Microgreens Market Size, Share, Trends, Industry Analysis Report: By Farming Type (Indoor Vertical Farming, Commercial Greenhouse, and Others), Product Type, End Use, Distribution Channel, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 119

- Format: PDF

- Report ID: PM3423

- Base Year: 2024

- Historical Data: 2020-2023

Microgreens Market Overview

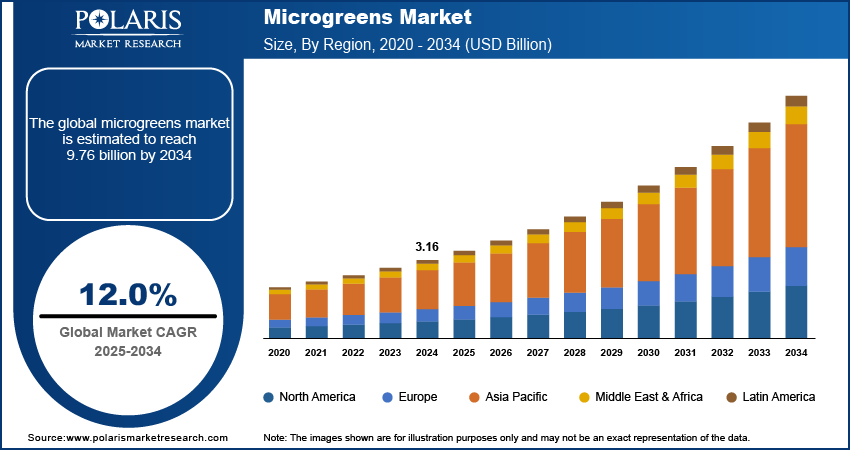

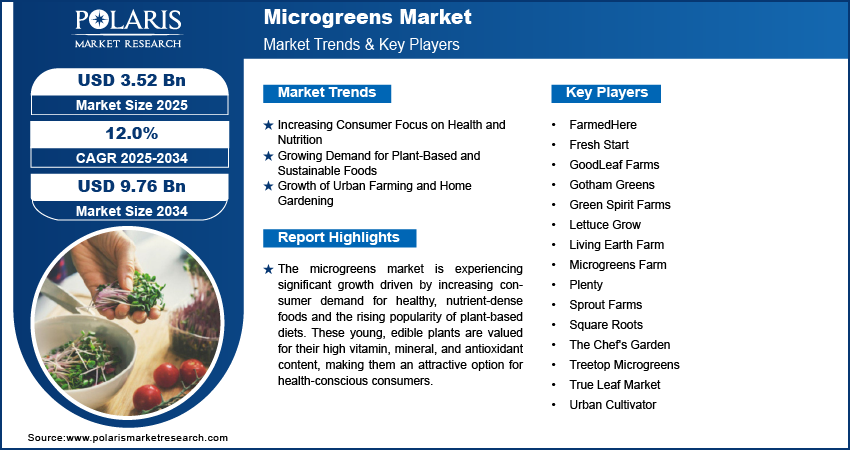

The microgreens market size was valued at USD 3.16 billion in 2024. The market is projected to grow from USD 3.52 billion in 2025 to USD 9.76 billion by 2034, exhibiting a CAGR of 12.0% during 2025–2034.

The microgreens market refers to the cultivation, processing, and distribution of edible young plants harvested at an early stage of growth, typically within 7 to 21 days after germination. These plants, which include varieties such as arugula, basil, and cilantro, are valued for their high nutritional content, unique flavors, and aesthetic appeal in culinary applications. Key drivers of the microgreens market demand include increasing consumer awareness of healthy diets, growing demand for plant-based foods, and the popularity of urban farming. Additionally, sustainability trends and the rising interest in home gardening and hydroponic systems are contributing to market growth. As consumer preferences shift toward more health-conscious and environmentally sustainable food options, the market is expected to expand during the forecast period.

To Understand More About this Research: Request a Free Sample Report

Microgreens Market Dynamics

Increasing Consumer Focus on Health and Nutrition

Microgreens are known for their high concentration of vitamins, minerals, and antioxidants, making them an attractive option for health-conscious consumers. Studies have shown that microgreens can contain up to 40 times higher nutrient levels compared to their mature counterparts. This nutritional benefit has led to a surge in their popularity, particularly among individuals seeking to incorporate more plant-based, nutrient-dense foods into their diets. As more consumers seek to improve their health and avoid chronic diseases, the demand for microgreens, which offer a quick, fresh, and easily accessible source of nutrition, continues to rise. Therefore, the rising consumer focus on health and wellness drives the microgreens market growth.

Growing Demand for Plant-Based and Sustainable Foods

Consumers are increasingly opting for plant-based food options for health and environmental reasons. Microgreens fit well within this trend, offering a sustainable and eco-friendly alternative to traditional crops. Their small scale of production requires less land, water, and energy, making them an attractive choice for environmentally-conscious consumers. The global shift toward reducing meat consumption, particularly among younger generations, is expected to fuel the demand for plant-based food products such as microgreens. According to a report by the Plant Based Foods Association, in the US, retail sales of plant-based foods grew by 27% from 2020 to 2021, reinforcing the growing preference for plant-based options. Hence, the increasing demand for plant-based and sustainable foods is expected to emerge as a key microgreens market trend during the forecast period.

Growth of Urban Farming and Home Gardening

Urban farming allows individuals in metropolitan areas to grow food in small spaces, such as apartments or rooftops, where traditional farming would not be feasible. Microgreens are particularly well-suited for urban farming due to their small size and rapid growth cycle. Additionally, advancements in hydroponic and vertical farming technologies have made it easier for individuals and businesses to grow microgreens efficiently. The global market for urban farming is expected to expand in the coming years, and microgreens are projected to play a central role in this growth. According to a 2021 report by the World Economic Forum, vertical farming is expected to grow at a rate of 24.8% annually by 2026, further supporting the demand for microgreens in urban agriculture. Thus, the rise of urban farming and home gardening practices has contributed to the microgreens market expansion.

Microgreens Market Segment Insights

Microgreens Market Assessment – Farming Type-Based Insights

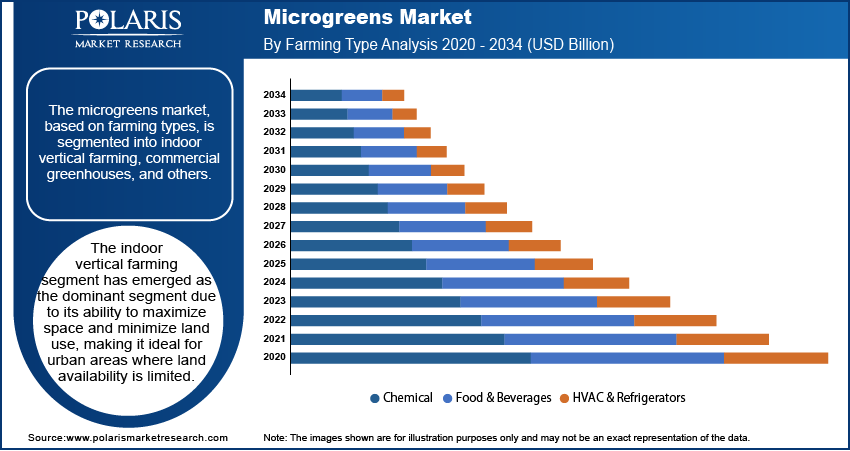

The microgreens market, based on farming types, is segmented into indoor vertical farming, commercial greenhouses, and others. The indoor vertical farming segment has emerged as the dominant segment due to its ability to maximize space and minimize land use, making it ideal for urban areas where land availability is limited. This method is experiencing the highest growth due to advancements in hydroponic and aeroponic systems, which allow for year-round cultivation with precise control over environmental factors. The efficiency and sustainability of indoor vertical farming align with the increasing demand for locally grown, fresh produce in urban markets. As technology in vertical farming continues to evolve, this segment is expected to register the highest growth rate in the coming years.

The commercial greenhouses segment is another key segment, offering a more traditional yet highly efficient method of growing microgreens. Greenhouses provide a controlled environment, ensuring optimal growing conditions while reducing the impact of weather on crop production. This segment remains popular in regions where land space is readily available and is expected to maintain a steady share of the market. Other farming methods, including traditional outdoor farming, contribute to a smaller portion of the market but continue to serve niche applications, particularly in rural areas or larger-scale operations. While this segment is not growing as rapidly as vertical farming, it still represents an essential part of the broader microgreens industry.

Microgreens Market Outlook – Distribution Channel-Based Insights

The microgreens market, by distribution channels, is segmented into retail stores, online platforms, farmers markets, and others. The retail stores segment holds the largest market share, driven by the widespread availability of microgreens in supermarkets and health food stores. This segment benefits from the convenience it offers consumers who prefer to purchase fresh produce during their regular shopping trips. The segment's dominance is supported by consumer preferences for purchasing food products in-store, where they can inspect freshness and quality. Additionally, the rising number of organic and healthy food retail outlets has provided a robust sales platform for microgreens.

The online platforms segment is experiencing the highest growth rate, fueled by the increasing adoption of e-commerce and the convenience of home delivery services. As consumer interest in fresh and healthy food options rises, more online platforms are offering microgreens for direct-to-consumer shipping. The expansion of grocery delivery services and specialized food platforms has significantly increased online sales of microgreens, particularly in urban areas. The farmers markets segment, while still important for direct farm-to-consumer sales, holds a smaller microgreens market share and caters to niche consumer segments who prioritize locally sourced produce. Other distribution channels, including foodservice and bulk supply, continue to hold a smaller but steady share, often driven by larger-scale buyers such as restaurants and wholesalers.

Microgreens Market Regional Insights

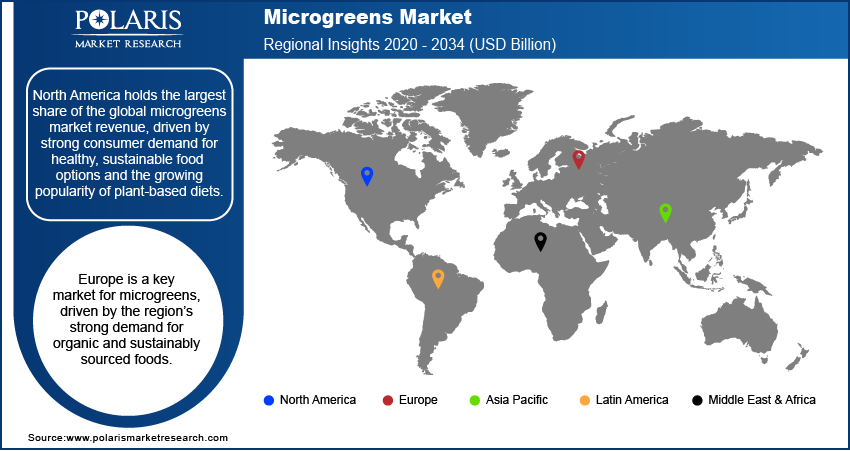

By region, the study provides microgreens market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest share of the global microgreens market revenue, driven by strong consumer demand for healthy, sustainable food options and the growing popularity of plant-based diets. The region benefits from advanced farming technologies, such as vertical farming and hydroponics, which support year-round production in urban areas. Additionally, the presence of well-established retail and e-commerce channels has facilitated widespread distribution, making microgreens easily accessible to a broad consumer base. The growing trend of health-conscious eating and the increasing focus on locally grown, fresh produce further propel the microgreens market development in North America. Europe also shows significant market potential, particularly in countries with strong organic food movements, while the Asia Pacific microgreens market is expected to grow rapidly due to urbanization and rising health awareness.

Europe is a key market for microgreens, driven by the region’s strong demand for organic and sustainably sourced foods. Countries such as the Netherlands, Germany, and the UK are leading the regional microgreens market share due to their established urban farming systems and advanced greenhouse technologies. The growing trend of plant-based diets and increasing consumer preference for nutrient-dense, fresh produce have contributed to the popularity of microgreens. Retail outlets, including supermarkets and health-focused stores, along with a strong presence of farmers' markets, ensure widespread availability of microgreens across the region. Additionally, the European Union’s support for sustainable agriculture practices, including vertical farming, is helping to fuel market growth.

The Asia Pacific microgreens market is expected to experience significant growth during the forecast period, driven by rapid urbanization, rising disposable incomes, and increasing health awareness. Countries such as Japan, China, and India are seeing a surge in demand for fresh, nutritious food options, including microgreens. The growing popularity of urban farming, along with technological advancements in hydroponic farming, is contributing to the Asia Pacific microgreens market expansion. However, while urban areas in countries such as Japan and China are the primary drivers of the market growth, the region as a whole is still in the early stages of widespread microgreens adoption. The demand for microgreens in foodservice, particularly in high-end restaurants, is gaining traction in these markets.

Microgreens Market – Key Players and Competitive Insights

The microgreens market is home to a variety of companies involved in the cultivation, distribution, and innovation of microgreens. Notable players in the market such as GoodLeaf Farms, a Canadian company, focus on the production of fresh, local microgreens using sustainable farming methods. The Chef's Garden, based in the US, specializes in a wide range of specialty vegetables and microgreens, serving both retail and foodservice sectors. Urban Cultivator is another key player that has revolutionized microgreen cultivation with its innovative indoor gardening systems. In the UK, Fresh Start produces high-quality microgreens for restaurants and retailers, emphasizing locally sourced and organic produce. A few other active market players are Green Spirit Farms, Gotham Greens, Sprout Farms, Living Earth Farm, True Leaf Market, Microgreens Farm, Plenty, FarmedHere, Lettuce Grow, Square Roots, Treetop Microgreens, and Miracle-Gro (operating as part of Scotts Miracle-Gro). These companies engage in various production methods, from vertical farming to hydroponics, ensuring year-round availability of microgreens in diverse markets.

The microgreens market is competitive with companies differentiating themselves through farming methods, product variety, and distribution networks. For instance, Gotham Greens and Plenty are prominent players in the vertical farming space, focusing on growing microgreens and other produce in climate-controlled indoor environments, which allows for consistent production regardless of external weather conditions. This positions them well to meet the demand for fresh, local produce in urban areas. Meanwhile, companies like True Leaf Market focus on providing a wide array of microgreen seeds to consumers and businesses, supporting both at-home growers and commercial producers. Retail distribution channels remain crucial for these companies, with brands like Fresh Start and Living Earth Farm successfully tapping into the organic and health-conscious consumer base.

The microgreens market is seeing increasing competition from companies venturing into home gardening and indoor farming solutions. Urban Cultivator and Lettuce Grow are examples of businesses offering products that allow consumers to grow microgreens at their homes. This trend aligns with the growing interest in sustainability and self-sufficiency, as well as the rising demand for fresh, home-grown food. As a result, companies are focusing on product innovation and customer education, offering tools and resources to help consumers achieve success in growing microgreens. This focus on sustainability, convenience, and health-consciousness will continue to shape the competitive landscape of the microgreens market.

Gotham Greens, an urban farming company, specializes in growing a variety of fresh produce, including microgreens, in controlled indoor environments. The company operates several hydroponic farms across the US, primarily focusing on providing locally grown vegetables to urban markets. Gotham Greens has expanded its operations to include multiple facilities in cities such as New York and Chicago, making its products available in retail stores and for foodservice. The company’s vertical farming methods allow it to grow food in city environments, reducing the need for long-distance transportation and maintaining the freshness of its products.

True Leaf Market, a US-based company, focuses on providing seeds for growing microgreens, herbs, and other plants. True Leaf Market serves both hobbyist growers and commercial producers, offering a range of seeds, supplies, and educational resources. The company operates an online platform where customers can purchase seeds and growing kits, and it also supplies products to various foodservice establishments. True Leaf Market has developed a strong customer base by offering a variety of microgreen seed options and ensuring high-quality, non-GMO products.

List of Key Companies in Microgreens Market

- FarmedHere

- Fresh Start

- GoodLeaf Farms

- Gotham Greens

- Green Spirit Farms

- Lettuce Grow

- Living Earth Farm

- Microgreens Farm

- Plenty

- Sprout Farms

- Square Roots

- The Chef's Garden

- Treetop Microgreens

- True Leaf Market

- Urban Cultivator

Microgreens Industry Developments

- In December 2024, True Leaf Market launched an updated version of its online store, which offers a wider range of eco-friendly growing tools and packaging to align with consumer preferences for sustainable farming practices.

- In May 2023, Gotham Greens announced the opening of a new indoor farm in Baltimore, aimed at expanding its reach and increasing its production capacity to meet growing consumer demand for locally grown produce.

Microgreens Market Segmentation

By Farming Type Outlook

- Indoor Vertical Farming

- Commercial Greenhouse

- Others

By Product Type Outlook

- Broccoli

- Cabbage

- Cauliflower

- Arugula

- Peas

- Basil

- Radish

- Others

By End Use Outlook

- Residential

- Commercial

By Distribution Channel Outlook

- Retail Stores

- Online

- Farmers Market

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Microgreens Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 3.16 billion |

|

Market Size Value in 2025 |

USD 3.52 billion |

|

Revenue Forecast by 2034 |

USD 9.76 billion |

|

CAGR |

12.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The microgreens market has been broadly segmented on the basis of farming type, product type, end use, and distribution channel. Moreover, the study provides the reader with a detailed understanding of the different segments at global and regional levels.

Growth/Marketing Strategy

The microgreens market growth strategy is focused on expanding product availability, improving cultivation methods, and increasing consumer awareness. Companies are leveraging innovative farming techniques, such as vertical farming and hydroponics, to boost production efficiency and ensure a consistent supply of fresh microgreens. Marketing efforts are often directed toward educating consumers on the health benefits and versatility of microgreens, with a strong emphasis on sustainability and local sourcing. Distribution strategies also include expanding into online platforms and grocery stores to increase accessibility. Additionally, partnerships with foodservice providers and restaurants help introduce microgreens to broader audiences, supporting market growth.

FAQ's

The microgreens market size was valued at USD 3.16 billion in 2024 and is projected to grow to USD 9.76 billion by 2034.

The market is projected to register a CAGR of 12.0% during the forecast period.

North America held the largest share of the market in 2024.

Notable players in the market such as GoodLeaf Farms, a Canadian company, focus on the production of fresh, local microgreens using sustainable farming methods. The Chef's Garden, based in the US, specializes in a wide range of specialty vegetables and microgreens, serving retail and foodservice sectors. Urban Cultivator is another key player that has revolutionized microgreens cultivation with its innovative indoor gardening systems.

The indoor vertical farming segment accounted for the largest share of the market in 2024.

The retail stores segment accounted for the largest share of the market in 2024.

Microgreens are young, edible plants harvested at an early stage of growth, typically between 7 to 21 days after germination. These plants are harvested when their first true leaves, or cotyledons, have developed. Microgreens are known for their intense flavors, vibrant colors, and high nutritional content, often containing higher levels of vitamins, minerals, and antioxidants compared to their mature counterparts. Common varieties of microgreens include arugula, basil, cilantro, radish, and sunflower. They are often used as garnishes in salads, sandwiches, or smoothies, offering both a nutritional boost and an aesthetic appeal to dishes.

A few key trends in the market are described below: Growing Demand for Health-Conscious Foods: Increasing consumer awareness about the health benefits of microgreens, such as their high vitamin and antioxidant content, is driving market growth. Sustainability Focus: A rising preference for environmentally friendly and locally grown produce is contributing to the popularity of microgreens, especially with their minimal resource requirements and low carbon footprint. Urban Farming and Vertical Farming: The growth of urban farming, supported by technologies such as hydroponics and vertical farming, is making microgreens more accessible in cities and reducing the reliance on traditional agriculture. Home Gardening Popularity: More consumers are turning to home gardening, including microgreens cultivation, with the help of innovative growing kits and indoor farming solutions.

A new company entering the microgreens market must focus on differentiating itself by adopting innovative farming technologies such as vertical farming and hydroponics to ensure year-round production with minimal environmental impact. Additionally, offering a wide range of unique, high-nutrient microgreens tailored to specific health benefits could appeal to health-conscious consumers. Emphasizing sustainability in sourcing, packaging, and distribution will resonate with eco-aware customers. Establishing a strong online presence with easy access to educational resources on growing microgreens at home or incorporating them into meals could enhance customer engagement. Further, building partnerships with restaurants and foodservice providers could help the company quickly gain traction in the market.

Companies manufacturing, distributing, or purchasing microgreens and related products and other consulting firms must buy the report.