Microbiome Sequencing Services Market Size, Share, Trends, Industry Analysis Report

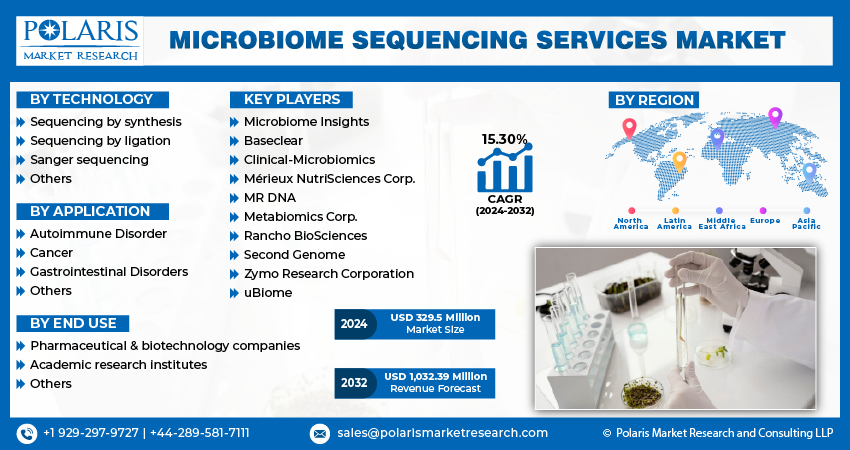

: By Technology (Sequencing by Synthesis, Sequencing by Ligation, Sanger Sequencing, and Others), Application, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 120

- Format: PDF

- Report ID: PM3620

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

The microbiome sequencing services market size was valued at USD 1,672.71 million in 2024, exhibiting a CAGR of 10.8% during 2025–2034. The market is driven by advancements in sequencing technologies, rising demand for personalized medicine, growing awareness of microbiome-health links, increasing research initiatives, supportive government collaborations, and expanding clinical applications in chronic disease management.

Key Insights

- The sequencing by synthesis (SBS) segment leads the microbiome sequencing services market due to its high throughput, accuracy, and widespread adoption in analyzing complex microbial communities across clinical and environmental studies.

- The gastrointestinal disorders segment holds the largest application share, driven by the critical role of the gut microbiome in digestive health and the growing use of sequencing to identify microbial imbalances linked to diseases such as Crohn’s and ulcerative colitis.

- North America dominates the microbiome sequencing services market owing to its strong healthcare infrastructure, major R&D investments, presence of key players, and extensive government funding for microbiome research.

- Europe is witnessing robust growth, fueled by increased awareness of genomic medicine, rising incidence of genetic disorders, and expanded use of microbiome sequencing in precision medicine and biomedical research.

Industry Dynamics

- Rising research in microbiome-based therapeutics increases demand for sequencing services to explore microbial roles in disease mechanisms.

- Integration of AI with sequencing allows faster, more precise microbial analysis for clinical, agricultural, and environmental applications.

- Government funding and academic collaborations enhance access to advanced sequencing platforms and promote large-scale microbiome research projects.

- Regulatory complexities around clinical applications of microbiome data can delay commercialization and approval of sequencing-based therapies.

Market Statistics

2024 Market Size: USD 1,672.71 million

2034 Projected Market Size: USD 4,654.10 million

CAGR (2025–2034): 10.8%

North America: Largest market in 2024

AI Impact on Microbiome Sequencing Services Market

- AI enhances the accuracy and speed of microbiome data analysis by automating complex bioinformatics processes and reducing human error.

- Machine learning algorithms identify patterns in microbial communities, enabling better interpretation of sequencing data for clinical and research applications.

- The integration of AI with next-generation sequencing platforms streamlines workflows, making microbiome sequencing more accessible and scalable for various industries.

- Advanced AI tools improve strain-level resolution in metagenomic sequencing, facilitating more precise identification of microbial species.

To Understand More About this Research: Request a Free Sample Report

The microbiome sequencing services market focuses on providing advanced sequencing technologies to analyze microbial communities across various applications, including healthcare, agriculture, and environmental research. This microbiome sequencing services market expansion is driven by increasing research initiatives in microbiome-based therapeutics, rising demand for personalized medicine, and advancements in next-generation sequencing technologies. Additionally, the growing prevalence of chronic diseases, including gastrointestinal disorders and metabolic conditions, has accelerated the adoption of microbiome sequencing in clinical diagnostics and drug development. The integration of bioinformatics and artificial intelligence for data analysis further enhances the efficiency and accuracy of microbiome research, supporting the microbiome sequencing services market trends.

Qualitative analysis of the microbiome sequencing services market highlights the competitive landscape, characterized by the presence of key players investing in research and development to offer innovative sequencing solutions. Service providers are expanding their offerings to include metagenomic sequencing, 16S rRNA sequencing, and whole-genome sequencing to cater to diverse industry needs. The regulatory environment also plays a crucial role, with stringent guidelines for clinical applications influencing market trends. Challenges such as high costs associated with sequencing technologies and data interpretation complexities may hinder growth, but continuous advancements in sequencing methodologies and increasing collaborations between research institutions and biotechnology companies are expected to drive market expansion.

Market Dynamics

Government Initiatives and Collaborations

Government initiatives and collaborations have been pivotal in propelling the microbiome sequencing services market growth. Recognizing the potential of microbiome research, various governmental bodies have launched programs to support and fund related projects. In February 2023, Locus Biosciences established a long-term collaboration with CosmosID to support its clinical trial research. CosmosID’s microbiome analysis expertise is expected to enhance Locus Biosciences' precision therapeutics platform. Such collaborations and initiatives propel the market growth.

Growing Awareness of Microbiome's Role in Health

There is an increasing recognition of the microbiome's critical role in human health, which has significantly driven the demand for microbiome sequencing services. Research has demonstrated that microbial communities influence various physiological processes, including digestion, immunity, and even behavior. Disruptions in the microbiome have been linked to numerous health conditions, such as inflammatory bowel disease, obesity, and mental health disorders. Growing consumer awareness has led to a surge in the demand for probiotics, prebiotics, and dietary interventions that support gut health. Companies are developing personalized nutrition plans based on individual microbiome profiles to optimize digestion and overall well-being. A comprehensive understanding of these associations necessitates detailed microbiome analysis, thereby boosting the demand for sequencing services.

Segment Insights

Assessment – By Technology

The microbiome sequencing services market, by technology, is segmented into sequencing by synthesis, sequencing by ligation, sanger sequencing, and others. The sequencing by synthesis (SBS) segment dominated the microbiome sequencing services market share in 2024. SBS's highly parallel nature enables the simultaneous sequencing of millions of DNA fragments, facilitating comprehensive analysis of complex microbial communities. This efficiency has made SBS the preferred method for numerous applications, including studies of bacterial populations in various human organs and environmental samples. The widespread adoption of SBS is further bolstered by its extensive use among commercial entities, contributing to its dominant position in the market.

Evaluation– By Application

The microbiome sequencing services market, by application, is segmented into autoimmune disorder, cancer, gastrointestinal disorders, and others. The gastrointestinal disorders segment holds the largest market share in 2024. This prominence is attributed to the critical role of the gut microbiome in maintaining digestive health and its association with various gastrointestinal diseases. Research has demonstrated that imbalances in the gut microbiome contribute to conditions such as Crohn's disease, ulcerative colitis, and gastrointestinal cancers. The advent of advanced sequencing technologies has enabled detailed analysis of gut microbiota, facilitating the identification of key microbial species involved in these disorders. Consequently, there is a growing interest in utilizing microbiome sequencing to develop personalized therapies and diagnostic tools for gastrointestinal conditions, driving segmental growth.

Regional Insights

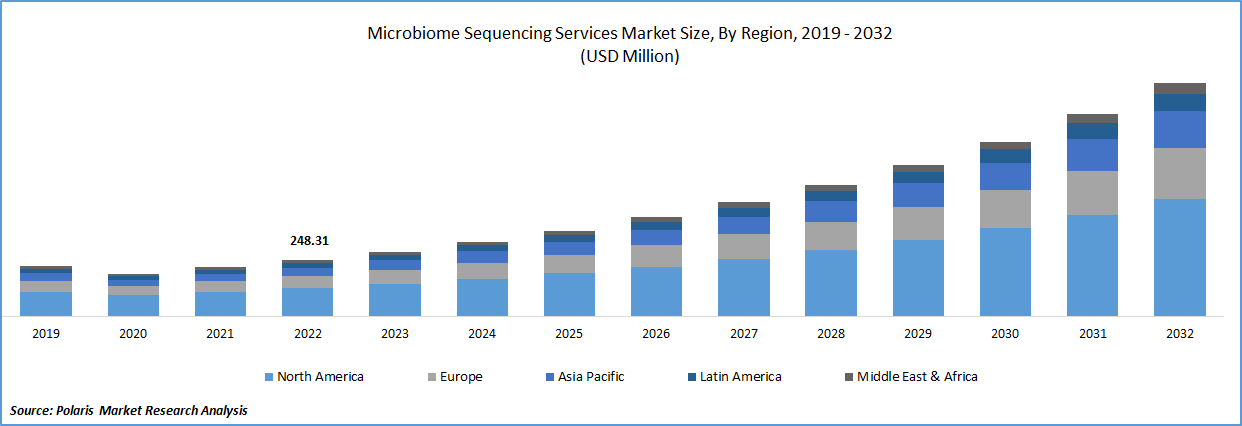

By region, the study provides microbiome sequencing services market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest share of the global microbiome sequencing services market revenue, primarily due to its well-established healthcare infrastructure and significant research and development activities in genomics and microbiology. The presence of key market players, such as Illumina and CosmosID, headquartered in the US, further strengthens the region's dominance. Additionally, substantial government support and funding for microbiome research contribute to the market growth.

The Europe microbiome sequencing services market is experiencing significant growth, driven by the increasing prevalence of genetic disorders and a rising preference for self-medication. Countries such as the UK and Germany are at the forefront, with the presence of major industry players and heightened awareness of next-generation sequencing technologies. The region's expansion is further supported by the growing application of microbiomes in genomics, proteomics, and metabolomics, contributing to advancements in personalized medicine and therapeutic research.

Key Players and Competitive Insights

The microbiome sequencing services market features several active key players contributing to its growth and innovation. Notable companies include Baseclear B.V.; Clinical Microbiomics A/S; Mérieux NutriSciences Corporation; Metabiomics Corp.; Microbiome Insights Inc.; Microbiome Therapeutics, LLC; Molzym GmbH & Co. KG; MR DNA; Resphera Biosciences, LLC; and Zymo Research Corporation.

Microbiome Insights Inc., established in 2015, is a Canadian company specializing in comprehensive microbiome DNA sequencing and bioinformatic analysis services. Based in Vancouver, the company offers tailored solutions for researchers and clinicians across various fields, including human and animal health, agriculture, and environmental studies. Their services encompass 16S rRNA gene sequencing, shotgun metagenomic sequencing, and metatranscriptomics, all supported by a team of experts in microbial ecology, microbiology, genomics, and molecular genetics. In May 2023, Microbiome Insights introduced metatranscriptomic sequencing services, enabling researchers to analyze gene expression and identify active metabolic pathways within microbial communities. Earlier, in June 2022, the company was awarded an Innovative Solutions Canada contract by Health Canada to enhance regulatory testing for microbial biotechnology products, reflecting their commitment to advancing microbiome research and its practical applications.

BaseClear B.V. is a prominent genomics service provider based in the Netherlands, specializing in comprehensive sequencing solutions. Their services include Next-Generation Sequencing (NGS), Sanger sequencing, and Good Manufacturing Practice (GMP) sequencing, utilizing advanced technologies from leading companies like Illumina, Pacific Biosciences (PacBio), and Oxford Nanopore Technologies (ONT). This enables them to cater to a wide range of research needs across various fields. BaseClear emphasizes delivering high-quality results with efficiency, providing expert support to help customers achieve their research objectives. Their sequencing services encompass Illumina sequencing on platforms like the NovaSeq 6000, as well as real-time quantitative PCR (qPCR) for precise gene expression analysis. Additionally, they offer rapid genome assembly and plasmid sequencing, which are crucial for understanding genetic structures and functions. Operating primarily in Europe, BaseClear serves as a reliable partner for research institutions and industries seeking advanced genomics solutions.

List of Key Companies

- Baseclear B.V.

- Clinical Microbiomics A/S

- Mérieux NutriSciences Corporation

- Metabiomics Corp.

- Microbiome Insights Inc.

- Microbiome Therapeutics, LLC.

- Molzym GmbH & Co. KG

- MR DNA

- Resphera Biosciences, LLC

- Zymo Research Corporation

Microbiome Sequencing Services Industry Developments

- In September 2024, Thermo Fisher Scientific introduced a next-generation microbiome analysis platform that combines advanced DNA sequencing technologies with AI-powered analytics. This innovative platform streamlines the interpretation of microarray data, enabling researchers and clinicians to gain deeper insights into microbial communities. As a result, it enhances the accuracy of diagnosis and treatment strategies in personalized medicine.

- In February 2023: The MetaXplore range was launched by Microba in Australia, offering diagnostic gastrointestinal health testing and metagenomic microbiome analysis. The product is expected to be rolled out internationally through distribution partners.

Microbiome Sequencing Services Market Segmentation

By Technology Outlook (Revenue – USD Million, 2020–2034)

- Sequencing by Synthesis

- Sequencing by Ligation

- Sanger Sequencing

- Others

By Application Outlook (Revenue – USD Million, 2020–2034)

- Autoimmune Disorder

- Cancer

- Gastrointestinal Disorders

- Others

By End Use Outlook (Revenue – USD Million, 2020–2034)

- Pharmaceutical & Biotechnology Companies

- Academic Research Institutes

- Others

By Regional Outlook (Revenue – USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1,672.71 million |

|

Market Size Value in 2025 |

USD 1,849.19 million |

|

Revenue Forecast by 2034 |

USD 4,654.10 million |

|

CAGR |

10.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 1,672.71 million in 2024 and is projected to grow to USD 4,654.10 million by 2034.

The market is projected to register a CAGR of 10.8% during the forecast period.

North America held the largest share of the market in 2024.

A few key players in the market are Baseclear B.V.; Clinical Microbiomics A/S; Mérieux NutriSciences Corporation; Metabiomics Corp.; Microbiome Insights Inc.; Microbiome Therapeutics, LLC; Molzym GmbH & Co. KG; MR DNA; Resphera Biosciences, LLC; and Zymo Research Corporation.

The sequencing by synthesis (SBS) segment dominated the market share in 2024.

The gastrointestinal disorders dominated the market share in 2024.