Mining Equipment Market Size, Share & Trends Analysis Report

: By Type, By Propulsion, By Power Output, By Application (Metal Mining, Mineral Mining, Coal Mining), and Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM1398

- Base Year: 2024

- Historical Data: 2020-2023

Mining Equipment Market Overview

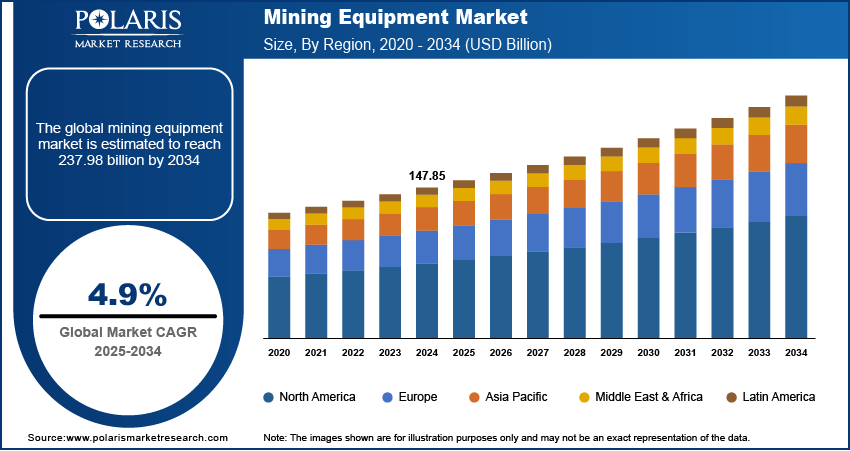

The global mining equipment market size was valued at USD 147.85 billion in 2024 and is projected to register a CAGR of 4.9% during the forecast period. The mining equipment market is driven by increasing demand for efficient mineral extraction, expanding mining activities in emerging economies, technological advancements in automation and electrification, and growing investments in infrastructure, metal exploration, and energy sectors to support global industrial development.

Key Insights

- The surface mining equipment segment led the market in 2024, driven by its widespread use in large-scale operations and ability to manage high-volume material extraction across diverse terrains efficiently.

- The drills and breakers segment is expected to witness strong growth due to rising demand for high-precision tools that enhance efficiency, safety, and productivity in increasingly complex mining environments.

- Coal mining accounted for the largest market share in 2024, supported by growing reliance on coal as a key energy source, particularly in regions where alternative fuels remain less accessible.

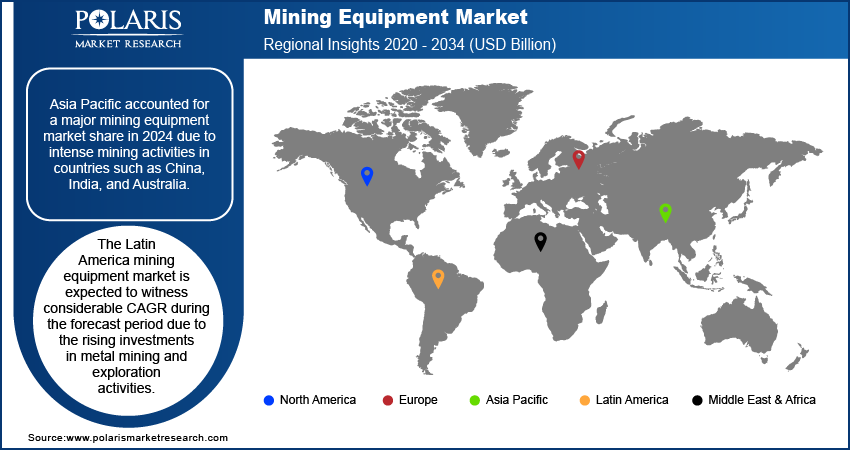

- Asia Pacific captured a major market share in 2024, owing to intensified mining activities across China, India, and Australia, driven by strong demand for minerals and favorable mining policies.

- The Latin America mining equipment market is projected to grow significantly, fueled by increased investments in metal mining and exploration, supported by rich mineral reserves and growing interest from international stakeholders.

Industry Dynamics

- Growing demand for efficient material extraction, driven by large-scale mining projects, is propelling the mining equipment market, emphasizing productivity, operational safety, and technological integration.

- Expanding applications across construction, energy, and infrastructure sectors are opening new opportunities for mining equipment, supported by rising mineral demand and urbanization in emerging economies.

- Regulatory challenges, environmental concerns, and high capital investment requirements pose significant hurdles to mining equipment adoption and project execution, especially in ecologically sensitive regions.

- Technological advancements such as automation, electrification, and smart diagnostics in mining equipment are enhancing efficiency, reducing environmental impact, and enabling data-driven, safer mining operations.

Market Statistics

- 2024 Market Size: USD 147.85 billion

- 2034 Projected Market Size: USD 237.98 billion

- CAGR (2025-2034): 4.9%

- Asia Pacific: Largest market in 2024

The increasing demand for coal worldwide, especially in emerging markets, is propelling the global market growth. As per the data published by the International Energy Agency, global coal consumption reached a record high in 2022, rising by 4% year-on-year to 8.42 billion tonnes (Bt). The ongoing rise in electricity generation is leading to high adoption of coal which is driving the demand for mining equipment.

Mining equipment is essential for the efficient extraction and processing of minerals from the earth. The equipment plays a crucial role in both surface and underground mining operations. It includes a diverse array of machinery, each designed for specific tasks within the mining process. Equipment such as excavators, dump trucks, and crawlers & dozers are commonly utilized for surface mining.

The growing mining activities for the extraction of metals drive the market demand. Mining companies require specialized equipment to meet the challenges of accessing deeper deposits, processing complex ores, and adhering to stricter environmental regulations as metal extraction increases. Moreover, the rising global demand for metals such as copper, lithium, and rare earth elements by growing industries such as electronics, renewable energy, and electric vehicles intensifies mining activities, which boosts the demand for mining equipment such as drills, excavators, crushers, and material handling systems.

Market Dynamics

Growing Urbanization Worldwide

The growing urbanization across the world is projected to propel the global mining equipment demand during the forecast period. According to the World Economic Forum, 55% of the world's population lives in urban areas, and is expected to rise to 80% by 2050. Urbanization creates demand for materials such as concrete, steel, and aluminum, necessitating the extraction of key resources such as limestone, iron ore, and bauxite. This drives mining companies to scale up operations by deploying advanced equipment such as excavators, loaders, crushers, and conveyors to meet higher production targets. The increased focus on sustainable and efficient mining practices in urban areas also encourages the adoption of modern, high-capacity, and environmentally friendly mining equipment.

Incorporation of Advanced Technologies

Integration of technologies such as automation, artificial intelligence (AI), and the Internet of Things (IoT) technologies in mining equipment enhances operational efficiency, safety, and productivity, encouraging mining companies to upgrade their equipment. Additionally, predictive maintenance tools and data-driven decision-making solutions improve equipment reliability and reduce downtime, making technologically advanced machinery a valuable investment, which increases their adoption for depth and complex mining activities. Therefore, the incorporation of advanced technologies in mining equipment is estimated to fuel the global market development.

Segment Analysis

Market Assessment by Type

Based on type, the market is categorized into underground mining equipment; surface mining equipment; crushing, pulverizing, & screening equipment; drills & breakers; and others. The surface mining equipment segment held the largest market share in 2024 due to its widespread application in large-scale operations and its ability to handle extensive material extraction efficiently. Industries such as construction, infrastructure development, and energy production heavily rely on resources such as coal, iron ore, and bauxite, which surface mining effectively extracts. The cost-efficiency, ease of use, and capability to process vast quantities of minerals make equipment like draglines, power shovels, and large-scale trucks crucial. Additionally, advancements in technology, including automation and fleet management systems, enhanced the appeal of the segment, enabling companies to improve productivity and reduce operational costs. The ongoing demand for resources driven by rapid urbanization and industrialization across emerging economies further contributed to the dominance of the segment.

The drills & breakers segment is expected to grow at a robust pace in the coming years owing to the increasing need for precision and efficiency in mining operations. Tools such as mining drill bits play a critical role in breaking down tough rock formations and ensuring access to deeper mineral deposits. Rising investments in infrastructure projects and renewable energy initiatives, which require materials such as lithium and rare earth elements, are projected to fuel the demand for specialized drilling and breaking equipment. Furthermore, the integration of advanced technologies, including hydraulic systems, real-time monitoring, and energy-efficient designs, enhances their operational capabilities, aligning with the industry’s focus on cost optimization.

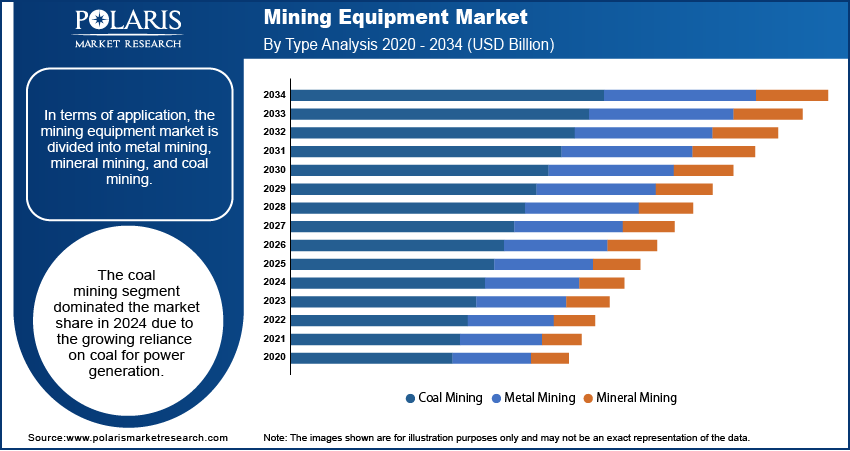

Market Evaluation by Application

In terms of application, the market is divided into metal mining, mineral mining, and coal mining. The coal mining segment dominated the share in 2024 due to the growing reliance on coal for power generation. Surface mining equipment has played a crucial role in coal extraction, offering cost-effective solutions for large-scale operations and making it easier to access coal deposits near the surface. Technological advancements, such as automation in large excavators and haul trucks, enhanced productivity and operational efficiency, further strengthening the segment's dominance. Moreover, governments of some regions have invested in coal production to ensure energy security, contributing to the rising demand for equipment and machinery made for coal mining.

Regional Analysis

By region, the study provides the insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific accounted for a major share in 2024 due to intense mining activities in countries such as China, India, and Australia. China dominated the region due to its massive demand for coal, metal recycling, and minerals. India’s growing investments in infrastructure and power generation further contributed to the expansion of mining activities, creating a demand for equipment. Australia, with its abundant mineral resources and advanced mining technologies, supported significant growth. The increasing adoption of surface mining techniques for efficient large-scale resource extraction and the integration of automation and digitalization technologies have further propelled Asia Pacific’s dominance in the market. Rapid urbanization, industrialization, and energy demands across emerging economies in the region continue to drive the need for advanced mining equipment, ensuring its leadership position.

The Latin America mining equipment market is expected to witness considerable CAGR during the forecast period due to the rising investments in metal mining and exploration activities. Countries such as Chile, Peru, and Brazil, which are rich in copper, lithium, and iron ore deposits, have attracted substantial foreign direct investment to develop their mining infrastructure. The transition to renewable energy and electric vehicles has amplified the demand for key metals, positioning Latin America as a critical supplier in the global footprint. Technological advancements in equipment, particularly drills and breakers, enable efficient extraction from the region’s challenging terrains, further boosting the Latin America industry expansion.

Key Players & Competitive Analysis Report

Major players are investing heavily in research and development to expand their offerings, which will drive the growth in the coming years. Players are also undertaking a variety of strategic activities to expand their global footprint, with important developments such as innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations.

The industry is fragmented, with the presence of numerous global and regional players. Major players include Guangdong Leimeng Intelligent Equipment Group Co. Ltd; Henan Baichy Machinery Equipment Co. Ltd; Komatsu Ltd; Liebherr; Atlas Copco AB; Sandvik AB; Doosan Corporation; AB Volvo; Hitachi, Ltd; Deere & Company; Metso Qutotec; Epiroc; Boart Longyear Ltd; Caterpillar Inc.; and Vipeak Mining Machinery Co. Ltd.

Caterpillar Inc., commonly referred to as CAT, is one of the world's largest manufacturers of construction and mining equipment, with a rich history dating back to its founding in 1925 through the merger of the Holt Manufacturing Company and the C. L. Best Tractor Company. Caterpillar has established itself as a major player in various industries, including construction, mining, oil & gas, and transportation. The company operates through three primary segments—Construction Industries, Resource Industries, and Energy & Transportation, along with offering financial products through its Financial Products segment. The company’s products range from excavators and bulldozers to specialized mining trucks and underground loaders. In June 2024, Caterpillar launched its new facelift excavators, Cat 323D3, 320D3, and 320D3 GC, to meet the demand for higher productivity, tighter project completion schedules, competitive cost of operations, and safety.

Atlas Copco AB, a prominent multinational industrial company founded in 1873, has evolved into a major player in manufacturing industrial tools and equipment. Headquartered in Nacka, Sweden, the company operates through four main business areas: Compressor Technique, Vacuum Technique, Industrial Technique, and Power Technique. Each segment is dedicated to providing innovative solutions that enhance productivity and efficiency across various industries, including construction, manufacturing, and mining. In the mining sector, Atlas Copco has established a strong reputation for delivering advanced equipment that meets the industry's demanding requirements. The company's mining equipment portfolio includes a wide range of products designed for both surface and underground operations.

List of Key Companies in Market

- AB Volvo

- Atlas Copco AB

- Boart Longyear Ltd

- Caterpillar Inc.

- Deere & Company

- Doosan Corporation

- Epiroc

- Guangdong Leimeng Intelligent Equipment Group Co. Ltd

- Henan Baichy Machinery Equipment Co. Ltd

- Hitachi, Ltd

- Komatsu Ltd

- Liebherr

- Metso Qutotec

- Sandvik AB

- Vipeak Mining Machinery Co. Ltd

Mining Equipment Industry Developments

June 2025: Komatsu bought six Core Machinery dealerships in Arizona and California, expanding its U.S. network to better serve southwest mining customers and improve equipment/service delivery. May 2025: Epiroc launched the Diamec Automated Rod Magazine (ARM) for core drilling rigs. The system enables remote control, reduces operator fatigue, and allows 252 meters of automated drilling without manual input, boosting safety and productivity.

September 2024: Komatsu, a global manufacturer of construction, mining, forestry, and industrial machinery, introduced the new Z3 series of medium-size class development jumbo drills and bolters to its lineup, further broadening Komatsu's selection of offerings for the underground mining industry.

September 2024: Sandvik, a global engineering company that provides products and solutions for the manufacturing, mining, and infrastructure industries, showcased its latest surface drilling solutions at MINExpo INTERNATIONAL 2024.

May 2024: Komatsu introduced the second generation of the company’s Z2 product line of drilling and bolting rigs for mining applications.

Mining Equipment Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Underground Mining Equipment

- Surface Mining Equipment

- Crushing, Pulverizing, & Screening Equipment

- Drills & Breakers

- Others

By Propulsion Outlook (Revenue, USD Billion, 2020–2034)

- Diesel

- CNG/LNG/RNG

By Power Output Outlook (Revenue, USD Billion, 2020–2034)

- < 500 HP

- 500–2,000 HP

- >2,000 HP

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Metal Mining

- Mineral Mining

- Coal Mining

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Mining Equipment Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 147.85 billion |

|

Market Size Value in 2025 |

USD 154.86 billion |

|

Revenue Forecast by 2034 |

USD 237.98 billion |

|

CAGR |

4.9 % from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global mining equipment market size was valued at USD 147.85 billion in 2024 and is projected to grow to USD 237.98 billion by 2034.

The global market is projected to register a CAGR of 4.9% during the forecast period.

Asia Pacific held the largest share of the global market in 2024.

A few of the key players in the market are Guangdong Leimeng Intelligent Equipment Group Co. Ltd; Henan Baichy Machinery Equipment Co. Ltd; Komatsu Ltd; Liebherr; Atlas Copco AB; Sandvik AB; Doosan Corporation; AB Volvo; Hitachi, Ltd; Deere & Company; Metso Qutotec; Epiroc; Boart Longyear Ltd; Caterpillar Inc.; and Vipeak Mining Machinery Co. Ltd.

The drill & breakers segment is projected to record a significant growth rate in the global market during 2025–2034.

The coal mining segment dominated the market share in 2024.