Military Sensors Market Share, Size, Trends, Industry Analysis Report, By Type; By Platform; By End-Use (Intelligence and Reconnaissance, Communication and Navigation, Combat Operations, Electronic Warfare, Target Recognition System, Surveillance and Monitoring, Command and Control, Cybersecurity, Simulation and training, Artillery System); By Component; By Region; Segment Forecast, 2022 - 2030

- Published Date:Jan-2022

- Pages: 118

- Format: PDF

- Report ID: PM2213

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

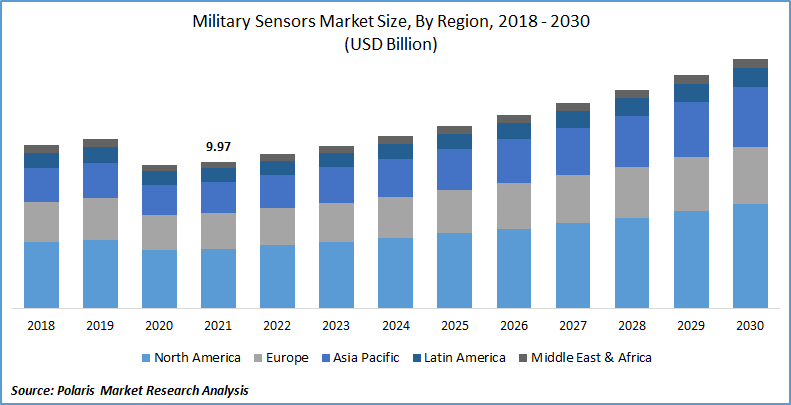

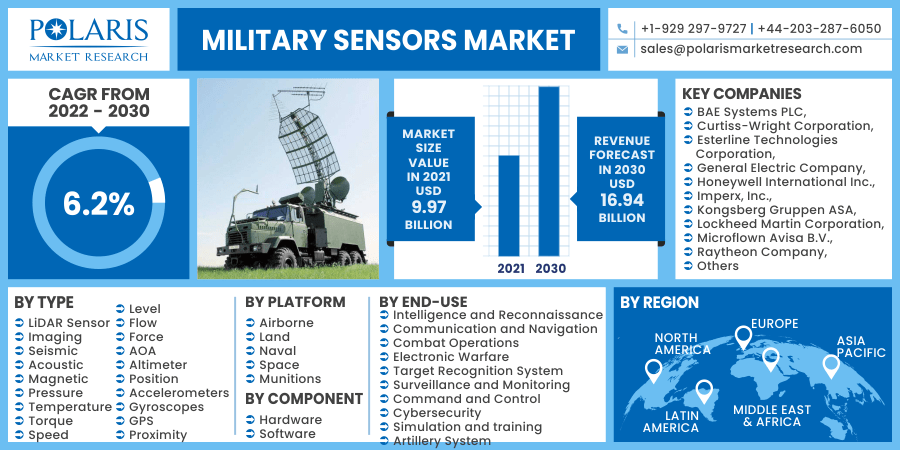

The global military sensors market was valued at USD 9.97 billion in 2021 and is expected to grow at a CAGR of 6.2% during the forecast period. The growth in the market is being driven by the rising market demand for battlespace awareness among the defense force. Situational awareness in the battlespace is critical for defense forces because it can track enemy movements and decode secret information. It's also essential for recognizing adversary threats in high-stress situations.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

The nature of the issues that military forces face worldwide has changed dramatically in recent years. Situational awareness has become crucial to ensuring the protection of defense personnel in the increasingly networked digital and data-heavy battlespace. Further, EO/IR sensors and other data processors are being used by armed forces to improve the capabilities of defense equipment. Defense forces can obtain real-time situational awareness using EO/IR systems, which provide continuous battlefield coverage and intuitive operator interfaces. As a result of the expanded surveillance applications of EO/IR systems, the need for military sensors in the defense sector has increased.

Nevertheless, alternative technologies, including Ring Laser Gyroscopes (RLGs) and Fiber Optic Gyros (FOGs), are more dependable than MEMS inertial navigation sensors because they produce extremely accurate findings. RLGs are laser oscillators integrating optical frequency generation and rotation sensing functions in a ring-shaped cavity.

The premise of FOGs is that optical fibers are tuned to a single frequency of light that is being propagated. The direction of the light, and hence the frequency of the propagated light, is changed by an external force. Furthermore, their servicing and assembly necessitate a highly trained crew and a regulated environment to avoid dust contamination. The operational challenges of building and maintaining RLGs and FOGs function as a stumbling block to the global growth of the military sensors market.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The market has observed extensive developments in the last few decades, supported by the rising market demand for the latest generation air and missile defense systems. New generation missiles, including nuclear-enabled ballistic missiles and other cruise missiles, pose a significant threat to critical infrastructure and platforms such as military airbases and ships.

During conflicts or warlike situations, nuclear ballistic missiles can devastate cities and hurt populations. Various countries are developing new weaponry to destroy defense systems such as the MEADS, Patriot Advanced Capability (PAC-3), and S-400. Furthermore, in July 2021, the latest-generation Akash surface-to-air missile system was successfully experimented with by DRDO from an integrated test range off the shore of Odisha. The Akash-NG missile has a range of 60 kilometers and can engage targets at velocities of Mach 2.5.

Report Segmentation

The market is primarily segmented based on type, platform, component, end-use, and region.

|

By Type |

By Component |

By Platform |

By End-Use |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Type

Based on the type segment, the gyroscope segment is expected to be the most significant revenue contributor in the global military sensors market in 2021 and is expected to retain its dominance in the foreseen period. MEMS-based gyroscopes were introduced as a significant point of advancement in gyroscope technology. The expansion of gyroscopes in the military sensor industry has been spurred by increased demand for high-performance inertial navigation systems (INS). Military aviation is one of the largest users of inertial guidance systems, has been and will prove to be a significant driver of market growth of military sensors.

Geographic Overview

In terms of geography, North America had the highest share in 2021. The market for the North American region is anticipated to grow significantly as a result of the presence of major players. Increased demand for lightweight and energy-efficient sensors and significant investments in R&D activities by important players to develop new military power solutions are projected to boost the expansion of the military sensors market in this region.

Due to easy access to numerous innovative technologies and substantial investment made by manufacturers to introduce improved monitoring systems and warfare sensors, the U.S. is expected to propel the growth of the North American military sensors market. Several advances in the field of military sensors have occurred in the region. For instance, in March 2021, Honeywell International was granted a cost-plus-fixed-fee upgrade contract to integrate the Advanced Battle Management Systems (ABMS) with various sensors and sensing modes.

Moreover, Asia-Pacific is expected to witness a high CAGR in the global market. This increase can be attributed to the rising demand for Military Sensors from countries such as India and China. Growing territorial conflicts between India and Pakistan and geopolitical concerns between China and India would aid growth.

Competitive Insight

Some of the major market players operating in the global military sensors include BAE Systems PLC, Curtiss-Wright Corporation, Esterline Technologies Corporation, General Electric Company, Honeywell International Inc., Imperx, Inc., Kongsberg Gruppen ASA, Lockheed Martin Corporation, Microflown Avisa B.V., Raytheon Company, T.E. Connectivity Ltd., Thales Group, Ultra Electronics, and Vectornav Technologies, LLC.

Military Sensors Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 9.97 billion |

|

Revenue forecast in 2030 |

USD 16.94 billion |

|

CAGR |

6.2% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Component, By Type, By Platform, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

BAE Systems PLC, Curtiss-Wright Corporation, Esterline Technologies Corporation, General Electric Company, Honeywell International Inc., Imperx, Inc., Kongsberg Gruppen ASA, Lockheed Martin Corporation, Microflown Avisa B.V., Raytheon Company, TE Connectivity Ltd., Thales Group, Ultra Electronics, and Vectornav Technologies, LLC. |