Microgrid Controller Market Share, Size, Trends, Industry Analysis Report

By Connectivity (Grid Connected, Off-Grid Connected); By Offering; By End-Use; By Region; Segment Forecast, 2022 - 2030

- Published Date:Oct-2022

- Pages: 117

- Format: PDF

- Report ID: PM2619

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

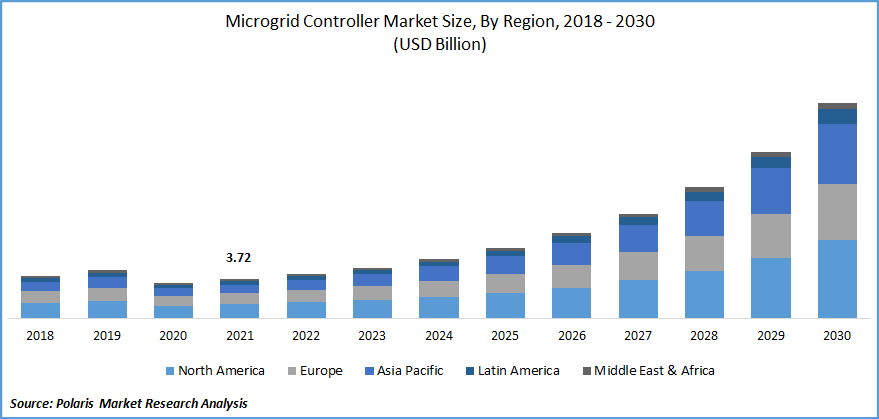

The global microgrid controller market was valued at USD 3.72 billion in 2021 and is expected to grow at a CAGR of 22.0% during the forecast period. Growing demand for microgrids, along with a rapid shift towards the utilization of renewable energy sources, have been influencing the growth of the microgrid controller market.

Know more about this report: Request for sample pages

A microgrid controller is basically a device that loads within a specific electrical system to maintain reliable frequency and voltage. In order to maintain stability and satisfy power demand, the microgrid controller effectively automates control of all modules and interconnections of microgrids.

The microgrid controller has some benefits, such as the ability to identify electrical disturbances and implement accurate responses, lower energy production costs, and reduced environmental impact. Key manufacturers of microgrid controllers are focused on the integration of new control technologies to minimize the overall cost while moving toward renewability.

Due to the growing preference for microgrids to ensure power stability in critical loads, the market for microgrid controllers is anticipated to expand significantly. During the COVID-19 pandemic, the need for microgrids and their operating systems has dramatically decreased due to the reduction in electricity usage, especially for industrial operations.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The microgrid controller market is the growing integration of distributed generation and microgrids and government measures to increase electrical access globally. In addition, the growing need for a reliable and resilient power supply with the potential to reduce carbon emissions is also expected to drive market growth.

The global microgrid controller market is anticipated to witness growth over the coming years as a result of an increase in clean energy projects and the adoption of renewable energy sources globally. Thus, the modern distributed power generation systems and the rapid expansion of the infrastructure for renewable energy sources are responsible for the market growth.

The demand for a reliable and secure power supply system propels market growth. The microgrid secures the supply of electricity in cases of blackout and power failure. Furthermore, microgrids capacity to operate autonomously for long periods of time while still providing enough power.

Report Segmentation

The market is primarily segmented based on connectivity, offering, end-use, and region.

|

By Connectivity |

By Offering |

By End-Use |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Grid connected is expected to spearhead the market growth

A grid network that is completely connected and set up to distribute electricity in accordance with the needs of the appropriate end user is referred to as grid-connected. The unique advantage of being the most affordable option among the available microgrid solutions has led the majority of homeowners and small-sized businesses to prefer grid-connected microgrid systems to meet their respective power demands. Increasing the electrification in rural areas led to the highest adoption rate of off-grid microgrid controllers. Off-grid networks are energy self-sufficient and offer power security during electricity failure.

Hardware segment accounted for the largest share in 2021

The hardware segment is driven by an increasing number of microgrid projects in large power plants and strong demand from process industries, including manufacturing, mining, steel, and chemical, oil and gas. The elements that comprise the hardware are the digital input and output modules, analogue input and output modules, local controller, and communication system. Additionally, the capability of software to monitor, predict, manage, and maximize the energy supply is predicted to allow the software sector to expand during the projected period.

Commercial & industrial accounted for the highest revenue share

The commercial & industrial segment holds the largest revenue share and is expected to grow in forthcoming years. The requirement for a continuous power supply and minimizing equipment damage during industrial activities may be a factor in this market segment's growth. The main driver propelling the expansion of this market is the increasing use of microgrid technology, which enables constructions to continue operating on their own power when the grid fails.

Asia Pacific is expected to dominate and witness the fastest growth over the forecast period

Asia Pacific is a major market for microgrid controller systems. The demand for electricity in the Asia Pacific region is increasing faster than the capabilities of traditional electrical networks, which is further boosting the market's The growth of the Asia Pacific is anticipated to be driven by the expansion of conventional electricity grids, significant spending on electrification projects, and moderation and renovation of existing electrical networks.

Increasing rural electrification projects in developing nations, including Bangladesh and India, have supported the growth of the microgrid controller market in the region. The government regulatory framework and major leading companies is also anticipated to fuel market expansion in North America. Additionally, the market has grown as more smart grid projects have been launched in Canada.

Competitive Insight

Some of the major players operating in the global market include ABB; Caterpillar Inc.; CleanSpark Eaton; Encorp Emerson commercial & residential solutions; General Electric; Honeywell International; Lockheed Martin; Ontech Electric Corporation; Opus One Solutions; RTSoft; Princeton Power Systems; S&C Electric; Schweitzer Engineering Laboratories; Siemens; Spirae; Schweitzer Engineering Laboratories; andWoodward Inc.

Recent Developments

In March 2022, SEL introduced two new field-upgradable cards for the SEL-751 Feeder Protection Relay, in addition to many upgrades that will allow the device to support a variety of applications.

In October 2021, Power management company Eaton and Enel X, the Enel Group's advanced energy services business line, declared plans for a second joint microgrid project in Puerto Rico. The initiatives will reduce the demand on the local energy infrastructure, allow Eaton to use more renewable energy sources to power its production, and increase its operations' energy resilience.

In January 2021, The SEL-3350 Automation Controller was recently introduced by SEL. It is more affordable and has a smaller 1U form factor than the SEL-3355 and SEL-3360 Automation Controllers.

In April 2019, A partnership on advanced automation and microgrid technology was announced by ABB and Rolls-Royce. Together, the two businesses will provide utilities, businesses, and industries with an energy-efficient microgrid solution.

Microgrid Controller Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 3.72 billion |

|

Revenue forecast in 2030 |

USD 20.68 billion |

|

CAGR |

22.0% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Connectivity, By Offering, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

ABB; Caterpillar Inc.; CleanSpark Eaton; Encorp Emerson commercial & residential solutions; General Electric; Honeywell International; Lockheed Martin; Ontech Electric Corporation;Opus One Solutions; RTSoft; Princeton Power Systems; S&C Electric; Schweitzer Engineering Laboratories; Siemens; Spirae; Schweitzer Engineering Laboratories; Woodward Inc. |