Micro-mobility Market Size, Share, Trends, and Industry Analysis Report

: By Application (Commercial and Private), Type (Bicycles, Shared Bicycles, Electric Scooters, and Electric Skateboards), End Users, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 117

- Format: PDF

- Report ID: PM3122

- Base Year: 2024

- Historical Data: 2020-2023

Micro-mobility Market Overview

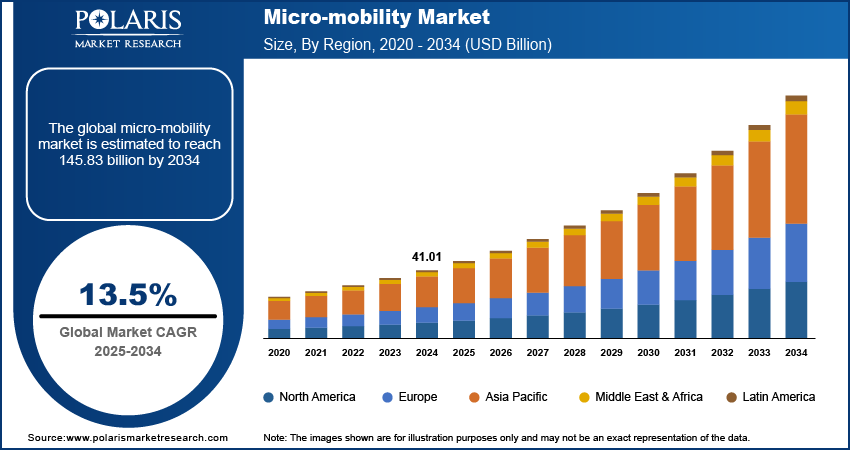

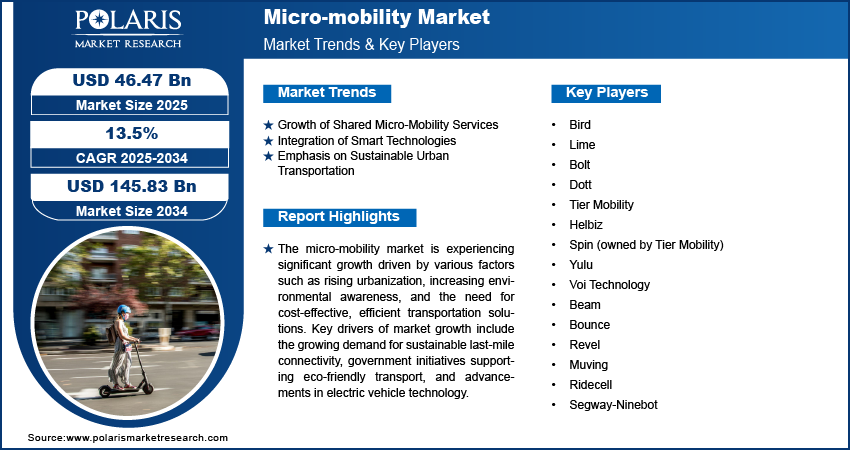

The global micro-mobility market size was valued at USD 41.01 billion in 2024. The market is projected to grow from USD 46.47 billion in 2025 to USD 145.83 billion by 2034, exhibiting a CAGR of 13.5% during 2025–2034.

The micro-mobility market encompasses small, lightweight transportation modes such as bicycles, electric bikes (e-bikes), electric scooters (e-scooters), and other compact electric vehicles, typically used for short-distance travel. The increasing urbanization, rising need for sustainable and cost-effective transportation solutions, and government initiatives promoting eco-friendly mobility drive the market growth. Key micro-mobility market trends include the integration of Internet of Things (IoT) technologies for fleet management, the growth of subscription-based and shared mobility services, and advancements in battery technology to improve efficiency and range. The micro-mobility sector also benefits from increasing consumer demand for convenient, last-mile connectivity options.

To Understand More About this Research: Request a Free Sample Report

Micro-mobility Market Dynamics

Growth of Shared Micro-Mobility Services

Shared micro-mobility services, including bike-sharing and scooter-sharing programs, have significantly transformed urban transportation. These services cater to the growing demand for flexible and affordable mobility solutions, particularly in densely populated cities. The convenience of app-based booking systems and integration with public transit networks are driving this trend. Additionally, private and public sectors are investing significantly in shared fleets. Thus, the growing shared micro-mobility services boost the micro-mobility market development.

Integration of Smart Technologies

The adoption of Internet of Things (IoT) and artificial intelligence (AI) technologies is reshaping the micro-mobility market. These innovations enable real-time tracking, predictive maintenance, and enhanced fleet management, improving operational efficiency and user experience. For instance, IoT-enabled sensors can monitor vehicle conditions and battery levels, reducing downtime and operational costs

Emphasis on Sustainable Urban Transportation

Environmental concerns and stringent emission regulations are prompting a shift toward sustainable micro-mobility options. Electric-powered vehicles, such as e-bikes and e-scooters, significantly reduce carbon footprints compared to traditional transportation methods. The International Energy Agency (IEA) estimates that electric micro-mobility solutions can save up to 0.3 million metric tons of CO₂ emissions annually in urban areas globally. Moreover, city administrations are increasingly supporting eco-friendly transport through dedicated bike lanes and subsidies, further accelerating adoption. Therefore, the increasing emphasis on sustainable urban transportation is expected to propel the micro-mobility market demand in the coming years.

Micro-mobility Market Segment Insights

Micro-mobility Market Outlook – Application-Based Insights

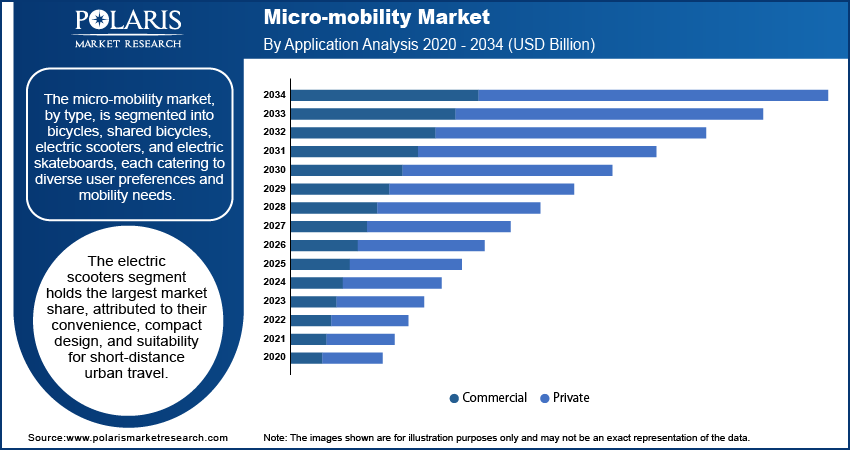

The micro-mobility market, by application, is primarily bifurcated into commercial and private, each catering to distinct consumer needs and usage patterns. The private segment holds a larger market share, driven by the growing preference for personal ownership of electric bikes (e-bikes) and scooters for daily commutes and leisure activities. Rising urbanization and consumer awareness regarding eco-friendly transportation are fueling demand in this segment, supported by advancements in battery technology and vehicle affordability. Many users opt for private micro-mobility solutions to avoid dependency on shared services and public transportation, particularly owing to the rising health and safety concerns since the COVID-19 pandemic.

The commercial segment is experiencing a higher growth rate, propelled by the expansion of shared mobility services and last-mile delivery applications. With the surge in e-commerce and food delivery platforms, businesses are increasingly adopting electric two-wheelers and lightweight vehicles to improve delivery efficiency and reduce operational costs. Fleet operators are leveraging IoT-enabled solutions to optimize routes and track performance, enhancing the segment’s value proposition. Additionally, the push for corporate sustainability initiatives and regulatory support for emission-free deliveries is driving the segment growth.

Micro-mobility Market Assessment – Type-Based Insights

The micro-mobility market, by type, includes bicycles, shared bicycles, electric scooters, and electric skateboards, each catering to diverse user preferences and mobility needs. The electric scooters segment holds the largest market share due to their convenience, compact design, and suitability for short-distance urban travel. The growing adoption of electric scooters for personal and shared mobility services, combined with advancements in battery technology and supportive infrastructure, such as dedicated scooter lanes, is driving their prominence in the market. Governments' initiatives to promote environmentally friendly transportation have further incentivized the use of electric scooters among urban commuters.

The electric skateboard segment is registering the highest growth rate due to increasing demand among younger consumers and enthusiasts seeking innovative and portable mobility options. These devices are particularly popular in regions with advanced urban infrastructure and among users looking for recreational and last-mile transportation solutions. Manufacturers are introducing features such as regenerative braking and improved safety mechanisms, enhancing their appeal. Additionally, the integration of smart technology, such as app connectivity and customizable riding modes, is boosting the adoption of electric skateboards, contributing to their rapid market expansion.

Micro-mobility Market Evaluation – End Users-Based Insights

The micro-mobility market, by end users, is segmented into state and national authorities, micro-mobility service providers, research organizations, government associations, and others. The micro-mobility service providers segment holds the largest market share due to their critical role in offering shared mobility solutions such as e-scooters and bike-sharing programs. The growing demand for convenient and cost-effective transportation options has led to a surge in shared service models across urban areas. These providers are leveraging advanced technologies such as IoT and data analytics to optimize operations, enhance user experience, and expand their fleet networks, solidifying their dominance in the market.

The state and national authorities segment is registering the highest growth rate in this micro-mobility market, driven by their increasing focus on promoting sustainable urban transportation and reducing traffic congestion. Governments are actively investing in micro-mobility infrastructure, including dedicated bike lanes and parking facilities, to support widespread adoption. Additionally, regulatory frameworks encouraging the use of eco-friendly vehicles and partnerships with private operators to implement city-wide programs are accelerating growth in this segment. The alignment of micro-mobility solutions with broader environmental and urban development goals further underscores the strategic importance of this end-user group.

Micro-mobility Market Regional Insights

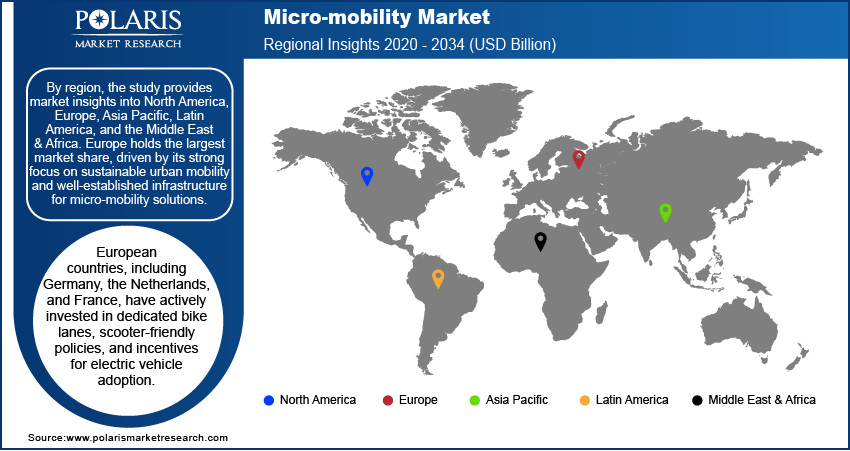

By region, the study provides micro-mobility market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The regional analysis of the micro-mobility market highlights that Europe holds the largest market share, driven by its strong focus on sustainable urban mobility, well-developed urban infrastructure, and well-established infrastructure for micro-mobility solutions. European countries, including Germany, the Netherlands, and France, have actively invested in dedicated bike lanes, scooter-friendly policies, and incentives for electric vehicle adoption. High environmental awareness among consumers, coupled with stringent emission regulations, has further fueled the adoption of bicycles, e-bikes, and e-scooters in the region. Additionally, the presence of leading micro-mobility service providers and supportive government initiatives, such as subsidies and tax exemptions, solidifies Europe's dominant position in the global market. Countries like Germany, the Netherlands, and France have implemented policies promoting the adoption of electric scooters, bicycles, and shared mobility services. Additionally, government investments in micro-mobility infrastructure, such as bike lanes and parking spaces, coupled with tax incentives for electric vehicles, have supported the micro-mobility market expansion in Europe.

The Asia Pacific micro-mobility market is witnessing rapid growth, driven by increasing urbanization and the rising demand for affordable last-mile connectivity solutions. Countries such as China, India, and Japan are major contributors to this growth, supported by the widespread adoption of shared bicycles and e-scooters. The region benefits from a large population base and government initiatives promoting electric mobility to reduce air pollution. Additionally, the expansion of app-based ride-sharing platforms and advancements in electric vehicle technology are boosting the adoption of micro-mobility solutions across the region.

Micro-mobility Market – Key Market Players and Competitive Insights

Key players in the micro-mobility market include Bird, Lime, Bolt, Dott, Tier Mobility, Helbiz, Spin (owned by Tier Mobility), Yulu, Voi Technology, Beam, Bounce, Revel, Muving, Ridecell, and Segway-Ninebot. These companies focus on offering diverse solutions such as electric scooters, bicycles, and shared mobility services, catering to growing consumer demand for cost-effective and sustainable transportation. Many of these firms have strengthened their presence in urban areas by expanding fleets, improving technology, and forming partnerships with city administrations to align with infrastructure development.

The competitive landscape of the micro-mobility market is shaped by technological advancements, geographic expansion, and the ability to address consumer preferences. Companies such as Lime and Bird prioritize innovation by integrating IoT features and optimizing operational efficiency through data analytics, while firms such as Bolt and Voi focus on affordability and enhancing accessibility in emerging markets. Additionally, Tier Mobility’s acquisition of Spin reflects ongoing market consolidation, with larger players absorbing smaller competitors to scale operations and streamline market offerings. Firms also differentiate themselves by tailoring services to specific regions, enhancing their competitiveness.

Insights into the market indicate increasing competition to secure regulatory approval and infrastructure support in densely populated urban centers. Established players are leveraging partnerships with governments and local businesses to gain an edge, while newer entrants emphasize niche solutions such as electric mopeds and advanced battery technology to capture market share. Consumer-centric innovations, such as subscription-based pricing models and improved safety features, are becoming critical for long-term market success as competition intensifies across segments.

Lime is a key player in the micro-mobility market, offering electric scooters, bicycles, and shared mobility services in numerous cities globally. The company focuses on providing sustainable and accessible transportation solutions tailored to urban needs. Lime also continues to enhance its offerings through partnerships with municipalities and by investing in fleet upgrades for improved performance and safety.

Tier Mobility, based in Germany, is a prominent provider of shared electric scooters and bikes with a strong presence in European and global markets. The company emphasizes sustainability and energy efficiency by implementing battery-swapping technology to reduce operational emissions.

List of Key Companies in Micro-mobility Market

- Beam

- Bird

- Bolt

- Bounce

- Dott

- Helbiz

- Lime

- Muving

- Revel

- Ridecell

- Segway-Ninebot

- Spin (owned by Tier Mobility)

- Tier Mobility

- Voi Technology

- Yulu

Micro-mobility Industry Developments

- In November 2023, Lime announced its expansion into additional European cities, highlighting its commitment to broadening its service reach and integrating with local transit systems.

- In October 2023, Tier completed its acquisition of Spin, a US-based micro-mobility operator, marking a significant step in expanding its footprint in North America. This acquisition reflects Tier’s strategy to diversify its offerings and strengthen its competitive position in the global market.

Micro-mobility Market Segmentation

By Application Outlook

- Commercial

- Private

By Type Outlook

- Bicycles

- Shared Bicycles

- Electric Scooters

- Electric Skateboards

By End Users Outlook

- State & National Authority

- Micro-mobility Services

- Research Organizations

- Government Associations

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Micro-mobility Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 41.01 billion |

|

Market Size Value in 2025 |

USD 46.47 billion |

|

Revenue Forecast by 2034 |

USD 145.83 billion |

|

CAGR |

13.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The micro-mobility market has been broadly segmented on the basis of application, type, and end users. Moreover, the study provides the reader with a detailed understanding of the different segments at both global and regional levels.

Growth/Marketing Strategy

The micro-mobility market growth and marketing strategies focus on expanding service coverage, enhancing user experience, and integrating advanced technologies. Companies are investing in fleet expansion and infrastructure development, particularly in urban areas with high demand for sustainable transportation. Partnerships with local governments and businesses help facilitate regulatory compliance and improve accessibility. Additionally, providers are leveraging data analytics and IoT solutions to optimize operations and tailor services to specific market needs. Pricing strategies, including subscription models and discounts, are also being used to attract and retain customers. These efforts aim to increase market penetration and foster long-term growth.

FAQ's

? The micro-mobility market size was valued at USD 41.01 billion in 2024 and is projected to grow to USD 145.83 billion by 2034.

? The market is projected to register a CAGR of 13.5% during 2025–2034.

? Europe held the largest share of the market in 2024.

? A few key players in the micro-mobility market are Bird, Lime, Bolt, Dott, Tier Mobility, Helbiz, Spin (owned by Tier Mobility), Yulu, Voi Technology, Beam, Bounce, Revel, Muving, Ridecell, and Segway-Ninebot.

? The private segment accounted for a larger share of the market in 2024.

? The electric scooters segment accounted for the largest share of the market in 2024.

? Micro-mobility refers to small, lightweight transportation modes typically used for short-distance travel, often within urban areas. These vehicles include electric scooters, e-bikes, bicycles, and electric skateboards, designed to offer an eco-friendly, cost-effective, and convenient alternative to traditional modes of transportation, particularly for last-mile connectivity. Micro-mobility solutions are typically shared, with users able to rent the vehicles through mobile apps, or privately owned for personal use. The sector is driven by the growing need for sustainable urban transport, reduced traffic congestion, and the increasing popularity of on-demand transportation services.

Here are a few key micro-mobility market trends: Growth of Shared Mobility Services – Increasing adoption of bike-sharing and e-scooter-sharing programs in urban areas. Integration of Smart Technologies – Use of IoT, AI, and data analytics to optimize fleet management, track vehicles, and enhance user experience. Focus on Sustainability – Rising demand for eco-friendly transportation options to reduce carbon emissions and reliance on fossil fuels. Expansion of Electric Vehicles – Growth in the adoption of electric bikes, scooters, and other electric-powered micro-mobility solutions. Government Support and Regulation – Increased government investments in infrastructure, policy support, and regulation to encourage the use of micro-mobility solutions. Advancements in Battery Technology – Improvements in battery efficiency, charging infrastructure, and range to enhance vehicle performance and reduce downtime

? A new company entering the micro-mobility market must focus on differentiating itself by emphasizing advanced technology, such as integrating AI and IoT for enhanced fleet management and user experience. Offering unique services such as electric vehicle options beyond scooters, such as electric mopeds or cargo bikes, could attract a diverse customer base. Focusing on underserved regions or niche markets where demand is growing, like suburban areas or specific business sectors, can help the company capture early market share. Additionally, adopting a strong sustainability-focused approach with eco-friendly vehicles and carbon-neutral operations could align with the increasing consumer preference for green transportation solutions. Finally, flexible pricing models, such as subscription plans or pay-as-you-go options, can enhance customer retention.

? Companies manufacturing, distributing, or purchasing micro-mobility and related products, and other consulting firms must buy the report.