Military Wearables Market Size, Share, Trends, Industry Analysis Report: By Product, Technology, End User (Land Forces, Naval Forces, and Air Forces), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 129

- Format: PDF

- Report ID: PM5520

- Base Year: 2024

- Historical Data: 2020-2023

Military Wearables Market Overview

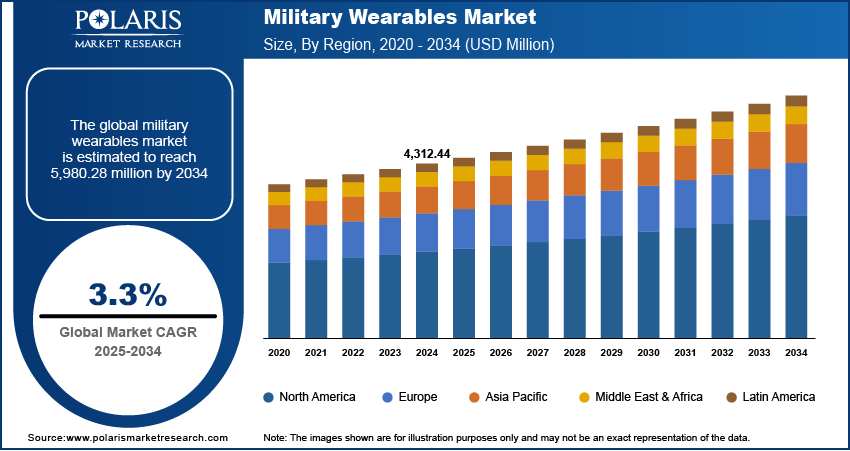

The global military wearables market size was valued at USD 4,312.44 million in 2024. It is expected to grow from USD 4,452.68 million in 2025 to USD 5,980.28 million by 2034, at a CAGR of 3.3% from 2025 to 2034.

Military wearables are technologically advanced equipment integrated into soldier's gear to enhance operational efficiency, situational awareness, and personal safety. The military wearables market growth is driven by the increasing demand for real-time data and communication, which enables seamless coordination between personnel and command centers. These devices, such as smart helmets, augmented reality (AR) displays, and tactical communication systems, facilitate instant data sharing, improving decision-making and battlefield awareness. For instance, in November 2021, Rice University received a USD 1.3 million grant from the Office of Naval Research to develop 3D-printed smart helmets for the military. The helmets feature embedded sensors, AI, and advanced materials to improve protection and threat detection for soldiers. The integration of AI-driven analytics and encrypted networks further strengthens secure communication, ensuring mission success in complex environments. The demand for robust and efficient wearable communication solutions continues to grow as modern warfare increasingly relies on digital connectivity.

To Understand More About this Research: Request a Free Sample Report

Another key driver shaping the military wearables market development is health monitoring and training, which focuses on optimizing soldier's physical performance and well-being. Advanced biometric sensors integrated into wearables track vital signs such as heart rate, body temperature, and hydration levels, allowing real-time health assessments. These insights support proactive medical interventions, reducing the risk of fatigue-related injuries and enhancing endurance during missions. For instance, in September 2023, the US Army tested the health readiness and performance system (HRAPS) during the best squad competition. The wearable device provides real-time health and location data, aiding commanders and medics in monitoring soldier's vital signs and improving decision-making in training and combat scenarios. Additionally, wearables equipped with virtual and augmented reality technologies are revolutionizing training programs by simulating combat scenarios and refining tactical skills. Therefore, as defense organizations prioritize soldier health and preparedness, wearable technologies play a crucial role in strengthening military effectiveness.

Military Wearables Market Driver Dynamics

Rising Integration of AI, AR, and Smart Textiles

AI-powered wearables process vast amounts of battlefield data in real-time, providing predictive analytics and decision-support systems for enhanced situational awareness. Augmented reality (AR) devices, such as smart helmets and heads-up displays, overlay critical information onto the soldier’s field of view, improving navigation and target acquisition and improving soldier capabilities through advanced technology. For instance, in September 2024, Anduril Industries collaborated with Microsoft to enhance the US Army's IVAS Program by integrating Anduril’s Lattice platform. This integration allows soldiers to detect real-time threats and respond more effectively in complex environments, showcasing the transformative potential of AI and AR in modern warfare. Meanwhile, smart textiles embedded with conductive fibers and nanotechnology enable real-time health monitoring, adaptive camouflage, and impact resistance. Therefore, as military forces increasingly prioritize automation and data-driven operations, the convergence of AI, AR, and smart textiles plays a crucial role in strengthening operational efficiency and soldier survivability.

Rising Budgets for Modernization

Governments worldwide are allocating substantial resources to upgrade military capabilities, focusing on equipping personnel with advanced technologies for enhanced performance and safety. For instance, in February 2022, the US Army granted USD 1.1 million to United Protected Technologies to develop a mobile power solution for charging wearable batteries used in Nett Warrior and IVAS programs, aiming to reduce soldier load and improve mobility with compact, expeditionary power generators. Additionally, increased funding supports the development and procurement of smart wearables, such as biometric monitoring devices, exoskeletons, and tactical communication systems. These investments drive innovation, allowing the integration of AI-driven analytics, AR-based training simulations, and advanced power management solutions. Therefore, as defense strategies evolve to address modern combat challenges, sustained financial commitments to military modernization are accelerating the adoption of high-performance wearable technologies, further boosting the military wearables market share.

Military Wearables Market Segment Insights

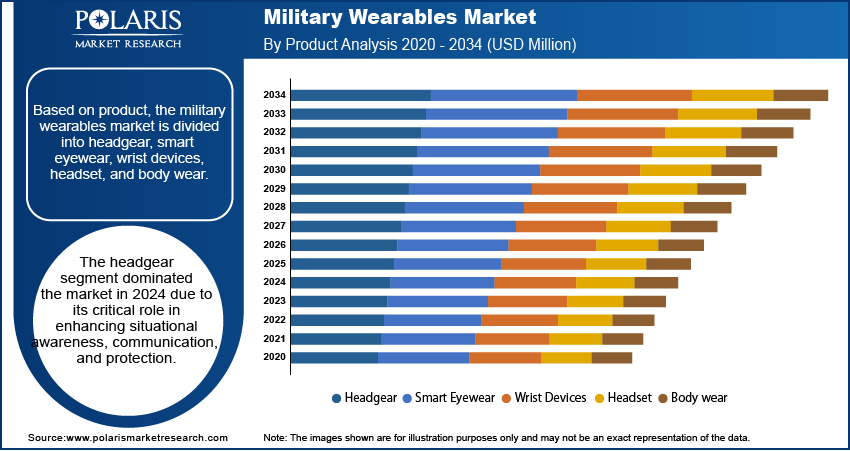

Military Wearables Market Assessment by Product Outlook

The global military wearables market assessment, based on product, includes headgear, smart eyewear, wrist devices, headset, and body wear. The headgear segment dominated the military wearables market in 2024 due to its critical role in enhancing situational awareness, communication, and protection. Advanced combat helmets integrated with AR displays, night vision capabilities, and real-time data transmission improve soldier performance on the battlefield. These smart headgear solutions offer hands-free access to mission-critical information, allowing seamless coordination and quick decision-making. Additionally, headgear equipped with ballistic protection and impact-resistant materials enhances soldier safety, making it an essential component of modern warfare. Thus, as defense forces prioritize technologically advanced protective gear, the headgear segment remains a key contributor to market growth.

Military Wearables Market Evaluation by End User Outlook

The global military wearables market evaluation, based on end user, includes land forces, naval forces, and air forces. The land forces segment is expected to witness the fastest military wearables market growth during the forecast period, driven by the high deployment of soldiers in ground operations. Land-based military personnel require advanced wearable technologies for real-time communication, situational awareness, and health monitoring to navigate complex and unpredictable combat environments. Smart wearables, such as exoskeletons, biometric sensors, and AI-powered navigation systems, enhance mobility and operational efficiency. Moreover, the increasing focus on infantry modernization programs and soldier survivability solutions is accelerating the adoption of wearable technologies among land forces. Therefore, as modern warfare continues to evolve, the demand for refined military wearables in ground operations is expected to surge.

Military Wearables Market Regional Analysis

By region, the report provides the military wearables market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the military wearables market revenue in 2024 due to substantial defense investments and technological advancements. The region benefits from strong government funding allocated toward military modernization programs, enabling the rapid adoption of next-generation wearable technologies. For instance, in January 2023, the US Army launched two SBIR Phase I opportunities, offering up to USD 150,000 for AI/ML solutions and USD 250,000 for wearable radiation sensors. These initiatives aim to enhance soldier capabilities, focusing on trusted AI, autonomy, and lightweight wearable technologies. Major defense organizations actively collaborate with technology firms to integrate AI, AR, and biometric monitoring into soldier systems. Additionally, the presence of leading military wearable manufacturers and extensive research initiatives accelerates innovation and deployment.

The military wearables market size in Asia Pacific is projected to witness the fastest growth during the forecast period, fueled by rising defense expenditures and large-scale military modernization efforts. Several countries in the region are investing heavily in advanced soldier systems to improve combat effectiveness and operational readiness. For instance, In February 2025, India’s Union Budget allocated over USD 82 billion to the Ministry of Defence, including USD 9.53 billion for modernization and USD 13.5 billion for domestic procurement, highlighting self-reliance and the growth of defense modernization. The growing geopolitical tensions and focus on strengthening military capabilities drive demand for smart wearables, including AI-powered surveillance gear, exoskeletons, and tactical communication systems. Additionally, the presence of emerging defense technology firms and government initiatives supporting indigenous defense production contribute to military wearables market expansion in the region.

Military Wearables Market – Key Players and Competitive Insights

The competitive landscape features global leaders and regional players competing for military wearables market share through innovation, strategic alliances, and regional expansion. Global players utilize strong R&D capabilities, technological advancements, and extensive distribution networks to deliver advanced solutions, meeting the growing demand for disruptive technologies and sustainable value chains. Military wearables market trends highlight rising demand for emerging technologies, digitalization, and business transformation driven by economic growth, geopolitical shifts, and macroeconomic trends. Global players focus on strategic investments, mergers and acquisitions, and joint ventures to strengthen their market position. Post-merger integration and strategic alliances are key strategies to improve competitive positioning and expand regional footprints. Regional companies, meanwhile, address localized needs by offering cost-effective solutions and leveraging economic landscapes. Competitive benchmarking includes market entry assessments, expansion opportunities, and partnership ecosystems to meet the demand for innovative products and future-ready solutions. The market is experiencing technological advancements, such as disruptive technologies and digital transformation, reshaping industry ecosystems.

Companies are investing in supply chain management, procurement strategies, and sustainability transformations to align with military wearables market demand, trends, and future development strategies. Pricing insights, revenue growth analysis, and competitive intelligence are critical for identifying opportunities and driving long-term profitability. In conclusion, the military wearables industry's growth is driven by technological innovation, market adaptability, and regional investments. Major players focus on strategic developments, market penetration, and competitive benchmarking to address economic and geopolitical shifts, assuring sustained growth in a hypercompetitive global market. A few key major players are Aselsan A.S.; Bae Systems Plc; Bionic Power Inc.; Elbit Systems Ltd; General Dynamics Corporation; L3harris Technologies Inc.; Leonardo S.P.A.; Lockheed Martin Corporation; Northrop Grumman Corporation; Rheinmetall Ag; Saab Ab; Safran Sa; Teledyne Flir Llc; Thales Group; and Ultra-Electronics.

BAE Systems PLC is a global defense, security, and aerospace company that develops military wearables. The company has been at the forefront of integrating advanced technologies into wearable solutions designed to improve soldier performance, situational awareness, and survivability on the battlefield. BAE Systems portfolio includes integrated body armor systems, tactical communication devices, and heads-up displays (HUDs) that provide real-time data visualization and operational intelligence to soldiers in combat situations. One notable innovation by BAE Systems is a communication device that utilizes bone conduction technology to transmit sound directly to the inner ear, allowing soldiers to receive audio communications while protecting their hearing from loud noises like gunfire. This technology is being developed to be integrated into future helmets, improving auditory situational awareness for armed forces personnel. BAE Systems' commitment to innovation and strategic partnerships with defense agencies in the military wearables market is expected to grow due to increasing demand for advanced communication systems and health monitoring technologies. The company's focus on wearable technology supports its mission to deliver military capability and protect national security through cutting-edge solutions.

Elbit Systems Ltd is a global defense electronics company specializing in the development and integration of advanced military technologies, including wearable devices. The company has introduced several innovative military wearables designed to improve situational awareness and command and control (C2) capabilities for infantry commanders and soldiers. One of its notable products is the Smart WristView. This compact, low-power wrist-strapped C2 display provides warriors with quick access to operational data, facilitating team-level command and control without disrupting weapon handling. Another innovation is the SmartEye, a head-mounted C2 display offering AR symbology, which integrates with various visual sources to enhance real-time situational awareness. Elbit Systems' wearable technologies are part of the DOMINATOR warrior combat suite, which aims to improve combat effectiveness and survivability by integrating C4I applications, personal network radios, and tactical computers. The company's RAPTOR is an all-in-one wearable computing unit that supports real-time situational awareness and is designed for harsh environments. These innovations highlight Elbit Systems' commitment to advancing military wearables and enhancing battlefield performance through integrated, networked solutions.

List of Key Companies in Military Wearables Market

- Aselsan A.S.

- BAE Systems PLC

- Bionic Power Inc.

- Elbit Systems Ltd

- General Dynamics Corporation

- L3Harris Technologies Inc.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Rheinmetall AG

- Saab AB

- Safran SA

- Teledyne FLIR LLC

- Thales Group

- Ultra-Electronics

Military Wearables Industry Developments

December 2024: BAE Systems received a USD 169 million contract from the Eurofighter consortium to advance its Striker II Helmet-Mounted Display (HMD). The helmet integrates night vision and color displays, providing pilots with critical mission data.

November 2024: The US Army Sustainment Command launched a program issuing smart watches and rings to soldiers, enabling real-time health monitoring. The devices track heart rate, sleep, hydration, and other metrics, providing daily readiness scores to enhance overall health and fitness.

July 2024: Viasat Inc. launched the Secure Wireless Hub (SWH), a lightweight, wearable tactical gateway for dismounted soldiers. Developed with USSOCOM, SWH reduces size, weight, and cabling by 85%, enhancing mobility and situational awareness for ground forces.

Military Wearables Market Segmentation

By Product Outlook (Revenue, USD Million, 2020–2034)

- Headgear

- Smart Eyewear

- Wrist Devices

- Headset

- Body Wear

By Technology Outlook (Revenue, USD Million, 2020–2034)

- Communication

- Network and Connectivity

- Imaging & Surveillance

- Navigation

- Intelligent Fabric

- Other

By End User Outlook (Revenue, USD Million, 2020–2034)

- Land Forces

- Naval Forces

- Air Forces

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Military Wearables Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 4,312.44 million |

|

Market Size Value in 2025 |

USD 4,452.68 million |

|

Revenue Forecast in 2034 |

USD 5,980.28 million |

|

CAGR |

3.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global military wearables market size was valued at USD 4,312.44 million in 2024 and is projected to grow to USD 5,980.28 million by 2034.

The global market is projected to register a CAGR of 3.3% during the forecast period.

North America dominated the military wearables market in 2024.

Some of the key players in the market are Aselsan A.S.; Bae Systems Plc; Bionic Power Inc.; Elbit Systems Ltd; General Dynamics Corporation; L3harris Technologies Inc.; Leonardo S.P.A.; Lockheed Martin Corporation; Northrop Grumman Corporation; Rheinmetall Ag; Saab Ab; Safran Sa; Teledyne Flir Llc; Thales Group; and Ultra-Electronics.

The headgear segment dominated the military wearables market expansion in 2024 due to its critical role in enhancing situational awareness, communication, and protection.

The land forces segment is expected to witness the fastest growth during the forecast period due to the high deployment of soldiers in ground operations.