Micro Mobile Data Center Market Size, Share, Trends, Industry Analysis Report: By Offering, By Type, By Rack Unit, By Form Factor, By Organization Size, By Application, By Vertical, and By Region (North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024 - 2032

- Published Date:Aug-2024

- Pages: 120

- Format: PDF

- Report ID: PM5024

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

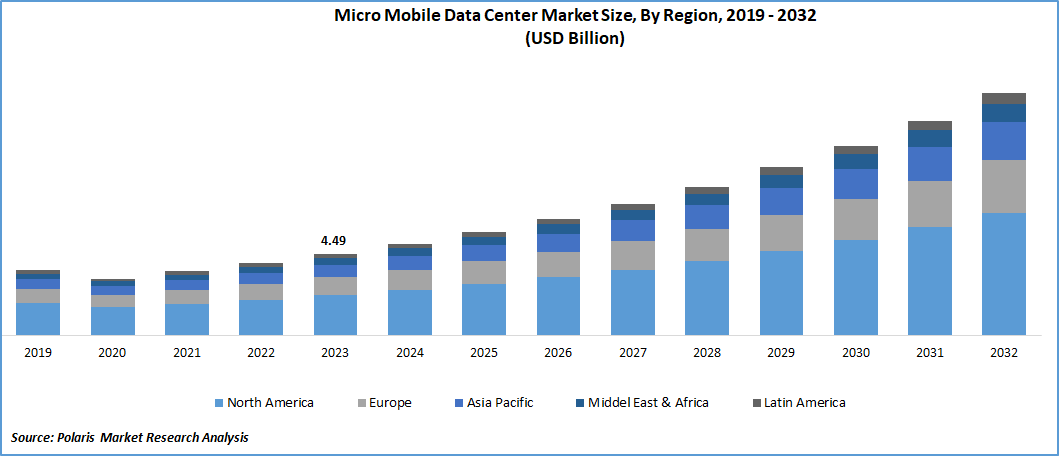

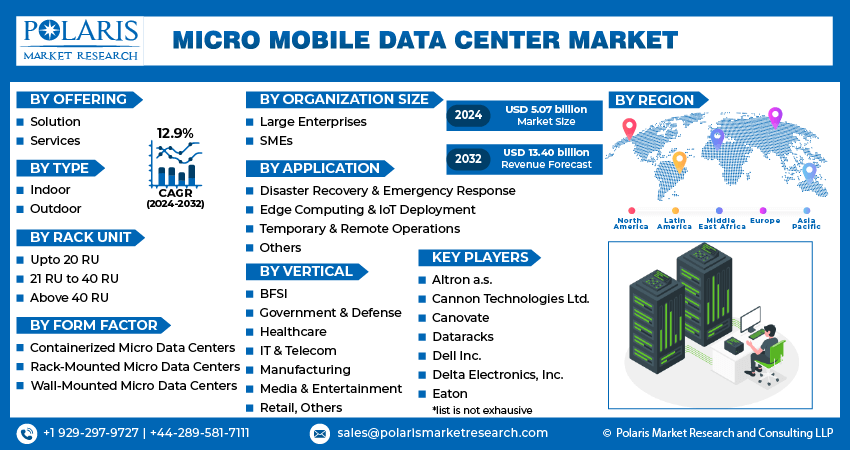

The global micro mobile data center market size was valued at USD 4.49 billion in 2023. The market is projected to grow from USD 5.07 billion in 2024 to USD 13.40 billion by 2032, exhibiting a CAGR of 12.9% during the forecast period.

A micro mobile data center is a compact, self-contained data center unit designed for rapid deployment and high mobility. The units integrate computing, storage, networking, and power supply within a single enclosure, allowing for efficient data processing and management on-site.

The growth in the micro mobile data center market is driven by the increasing adoption of thee data centers by small and medium enterprises. These enterprises prefer micro data center solutions instead of traditional large stationary data centers. Thus, the manufacturers are introducing innovative data center solutions to cater to the growing demand from small-scale businesses.

To Understand More About this Research: Request a Free Sample Report

For instance, in October 2023, PROSE Technologies launched the Khipu Micro Data Center at the 2023 India Mobile Congress in Delhi. The product was designed to cater to the specific needs of small and medium enterprises that are seeking robust data security solutions while working within constrained IT budgets. As a result, micro mobile data centers are gaining popularity among companies worldwide due to their cost-effectiveness, scalability, and efficiency, thereby driving global market growth.

The expansion of the Internet of Things (IoT) is driving the micro mobile data center market. It has led to a massive increase in data generation from a diverse array of connected devices, such as sensors, cameras, and smart appliances. These devices require real-time data processing and analysis to function effectively. Thus, micro mobile data centers offer the necessary localized processing power, thereby reducing latency and improving response times. The localized capability is essential for IoT applications in sectors such as healthcare, manufacturing, and smart cities. Therefore, the expansion of the IoT sector and its adoption of micro mobile data centers is driving global market growth.

Micro Mobile Data Center Market Trends

Strategic Activities Used by Key Players

The key market players are continuously innovating and introducing advanced micro mobile data center solutions to cater to the increasing demand for localized data processing. For instance, in August 2020, EdgeMicro, an edge colocation company, announced the expansion of its micro data center network with the addition of five new sites, including Memphis, Houston, Cleveland, Indianapolis, and Pittsburgh, in the United States. The new sites were strategically chosen based on strong population density and input from EdgeMicro's growing client base. Thus, these types of efforts by the market players are meeting the growing needs of diverse applications, such as edge computing, IoT, and disaster recovery, thereby driving the micro mobile data center market.

Growth in Healthcare Sector

The healthcare sector across the globe is experiencing significant growth due to the rise in the adoption of advanced technologies such as AI-driven diagnostics and remote patient monitoring. For instance, according to the IBEF, the hospital market in India was USD 98.98 billion in 2023 and is expected to grow at a CAGR of 8.0% from 2024 to 2032. The growth trajectory is anticipated to grow to USD 193.59 billion by 2032. Additionally, the e-health market is projected to reach a size of USD 10.6 billion by 2025. This growth in healthcare facilities has resulted in the generation of amounts of data from electronic health records (EHRs), medical imaging, patient monitoring systems, and telemedicine applications.

The generated data from the aforementioned applications has created the need for secure, efficient, and immediate processing to ensure timely patient care. Thus, micro mobile data centers are gaining traction since they enable healthcare providers to handle data at the point of origin with reduced latency and enhanced security. As a result, healthcare facilities are increasingly adopting these mobile units, driving the micro mobile data center market growth.

Market Segment Insights

Micro Mobile Data Center Market Breakdown by Application Insights

The global micro mobile data center market segmentation, based on application, includes disaster recovery & emergency response, edge computing & loT deployment, temporary & remote operations, and others. The temporary and remote operations segment held the largest revenue share in the global micro mobile data center market due to its critical role in supporting industries that require flexible and rapidly deployable data processing solutions.

Micro mobile data centers offer industries the necessary data storage capabilities on-site, enabling real-time data processing without the latency issues associated with distant centralized data centers. Further, the modularity and portability of these data centers allow quick deployment and relocation as per operational needs, making them ideal for temporary setups such as construction sites and large-scale events. This adaptability and convenience offered by the micro data centers have resulted in a significant revenue share of the temporary and remote operations segment in the global market.

Micro Mobile Data Center Market Breakdown by Vertical Insights

The global micro mobile data center market segmentation, based on vertical, includes BFSI, government & defense, healthcare, IT & telecom, manufacturing, media & entertainment, retail, and others. The IT & telecom segment is expected to register a significant CAGR due to the rapid expansion of 5G networks and the proliferation of IoT devices that require robust and efficient data processing and storage solutions. Micro mobile data centers, with their compact size and ease of deployment, are ideal for supporting edge computing needs in this sector. It enables telecom providers to deliver enhanced network performance, improve customer experiences, and meet the growing demand for high-speed connectivity.

The flexibility and scalability of micro mobile data centers allow IT & telecom companies to quickly adapt to market changes, optimize their infrastructure costs, and enhance their service offerings, driving significant growth in the IT & telecom vertical.

Global Micro Mobile Data Center Market, Segmental Coverage, 2019 - 2032 (USD billion)

Source: Secondary Research, Primary Research, PMR Database, and Analyst Review

Micro Mobile Data Center Market Breakdown by Regional Insights

By region, the study provides the micro mobile data center market insights into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America micro mobile data center market held the largest revenue share due to the presence of several key market players in the region. The major companies, such as Schneider Electric, IBM Corporation, Vertiv Group Corp., Eaton, Panduit Corp., and Dell Technologies, have a business presence in North America, providing an ecosystem of innovation, expertise, and technological advancement. These companies are investing heavily in research and development to enhance the capabilities and efficiency of micro mobile data centers. Also, the presence of the aforementioned key players resulted in the availability of tailored data center solutions to diverse industries, including BFSI, defense, and healthcare. Thus, the North America dominated the global micro mobile data center market in 2023.

The U.S. micro mobile data center market dominated North America because of the increased adoption of mobile data centers by the defense sector of the country. The modern military applications of the U.S. Department of Defense (DoD) rely heavily on data and require low latency for critical communications and coordination in the field. Thus, solution providers are introducing mobile data centers to provide access, processing, and sharing of data. For instance, in February 2023, Amazon Web Services announced the availability of an AWS (Amazon Web Services) modular data center to the United States Department of Defense under the JWCC (Joint Warfighting Cloud Capability) contract. This AWS modular data center allowed the DoD to deploy independent data centers with built-in AWS infrastructure to areas with limited infrastructure, thereby contributing to the growth of the micro mobile data center market in the United States.

Global Micro Mobile Data Center Market, Regional Coverage, 2019 - 2032 (USD billion)

Source: Secondary Research, Primary Research, PMR Database, and Analyst Review

The Asia Pacific micro mobile data center market is anticipated to grow significantly due to the expansion operations by the major market players in the region. Global companies are increasing their presence and investments in Asia Pacific to meet the increasing demand for advanced IT infrastructure. For instance, Vertiv launched the Vertiv SmartAisle 3, a micro modular data center system that integrates Artificial Intelligence (AI) to optimize operations in data center environments across Southeast Asia, Australia, and New Zealand. Thus, these types of expansions by the major players to increase market penetration are driving the growth in Asia Pacific micro mobile data center market.

Micro Mobile Data Center Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their types, which will help the micro mobile data center market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including innovative product launches, international collaborations, higher investments, and mergers and acquisitions between organizations. To expand and survive in a more competitive and rising market climate, the micro mobile data center industry must offer cost-effective solutions.

The market has a presence of several key players, both established technology MNCs and emerging startups, each competing for market share through innovation and strategic initiatives. Major companies dominate the market with their extensive portfolios, strong financial capabilities, and global reach. Major players in the micro mobile data center market include Altron a.s., Cannon Technologies Ltd., Canovate, Dataracks, Dell Inc., Delta Electronics, Inc., Eaton, Hewlett Packard Enterprise Development LP, Huawei Technologies Co., Ltd., IBM, Panduit Corp., Rittal GmbH & Co. KG, ScaleMatrix Holdings, Inc., Schneider Electric, STULZ GMBH, Vericom Global Solutions, Vertiv Group Corp., and Zella DC.

Schneider Electric is a global industrial technology company engaged in providing digital transformation of energy management and automation. The company offers software, control, and end-point-to-cloud integration connecting products and services. Also, Schneider Electric offers its products in various segments, including building automation and control, low voltage products and systems, residential and small businesses, solar and energy storage, critical power, cooling and racks, medium voltage distribution and grid automation, and industrial automation and control. In June 2022, Schneider Electric introduced a faster prefabricated micro data center service in Europe and announced a "modernization" of its infrastructure management product, EcoStruxure IT. The company provides prefabricated containerized data centers ranging from 27kW to 80kW, all manufactured at its facility in Barcelona.

Eaton is a power management company that operates across multiple segments, such as electrical systems and services, electrical products, vehicles, aerospace, and eMobility. The company's portfolio is broadly categorized into two main sections, including industrial and electrical. The industrial sector encompasses a diverse range of end markets, such as commercial vehicles, general aviation, and trucks. On the other hand, the electrical sector portfolio caters to utilities, data centers, and the residential end market, among others. In June 2021, Eaton launched the iCube 2.0 and the 9PX lithium-ion UPS, the additions to its micro data center and 9PX uninterruptible power supply series. The new solutions are designed to specifically cater to the requirements and challenges faced by organizations aiming to future-proof their data center infrastructure.

List of Key Companies in Micro Mobile Data Center Market

- Altron a.s.

- Cannon Technologies Ltd.

- Canovate

- Dataracks

- Dell Inc.

- Delta Electronics, Inc.

- Eaton

- Hewlett Packard Enterprise Development LP

- Huawei Technologies Co., Ltd.

- IBM

- Panduit Corp.

- Rittal GmbH & Co. KG

- ScaleMatrix Holdings, Inc.

- Schneider Electric

- STULZ GMBH

- Vericom Global Solutions

- Vertiv Group Corp.

- Zella DC

Micro Mobile Data Center Industry Developments

- August 2023: Vertiv announced the availability of the Vertiv SmartCabinet 2 in Africa. This self-contained micro data center is designed for edge computing applications and is suitable for various sectors such as banking and financial institutes, warehousing, education, government, and retail.

- November 2022: Schneider Electric introduced the EcoStruxure Micro Data Center R-Series 42U Medium Density, designed to handle the hybrid IT infrastructure. This Micro Data Center solution is specifically tailored for IT applications in distributed locations with industrial settings and comes fully integrated for quick deployment.

- March 2019: ScaleMatrix, the provider of variable density colocation and hybrid hosting services in the United States, along with DDC Cabinet Technology, its product business, announced the acquisition of Instant Data Centers, an Arizona-based company specializing in offering ruggedized micro data centers for Edge computing.

Market Segmentation:

Micro Mobile Data Center– Offering Outlook

- Solution

- Services

Micro Mobile Data Center– Type Outlook

- Indoor

- Outdoor

Micro Mobile Data Center– Rack Unit Outlook

- Upto 20 RU

- 21 RU to 40 RU

- Above 40 RU

Micro Mobile Data Center– Form Factor Outlook

- Containerized Micro Data Centers

- Rack-Mounted Micro Data Centers

- Wall-Mounted Micro Data Centers

Micro Mobile Data Center– Organization Size Outlook

- Large Enterprises

- SMEs

Micro Mobile Data Center– Application Outlook

- Disaster Recovery & Emergency Response

- Edge Computing & loT Deployment

- Temporary & Remote Operations

- Others

Micro Mobile Data Center– Vertical Outlook

- BFSI

- Government & Defense

- Healthcare

- IT & Telecom

- Manufacturing

- Media & Entertainment

- Retail

- Others

Micro Mobile Data Center– Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Micro Mobile Data Center Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 4.49 billion |

|

Market Sze Value in 2024 |

USD 5.07 billion |

|

Revenue Forecast in 2032 |

USD 13.40 billion |

|

CAGR |

12.9% from 2024 – 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global micro mobile data center market size was valued at USD 4.49 billion in 2023 and is projected to grow to USD 13.40 billion by 2032.

The global market is projected to register at a CAGR of 12.9% during the forecast period, 2024-2032.

North America had the largest share of the global market

The key players in the market are Altron a.s., Cannon Technologies Ltd., Canovate, Dataracks, Dell Inc., Delta Electronics, Inc., Eaton, Hewlett Packard Enterprise Development LP, Huawei Technologies Co., Ltd., IBM, Panduit Corp., Rittal GmbH & Co. KG, ScaleMatrix Holdings, Inc., Schneider Electric, STULZ GMBH, Vericom Global Solutions, Vertiv Group Corp., and Zella DC.

The temporary and remote operations segment held the highest share of the micro mobile data center market in 2023

The IT & telecom had the highest CAGR in the global market.