Micro Combined Heat and Power Market Share, Size, Trends, Industry Analysis Report – By Fuel (Natural Gas & LPG, Coal, Hydrogen, and Others), Prime Mover, Capacity, Application, and Region; Segment Forecast, 2024–2032

- Published Date:Oct-2024

- Pages: 114

- Format: PDF

- Report ID: PM5106

- Base Year: 2023

- Historical Data: 2019-2022

Micro Combined Heat and Power Market Outlook

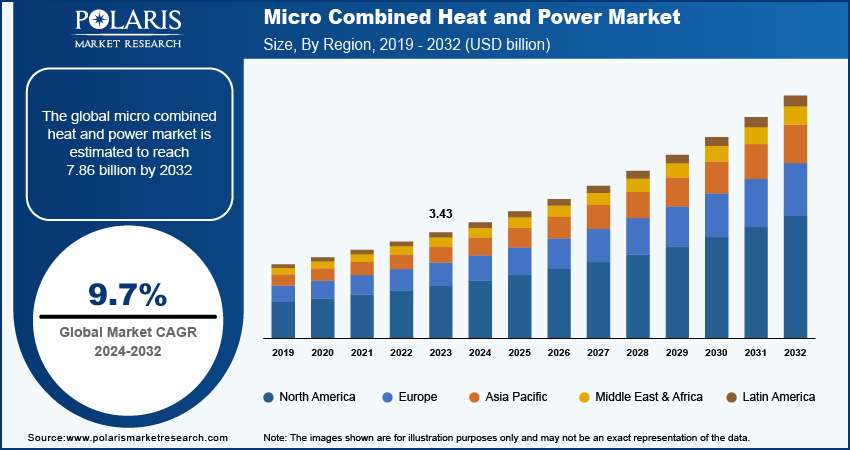

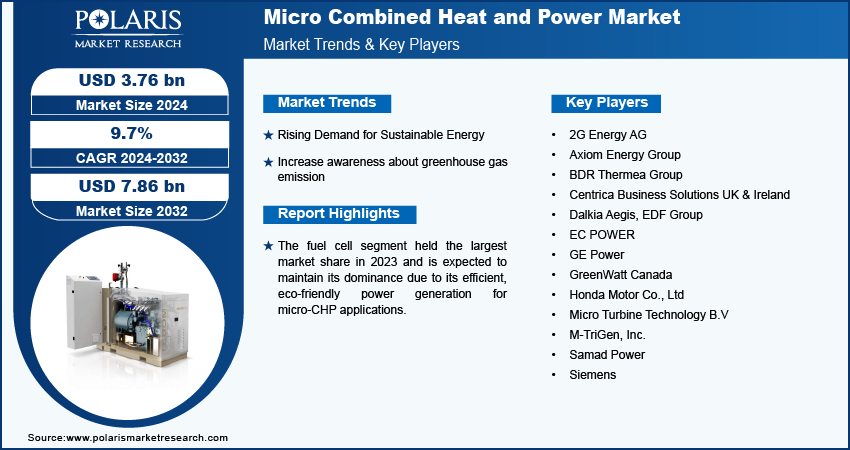

The micro combined heat and power market size was valued at USD 3.43 billion in 2023. The market is anticipated to grow from USD 3.76 billion in 2024 to USD 7.86 billion by 2032, exhibiting a CAGR of 9.7% during 2024–2032.

Micro Combined Heat and Power Market Overview

Micro combined heat and power (micro-CHP) market is experiencing substantial growth due to increasing awareness of their advantages compared to traditional water boilers. These systems are gaining traction for their ability to generate electricity from heat, which can significantly reduce electricity bills. A few long-term benefits of micro-CHP systems, including energy efficiency and cost savings, are likely to create new opportunities for the market growth during the forecast period. Further, many companies commit to reducing their carbon footprint to meet global net zero emission targets. For instance, in September 2023, Danone announced its plan to develop a robust microgrid at its dairy food manufacturing facility in South Africa by installing combined heat and power technology in cooperation with Clarke Energy. This initiative is planned to meet its net-zero target by 2050. Such initiatives propel the adoption of micro-CHP systems, further driving the micro-combined heat and power market expansion.

To Understand More About this Research: Request a Free Sample Report

Increasing business agreements aimed at advancing the global energy transition toward a greener economy are expected to boost the micro combined heat and power (micro-CHP) market. For example, in February 2023, General Electric (GE) signed an agreement with Aksa Energy to supply its high-performance 6F.03 gas turbines. The turbines are intended to enhance Aksa Energy's micro-CHP systems in Kazakhstan, demonstrating a commitment to integrating advanced technology for efficient and sustainable energy solutions. Such partnerships and investments underscore the growing focus on micro-CHP systems and their role in driving the shift toward sustainable energy practices.

Growth Drivers

Rising Demand for Sustainable Energy

There is a growing shift toward sustainable energy solutions that reduce carbon footprints and enhance energy efficiency, owing to the rising concerns about climate change and environmental impact across the world. Micro-CHP systems, which simultaneously generate heat and electricity from a single fuel source, align well with these sustainability goals by maximizing energy utilization and minimizing waste. Their ability to lower energy costs while contributing to reduced greenhouse gas emissions makes them an attractive option for residential and commercial applications, which fuels the adoption of micro-CHP systems. Therefore, the increasing demand for sustainable energy is significantly driving the growth of the micro combined heat and power (micro-CHP) system market.

Increasing Awareness About Greenhouse Gas Emissions

Growing government initiatives aimed at reducing greenhouse gas emissions and safeguarding natural resources significantly boost the adoption of micro-combined heat and power (micro-CHP) systems. These initiatives, coupled with increasing commitments from private sector players to achieve lower or zero carbon emissions, increase the use of micro-CHP technologies. By offering an efficient means to generate heat and power while minimizing carbon footprints simultaneously, micro-CHP systems align with regulatory demands and corporate sustainability goals. For instance, In September 2023, AstraZeneca announced its commitment to invest approximately $125 million to enhance the heat and power efficiency of its facility in the UK. As a part of this project, it is aiming to replace its existing combined heat and power systems in the Macclesfield office, reducing 16,000 tonnes of carbon dioxide generation annually. Therefore, synergy between government policies and private sector efforts to minimize greenhouse gas emissions drives the growth of the micro combined heat and power market growth.

Restraining Factors

High Operating Cost of System

The high operating costs associated with micro combined heat and power (micro-CHP) systems pose a significant restraint on market growth. These systems, while efficient, require substantial initial investment and ongoing maintenance expenses, which can deter potential users, especially in residential sectors. Additionally, fluctuating energy prices and the need for specialized installation can further elevate costs. As a result, many consumers and businesses may opt for conventional energy solutions that appear more economically viable in the short term, hindering the widespread adoption of micro-CHP technology.

Micro CHP Market Report Segmentation

The micro combined heat and power market is primarily segmented on the basis of fuel, prime mover, capacity, application, and region.

By Fuel Analysis

Hydrogen Segment to Witness Highest Growth Rate During 2024–2032

The hydrogen segment is projected to register the highest CAGR in the micro combined heat and power market during the forecast period. Due to its ease of production, a larger number of manufacturers adopt hydrogen fuel-based micro-CHP system product production. In May 2022, Caterpillar announced the launch of a demonstration project that will last for three years in collaboration with the Minnesota-based District Energy St. Paul to develop a hydrogen-fueled combined heat and power (CHP) system.

By Prime Mover Analysis

Fuel Cell Segment Accounted for Largest Share in Micro Combined Heat and Power Market in 2023

The fuel cell segment accounted for the largest market share in 2023 and is likely to retain its dominance during the forecast period. Fuel cells generate electricity through electrochemical reactions, providing power and heat with minimal environmental impact. This efficiency and environmental advantage make fuel cells the preferred choice for many micro-CHP applications, driving their leading market share.

By Application Analysis

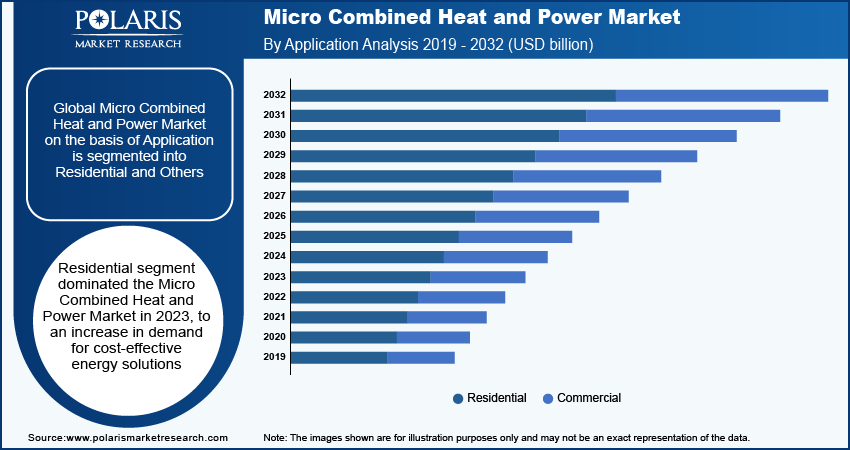

Residential Segment Held Significant Market Revenue Share in Micro Combined Heat and Power Market in 2023

The residential segment accounted for a larger revenue share in 2023, driven by the continuous rise in electricity costs. As consumers seek cost-effective energy solutions, the dual capability of micro-CHP systems to provide heat and electricity has led to increased adoption. Additionally, the expansion of smart homes and rising urbanization worldwide are expected to boost the demand for micro-CHP systems among residents in the coming years.

Micro CHP Market Regional Insights

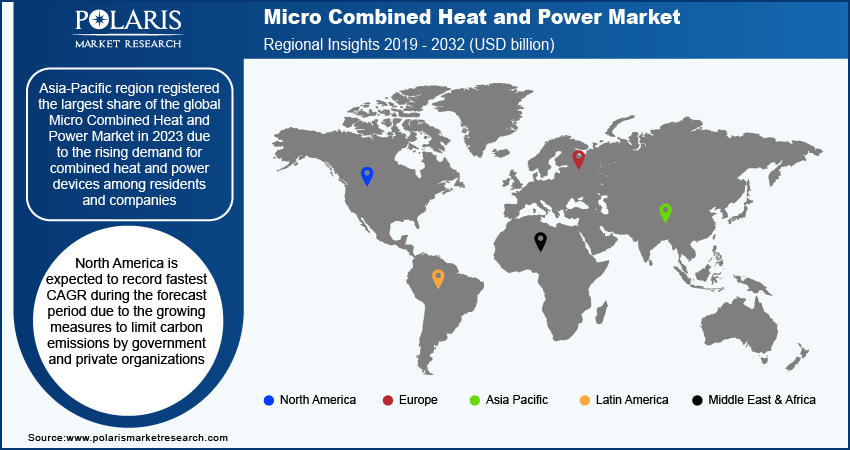

Asia Pacific Held Largest Share of Global Micro Combined Heat and Power Market in 2023

Asia Pacific accounted for the largest revenue share of the market in 2023, owing to the rising demand for combined heat and power devices among residents and companies. The growing number of companies working on cost-effective options to optimize business operations, specifically in China and India, is boosting the demand for micro combined heat and power systems across the region.

North America is expected to record the highest CAGR in the micro combined heat and power market during 2024–2032, owing to the growing measures to limit carbon emissions by government and private organizations. The increasing research initiatives to produce highly energy efficient and performing micro combined heat and power systems are fostering the North America market growth.

Key Market Players and Competitive Insights

Strategic Initiatives by Market Players to Fuel Competition

The micro combined heat and power market is partially fragmented. Rising initiatives by companies to follow the green energy transition create demand for micro-combined heat and power systems. This will fuel research activities to develop efficient and sustainable products, contributing to the higher competition in the micro combined heat and power market. For instance, in November 2022, UPM introduced a new combined heat and power plant at its paper mill in Europe. This initiative is part of its goal to reduce 65% of the carbon emissions by 2030.

Major Players Operating in Global Micro CHP Market

- 2G Energy AG

- Axiom Energy Group

- BDR Thermea Group

- Centrica Business Solutions UK & Ireland

- Dalkia Aegis, EDF Group

- EC POWER

- GE Power

- GreenWatt Canada

- Honda Motor Co., Ltd

- Micro Turbine Technology B.V

- M-TriGen, Inc.

- Samad Power

- Siemens

Recent Developments in Industry

- In October 2023, Fortum inaugurated a biomass-fueled combined heat and power plant in Jelgava, Latvia, with an investment of approximately $75 million. The plant is designed to meet 85% of the district's heat demand, supplying electricity and heat to both residents and businesses.

- In February 2024, DTGen and TEDOM established a partnership for the supply of combined heat and power (CHP) equipment and expanding their footprint globally.

Micro Combined Heat and Power Market Segmentation

By Fuel Outlook (USD Billion, 2019–2032)

- Natural Gas & LPG

- Coal

- Hydrogen

- Renewable Resources

- Oil

By Prime Mover Outlook (USD Billion, 2019–2032)

- Stirling Engine

- Internal Combustion Engine

- Fuel Cell

- Other

By Capacity Outlook (USD Billion, 2019–2032)

- UP to 2 KW

- 2 KW to 10 KW

- 10 to 50 KW

By Application Outlook (USD Billion, 2019–2032)

- Residential

- Commercial

By Regional Outlook (USD Billion, 2019–2032)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Micro CHP Market Report Coverage

The micro combined heat and power market report emphasizes key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, it covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, fuel, prime mover, application, capacity, and futuristic opportunities.

Micro Combined Heat and Power Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 3.76 billion |

|

Revenue Forecast by 2032 |

USD 7.86 billion |

|

CAGR |

9.7% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019–2022 |

|

Forecast Period |

2024–2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The micro combined heat and power market size was valued at USD 3.43 billion in 2023 and is projected to grow to USD 7.86 billion by 2032.

The global market is projected to register a CAGR of 9.7% during the forecast period.

Asia Pacific accounted for the largest share of the global market.

A few key players in the market are 2G Energy AG Axiom Energy Group; BDR Thermea Group; Centrica Business Solutions; Dalkia Aegis; EDF Group; EC POWER; GE Power; GreenWatt Canada; Honda Motor Co., Ltd; Micro Turbine Technology B.V; M-TriGen, Inc.; Samad Power; and Siemens.

The fuel cell segment is anticipated to experience substantial growth at a significant CAGR in the global market during the forecast period. This growth is attributed to the cell’s efficiency and environmental advantage.

The residential segment accounted for a larger revenue share of the market in 2023 due to an increase in demand for cost-effective energy solutions