Global Microcrystalline Cellulose Market Size, Share, Trends, Industry Analysis Report: By Source Type (Wood Based, Non-Wood Based), By Form, By Grade, By End Use, and By Region (North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024 - 2032

- Published Date:Aug-2024

- Pages: 117

- Format: PDF

- Report ID: PM5007

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

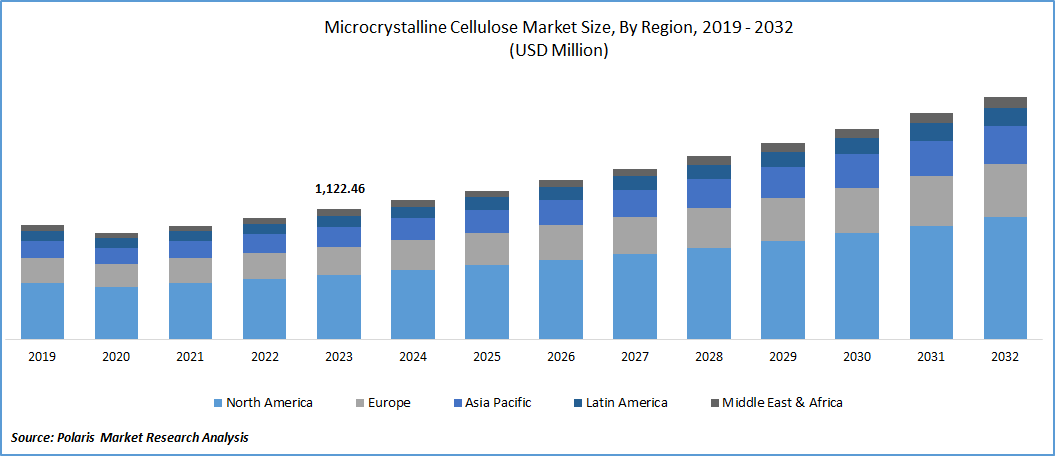

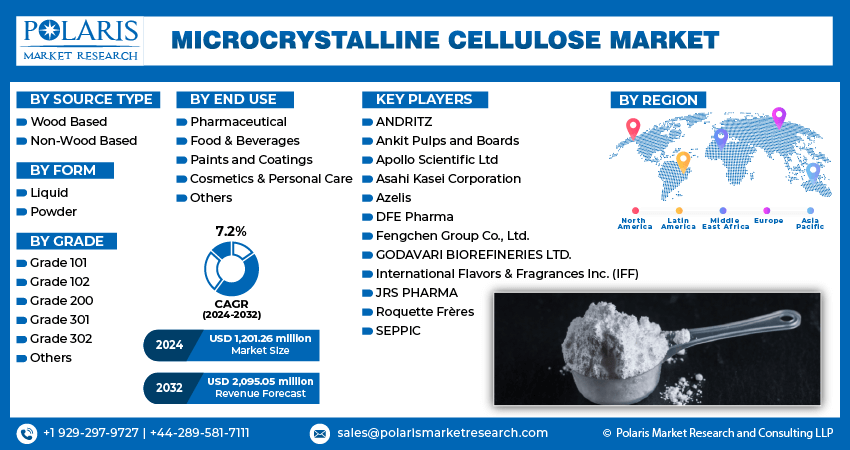

Global microcrystalline cellulose market size was valued at USD 1,122.46 million in 2023. The microcrystalline cellulose industry is projected to grow from USD 1,201.26 million in 2024 to USD 2,095.05 million by 2032, exhibiting a compound annual growth rate (CAGR) of 7.2% during the forecast period (2024 - 2032).

Microcrystalline cellulose is a versatile substance derived from cellulose, primarily sourced from wood pulp or cotton, and is widely used across various industries, including pharmaceuticals, food & beverage, cosmetics, and more. It is used primarily as a binder, bulking agent, and disintegrant in pharmaceutical tablets and capsules. It also has applications such as a stabilizer and texturizer in food products and as an absorbent in cosmetics.

The microcrystalline cellulose market has been experiencing steady growth due to increasing demand from the pharmaceutical industry, driven by the rising prevalence of chronic diseases and the need for innovative drug formulations. The food and beverage industry also contributes to the microcrystalline cellulose market growth, particularly in low-fat and low-calorie products where MCC acts as a fat substitute and texture enhancer.

To Understand More About this Research:Request a Free Sample Report

The key players in microcrystalline cellulose market include multinational corporations and regional manufacturers specializing in cellulose derivatives. These companies focus on product innovation, quality assurance, and expanding their market presence through collaboration and the inauguration of new manufacturing plants.

For instance, in September 2023, Nitika Pharmaceuticals announced the inauguration of a new manufacturing plant for microcrystalline cellulose in Nagpur, marking a significant rise in the microcrystalline cellulose industry.

Microcrystalline Cellulose Market Trends:

Rising Pharmaceutical Industry Demand is Driving Market Growth

The rising pharmaceutical industry demand is driving the microcrystalline cellulose market CAGR due to its binding properties, stability, and safety profile. The global pharmaceutical industry is experiencing robust growth, driven by aging populations, increasing healthcare needs, and the rising prevalence of chronic diseases. As the industry expands, the demand for high-quality excipients like MCC also rises to meet the production needs of various medications.

The pharmaceutical industry continually develops new and innovative drug formulations to improve efficacy and patient compliance. MCC's versatility and functionality support these advancements, making it a preferred excipient in modern drug development processes. MCC is recognized for its safety and efficacy by major regulatory authorities, including the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). Its inclusion in pharmacopeia ensures stringent quality standards, further driving its adoption in the pharmaceutical industry.

Thus, pharmaceutical companies are expanding their production capacities to meet the growing global demand for medications. The expansion requires a steady supply of excipients like MCC, further fueling microcrystalline cellulose industry growth.

For instance, in February 2024, Asahi Kasei introduced the pharmaceutical excipient Ceolus microcrystalline cellulose with nitrite levels of 0.1 μg/g (ppm) or more undersized. This lowered the risk of potentially carcinogenic nitrosamine contaminants in nutritional and pharmaceutical supplements, which led to increased demand from the pharmaceutical industry and significantly drove the growth of the microcrystalline cellulose market.

Rising Food and Beverage Industry Boosts Market Demand

The rising growth of the food and beverage industry significantly impacts the demand for the microcrystalline cellulose market due to its multifunctional properties. MCC is widely used as a texturizer and fat replacer, making it an essential ingredient in various food products. Its ability to improve the texture and stability of food items without adding calories makes it a necessary substance in the food and beverage sector, especially in the context of the increasing consumer trend toward low-fat and low-calorie foods.

Various consumers seek healthier dietary options, and food manufacturers are increasingly incorporating MCC to create products that meet the demands without compromising on taste or quality.

For instance, Roquette Frères offers MICRCOCEL, a purified form of microcrystalline cellulose, under the MICROCEL brand. MICRCOCEL serves as an insoluble fiber, anti-caking, extrusion auxiliary, and compression agent. It is 100% insoluble fiber, physiologically safe, inactive, and free from gluten and sugar. MICRCOCEL aids in the development of extruded snacks, grated cheese, hamburgers, and dietary supplements. This trend, driven by rising health awareness and lifestyle changes, has led to a substantial increase in the use of MCC in the food and beverage industry, further boosting microcrystalline cellulose market revenue.

Microcrystalline Cellulose Market Segment Insights:

Microcrystalline Cellulose Form Insights:

The global microcrystalline cellulose market segmentation, based on form, includes liquid and powder. In 2023, the powder segment accounted for the largest market share due to its widespread applications and versatility. Powdered MCC is preferred for its excellent binding, filling, and disintegrating properties, making it a crucial ingredient in pharmaceutical tablets and capsules. Further, in the food and beverage industry, powdered MCC is used to enhance product quality and appeal. Its ease of handling, uniform particle size, and consistent performance contribute to its popularity in these industries.

Additionally, the launch of new excipient solutions by various companies indicates that key market players are actively engaged in developing innovative MCC solutions, driving the demand for microcrystalline cellulose.

For instance, in July 2021, DFE Pharma launched Pharmacol sMCC 90, a silicified microcrystalline cellulose developed as a synergistic solution for challenging oral solid dosage formulations. Pharmacel sMCC 90, the latest addition to the MCC co-processed portfolio, is a silicified microcrystalline cellulose developed for challenging formulations. Co-processing silicon dioxide with MCC increases surface area, which enhances powder flow and tablet ability and ensures formulation robustness. Such solutions expand the application of MCC in powder form, thereby driving microcrystalline cellulose market growth.

Microcrystalline Cellulose End Use Insights:

The global microcrystalline cellulose market segmentation, based on end use, includes pharmaceuticals, food and beverages, paints and coatings, cosmetics & personal care, and others. The pharmaceutical segment held the largest market share in 2023 due to the extensive use of MCC as a critical excipient in drug formulation. MCC's superior binding, disintegrating, and bulking properties are indispensable for producing high-quality tablets and capsules, making it a valued asset in the pharmaceutical industry.

Morever, the continuous development of new and innovative drug formulations is creating an abundant ground for advanced excipients that meet stringent regulatory standards and performance requirements in the pharmaceutical sector. As pharmaceutical companies expand their production capacities and develop new therapies, the reliance on MCC as a versatile and reliable excipient is poised to grow, maintaining its dominant position in the microcrystalline cellulose market.

For instance, in September 2023, IFF’s Pharma Solutions division showcased its major excipient products at CPHI 2023 in Barcelona, Spain. The excipient products included the Avicel PH LN portfolio—a vigorous, low-nitrite MCC that lowers the risk of nitrosamine formation in final drug products, catering to pharmaceutical customers' requirements.

Furthermore, in February 2022, Azelis announced an agreement with Roquette for the distribution of their pharmaceutical cellulose product range in India. Through this collaboration, Azelis India expanded its comprehensive product portfolio to include Roquette’s microcrystalline cellulose products. Such products indicate the rising innovation in MCC in the pharmaceutical industry, catering to the increasing demand in the microcrystalline cellulose market.

Global Microcrystalline Cellulose Market, Segmental Coverage, 2019 - 2032 (USD - Million, Volume - Kilotons)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

Microcrystalline Cellulose Regional Insights:

By region, the study provides market insights into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. The North America microcrystalline cellulose market accounted for the largest share in 2023 due to the region’s well-established and robust pharmaceutical sector, which is one of the major applications of MCC. The region's focus on research and development, coupled with the presence of major pharmaceutical companies, drives the demand for high-quality excipients like MCC.

In addition, the presence of major companies such as Roquette Frères, Asahi Kasei Corporation, and DFE Pharma offering their services further strengthens the market landscape in North America. The key market players are merging, acquiring, and collaborating to strengthen their market presence and serve better offerings in North America, further driving the market during the forecast period.

Global Microcrystalline Cellulose Market Share, Regional Coverage, 2019 - 2032 (USD Million) (Kilotons)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

The U.S. microcrystalline cellulose market is expected to witness significant CAGR growth during the forecast period. The increasing trend towards healthier and low-calorie food options has bolstered the demand for microcrystalline cellulose in the food and beverage industry. The rising food spending and growing consumer awareness regarding healthy eating habits significantly contribute to the microcrystalline cellulose market demand in the U.S.

Further, the Canadian microcrystalline cellulose market held a significant market share in 2023. Similar to other developed nations, Canada has a strong pharmaceutical sector that significantly drives the demand for microcrystalline cellulose market. The country's pharmaceutical industry relies on high-quality excipients like MCC for the production of tablets, capsules, and other dosage forms. Thus, the factors mentioned above are expected to drive the market during the forecast period.

The Europe microcrystalline cellulose market is anticipated to grow at the fastest CAGR from 2024 to 2032. European manufacturers and suppliers of microcrystalline cellulose are expanding their focus towards emerging markets in Eastern Europe and beyond.

For instance, in June 2024, Nordic Bioproducts Group announced that its new manufacturing facility in Lappeenranta, Finland, received the prestigious EXCiPACT certification for MCC production.

Moreover, the German microcrystalline cellulose (MCC) market held a significant market share in 2023, driven by the increasing demand for natural and sustainable ingredients in beauty products. This trend has led to the expanded use of MCC in formulations requiring improved texture and stability. This further boosts the microcrystalline cellulose market in Germany.

Further, the major countries studied in the market report are the US, Canada, Germany, France, the U.K., Italy, Spain, China, Japan, India, Australia, South Korea, Brazil, and Others.

Microcrystalline Cellulose Key Market Players & Competitive Insights

Leading market players are the driving force behind innovation and competitive dynamics in the microcrystalline cellulose industry. Their focus on expanding production capacities and technological advancements to enhance MCC's functional properties is shaping the industry. This competitive landscape is marked by strategic partnerships, mergers and acquisitions, and a strong emphasis on sustainability and meeting stringent regulatory standards across different regions. To thrive in such a competitive and rising market environment, the microcrystalline cellulose industry must offer cost-effective products.

One of the key business tactics used by manufacturers in the global microcrystalline cellulose industry is local manufacturing to minimize operational costs. This strategy not only benefits clients but also increases the market sector. Major players in the microcrystalline cellulose industry include ANDRITZ, Ankit Pulps and Boards, Apollo Scientific Ltd, Asahi Kasei Corporation, Azelis, DFE Pharma, Fengchen Group Co., Ltd., GODAVARI BIOREFINERIES LTD., International Flavors & Fragrances Inc. (IFF), JRS PHARMA, Roquette Frères, and SEPPIC etc.

Azelis, a global provider of innovation services in the specialty chemicals and food ingredients sectors, operates through a robust network of over 70 application laboratories. Their services span diverse markets, including animal nutrition, food & nutrition, home care & industrial cleaning, personal care, pharma & healthcare, and agricultural & environmental solutions. In November 2023, Azelis introduced the S-Tab from SPI Pharma, a standout player in swallow tablet formulations. S-Tab utilizes an optimized platform incorporating a blend of materials such as sodium stearyl fumarate, silicon dioxide, sodium starch glycolate, silicified MCC, and microcrystalline cellulose, among others.

Godavari Biorefineries Ltd., a member of the Somaiya Group, specializes in the production of sugar, various foods, biofuels, chemicals, power, compost, waxes, and related products, utilizing sugarcane and other biomass as their primary raw materials. Their manufacturing facilities are situated in Karnataka and the Ahmednagar district of Maharashtra. Godavari Biorefineries Ltd. introduced microcrystalline cellulose (MCC) derived from sugarcane, which is a partially hydrolyzed cellulose available in the form of a white, odorless powder. In April 2021, the company established India’s largest-capacity ethanol plant based on sugarcane syrup.

Key companies in the microcrystalline cellulose market include:

- ANDRITZ

- Ankit Pulps and Boards

- Apollo Scientific Ltd

- Asahi Kasei Corporation

- Azelis

- DFE Pharma

- Fengchen Group Co., Ltd.

- GODAVARI BIOREFINERIES LTD.

- International Flavors & Fragrances Inc. (IFF)

- JRS PHARMA

- Roquette Frères

- SEPPIC

Microcrystalline Cellulose Industry Developments

- October 2023: Roquette introduced three new excipient grades to its extensive portfolio of solutions designed for moisture-sensitive active nutraceutical and pharmaceutical ingredients, which includes LYCATAB CT-LM, a partially pregelatinized starch, along with MICROCEL 113 SD and MICROCEL 103 SD microcrystalline cellulose products.

- January 2023: Asahi Kasei completed the construction of its Ceolus microcrystalline cellulose second plant at its Mizushima Works in Okayama, Japan, to meet the growing demand of MCC.

- November 2022: DFE Pharma announced a distribution agreement with Azelis for EMEA countries, allowing Azelis to exclusively distribute DFE Pharma excipients such as Nutracel, Pharmacel, and Pharmacel sMCC90, high-quality MCCs and co-processed MCC used as fillers and binders in oral dosage forms.

Microcrystalline Cellulose Market Segmentation:

Microcrystalline Cellulose Source Type Outlook

- Wood Based

- Non-Wood Based

Microcrystalline Cellulose Form Outlook

- Liquid

- Powder

Microcrystalline Cellulose Grade Outlook

- Grade 101

- Grade 102

- Grade 200

- Grade 301

- Grade 302

- Others

Microcrystalline Cellulose End Use Outlook

- Pharmaceutical

- Food & Beverages

- Paints and Coatings

- Cosmetics & Personal Care

- Others

Microcrystalline Cellulose Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- apan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Microcrystalline Cellulose Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 1,122.46 million |

|

Market Size Value in 2024 |

USD 1,201.26 million |

|

Revenue Forecast in 2032 |

USD 2,095.05 million |

|

CAGR |

7.2% from 2024 – 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The global microcrystalline cellulose market size was valued at USD 1,122.46 million in 2023 and is expected to grow to USD 2,095.05 million in 2032

The global market is projected to grow at a CAGR of 7.2% during the forecast period, 2024-2032

North America held the largest share in the global market

The key players in the market are ANDRITZ, Ankit Pulps and Boards, Apollo Scientific Ltd, Asahi Kasei Corporation, Azelis, DFE Pharma, Fengchen Group Co., Ltd., GODAVARI BIOREFINERIES LTD., International Flavors & Fragrances Inc. (IFF), JRS PHARMA, Roquette Frères, and SEPPIC

The powder category dominated the market in 2023

The pharmaceutical segment held the largest share of the global market.