Metal Recycling Market Share, Size, Trends, Industry Analysis Report, By Type (Ferrous Metal and Non-Ferrous Metal); By Scrap Type; By End-User; By Region; Segment Forecast, 2024-2032

- Published Date:Jan-2024

- Pages: 114

- Format: PDF

- Report ID: PM3387

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

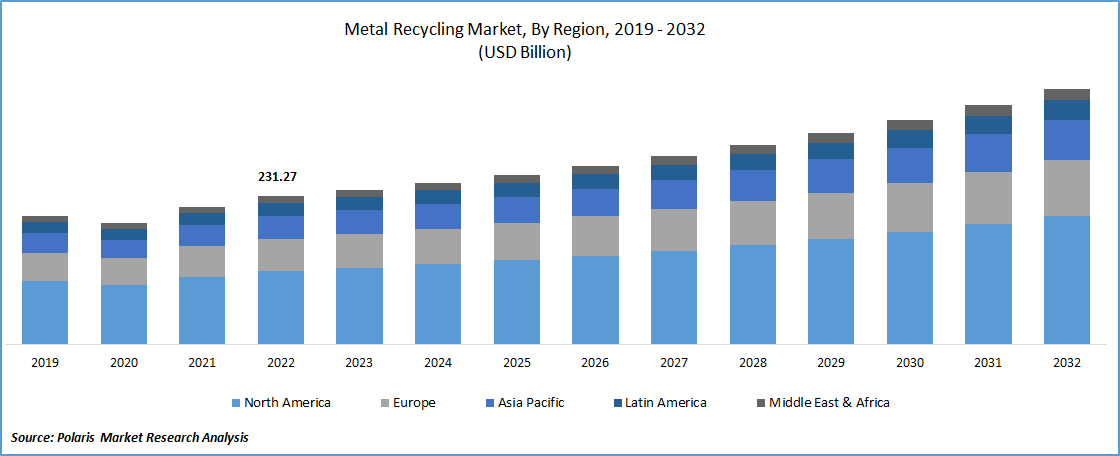

The global metal recycling market was valued at USD 231.27 billion in 2023 and is expected to grow at a CAGR of 5.70% during the forecast period. The rising focus towards the conservation of various types of natural resources and reduction in the greenhouse emissions along with the growing number of manufacturers adopting metal recycling as it allows them to easily procure the raw materials for the production of finished goods without resulting any degradation in their properties, are driving the demand and growth of the global market. In addition, growing awareness regarding the sustainable waste management and rising applications of metal scraps in ships, railways, and cars among others coupled with the implementation on developing new advanced solutions by key companies, has also been propelling the market growth. For instance, in December 2022, ArcelorMittal, announced that they have acquired Dutch scrap metal recycling business named ‘Riwald Recycling’ based in the Netherlands. The company utilize high-specification technical equipment in separation of metals, while ensuring the quality of materials that will strengthen the company product portfolio.

To Understand More About this Research: Request a Free Sample Report

Moreover, various new separation technologies have been developed in the recent years that allow for more efficient separation of different types of metals from each other which includes technologies such as magnetic separation, density separation, and advanced sensor-based sorting systems that can distinguish between different types of metals with high precision.

The outbreak of the COVID-19 pandemic has significantly impacted the growth of the metal recycling market. The rapid spread of the pandemic has resulted in reduced demand for metals in several industries including construction, automotive, and aerospace and has als disrupted the global supply chain, making it difficult for metal recyclers to obtain the equipment and materials they need to operate. This has led to a slowdown in the recycling process and reduced output during the pandemic.

Industry Dynamics

Growth Drivers

There has been significant increase in the popularity and prevalence of recycling process globally, as it is an eco-friendly and sustainable process that reduces greenhouse gas emissions and energy consumption associated with the production of new metals which has led to an increase in public awareness and government regulations that promote recycling and the process is even less expensive than mining or refining new metals, that are among the major factors boosting the market growth.

Furthermore, the growing incorporation of advanced sorting technologies such as X-ray fluorescence and optical sensors that are being are used to identify and separate different types of metals from each other and surging prevalence of shredding technologies in the recycling process that breaks down scrap metal into smaller pieces as it uses high-speed rotors and magnets to separate ferrous and non-ferrous metals, are also likely to create huge growth potential for the market.

Report Segmentation

The market is primarily segmented based on type, scrap type, end-user, and region.

|

By Type |

By Scrap Type |

By End-User |

By Region |

|

|

|

|

Know more about this report: Speak to Analyst

Ferrous metal segment held the significant market revenue sharTo Understand the Scope of this Reporte in 2022

The ferrous metal segment held the maximum market share in terms of revenue in 2022, and is likely to retain its market position over the projected period. The growth of the segment market can be highly attributed to continuous rise in the demand for ferrous metals across numerous end-use industries including automotive, construction, and electronics and properties of these metals mainly iron and steel to be recycled both externally and internally. Moreover, the process of recycling these materials is comparatively less expensive than producing new materials from the basic core, that is positively influencing the segment market.

The non-ferrous metal segment is anticipated to exhibit significant growth rate over the coming years, on account of significant technological advancements, which have made the recycling of non-ferrous metals more efficient and cost-effective. Additionally, the rising focus of major countries of boosting the production of recycled non-ferrous metals in order to meet the growing demand and supplies. For instance, according to a report published in 2021, China plants to boost the use of steel crap by over 23% to around 320 million tonnes by 2025 and further increase the overall production of recycled non-ferrous metals to meet the country’s climate commitments and ensure supplies.

New scrap segment is expected to witness highest growth during forecast period

The new scrap segment is projected to grow at a highest CAGR during the anticipated period, which can be highly attributed to increasing need and penetration for metals from various industries coupled with the economic benefits of metal recycling such as reduced energy consumption and lower production costs, which has led to an increase in the production of new scrap all over the world.

The old scrap segment led the industry market with significant share in 2022, mainly due to growing utilization of these to lower the production cost and enhancement in technologies such as improved sorting and separation techniques, that results in better material efficiency and help in lowering the prices for variety of consumer goods such as appliances, furniture, and grocery packaging among others.

Construction segment accounted for the largest market share in 2022

The construction segment accounted for major global market share in 2022, and is likely to retain its market position over the forecast period, on account of constant demand and need for steel and aluminum from the construction sector and rapid rate of urbanization especially in the emerging economies which led to development of new buildings for residential or business purposes. For instance, according to our findings, around 1.55 million new housing units being planned every year in the United States with a significant rise from 583,000 in 2009. There was an increase of 12% in the total construction across 2021 as compared to 2020 and 5% rise in engineering and construction spending levels.

The automotive segment is anticipated to grow at fastest growth rate over the next coming years, which is mainly driven by increasing demand and production of automobiles across the globe due to rising consumer disposable incomes and high preference for convenient travelling. Wide range of automotive engine components and other auto components including hoods, mufflers, fuel tanks, and vehicle frames are made of steel, which accounts for a huge weight percentage of an automobiles, that is likely to contribute significantly towards the segment market growth.

Asia Pacific region dominated the global market in 2022

The Asia Pacific region dominated the global market for metal recycling in 2022, and is projected to maintain its dominance throughout the anticipated period. The growth of the regional market can be highly attributable to presence of well-established recycling industry and significant expansion in various end-use industries across the region coupled with the growing advancements and developments in the recycling process and techniques.

The North America region is projected to register a steady growth rate of estimated period, owing to significant rise in the focus of major market players to reduce their metal waste and carbon footprint and surging need for metals in the automotive industry especially in developed countries like US and Canada. The emergence of the region as a major producer of aluminum and widespread production of crude steel using the recycled materials, which illustrate the massive significance of the recycling in the region, are further likely to boost the growth of the market.

Competitive Insight

Some of the major players operating in the global market include Kuusakoski Recycling, Sims Metal Management, Tom Martin., Nucor Corporation, Novelis Inc., European Metal Recycling, ArcelorMittal, Commercial Metals Company, Aurubis, Norton Aluminum, DOWA Holdings, Tata Steel, Schnitzer Steel Industries, Norsk Hydro ASA, GFG Alliance, and Kimmel Scrap.

Recent Developments

- In May 2022, TOMRA Recycling, introduced new X-TRACT designed for aluminum recycling & processing. This technology combines the innovative synergies in diamond & metal recovery. Its enhanced capabilities and machine intelligence provide advancements in sorting of complex metal mixtures.

- In March 2022, AMCS, un-veiled its new cloud enabled metal re-cycling platform at the ISRI Convention, which is specially designed in collaboration with the scrap recyclers to accordingly automate its operations from scales, compliance, & contract management as well as transport, hauler portal, inventory valuation, out-bound logistics, & finance.

Metal Recycling Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 241.31 billion |

|

Revenue forecast in 2032 |

USD 397.66 billion |

|

CAGR |

5.70% from 2024– 2032 |

|

Base year |

2023 |

|

Historical data |

2019– 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, By Scrap Type, By End-User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Kuusakoski Recycling, Sims Metal Management, Tom Martin & Co. Ltd., Nucor Corporation, Novelis Inc., European Metal Recycling, ArcelorMittal S.A. Ltd., Commercial Metals Company, Aurubis AG, Norton Aluminum Ltd., DOWA Holdings Co., Tata Steel, Schnitzer Steel Industries Inc., Norsk Hydro ASA, GFG Alliance, and Kimmel Scrap Iron & Metal Co. Inc. |

FAQ's

The Metal Recycling Market report covering key segments are type, scrap type, end-user, and region.

Metal Recycling Market Size Worth $ 395.48 Billion By 2032.

The global metal recycling market expected to grow at a CAGR of 5.71% during the forecast period.

Asia Pacific is leading the global market.

key driving factors in Metal Recycling Market are Laws and regulation enforced by governments.