Micro Computed Tomography Market Size, Share, Trends, Industry Analysis Report: By Product (In Vivo Micro-CT and Ex Vivo Micro-CT), Application, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 129

- Format: PDF

- Report ID: PM5468

- Base Year: 2024

- Historical Data: 2020-2023

Micro Computed Tomography Market Overview

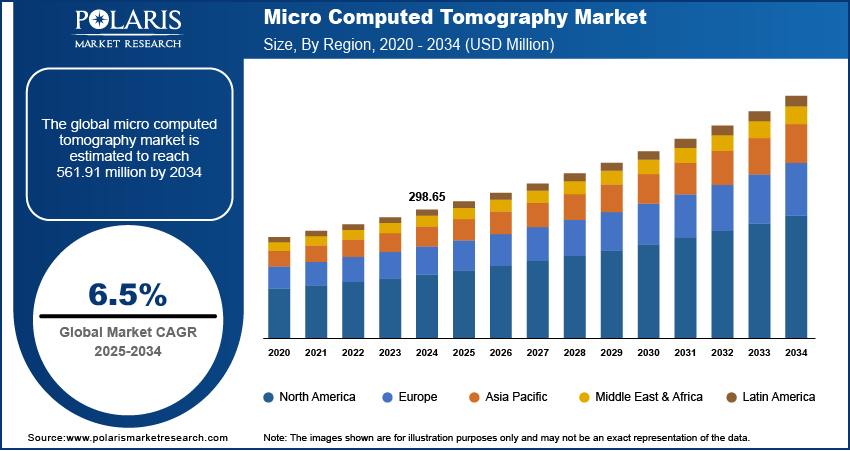

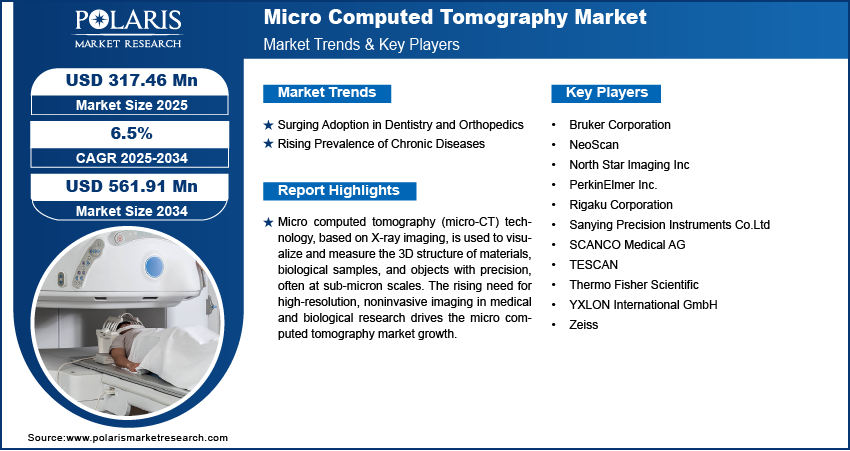

The global micro computed tomography market size was valued at USD 298.65 million in 2024 and is expected to reach USD 317.46 million by 2025 and USD 561.91 million by 2034, exhibiting a CAGR of 6.5% during 2025–2034.

The micro computed tomography (micro-CT) market refers to the sector that provides high-resolution, non-destructive imaging solutions for detailed internal structure analysis at the microscopic level. Micro-CT technology, based on X-ray imaging, is used to visualize and measure the 3D structure of materials, biological samples, and objects with precision, often at sub-micron scales. The technology is widely used in various industries, including medical research, material science, pharmaceuticals, and industrial sectors, for applications such as bone imaging, failure analysis, and 3D model creation for product design. The market encompasses the sales of micro CT scanners, software, and related services. The rising need for high-resolution, noninvasive imaging in medical and biological research is driving the micro computed tomography market growth.

To Understand More About this Research: Request a Free Sample Report

Improvements in micro-CT resolution and speed are expanding its applications across various sectors, including pharmaceuticals, material science, and electronics, contributing to the micro-CT market demand. Furthermore, the application of micro-CT in forensic investigations and cultural heritage conservation is expanding its market scope.

Micro Computed Tomography Market Dynamics

Surging Adoption in Dentistry and Orthopedics

The increasing adoption of micro-computed tomography (micro-CT) in dentistry and orthopedics is significantly contributing to the micro-CT market growth. For instance, according to the Office of Disease Prevention and Health Promotion, approximately one in four adults in the US suffers from arthritis, driving the need for advanced imaging techniques such as micro-CT in orthopedics and dentistry. The technology’s ability to provide high-resolution, three-dimensional imaging of bone structures and dental implants is driving its demand among clinicians and researchers. Moreover, in dentistry, micro-CT enhances preoperative assessments, ensuring precise implant placement and improving treatment outcomes. In orthopedics, it aids in bone density measurement, fracture analysis, and biomaterial evaluation. As the focus on minimally invasive procedures and personalized treatment intensifies, demand for micro-CT continues to grow. Further, the rising prevalence of dental disorders and musculoskeletal conditions is expected to offer new micro computed tomography market opportunities for innovation and adoption across the healthcare sector during the forecast period.

Rising Prevalence of Chronic Diseases

The increasing prevalence of osteoporosis, cardiovascular diseases, and cancer propels the demand for high-resolution, non-destructive imaging solutions. According to the Centers for Disease Control, in the US, an increasing number of individuals are managing multiple chronic conditions, with 42% having two or more chronic conditions and 12% having five or more. This trend highlights the growing burden of chronic diseases on healthcare systems. Micro-CT plays a crucial role in assessing bone microarchitecture in osteoporosis research, aiding in cardiovascular disease modeling, and enhancing tumor analysis in cancer studies. The need for precise, early-stage diagnostics is driving micro-CT market demand, encouraging further advancements in imaging technology. Healthcare providers and research institutions prioritize accurate disease characterization, positioning the technology as a critical tool in modern diagnostic and therapeutic applications. Therefore, the rising prevalence of chronic diseases is a key factor contributing to the micro computed tomography market growth.

Micro Computed Tomography Market Segment Insights

Micro Computed Tomography Market Assessment by Product Outlook

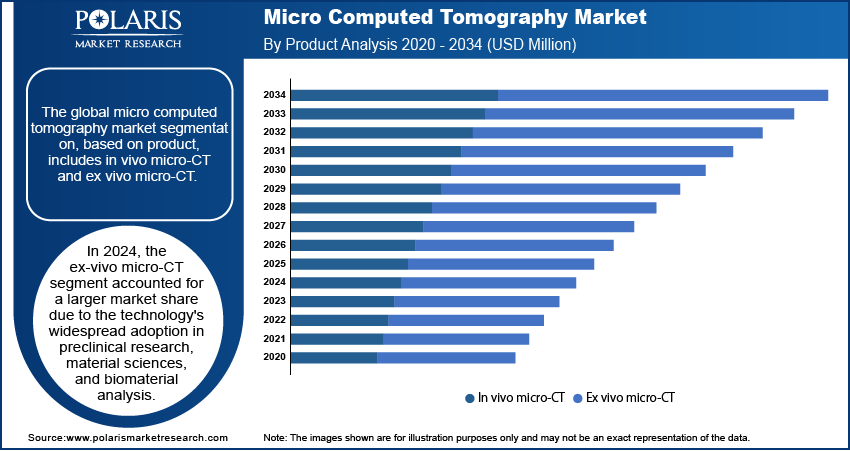

The global micro computed tomography market segmentation, based on product, includes in vivo micro-CT and ex vivo micro-CT. In 2024, the ex-vivo micro-CT segment accounted for a larger market share due to the technology's widespread adoption in preclinical research, material sciences, and biomaterial analysis. Ex-vivo micro-CT enables high-resolution imaging of biological and non-biological specimens without the constraints of radiation exposure limits seen in in-vivo applications. Ex-vivo micro-CT ability to deliver precise 3D reconstructions at sub-micron levels makes it indispensable in bone microarchitecture studies, dental research, and tissue engineering. The growing investments in life sciences research, combined with the rising demand for advanced imaging solutions in pharmaceutical and biomedical applications, are driving the segment's dominance in the micro computed tomography market.

The in vivo-CT segment is expected to witness the fastest growth over the forecast period due to increasing adoption in preclinical studies, disease modeling, and real-time biological assessments. Advancements in detector technology and reduced radiation exposure have enhanced the applicability of in vivo micro-CT, allowing for longitudinal studies in small animal models without compromising tissue integrity. The rising emphasis on noninvasive imaging techniques in oncology, neurology, and cardiovascular research is accelerating market demand. As pharmaceutical and biotechnology firms focus on precision medicine and drug efficacy testing, the in-vivo micro-CT market expansion is expected to gain momentum during the forecast period.

Micro Computed Tomography Market Evaluation by End Use Outlook

The global micro computed tomography market segmentation, based on end use, includes industries, research institutes, diagnostic imaging labs, and others. In 2024, the research institutes segment accounted for the largest market share due to the increasing utilization of micro-CT in advanced scientific studies, including biomaterials research, regenerative medicine, and nanotechnology. Research institutions leverage micro-CT’s high-resolution imaging capabilities to investigate the structural properties of biological tissues, polymers, and composites. The availability of government and private funding for academic research, along with growing collaborations between universities and industry players, is boosting market value. As the need for high-precision imaging tools in fundamental and applied research continues to rise, the segment remains a key contributor to the micro computed tomography market dynamics.

The diagnostic imaging labs segment is anticipated to grow significantly over the forecast period due to the increasing demand for high-resolution imaging in clinical diagnostics and pathology. The growing adoption of micro-CT in dental imaging, orthopedic assessments, and oncology diagnostics is driving market expansion. Advancements in automation and AI-driven image analysis are enhancing the efficiency and accuracy of diagnostic workflows, improving patient outcomes. Since healthcare providers prioritize early and accurate disease detection, the market demand for micro-CT is expected to rise in diagnostic labs during the forecast period. Additionally, the expanding integration of micro-CT with conventional imaging modalities will further support segment growth.

Micro Computed Tomography Market Regional Analysis

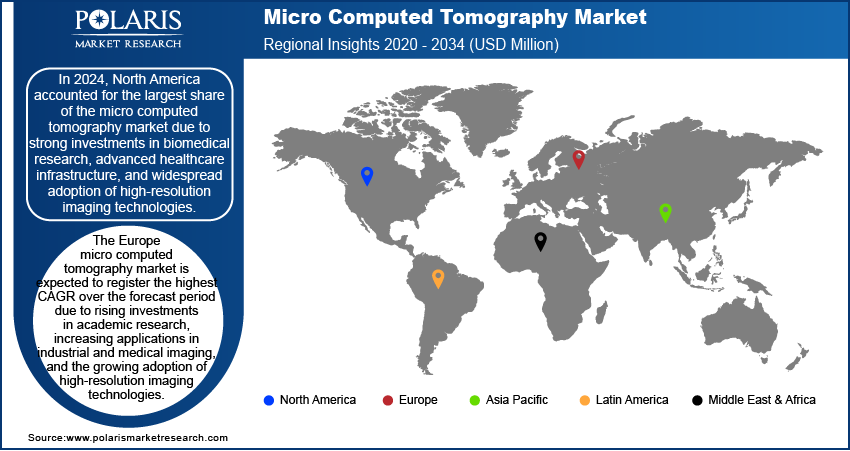

By region, the study provides micro computed tomography market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest micro computed tomography market share due to strong investments in biomedical research, advanced healthcare infrastructure, and widespread adoption of high-resolution imaging technologies. The region's dominance is driven by significant funding from government and private institutions for preclinical research, drug discovery, and material science applications. For instance, President Biden's FY2024 budget proposal allocated approximately USD 209.7 billion for research and development (R&D), an increase from USD 200.8 billion (i.e., 4.4%) in FY2023. The presence of leading pharmaceutical and biotechnology companies, along with research institutes actively utilizing micro-CT for precision imaging, is further fueling market demand. Additionally, technological advancements, such as AI-powered image reconstruction and automation in imaging workflows, are enhancing adoption rates. Regulatory support for advanced imaging modalities and a strong emphasis on innovation in diagnostics and life sciences research continue to contribute to the market growth in North America.

The Europe micro computed tomography market is expected to witness the highest CAGR over the forecast period due to rising investments in academic research, increasing applications in industrial and medical imaging, and the growing adoption of high-resolution imaging technologies. The expansion of research initiatives in regenerative medicine, dental imaging, and orthopedic diagnostics is driving market demand. Additionally, the European Union’s funding for innovative healthcare technologies, combined with collaborations between universities and industry players, is boosting micro-CT market expansion. The region’s strong emphasis on precision imaging for non-destructive testing in materials science and the rapid integration of AI-driven imaging solutions are further accelerating market growth. Regulatory frameworks evolve to support advanced imaging in both clinical and research applications; thus, the market in Europe is poised for significant growth.

Micro Computed Tomography (Micro-CT) Market Players & Competitive Analysis Report

The competitive landscape of the micro computed tomography market is characterized by the presence of key players focusing on technological advancements, strategic partnerships, and expanding application areas. Leading companies such as Bruker Corporation, Zeiss Group, Thermo Fisher Scientific, and SCANCO Medical dominate the market through continuous innovation in high-resolution imaging, AI-powered analysis, and automation of imaging workflows. These players invest heavily in R&D to enhance micro-CT system capabilities, improving spatial resolution, faster data processing, and 3D reconstruction techniques. Mergers and acquisitions are shaping the market dynamics, with larger firms acquiring smaller, specialized imaging technology companies to strengthen their portfolios. Additionally, partnerships between industry leaders and research institutes are driving advancements in medical diagnostics, material sciences, and industrial applications. The growing demand for high-precision imaging in preclinical research, dental analysis, and orthopedic applications is intensifying competition.

Emerging companies are focusing on cost-effective micro-CT solutions with AI-driven analytics to enhance adoption in academic and clinical settings. Additionally, regulatory approvals and compliance with stringent quality standards remain crucial for market players to maintain a competitive edge. As the industry advances, companies are expected to focus on miniaturization, improved image resolution, and software-driven automation, further shaping the competitive landscape.

Thermo Fisher Scientific Inc. is the in providing services to the scientific community. They are improving patient health via diagnostics, promoting the study of life sciences, resolving complex analytical problems, increasing lab productivity, and creating and producing therapies that will change people's lives. Through its industry-leading brands, which include Thermo Scientific, Invitrogen, Applied Biosystems, Unity Lab Services, Fisher Scientific, Patheon, and PPD, its team offers an unmatched mix of innovative technology, buying ease, and pharmaceutical services. Thermo Fisher Scientific Inc. is a key player in the micro-computed tomography (micro-CT) market, offering advanced imaging solutions for high-resolution 3D analysis in life sciences, material research, and industrial applications. The company provides advance micro-CT systems with superior spatial resolution, enabling precise internal structure visualization for biomedical research, dental analysis, and pharmaceutical development.

ZEISS is a global lens manufacturing company operating in the business segments of optics and optoelectronics industries. The company operates through more than 60 sales and service locations, 40 research and development centers, and 35 manufacturing sites worldwide. Moreover, the company’s operations are structured into four core segments, including semiconductor manufacturing technology, industrial quality & research, medical technology, and consumer markets. The industrial quality & research segment focuses on precision measurement and visualization solutions for industries such as aerospace, electronics, and mechanical engineering. ZEISS offers coordinate measuring machines, 3D X-ray systems, and high-performance microscopes, which are instrumental in quality assurance and scientific research. These tools are essential for applications such as electric drivetrain development, power generation, and pharmaceutical workflows.

List of Key Companies in Micro Computed Tomography Market

- Bruker Corporation

- NeoScan

- North Star Imaging Inc.

- PerkinElmer Inc.

- Rigaku Corporation

- Sanying Precision Instruments Co.Ltd

- SCANCO Medical AG

- TESCAN

- Thermo Fisher Scientific

- YXLON International GmbH

- Zeiss

Micro Computed Tomography Industry Developments

In August 2024, ZEISS expanded its micro-CT research pipeline through a partnership with the Beckman Institute for Advanced Science and Technology. The collaboration involves the use of the ZEISS Xradia 630 Versa micro-CT scanner, the first of its kind for life science applications in the US, enhancing research capabilities across various disciplines

In February 2023, ZEISS launched the Xradia 630 Versa XRM, enhancing the Versa family with superior resolution performance, intuitive workflows, and increased productivity. It offers submicron imaging capabilities, leveraging AI for advanced reconstruction and supporting diverse research applications.

In May 2022, Shimadzu launched the XSeeker 8000, the smallest and lightest high-output bench-top X-ray CT system, offering clear imaging of resin, aluminum, and metal parts with a 160 kV output.

Micro Computed Tomography Market Segmentation

By Product Outlook (Revenue – USD Million, 2020–2034)

- In Vivo Micro-CT

- Ex Vivo Micro-CT

By Application Outlook (Revenue – USD Million, 2020–2034)

- Life Science

- Bones

- Dentistry

- Plant and Food

- Material Science

- Geology/Oil and Gas Geology

By End Use Outlook (Revenue – USD Million, 2020–2034)

- Industries

- Research Institutes

- Diagnostic Imaging Labs

- Others

By Regional Outlook (Revenue – USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Micro Computed Tomography Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 298.65 Million |

|

Market Size Value in 2025 |

USD 317.46 Million |

|

Revenue Forecast by 2034 |

USD 561.91 Million |

|

CAGR |

6.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global micro computed tomography market size was valued at USD 298.65 million in 2024 and is projected to grow to USD 561.91 million by 2034.

The global market is projected to register a CAGR of 6.5% during the forecast period.

In 2024, North America accounted for the largest market share due to strong investments in biomedical research, advanced healthcare infrastructure, and widespread adoption of high-resolution imaging technologies.

A few of the key players in the market are Bruker Corporation, NeoScan, North Star Imaging Inc., PerkinElmer Inc., Rigaku Corporation, Sanying Precision Instruments Co. Ltd, SCANCO Medical AG, TESCAN, Thermo Fisher Scientific, YXLON International GmbH, and Zeiss.

In 2024, the ex-vivo micro-CT segment accounted for a larger market share due to the technology's widespread adoption in preclinical research, material sciences, and biomaterial analysis.

In 2024, the research institutes segment accounted for the largest market share due to the increasing utilization of micro-CT in advanced scientific studies, including biomaterials research, regenerative medicine, and nanotechnology.