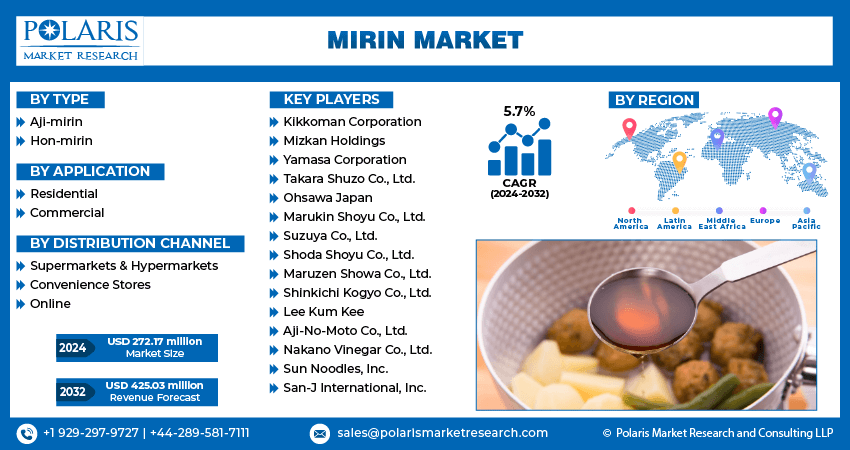

Mirin Market Size, Share, Trends, Industry Analysis Report: By Type (Aji-mirin and Hon-mirin), By Application (Residential and Commercial), By Distribution Channel, and By Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024–2032

- Published Date:Aug-2024

- Pages: 117

- Format: PDF

- Report ID: PM5031

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

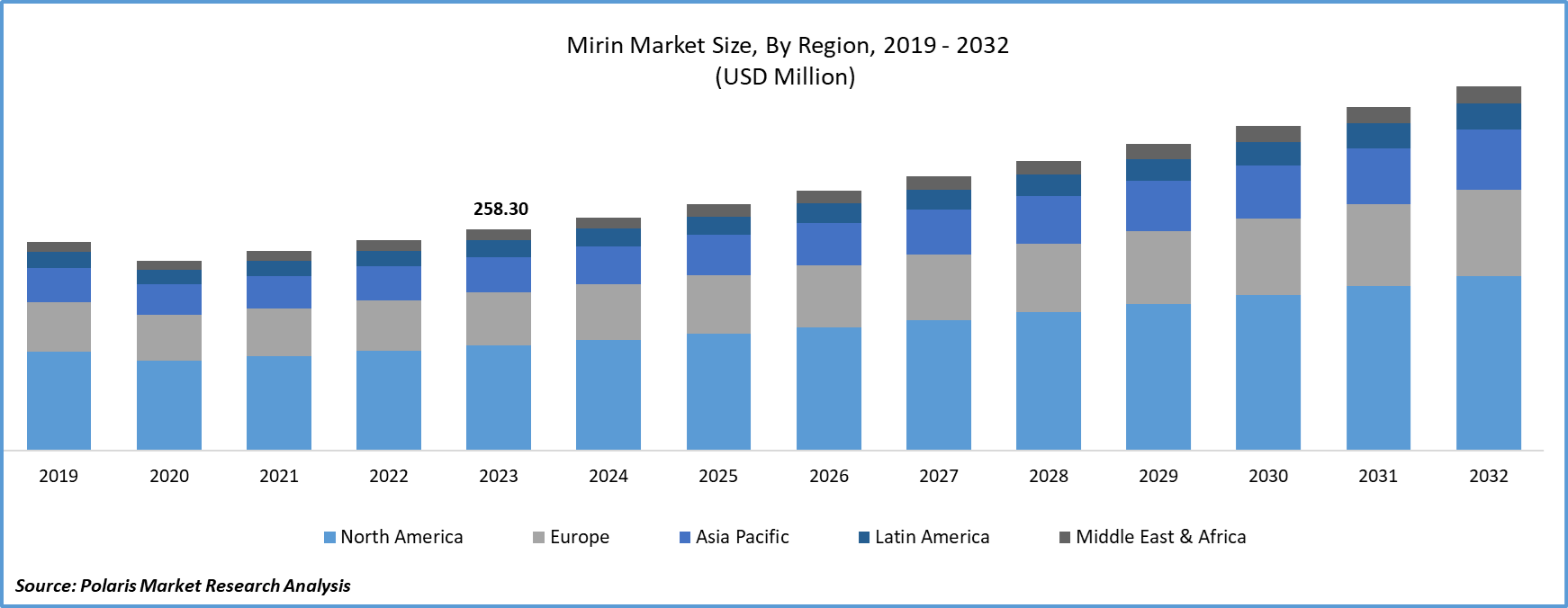

The global mirin market size was valued at USD 258.30 million in 2023. The market is projected to grow from USD 272.17 million in 2024 to USD 425.03 million by 2032, exhibiting a CAGR of 5.7% during forecast period.

The mirin market refers to the commercial sector involved in the production, distribution, and sale of mirin, a type of Japanese rice wine used primarily as a seasoning in cooking. Mirin is characterized by its sweet flavor and low alcohol content, which is achieved through the fermentation of glutinous rice and koji mold. It is a staple ingredient in Japanese cuisine, commonly used to enhance the flavor of sauces, glazes, and marinades.

The global mirin market is experiencing notable growth driven by increasing consumer interest in authentic Japanese cuisine and a rising preference for versatile cooking ingredients. Key drivers include the growing popularity of Asian culinary traditions, the expansion of Japanese restaurants and food products worldwide, and the surge in home cooking and gourmet food trends. Additionally, the shift of health-conscious consumers toward food made with natural and less processed ingredients propels the demand for mirin, a naturally fermented rice wine. Trends emerging in the market include innovations in mirin production, such as reduced-sugar and premium variants, and the expansion of distribution channels, including online grocery platforms and specialty stores.

To Understand More About this Research:Request a Free Sample Report

Mirin Market Trends

Rising Popularity of Asian Cuisine

Mirin is a key ingredient in Japanese cooking. It is gaining traction beyond its traditional use as culinary enthusiasts and home cooks across the world explore diverse flavor profiles. This trend is fueled by the growing presence of Japanese restaurants and food products in international markets and the proliferation of cooking shows and food blogs highlighting Asian recipes. The demand for authentic ingredients to recreate traditional dishes has led to an uptick in mirin consumption, as consumers seek to enhance their cooking with genuine flavors.

Expansion of Premium and Health-Conscious Varieties

There is a noticeable shift toward premium and health-conscious mirin varieties in the market. As consumers become more aware of their dietary choices, they are increasingly seeking products with natural ingredients and reduced sugar content. This trend is prompting manufacturers to innovate by offering high-quality, less processed mirin options that cater to health-conscious buyers. Premium mirin products often feature artisanal production methods and superior taste profiles, appealing to gourmet cooks and food enthusiasts who are willing to invest in high-end ingredients for their culinary creations.

Growth of E-Commerce and Specialty Distribution Channels

Online grocery platforms and specialty food stores are making mirin more accessible to consumers worldwide, particularly in regions where it was previously less available. The convenience of online shopping and the increasing variety of food products available through these channels are propelling mirin sales. Additionally, specialty stores that focus on international ingredients are catering to niche markets, further boosting the visibility and availability of mirin. This trend reflects a broader shift toward digital and diversified retail strategies in the food & beverages industry. Thus, the expansion of e-commerce and specialty distribution channels is expected to transform the global mirin market during the forecast period.

Mirin Market Segment Insights

Mirin Market – Type-Based Insights

The global mirin market, by type, is bifurcated into Aji-mirin and Hon-mirin. The Aji-mirin segment dominates the market due to its widespread availability, affordability, and suitability for a variety of culinary applications. Ajj-mirin, often referred to as "fake" or "sweetened" mirin, is commonly used in everyday cooking and processed foods, appealing to a broad consumer base. The Hon-mirin segment is experiencing a higher growth rate. Hon-mirin is the authentic, naturally brewed mirin. The segment benefits from increasing consumer demand for high-quality, natural ingredients and a growing interest in authentic Japanese cuisine. As health-conscious consumers seek premium and less processed options, demand for Hon-mirin is growing rapidly.

The Hon-mirin is the fastest-growing segment owing to rise in health awareness and the pursuit of genuine culinary experiences. Despite Aji-mirin's dominance in terms of volume due to its affordability and versatility, Hon-mirin's premium positioning and increasing consumer preference for authentic flavors and natural ingredients are accelerating its demand. The ongoing trend toward premium and artisanal food products supports the growth of Hon-mirin, while Aji-mirin remains prevalent in mainstream and cost-sensitive markets.

Mirin Market – Application-Based Insights

By application, the commercial segment dominates the global mirin market. Commercial use, encompassing restaurants, hotels, and foodservice establishments, drives a significant portion of mirin consumption due to its essential role in Japanese and Asian cuisine. The demand from these sectors is consistent, as mirin is a staple ingredient in many professional kitchens where it is used to enhance flavors in a wide range of dishes. This steady consumption in commercial settings ensures that the commercial segment maintains a leading position in the market.

The residential segment is experiencing a higher growth rate. The increasing interest in home cooking, particularly in authentic and international cuisines, is contributing to the rising demand for mirin in household application. As more consumers seek replicating restaurant-style dishes at home and explore new culinary experiences, the demand for mirin in residential kitchens is growing rapidly. This trend is supported by the expansion of e-commerce platforms and specialty food retailers, which make it easier for home cooks to access high-quality mirin products. The growing preference for home-cooked meals and gourmet ingredients is driving the mirin market growth for the residential segment.

Mirin Market – Distribution Channel-Based Insights

In terms of distribution channel, the supermarkets and hypermarkets segment dominates the global mirin market. These retail formats offer a broad selection of food products, including mirin, making them a primary shopping destination for consumers seeking convenience and variety. The extensive reach and established infrastructure of supermarkets and hypermarkets ensure high visibility and accessibility of mirin, solidifying their leading position in the market.

The online distribution channel segment is experiencing the highest growth owing to the rising adoption of e-commerce and the increasing preference for online grocery shopping. Consumers are increasingly turning to online shopping as these retail platforms offer the convenience of home delivery and the availability of a wider range of mirin products, including specialty and premium varieties. The growth of online retail is further supported by advancements in digital payment methods and the expansion of delivery services, making it easier for consumers to purchase mirin from the comfort of their homes. This shift toward online shopping is rapidly gaining traction, positioning it as the fastest-growing segment in the distribution landscape.

Global Mirin Market, Segmental Coverage, 2019 - 2032 (USD Million)

Secondary Research, Primary Research, PMR Database and Analyst Review

Mirin Market – Regional Insights

By region, the study provides the market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In the global mirin market, Asia Pacific is the dominant region, primarily due to its cultural affinity for Japanese cuisine and the high consumption rates of mirin in countries such as Japan, China, and South Korea. The region's strong culinary traditions and the prevalence of Japanese restaurants and food products contribute significantly to its leading position. Additionally, the growing popularity of Asian cuisine worldwide, coupled with the expansion of foodservice sectors and increased interest in authentic cooking ingredients, further bolsters the Asia Pacific's dominance. The region’s established supply chain, extensive market knowledge, and high consumer demand for traditional and premium mirin products solidify its leading role in the global market.

In Europe, the mirin market is experiencing steady growth, driven by increasing interest in Asian cuisine and the expanding presence of Japanese restaurants. While mirin is not traditionally used in European cooking, its adoption is rising as consumers and chefs in the region seek to diversify their culinary experiences. The growth is supported by the rising trend of gourmet cooking and international food flavors. Key markets in Europe include the UK, Germany, and France, where the growing number of Asian food enthusiasts and specialty stores is driving demand. The European market is also reporting an increase in online sales channels, which provide easier access to mirin and other international ingredients.

Global Mirin Market, Regional Coverage, 2019 - 2032 (USD Million)

Secondary Research, Primary Research, PMR Database and Analyst Review

Mirin Market – Key Market Players and Competitive Insights

Kikkoman Corporation; Mizkan Holdings; Yamasa Corporation; and Takara Shuzo Co., Ltd. are a few of the key players in the global mirin market. These companies are well-established in the production of traditional and authentic mirin. Other notable players include Ohsawa Japan; Marukin Shoyu Co., Ltd.; and Suzuya Co., Ltd., which contribute to the market with a variety of mirin products. Additionally, companies such as Shoda Shoyu Co., Ltd.; Maruzen Showa Co., Ltd.; and Shinkichi Kogyo Co., Ltd. are significant contributors. International brands, including Lee Kum Kee and Aji-No-Moto Co., Ltd., also offer mirin among their diverse product ranges. Players such as Nakano Vinegar Co., Ltd. and Sun Noodles, Inc. further enhance market diversity.

The competitive landscape of the global mirin market is characterized by a mix of traditional producers and emerging players focusing on premium and specialty products. Established companies such as Kikkoman and Mizkan leverage their extensive distribution networks and brand reputation to maintain market dominance. These players often emphasize product authenticity and quality to appeal to traditional and modern consumers. On the other hand, entrants and regional brands are capturing niche markets by offering unique formulations or catering to specific dietary preferences, such as low-sugar or organic mirin.

The mirin market is witnessing increasing competition due to the growing consumer demand for authentic and premium ingredients, prompting companies to innovate and diversify their product offerings. This includes expanding into online sales channels to reach a broader audience and exploring new distribution methods to enhance market reach. Additionally, the focus on health and wellness is driving players to develop mirin variants that align with modern dietary trends. The competitive dynamics are shaped by these factors, leading to a vibrant market with continuous product development and strategic market positioning.

Kikkoman Corporation is a major player in the global mirin market, renowned for its extensive range of soy sauce and seasoning products, including mirin. Established in 1917 in Japan, the company has built a strong global presence with its commitment to quality and authentic flavors. Its mirin products are widely used in commercial and residential kitchens, benefiting from its robust distribution network and brand reputation. Kikkoman’s focus on maintaining high production standards and expanding its international footprint helps it stay competitive in the global market.

Mizkan Holdings is another major player in the global mirin market, known for its diverse portfolio of culinary products. Founded in 1804, it is a well-established Japanese company that offers a variety of seasonings, vinegars, and sauces, including mirin. Its strong emphasis on quality and innovation has established it as a key player in domestic and international markets. Mizkan’s extensive product range and strategic acquisitions have driven its position in the global food industry.

Key Companies in Mirin Market

- Kikkoman Corporation

- Mizkan Holdings

- Yamasa Corporation

- Takara Shuzo Co., Ltd.

- Ohsawa Japan

- Marukin Shoyu Co., Ltd.

- Suzuya Co., Ltd.

- Shoda Shoyu Co., Ltd.

- Maruzen Showa Co., Ltd.

- Shinkichi Kogyo Co., Ltd.

- Lee Kum Kee

- Aji-No-Moto Co., Ltd.

- Nakano Vinegar Co., Ltd.

- Sun Noodles, Inc.

- San-J International, Inc.

Mirin Industry Developments

- In June 2024, Kikkoman announced a new initiative to expand its mirin product line with a focus on organic and low-sugar options. This move aligns with the growing consumer demand for healthier and more natural ingredients and aims to capture a larger share of the premium mirin market.

- In February 2024, Sung Si-Kyung introduced a new liquor brand named "Kyung," debuting with its initial product, "Kyungtakju," a type of makgeolli (Korean rice wine). This makgeolli stands out with an alcohol content of 12%, which is notably higher than the usual 6-9% found in most commercially available makgeolli.

Mirin Market Segmentation:

Mirin Outlook, by Type

- Aji-mirin

- Hon-mirin

Mirin Outlook, by Application

- Residential

- Commercial

Mirin Outlook, by Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Online

Mirin Outlook, by Region

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Mirin Market Report Scope:

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 258.30 million |

|

Market size value in 2024 |

USD 272.17 million |

|

Revenue forecast in 2032 |

USD 425.03 million |

|

CAGR |

5.7% from 2024 to 2032 |

|

Base year |

2023 |

|

Historical data |

2019–2022 |

|

Forecast period |

2024–2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Report coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive landscape |

Mirin Market Share Analysis (2023) Company Profiles/Industry participants profiling includes company overview, financial information, product/service benchmarking, and recent developments |

|

Report format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

How the report is valuable for an organization?

Workflow/Innovation Strategy: The mirin market has been broadly segmented on the basis of types, applications, and distribution channel. Moreover, the study provides the reader with a detailed understanding of these segments at regional and global level.

Growth/Marketing Strategy: Companies are leveraging digital marketing and e-commerce platforms to reach a broader audience and cater to the rising interest in Asian cuisine and gourmet cooking. They are also investing in product innovation, including premium and health-conscious variants, to meet evolving consumer preferences. Strategic partnerships with international retailers and foodservice providers are enhancing market reach, while targeted promotions and educational campaigns are designed to introduce mirin to new markets and boost consumption. Additionally, firms are emphasizing sustainability and authenticity to appeal to discerning consumers and differentiate their products in a competitive landscape.

FAQ's

The global mirin market size was valued at USD 468.3 million in 2023 and is projected to grow to USD 810.1 million by 2032.

The global market is projected to register a CAGR of 5.70% during 2023–2032.

Asia Pacific held the largest share of the global market.

Kikkoman Corporation; Mizkan Holdings; Yamasa Corporation; and Takara Shuzo Co., Ltd. are among the key players in the global mirin market.

The hon-miring segment dominated the market in 2023.

The commercial segment held a larger share of the global market.

Mirin is a sweet, low-alcohol Japanese rice wine used as a seasoning and cooking ingredient. It is traditionally made with glutinous rice, kome koji (a type of mold), and shochu (a distilled spirit). Mirin adds a unique flavor to dishes, with a slightly sweet and umami-rich taste that enhances the overall profile of savory foods.

A few key trends in the mirin market are described below: Rising Popularity of Asian Cuisine: Increased interest in Japanese and other Asian culinary traditions is driving demand for mirin. Health-Conscious Consumer Shift: Growing demand for natural and less processed ingredients is leading to the rise of premium and low-sugar mirin variants. Growth in Adoption of E-Commerce Platforms: Expansion of online grocery shopping and digital platforms is enhancing consumer access to mirin. Premium Product Innovations: Development of high-quality, artisanal mirin products is catering to gourmet and health-conscious markets.

New company entering the mirin market must focus on offering premium and health-conscious variants. This strategy could provide a competitive edge. By developing organic, low-sugar, or specialty mirin options, the company can appeal to the growing segment of health-conscious and gourmet consumers. Investing in innovative marketing strategies and leveraging e-commerce platforms will help in reaching a broader audience and establishing a strong brand presence. Additionally, emphasizing sustainability in production and packaging can resonate with environmentally-conscious consumers. Building strategic partnerships with international retailers and foodservice providers can also enhance market penetration and visibility.

Companies producing mirin and related cuisine products, firms distributing mirin, and other consulting firms must buy this report.