Mobile Video Surveillance Market Share, Size, Trends, Industry Analysis Report, By Offering (Hardware, Software, and Service); By Application; By Vertical; By Region; Segment Forecast, 2023 - 2032

- Published Date:Jan-2023

- Pages: 115

- Format: PDF

- Report ID: PM2991

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

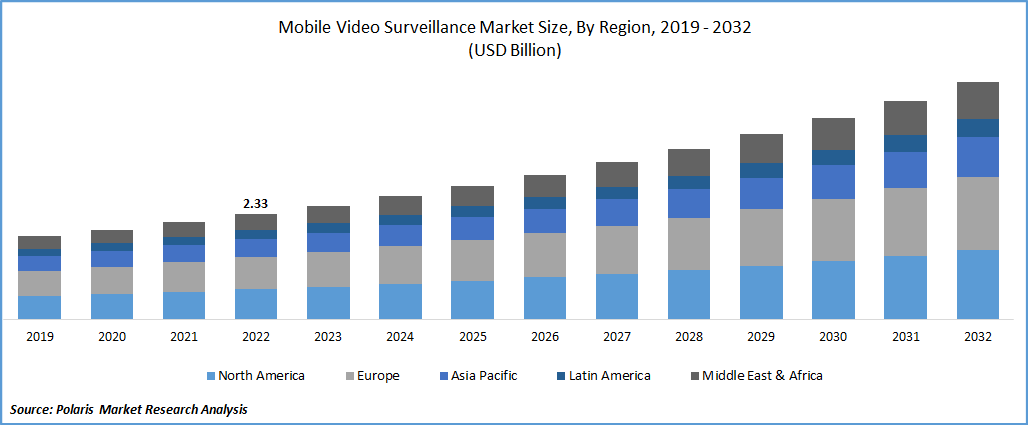

The global mobile video surveillance market was valued at USD 2.33 billion in 2022 and is expected to grow at a CAGR of 8.5% during the forecast period.

The increasing popularity of mobile video surveillance systems that allow video to be easily wirelessly streamed through a mobile video surveillance camera to a control center along with the high need for real-time access to surveillance data across the world are key major factors propelling the growth and demand of the global market. In addition, to offer and provide adequate security from fraud, theft, terrorism, and vandalism various government authorities and businesses are seeking highly adaptable and practical video surveillance technology that has led to rising innovations and new product launches by key companies and fueling the market growth.

Know more about this report: Request for sample pages

For instance, in February 2022, Hikvision announced the launch of its latest TandemVu PTZ camera range, which integrates multiple lenses and bullets in one single unit for providing the big picture and smaller details in tandem. The new range of cameras comes with 100% security coverage without any blind spots, extraordinary image performance, and PTZ and bullet capabilities for efficiency and cost savings.

Furthermore, rising awareness regarding the benefits of advanced video surveillance software including system health management, video content analysis, and retrieval of video information along with the undergoing evolutionary transitions in a variety of surveillance systems likely to create high market growth opportunities at a rapid pace over the coming years. However, increased privacy and security concerns associated with video data especially in wireless cameras, as video surveillance is often taken as a violation of privacy and people think that their personal information could be leaked or used for illegal purposes, are key factors expected to hamper the global market growth over the study period.

The outbreak of the COVID-19 pandemic has significantly impacted the growth of the market. The rapid emergence of the pandemic affected technological advancements and further reduced consumer demand. The supply chain was totally interrupted as a result of imposed lockdown and various other restrictions on trade activities across several countries. However, the market has started to recover slowly post-pandemic, and likely to get his previous positions in the next few years.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The extensive rise in the use of various advanced software analytics and artificial intelligence across mobile video monitoring solutions around the world is the primary factor expected to drive the growth and demand of the global market during the anticipated period. Intelligent mobile video surveillance systems have gained high popularity and becoming very crucial and in fact essential for upholding safety and security as well as the identification of trends and patterns. In addition, the growing number of smart city projects and digitalization of infrastructure especially in emerging economies like India, China, Indonesia, and South Korea, highly leverage networks of innovative intelligent cameras and sensors to organize system responses. Thus, the rapidly growing demand for these intelligent monitoring devices across the globe is also likely to positively impact the market for video surveillance systems in the coming years.

Report Segmentation

The market is primarily segmented based on offering, application, vertical, and region.

|

By Offering |

By Application |

By Vertical |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Hardware Segment Accounted for the Largest Market Share in 2022

The hardware segment accounted for a significant global market share in 2022 owing to the high utilization of video encoders, storage options, and cameras in mobile video surveillance systems. Moreover, with the increase in the shift towards IP cameras, a large number of hardware-based advancements have emerged, which further improve low-light performance, object tracking, and security. Many large market players are heavily investing in research & development activities to introduce innovative cameras and other surveillance products, which is also pushing segment market growth forward.

For instance, in May 2022, Hanwha Techwin, unveiled its new PNM-C12083RVD & PNM-C7083RVD, multi-directional cameras that come with AI capabilities. The new cameras are powered by AI-deep learning algorithms that reduce the occurrence of false alarms with the help of reliable object detection.

Drones Segment is Expected to Register the Highest Growth Rate

The drone segment is projected to grow at a considerable CAGR during the anticipated period, which is mainly accelerated by the easy deployment and integration of drones into a wide range of command, control, communications, intelligence, surveillance, and reconnaissance systems. Drones have very simple maintenance and operational procedures along with high tactical capabilities and they are capable of performing a spread of missions like mountain search and rescue, army support, intelligence missions, and illegal traffic monitoring, as result, drones are gaining high traction and contributing to market growth significantly.

Furthermore, the railway segment is anticipated to grow significantly with a healthy growth rate over the coming years. The growth of the segment market can be attributed to the continuously growing need to provide higher safety levels to passengers and goods and improvement in railway management systems. Additionally, increasing proliferation and demand for minimizing the risk and concerns related to uncertified access to platforms are also propelling market growth.

Transportation Segment Held the Largest Market Revenue Share in 2022

The transportation segment held the majority of the market share in terms of revenue in 2022 and is projected to retain its position throughout the projected period. Increase in the crime, harassment, vandalism, terrorism, and liability suits, and the growing necessity of providing surveillance for effective transportation around the world are key factors fueling the segment’s growth.

However, the commercial segment led the market for mobile video surveillance in 2022, which is mainly driven by a surge in the number of security concerns related to a variety of applications including companies, retail, financial institutes, and banks. As a result of security breaches like inventory loss, criminal activities, robbery, and illegal access, various industries have seen tremendous growth in the need for security solutions, in turn, the market for mobile video surveillance is growing rapidly.

Asia Pacific Region Dominated the Global Market in 2022

The Asia Pacific region was the leading region in the mobile video surveillance market in 2022 and is expected to maintain its dominance throughout the projected period. The increased population density in various major cities and high investments in smart city projects in countries like China, South Korea, and India coupled with the growing number of retail chains, small businesses, and favorable government initiatives are major reasons behind the market growth in the region. In addition, a rapid increase in smartphone penetration as a result of the easy availability of fast internet facilities in the region, is driving the demand and growth significantly.

North American region is projected to account for a prominent market share over the forecast period, on account of increasing demand for advanced surveillance cameras mainly from military & defense applications in countries like the United States and Canada. Moreover, the surge in the usage of surveillance cameras along both regional and international borders to get control of terrorist and criminal attacks will also propel the market in the near future.

Competitive Insight

Some of the major players operating in the global market include Dahua Technology, Axis Communications, Bosch Security and Safety Systems, Hanwha Techwin, Avigilon, Huawei Technologies, Rosco Vision, Wireless CCTV, Strops Technology, Ivideon, DTI Group, Agent Video Surveillance, Cisco Systems Inc., Advantech, Infinova and United Technologies, Pelco, Hikvision, and Eagle Eye Networks.

Recent Developments

In February 2022, Bosch Security & Safety Systems introduced its latest “MIC IP fusion 9000i 9 mm cameras” which offer the highest situational awareness for perimeter detection applications. This is developed with a 9-mm lens that provides an expanded thermal view of 360 degrees in just 30 seconds. It comes with a solid metal body with metallurgy and finishes that provide exceptional safety against corrosion.

Furthermore, in November 2022, Axis Communications announced its new partnership with SecuriThings, a leading IoTOps solution provider. With this partnership, both companies will focus on simplifying and improving the operational management of physical security and safety infrastructure.

Mobile Video Surveillance Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 2.52 billion |

|

Revenue forecast in 2032 |

USD 5.28 billion |

|

CAGR |

8.5% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Offering, By Application, By Vertical, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Dahua Technology, Axis Communications, Bosch Security and Safety Systems, Hanwha Techwin, Avigilon, Huawei Technologies, Rosco Vision, Wireless CCTV, Strops Technology, Ivideon, DTI Group, Agent Video Surveillance, Cisco Systems Inc., Advantech, Infinova and United Technologies, Pelco, Hikvision, and Eagle Eye Networks. |

FAQ's

key segments are offering, application, vertical, and region.

Mobile Video Surveillance Market Size Worth $5.28 Billion By 2032.

The global mobile video surveillance market expected to grow at a CAGR of 8.5% during the forecast period.

Asia Pacific is leading the global market.

key driving factors are Increase in hardware capabilities of mobile video cameras and Rising awareness regarding the benefits of advanced video surveillance software.