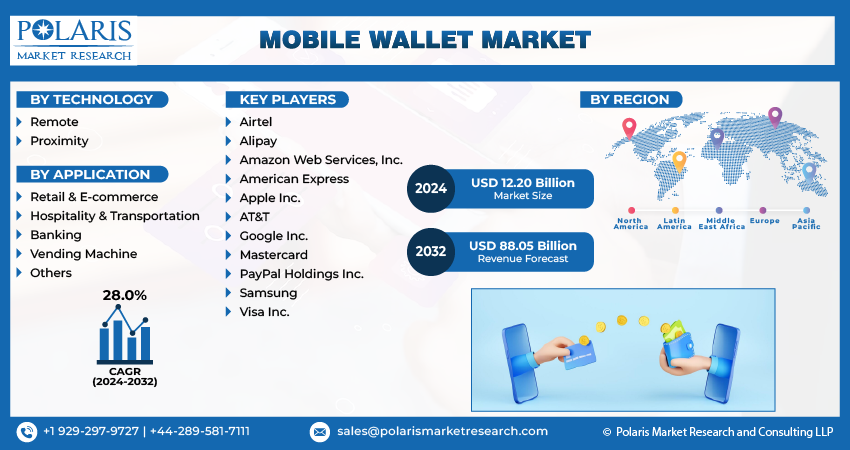

The global mobile wallet market was valued at USD 9.55 billion in 2023 and is expected to grow at a CAGR of 28.0% during the forecast period.

The mobile wallet market report details key market dynamics to help industry players align their business strategies with current and future trends. It examines technological advances and breakthroughs in the industry and their impact on the market presence. Furthermore, a detailed regional analysis of the industry at the local, national, and global levels has been provided.

This growth is primarily attributed to the widespread adoption of smartphones and increased internet penetration, coupled with the expansion of the e-commerce sector. A mobile wallet functions as an electronic wallet, enabling users to facilitate seamless payments using credit/debit cards or linked bank accounts while prioritizing the security of user data. These digital wallets offer a range of services, including mobile recharges, bill payments, movie, and travel bookings, as well as facilitating money transfers between different bank accounts. Essentially, mobile wallets provide a convenient and secure means for users to conduct various financial transactions through their mobile devices. The anticipated growth in this market reflects the increasing reliance on digital payment solutions in the modern landscape.

To Understand More About this Research: Request a Free Sample Report

COVID pandemic had a large impact on consumer behavior, particularly in the realm of commerce. With, social distancing & concerns about in-person transactions, there was a notable surge in digital transactions and mobile payments worldwide. This shift was instrumental in accelerating the growth of the e-commerce industry, attracting new customers, engaging additional firms, and expanding the range of products available online.

In response to government regulations and travel restrictions, many industry players found themselves compelled to temporarily close physical offices. This situation necessitated a significant shift in their operational strategies. One notable example is NICE, which, like many others, adapted to the circumstances by implementing work-from-home and hybrid working models. Additionally, measures such as restricting employee travel were put in place to ensure compliance with safety guidelines.

Despite the initial uncertainties and perceived risks posed by the pandemic, a noteworthy trend emerged. Contrary to expectations, several prominent market players experienced positive revenue growth during this challenging period. The shift towards remote and hybrid working models, along with increased reliance on digital solutions, likely played a role in this unexpected positive impact. This illustrates the adaptability and resilience of these industry players in navigating the changing business landscape brought about by the pandemic.

Industry Dynamics

Growth Drivers

Digitalization of Payment Methods

Governments and financial institutions worldwide are promoting digital payment methods to reduce the reliance on cash, leading to increased acceptance of mobile wallets. In the U.S., the Census Bureau's Annual Retail Trade Survey (ARTS) provided insights into the significant growth experienced by the e-commerce sector. In 2020, the first year of the pandemic, sales in e-commerce soared by an impressive 43%, amounting to a substantial USD 244.2 billion. This surge marked a substantial increase from USD 571.2 billion in 2019 to USD 815.4 billion in 2020. These figures underscore the rapid and substantial expansion of online retail activities during the pandemic.

E-commerce not only proved to be a resilient business model during challenging times but also became an essential channel for consumers to access a wide variety of products and services. The data from the Census Bureau's survey reflects the significant impact of the pandemic on reshaping the landscape of retail and commerce in the digital era.

Report Segmentation

The market is primarily segmented based on technology, application, and region.

|

By Technology |

By Application |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Technology Analysis

Proximity Segment Accounted for the Largest Market Share in 2023

Proximity segment accounted for the largest share. With proximity technology, users can utilize their mobile phones or smart devices to initiate payments when they are physically present at a retail location or any other place with a POS terminal. This form of payment typically involves close-range communication between the user's device and the terminal, often utilizing technologies such as Near Field Communication (NFC) or Bluetooth. The user simply brings their device close to the POS terminal, and the transaction is processed, offering a convenient and efficient way to make in-person payments without the need for physical cash or cards.

This method of payment aligns with the increasing trend of contactless transactions, providing a secure and swift way for consumers to complete purchases. The dominance of the proximity segment in revenue suggests the significant adoption and preference for these in-person, contactless payment methods within the market.

Remote segment will grow rapidly. This growth is attributed to the increasing prevalence of cashless payments facilitated by communication networks. In the context of mobile wallets, remote technology refers to a method where users can make purchases without physically being present at a point-of-sale terminal. The growth of remote technology is driven by the expanding adoption of cashless payment practices, where users leverage communication networks to conduct transactions. This mode of payment enhances convenience, as users can make purchases remotely, accessing goods or services with their mobile devices without the need for a physical card or cash.

By Application Analysis

Retail & E-Commerce Segment Held the Significant Market Share in 2023

Retail & e-commerce segment held the significant market share. Retailers, both in physical stores and online platforms, are recognizing the growing benefits of adopting mobile wallet payments. The integration of cashless and contactless payment technologies with digital marketing strategies presents an opportunity for retailers to access valuable consumer data and foster customer loyalty. By incorporating mobile wallet payments, retailers aim to enhance their understanding of consumer behaviors and preferences. This integration not only provides a seamless payment experience but also opens avenues for retailers to gather data on consumer spending patterns, enabling them to tailor promotions and offers more effectively.

Banking segment is expected to gain substantial growth rate. Financial institutions are likely leveraging mobile payment technologies to enhance their services, offering customers efficient and secure ways to manage their finances through digital platforms. This aligns with the broader trend of digital transformation within the banking industry. Through QR code systems, customers can scan codes on vending machines with their mobile devices to initiate payments. Wallet apps provide another avenue for seamless transactions, allowing users to make purchases directly from their mobile wallets.

Regional Insights

Asia Pacific Dominated the Global Market in 2023

The substantial growth is further propelled by government initiatives, such as Digital India and Make in India, which aim to boost the use of digital technologies. These initiatives are expected to contribute to increased smartphone and smart device penetration, consequently fostering a higher demand for mobile wallet market services. Moreover, including a burgeoning population, widespread adoption of smartphones, a growing number of internet subscribers, and the rapid expansion of the retail and e-commerce sectors.

Latin America will grow with substantial pace. This growth is driven by escalating penetration of smartphones, the surge in e-commerce activities, and a growing demand for convenience among consumers. Facilitating this growth, governments and financial institutions in Latin America are actively supporting the expansion of mobile wallets by establishing regulatory frameworks and developing necessary infrastructure.

Key Market Players & Competitive Insights

Prominent players in the industry are engaging in partnerships with payment service providers, vendors, & banks to enhance the necessary infrastructure, aiming to elevate the overall consumer experience. For instance, in July 2022 launch of Damen ePayment's mobile wallet app, developed in collaboration with the BKN301. It is a financial technology company specializing in the banking-as-a-service & payment services.

Some of the major players operating in the global market include:

- Airtel

- Alipay

- Amazon Web Services, Inc.

- American Express

- Apple Inc.

- AT&T

- Google Inc.

- Mastercard

- PayPal Holdings Inc.

- Samsung

- Visa Inc.

Recent Developments

- In June 2023, Google has unveiled plans to extend the availability of Google Wallet to 5 additional countries: Albania, Argentina, Bosnia & Herzegovina, North Macedonia, & Montenegro. This expansion was disclosed by a company representative in a forum post.

- In June 2023, in a collaborative effort, Alipay, & Mastercard, a global payments network, have joined forces to offer international tourists a convenient cashless payment option in China. Through this partnership, international tourists now have the flexibility to link any Mastercard card to their Alipay digital wallet, streamlining the process of making electronic payments within the China.

Mobile Wallet Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 12.20 billion |

|

Revenue forecast in 2032 |

USD 88.05 billion |

|

CAGR |

28.0% from 2024– 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Technology, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

Explore the market dynamics of the 2024 Mobile Wallet Market share, size, and revenue growth rate, meticulously examined in the insightful reports crafted by Polaris Market Rersearch Industry Reports. The analysis of Mobile Wallet Market extends to a comprehensive market forecast up to 2032, coupled with a retrospective examination. Avail yourself of a complimentary PDF download to sample this in-depth industry analysis.

Browse Our Bestselling Reports:

Lithium Titanate Oxide (LTO) Battery Market Size, Share Research Report

Mobility as a Service Market Size, Share Research Report

Oncology companion diagnostic market Size, Share Research Report

FAQ's

Technology, application, and region are the key segments in the Mobile Wallet Market.

The global mobile wallet market size is expected to reach USD 88.05 billion by 2032

The global mobile wallet market is expected to grow at a CAGR of 28.0% during the forecast period.

Asia Pacific regions is leading the global market.

Digitalization of Payment Methods are the key driving factors in Mobile Wallet Market.