Military Lighting Market Share, Size, Trends, Industry Analysis Report, By Product (Interior, Exterior, Others); By Type (LED, Non-LED); By End-Use (Ground, Marine, Airborne); By Region; Segment Forecast, 2022 – 2030

- Published Date:Oct-2022

- Pages: 117

- Format: PDF

- Report ID: PM2666

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

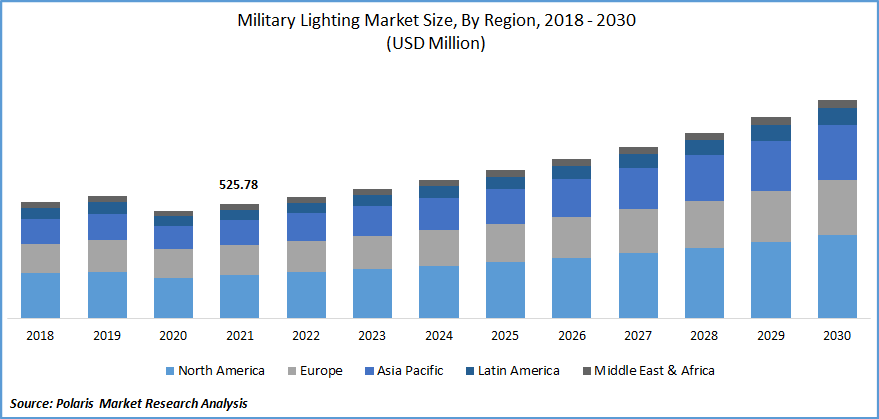

The military lighting market was valued at USD 525.78 million in 2021 and is expected to grow at a CAGR of 7.6% during the forecast period. The growing adoption of security in military areas and rising investment in the modernization of the military all over the world are crucial factor that drives the market. Also, increased demand for energy-efficient lighting solutions for military applications fuels market growth.

Know more about this report: Request for sample pages

Military lighting products are most frequently installed at military shelters, personal combat helmets, and military airfields or airports. Gooseneck lights and drop or task lighting are frequently included in these products. Additionally, military aircraft are guided by military airfields or airport lights when landing and taking off. Exterior, interior, LED, and non-LED lights are some of the main product categories offered by manufacturers in the global military lighting industry.

LEDs perform well in cold environments such as outdoor winter, freezer rooms, and supermarket coolers. LEDs can also be combined in any shape to produce highly efficient lighting. Dimming individual LEDs allows for dynamic light, color, and distribution control. These LED functionalities introduce a growth opportunity for the military lighting market.

The old and conventional light systems that are already installed but cannot be removed from military bases are expected to be the major obstacle to the growth of the military lighting market. Power generation is another major factor limiting the growth of the military lighting market in some developing countries.

The Covid-19 outbreak had a detrimental impact on the military lighting sector since various manufacturing processes had been temporarily halted throughout key industrial centers, leading to a considerable reduction in production. People are becoming more isolated due to stringent laws and regulations regarding public gatherings and travel. Additionally, the expansion of the market was impacted by supply chain disruption, aircraft cancellations, and stock market volatility, which had an immediate effect on the supply and demand for military lighting.

Industry Dynamics

Growth Drivers

Global military lighting demand is anticipated to be driven by the need for line fitting and retrofitting modern LEDs in marine, aerial, and land applications. Governments worldwide are investing significantly in updating their army equipment and weaponry. Most nations are concentrating on updating the lighting systems for armored vehicles and their soldiers' helmet lighting systems. The upgraded lighting systems would have night vision capabilities and be better suited for covert activities.

The growing utilization of LED technology in the military sector for energy efficiency propels the market's growth. Many military personnel travels through combat zones in tanks to protect themselves from attacks. Due to their longer lifespan and higher durability, tank manufacturers have recently used LEDs to replace incandescent lightbulbs in the headlights of vehicles. LEDs have thick silicon barriers to prevent damage from rocks and other objects. So LEDs are an excellent choice for drivers who need to notice enemies in the distance.

For instance, SolTech Lightings introduced a military base solar LED lighting solution in which the solar panel and battery are attached to the fixture to make the light self-sustaining. Due to this, the lights are very efficient and compact while lighting up a military base. Even when the weather is not as sunny, the lights may last up to 7 nights with just one day of sunlight. Most places provide enough sunlight for these lights to stay adequately charged.

Furthermore, rising investments in the defense sectors by emerging economies and growing concerns over the security of troops and equipment influence the market's growth. Defense forces are now concentrating on expanding their operational zones by building military camps or securing military bases, which has anticipated driving the military lighting business internationally.

Report Segmentation

The market is primarily segmented based on product, type, end-use, and region.

|

By Product |

By Type |

By End-Use |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Interior lighting segment accounts for the largest market share

The interior lighting segment is projected to account for the largest market revenue. Interior lights are installed in general buildings, administrative, educational, healthcare, food & service, recreational, and maintenance spaces of the military area. Additionally, special lighting is used on military aircraft to illuminate the main cabin. Military aircraft also include an emergency lighting system on the floor to help passengers in an emergency.

The increased usage of map and chart lighting while keeping night vision to view outside the aircraft drives the demand for effective cockpit lights. LEDs are used in the cockpit of new and retrofitted aircraft to improve reliability and lower lifecycle costs. These solid-state components use less energy and don't contain coiled filaments, which can become rigid from vibration and excessive temperatures.

LED segment acquires the largest market revenue

LED light accounts for the largest market share in 2021. Numerous military uses, including land, airborne, and maritime, use LEDs. LEDs have several benefits over conventional bulbs, including a longer lifespan, greater efficiency, and improved resistance to harsh environments.

The standard type of LEDs used in military lighting applications is the more prominent general-purpose or small tactical lights, often called white LEDs, as they do not produce color. White LED can be used alone for general illumination or in combination with other colors to create red, blue, or green light. Additionally, LED technology is used in military aircraft cockpits. Thus, the growing utilization of cockpits has accelerated the segment’s growth.

Ground segment holds a significant revenue share

Based on end-use, the military lighting market is categorized as ground, marine, and airborne. The ground segment is expected to hold significant revenue. Many businesses are developing military lighting for armored vehicles. For instance, Oxley created and manufactured various challenging LED systems for armored vehicles, including a comprehensive range of external and internal lighting for military vehicles. Oxley for armored vehicles offers light solutions such as LED lamps & indicators, IR driving lights, DC combi lights, IR brake and floodlights, and IR Beacon lights.

Similarly, Eeltex, an international company providing emergency egress lighting systems and military lighting expertise, has various LED solutions for the military, such as vehicle lighting, emergency escape lighting system, robust LED lighting, and rapid deployment LED lighting for the ground route. All aforementioned factors collectively increase segment growth.

North America acquired the major market share

North America is expected to have the highest market share owing to the high investments made by the economies of Canada and the United States in enhancing their military capabilities. Additionally, the ongoing modernization of military technologies and the growing demand for powerful armies that can wage asymmetrical warfare fuel the market in this region.

The Asia Pacific is expected to acquire the second-largest market share due to growing regional geopolitical pressure and rising defense budgets in countries such as India, China, and Japan.

Competitive Insight

Some of the major players operating in the global market are Acuity Brands Lighting, ADB Safegate, Astronics, ATG Airports Limited, Avlite Systems, Carmanah Technologies, Cobham, Glamox, Honeywell, L. C. Doane Company, Luminator Technology, Orion Energy Systems, Osram Licht, Oxley Developments Company, Revolution Lighting Technologies, Rockwell Collins, Soderberg Manufacturing Company, STG Aerospace, United Technologies, Zodiac Aerospace

Recent Developments

In May 2022, Astronics expanded its CorePower product portfolio and capabilities for addressing the needs of the emerging electric aircraft industry.

Military Lighting Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 558.91 million |

|

Revenue forecast in 2030 |

USD 1,007.82 million |

|

CAGR |

7.6% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Segments covered |

By Product, By Type, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Acuity Brands Lighting, ADB Safegate, Astronics, ATG Airports Limited, Avlite Systems, Carmanah Technologies, Cobham, Glamox, Honeywell, L. C. Doane Company, Luminator Technology, Orion Energy Systems, Osram Licht, Oxley Developments Company, Revolution Lighting Technologies, Rockwell Collins, Soderberg Manufacturing Company, STG Aerospace, United Technologies, Zodiac Aerospace |