Mining Lubricants Market Size, Share, Trends, Industry Analysis Report: By Product Type, Lubricant Type (Mineral Oil, Synthetic Lubricants, and Bio-Based Mining Lubricants), End-Use Industry, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 129

- Format: PDF

- Report ID: PM5497

- Base Year: 2024

- Historical Data: 2020-2023

Mining Lubricants Market Overview

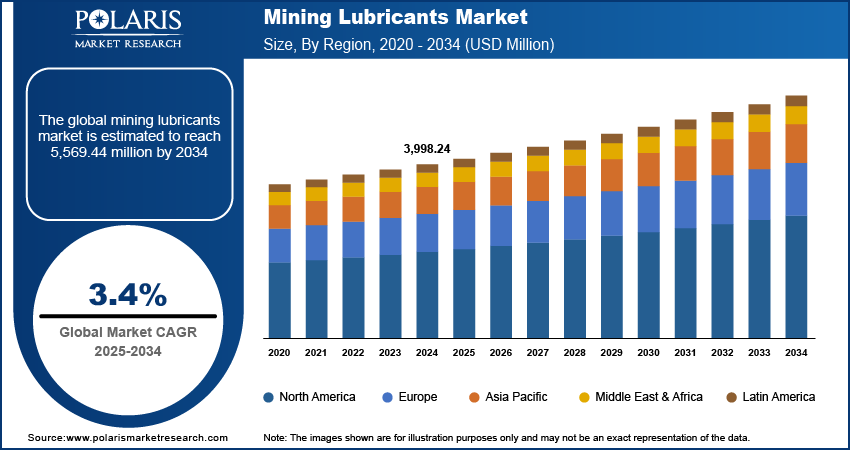

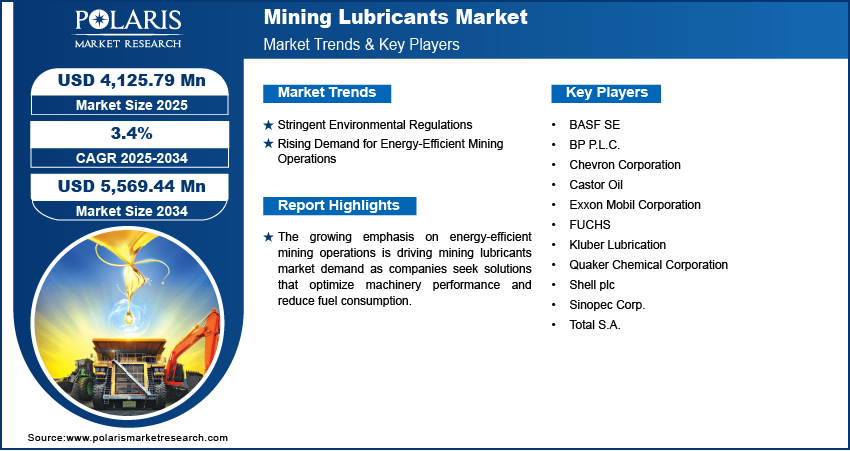

The global mining lubricants market size was valued at USD 3,998.24 million in 2024 and is expected to reach USD 4,125.79 million by 2025 and USD 5,569.44 million by 2034, exhibiting a CAGR of 3.4% during 2025–2034.

The mining lubricants market comprises specialized lubricants designed to enhance the performance, efficiency, and longevity of heavy mining equipment and machinery. These lubricants reduce friction, wear, and corrosion, ensuring optimal operation in extreme conditions such as high loads, varying temperatures, and harsh environmental factors. The market includes engine oils, transmission fluids, hydraulic fluids, and greases used in mining activities such as extraction, processing, and transportation of minerals.

Rising global demand for minerals and metals, driven by industrialization and infrastructure development, is fueling mining lubricants market demand. Increasing extraction activities in remote and high-risk environments require advanced lubrication solutions to ensure uninterrupted operations.

To Understand More About this Research: Request a Free Sample Report

The development of synthetic and bio-based lubricants with superior viscosity, thermal stability, and wear resistance is driving the mining lubricants market expansion. Advanced formulations improve equipment efficiency, reduce maintenance costs, enhance sustainability, and meet evolving industry needs. Additionally, the growing focus on predictive maintenance and asset optimization is propelling the market demand. High-performance lubricants play a crucial role in extending equipment lifespan, minimizing downtime, and reducing overall operational costs.

Mining Lubricants Market Dynamics

Stringent Environmental Regulations

Stringent environmental regulations are contributing to mining lubricants market growth by driving the adoption of low-emission and biodegradable lubrication solutions. Governments and regulatory agencies, including the EPA and EU environmental directives, are imposing strict limits on hazardous emissions and non-biodegradable waste, compelling mining companies to transition toward eco-friendly lubricants. In April 2024, the US Environmental Protection Agency finalized a comprehensive set of regulations aimed at mitigating emissions from fossil fuel-fired power generation facilities. This regulatory shift is leading to increased demand for bio-based and high-performance synthetic lubricants that minimize environmental impact without compromising equipment efficiency. Lubricant manufacturers are investing in advanced formulations that meet stringent sustainability standards, ensuring compliance while enhancing equipment longevity. Thus, as regulatory scrutiny intensifies, the shift toward greener solutions is accelerating mining lubricants market expansion.

Rising Demand for Energy-Efficient Mining Operations

The growing emphasis on energy-efficient mining operations is driving mining lubricants market development as companies seek solutions that optimize machinery performance and reduce fuel consumption. High-performance lubricants reduce frictional losses, enhance thermal stability, and improve the efficiency of mining equipment, leading to lower energy costs and reduced carbon footprints. The adoption of synthetic and advanced mineral-based lubricants designed for extreme conditions is fueling market expansion as mining companies prioritize operational efficiency and sustainability. Integration of smart lubrication technologies, such as IoT-based predictive maintenance and automated lubrication systems, is minimizing downtime and maximizing asset utilization. The increasing focus on energy conservation and emission reduction is a key factor driving mining lubricants market growth, ensuring sustained industry advancements.

Mining Lubricants Market Segment Insights

Mining Lubricants Market Assessment by Lubricant Type Outlook

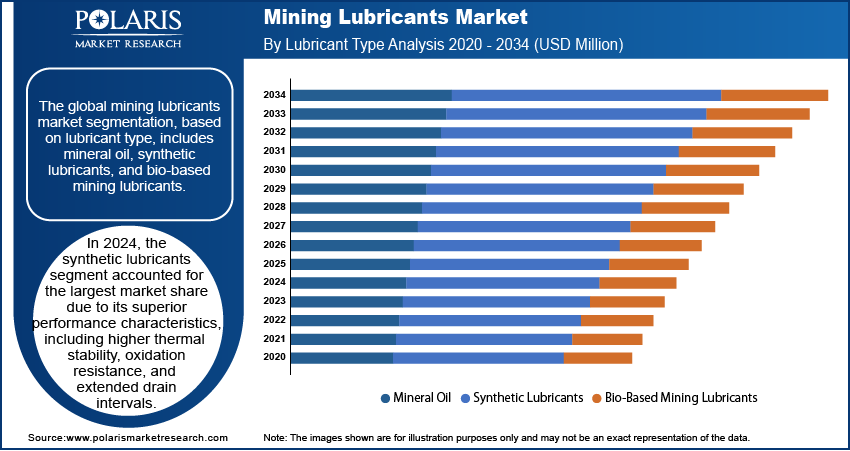

The global mining lubricants market segmentation, based on lubricant type, includes mineral oil, synthetic lubricants, and bio-based mining lubricants. In 2024, the synthetic lubricants segment accounted for the largest market share due to its superior performance characteristics, including higher thermal stability, oxidation resistance, and extended drain intervals. The increasing adoption of advanced mining equipment and automated machinery has highlighted the need for lubricants capable of withstanding extreme operating conditions. Synthetic lubricants offer enhanced protection against wear, friction, and temperature variations, contributing to market expansion by improving equipment lifespan and operational efficiency. Stringent environmental regulations promoting low-emission and biodegradable formulations have further accelerated synthetic lubricant adoption across large-scale mining operations.

The mineral oil segment is expected to register the highest CAGR during the forecast period due to its cost-effectiveness and widespread availability. Small- and medium-scale mining operations, particularly in emerging markets, continue to rely on mineral oils due to their affordability and ease of application. Advancements in additive technologies have enhanced the performance of mineral-based lubricants, improving viscosity stability and oxidation resistance. Expanding coal and metal mining industries in resource-rich regions are contributing to mineral oil segment expansion, with manufacturers focusing on innovative formulations to meet evolving industry standards while maintaining cost efficiency.

Mining Lubricants Market Evaluation by End-Use Industry Outlook

The global mining lubricants market segmentation, based on end-use industry, includes coal mining, iron ore mining, bauxite mining, rare earth mineral mining, precious metals mining, and others. In 2024, the iron ore mining segment accounted for the largest market share due to the high demand for iron ore in steel production and infrastructure development. The operational intensity of iron ore mining, which involves heavy machinery for drilling, crushing, and transportation, necessitates high-performance lubricants to ensure equipment reliability. Increasing investments in advanced mining technologies and automation require specialized lubricants that enhance operational efficiency, supporting market growth. Sustainability initiatives aimed at reducing carbon emissions in steel manufacturing have also prompted the adoption of energy-efficient lubrication solutions, further solidifying the dominance of the iron ore mining segment.

The coal mining segment is expected to register significant growth over the forecast period due to rising energy demands for coal as an energy source, particularly in developing economies. Despite global transitions toward renewable energy, coal remains a crucial resource for power generation and industrial applications. Innovations in lubrication technology, including dust-resistant and water-tolerant formulations, are expanding mining lubricants market opportunities. Regulatory policies emphasizing environmental compliance have also led to an increased focus on bio-based and synthetic alternatives, further shaping market expansion in the coal mining industry.

Mining Lubricants Market Regional Analysis

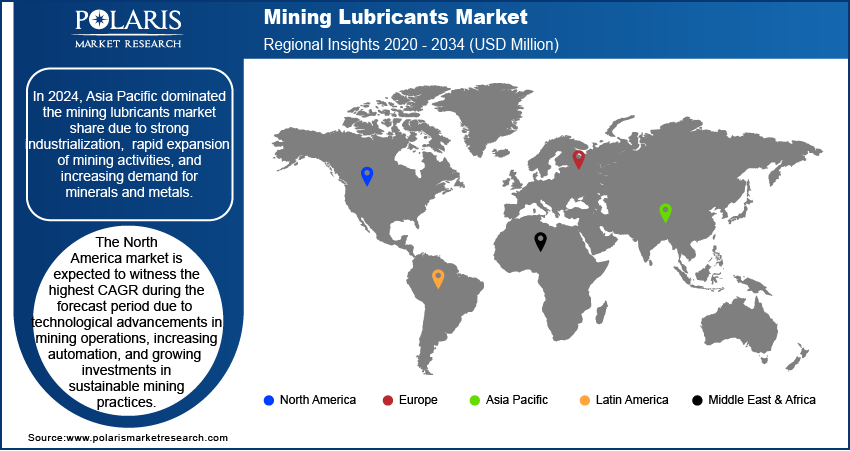

By region, the study provides mining lubricants market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, Asia Pacific accounted for the largest share due to strong industrialization, rapid expansion of mining activities, and increasing demand for minerals and metals. Countries such as China, India, and Australia are at the forefront of mining production, with significant investments in coal, iron ore, and rare earth mineral extraction. For instance, in 2020, China was the world's leading producer of coal and accounted for 50.7% of world production. The deployment of advanced mining machinery, coupled with the need for high-performance lubrication solutions, is fueling market demand in the region. Government policies supporting domestic mining operations and the presence of leading mining lubricant manufacturers are contributing to mining lubricants market expansion. Additionally, environmental regulations promoting sustainable lubrication solutions have accelerated the adoption of bio-based and synthetic mining lubricants.

The North America mining lubricants market is expected to witness the highest CAGR during the forecast period due to technological advancements in mining operations, increasing automation, and growing investment in sustainable mining practices. For instance, in January 2025, the US Department of Energy's Office of Fossil Energy and Carbon Management (FECM) offered USD 32.75 million to 12 projects focused on advancing cost-effective and sustainable methods for producing and refining critical minerals and materials in the US. Furthermore, the region’s shift toward digitalization, AI-driven predictive maintenance, and IoT-enabled mining equipment has elevated the demand for mining lubricants that enhance operational efficiency and equipment longevity. Rising exploration activities, particularly for rare earth minerals and battery metals, are further fueling market growth. Stringent regulatory standards and the push for environmentally friendly lubricants are driving the adoption of synthetic and bio-based alternatives. Strategic collaborations between lubricant manufacturers and mining companies are also expanding market opportunities, ensuring long-term growth in the North American market.

Mining Lubricants Key Market Players & Competitive Analysis Report

The mining lubricants market is defined by intense competition among global leaders and regional players, with companies focusing on technological advancements, strategic partnerships, and market expansion initiatives to strengthen their positions. Leading manufacturers leverage advanced R&D capabilities, AI-driven automation, and next-generation lubricant formulations to enhance equipment efficiency, reduce downtime, and meet rising market demand for high-performance products. Increasing adoption of synthetic and bio-based lubricants is reshaping market dynamics, driven by the need for improved thermal stability, extended equipment life, and compliance with stringent environmental regulations.

Growing investments in sustainable mining practices, automation, and next-generation mining equipment are fueling mining lubricants market growth, prompting manufacturers to develop innovative lubrication solutions with low environmental impact and extended drain intervals.

Strategic mergers and acquisitions, supply chain optimization, and cross-industry collaborations are driving mining lubricants market expansion, allowing companies to strengthen their market footprint and enhance product portfolios. Post-merger integration and adherence to evolving regulatory frameworks are critical in maintaining competitive positioning. Competitive benchmarking involves strategic alliances with mining companies, OEMs, and regulatory bodies to align with shifting industry trends and technological advancements. Pricing strategies, revenue growth models, and regional market intelligence remain essential for identifying long-term market opportunities. Leading players emphasize technological leadership, operational efficiency, and adaptable market strategies to navigate fluctuating commodity prices and regulatory uncertainties, ensuring sustained market growth in a rapidly evolving global landscape.

BASF SE is a chemical corporation that operates all over the world. The company operates through seven segments, including chemicals, industrial lubricants, materials, surface technologies, nutrition & care, and agricultural solutions, and others. Petrochemicals and intermediates are provided in the chemicals section. Advanced materials and their precursors for applications such as isocyanates and polyamides are available through the Materials section, as well as inorganic basic products and specialties for the plastic and plastic processing industries. BASF SE is actively engaged in the mining lubricants market, offering high-performance synthetic and mineral-based lubrication solutions designed to enhance equipment efficiency and durability. The company focuses on advanced additive technologies, improving wear protection, thermal stability, and operational reliability in extreme mining conditions.

Shell plc is engaged in the oil & gas industry in the US. The company is engaged in various sectors of the energy industry, including exploration and production of oil and natural gas, refining, distribution, and marketing of petroleum products, as well as petrochemical manufacturing. Shell plc plays a significant role in the mining lubricants market, providing innovative lubricant formulations that optimize fuel efficiency, reduce downtime, and extend machinery lifespan. The company leverages advanced lubrication technologies and sustainability-driven solutions, including bio-based and low-viscosity lubricants, to meet evolving industry demands and regulatory requirements.

List of Key Companies in Mining Lubricants Market

- BASF SE

- BP P.L.C.

- Chevron Corporation

- Castor Oil

- Exxon Mobil Corporation

- FUCHS

- Kluber Lubrication

- Quaker Chemical Corporation

- Shell plc

- Sinopec Corp.

- Total S.A.

Mining Lubricants Industry Developments

In November 2024, TotalEnergies Lubrifiants launched a new line of heavy-duty lubricants that are OEM-approved and formulated with premium regenerated base oils.

In July 2024, Wolf Lubricants launched a new lubricant tailored specifically for Stellantis engines, designated as 5W-30. This formulation incorporates advanced additive technology to meet the stringent performance requirements of Stellantis's engineering specifications, ensuring optimal engine protection and efficiency.

In March 2023, ExxonMobil invested around USD 110 million to establish a lubricant manufacturing facility in the Isambe Industrial Area of Raigad, Maharashtra. This investment highlights the company's focus on enhancing its production capabilities for high-performance lubricants.

Mining Lubricants Market Segmentation

By Product Type Outlook (Revenue – USD Million, 2020–2034)

- Engine Oil

- Hydraulic Oil

- Transmission Oil

- Gear Oil & Grease

By Lubricant Type Outlook (Revenue – USD Million, 2020–2034)

- Mineral Oil

- Synthetic Lubricants

- Bio-Based Mining Lubricants

By End-Use Industry Outlook (Revenue – USD Million, 2020–2034)

- Coal Mining

- Iron Ore Mining

- Bauxite Mining

- Rare Earth Mineral Mining

- Precious Metals Mining

- Others

By Regional Outlook (Revenue – USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Mining Lubricants Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 3,998.24 million |

|

Market Size Value in 2025 |

USD 4,125.79 million |

|

Revenue Forecast by 2034 |

USD 5,569.44 million |

|

CAGR |

3.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 3,998.24 million in 2024 and is projected to grow to USD 5,569.44 million by 2034.

The global market is projected to register a CAGR of 3.4% during the forecast period.

In 2024, Asia Pacific accounted for the largest share due to strong industrialization, rapid expansion of mining activities, and increasing demand for minerals and metals.

A few of the key players in the market are BASF SE, BP P.L.C., Chevron Corporation, Castor Oil, Exxon Mobil Corporation, FUCHS, Kluber Lubrication, Quaker Chemical Corporation, Shell plc, Sinopec Corp., and Total S.A.

In 2024, the synthetic lubricants segment accounted for the largest market share due to its superior performance characteristics, including higher thermal stability, oxidation resistance, and extended drain intervals.

In 2024, the iron ore mining segment accounted for the largest market share due to the high demand for iron ore in steel production and infrastructure development.