Methyl Methacrylate Market Size, Share, Trends, Industry Analysis Report: By Application (Chemical Intermediate, Surface Coatings, and Emulsion Polymer), End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast (2025–2034)

- Published Date:Nov-2024

- Pages: 115

- Format: PDF

- Report ID: PM5169

- Base Year: 2024

- Historical Data: 2020-2023

Methyl Methacrylate Market Overview

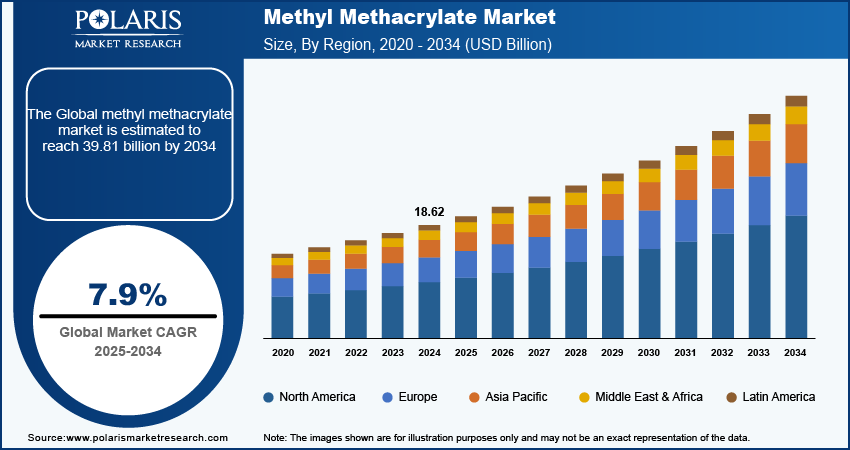

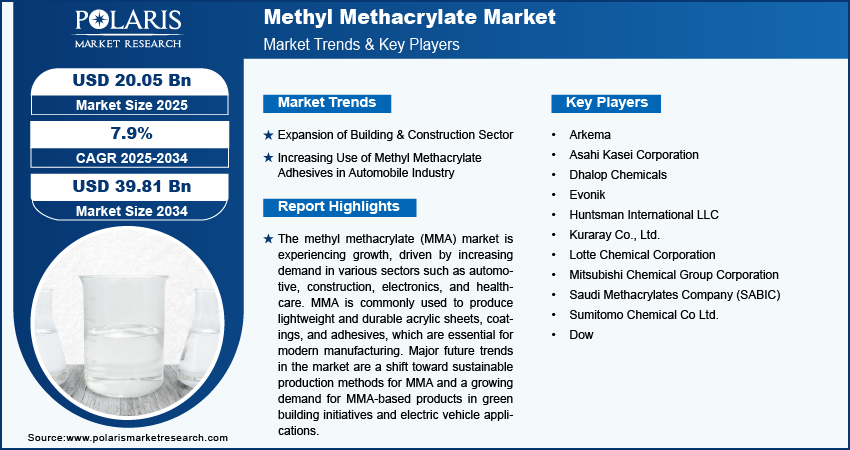

The methyl methacrylate market size was valued at USD 18.62 billion in 2024. The market is projected to grow from USD 20.05 billion in 2025 to USD 39.81 billion by 2034, exhibiting a CAGR of 7.9% during 2025–2034.

Methyl methacrylate (MMA) is a colorless liquid monomer primarily used in the production of acrylic plastics, coatings, and adhesives. MMA has key properties such as clarity, durability, and resistance to UV light and weathering. MMA is witnessing significant demand in various industries, such as automotive, construction, and electronics, due to its varied applications, including automotive glazing, light diffusers, and diffusing panels. Additionally, the construction sector is adopting MMA-based materials for their durability and weather resistance, particularly in applications such as coatings and adhesives.

To Understand More About this Research: Request a Free Sample Report>

The expanding industrialization, especially in regions such as North America, Asia Pacific, and others, is fueling the methyl methacrylate (MMA) market growth. As per a report by Mitsubishi Chemical Group, Mitsubishi Chemical Group set up its MMA production facility in September 2023 in Japan, aiming to strengthen its global leadership in the market. The group’s capabilities in MMA manufacturing, particularly through its cost-competitive ethylene method (Alpha technology), position it to leverage opportunities effectively. Additionally, Mitsubishi announced that it is focusing on developing PMMA recycling technology and bio-MMA monomers, underscoring its commitment to sustainability and a circular economy.

Methyl Methacrylate Market Drivers

Increasing Urbanization Worldwide

Urbanization leads to more construction projects, including residential, commercial, and public infrastructure. According to data published by the United Nations, 55% of the world's population lives in urban areas, and is expected to increase to 68% by 2050. MMA is a key component in the production of acrylic sheets, panels, and glazing materials, which are commonly used in buildings, windows, signage, and facades. Therefore, as cities expand, the demand for these materials increases. Additionally, MMA-based products such as acrylic resins are used in flooring, coatings, paints, and adhesives, which are essential for the development of both new buildings and the renovation of existing urban infrastructure.

Increasing Use of Methyl Methacrylate Adhesives in the Automobile Industry

Methyl methacrylate (MMA) adhesives are increasingly used in the automotive industry due to their strength and universal refinishing profile, making them ideal for lightweight and streamlined designs. The snap-cure feature allows adhesives to bond quickly upon contact, offering immediate strength and integrity, which is particularly beneficial in critical applications such as metals, plastics, and composites, which reduce manufacturing time. MMAs can bond with metals, plastics, and composites and resist common contaminants such as grease and oil, enabling faster production by eliminating extensive surface cleaning. The use of MMA also helps reduce vehicle weight, lowering fuel and material costs while minimizing bond-line read-through for a smoother finish.

Methyl Methacrylate Market Segment Insights

Methyl Methacrylate Market Breakdown by Application Outlook

The global methyl methacrylate market, based on application, is segmented into chemical intermediates, surface coatings, and emulsion polymers. The chemical intermediates segment is projected to register a significant CAGR during the forecast period due to its crucial role in producing various adhesives and coatings, such as acrylic adhesives, epoxy resins, and others. MMA serves as a key component for creating acrylic resins, known for their superior weather resistance, adhesion properties, and durability. Additionally, MMA can be polymerized to form co-polymers used as impact modifiers, improving the toughness and impact resistance of other plastic materials. The versatile applications of MMA as a chemical intermediate are instrumental in driving its demand, particularly across industries requiring high-performance materials.

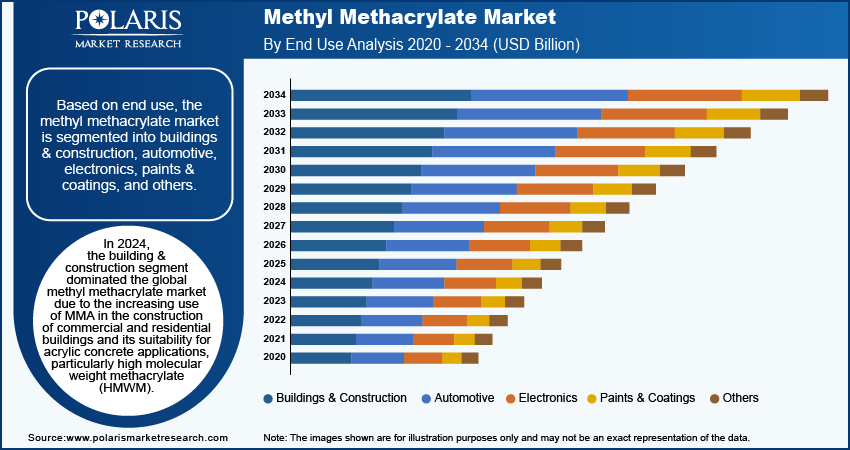

Methyl Methacrylate Market Breakdown by End Use Outlook

The global methyl methacrylate market segmentation, based on end use, is segmented into buildings & construction, automotive, electronics, paints & coatings, and others. In 2024, the building & construction segment dominated the market due to the increasing use of MMA in the construction of commercial & residential buildings and its suitability for acrylic concrete applications, particularly high molecular weight methacrylate (HMWM). Rapid urbanization, a growing population, and rising consumer spending are among the major factors boosting the demand for MMA in the construction industry.

Rising vehicle production is increasing the demand for methyl methacrylate (MMA) in automotive applications such as windshields, fenders, and bumpers. Its lightweight and durable properties, along with a focus on design aesthetics and emission control, improve its use in components such as trims and indicator light covers.

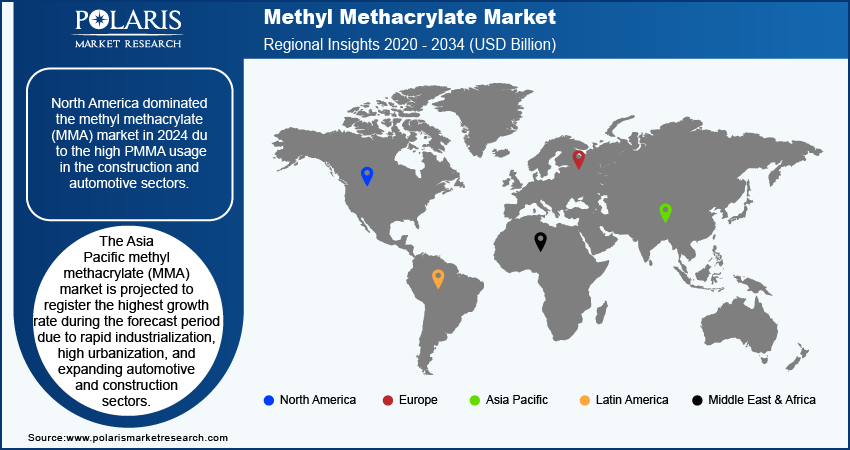

Methyl Methacrylate Market Breakdown by Regional Outlook

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the methyl methacrylate (MMA) market in 2024 due to the high PMMA usage in the construction and automotive sectors. The region's market is consolidated, with regulatory support from the EPA and FDA recognizing the non-carcinogenic nature of MMA, encouraging its adoption in various applications. Increased R&D investments by key manufacturers such as Mitsubishi Chemical Corporation, Arkema, and Evonik have supported innovation, improving MMA's performance in demanding environments such as automotive glazing and architectural components.

Asia Pacific is estimated to be the fastest-growing region during the forecast period due to rapid industrialization, high urbanization, and expanding automotive and construction sectors. The rising demand for lightweight materials in automotive manufacturing and infrastructure development is boosting MMA use for applications such as automotive glazing, coatings, and adhesives. Additionally, the increasing use of PMMA in electronics, such as LED screens and smartphone displays, contributes to the regional market growth. Mitsubishi Chemical Methacrylates (MCM) and Agilyx collaborated on a full-scale production trial for polymethyl methacrylate (PMMA) depolymerization at Agilyx’s facility in Tigard, Oregon, to improve MMA recycling methods to meet the rising regional demand and promote sustainable practices in the MMA market.

Methyl Methacrylate Market – Key Players and Competitive Insights

The competitive landscape of the methyl methacrylate (MMA) market is marked by a combination of global leaders and regional players competing for market share through innovation, strategic collaborations, and regional expansion. Major companies in the industry, such as Arkema, Sumitomo Chemical Co Ltd., and Evonik, leverage their strong R&D capabilities and broad distribution networks to deliver advanced MMA solutions that cater to applications across sectors such as automotive, construction, electronics, and industrial manufacturing. The leading players emphasize product innovation, focusing on improving durability, performance, and sustainability to meet the demands of industries such as automotive components, coatings, and adhesives. Meanwhile, smaller regional firms are emerging with niche MMA products tailored to specific local markets, which offer unique solutions and customized applications. A few competitive strategies in this market are mergers and acquisitions, partnerships with raw material suppliers, and expanding product portfolios to strengthen market presence in key geographic regions. Arkema; Asahi Kasei Corporation; Dhalop Chemicals; Evonik; Huntsman International LLC; Kuraray Co., Ltd.; Lotte Chemical Corporation; Mitsubishi Chemical Group Corporation, Saudi Methacrylates Company (SABIC); Sumitomo Chemical Co Ltd.; and DOW are among the key major players.

Sumitomo Chemical Co., Ltd. is a Tokyo-based chemical company offering a diverse range of products across six sectors, including petrochemicals, pharmaceuticals, IT-related chemicals, energy, functional materials, and health and crop sciences. Its petrochemicals and plastics division provides products such as propylene and polypropylene for automotive use. The company operates globally and holds a key position in terms of market share within countries such as Japan and China. Sumitomo Chemical announced the creation of a new MMA Division, effective April 1, 2022, to improve its MMA business. This division will oversee the production of MMA (methyl methacrylate) monomer and acrylic resin (PMMA, polymethyl methacrylate). It will be responsible for formulating strategies and managing global marketing and sales for the entire business.

Arkema, headquartered in Colombes, France, is a manufacturing company engaged in the production of specialty chemicals and innovative materials. The company’s business operations are diversified across four segments, including adhesives, advanced materials, and coatings solutions. The company offers products, including adhesives, biobased materials, and technical polymers, for various industries such as automotive, construction, healthcare, and consumer goods. Arkema operates in the US, Europe, Canada, Mexico, and Asia. In December 2020, the company entered into a partnership for the offered sale of its PMMA (polymethyl methacrylate) business to Trinseo, valuing the deal at USD 1,352 billion. This divestment marks Arkema's strategic shift toward becoming a pure Specialty Materials company by 2024.

Key Companies in Methyl Methacrylate Market

- Arkema

- Asahi Kasei Corporation

- Dhalop Chemicals

- Evonik

- Huntsman International LLC

- Kuraray Co., Ltd.

- Lotte Chemical Corporation

- Mitsubishi Chemical Group Corporation

- Saudi Methacrylates Company (SABIC)

- Sumitomo Chemical Co Ltd.

- Dow

Methyl Methacrylate Industry Developments

In January 2024, EVONIK launched VISIOMER HEMA-P 100, a nonmigratory phosphate methacrylate monomer that offers long-lasting effects. The product improves flame retardancy, adhesion, and corrosion resistance while maintaining transparency and mechanical properties. Ideal for various applications, such as coatings, adhesives, and composites, VISIOMER HEMA-P stands out due to its high monoester content.

In October 2022, Röhm and OQ Chemicals collaborated on the construction of a world-scale methyl methacrylate (MMA) plant at OQ Chemicals’ Bay City, Texas. The facility, which utilized Röhm's proprietary LiMA technology, was set to produce 250,000 metric tons of MMA annually upon its completion in early 2024 and create 70 direct jobs. OQ Chemicals had significantly invested in expanding the capacity for propionaldehyde and improving local infrastructure to support the new plant.

Methyl Methacrylate Market Segmentation

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Chemical Intermediate

- Surface Coatings

- Emulsion Polymer

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Buildings & Construction

- Automotive

- Electronics

- Paints & Coatings

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Methyl Methacrylate Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 18.62 billion |

|

Market Size Value in 2025 |

USD 20.05 billion |

|

Revenue Forecast by 2034 |

USD 39.81 billion |

|

CAGR |

7.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global methyl methacrylate market size was valued at USD 18.62 billion in 2024 and is projected to grow to USD 39.81 billion by 2034

The global market is projected to register a CAGR of 7.9% during the forecast period.

North America dominated the market in 2024 due to the high PMMA usage in the construction and automotive sectors.

A few key players in the market are Arkema; Asahi Kasei Corporation; Dhalop Chemicals; Evonik; Huntsman International LLC; Kuraray Co., Ltd.; Lotte Chemical Corporation; Mitsubishi Chemical Group Corporation, Saudi Methacrylates Company (SABIC); Sumitomo Chemical Co Ltd.; and DOW.

The building & construction segment dominated the market in 2024 due to the increasing use of MMA in the construction of commercial and residential buildings and its suitability for acrylic concrete applications, particularly high molecular weight methacrylate (HMWM).

The chemical intermediates segment is projected to record the highest CAGR during the forecast period due to its crucial role in producing various adhesives and coatings.