Metal Li-Based Battery Casing Market Size, Share, Trends, Industry Analysis Report: By Type (Primary and Rechargeable), Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 116

- Format: PDF

- Report ID: PM5154

- Base Year: 2024

- Historical Data: 2020-2023

Metal Li-Based Battery Casing Market Overview

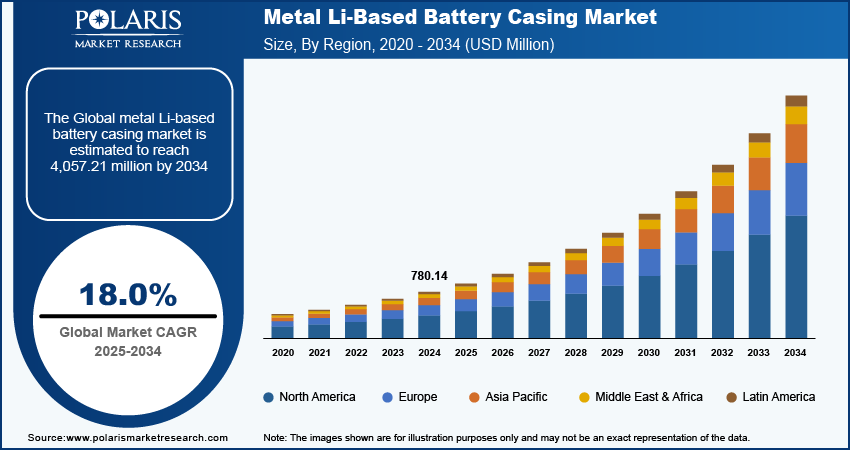

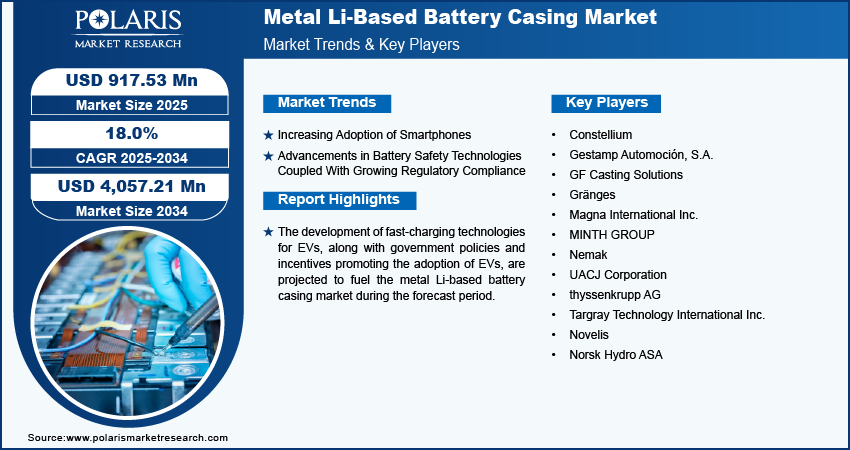

The metal Li-based battery casing market size was valued at USD 780.14 million in 2024. The market is projected to grow from USD 917.53 million in 2025 to USD 4,057.21 million by 2034, exhibiting a CAGR of 18.0% during 2025–2034.

Metal casings are essential for lithium-ion batteries, providing protection against mechanical impacts, thermal instability, and environmental stresses. These casings are primarily made of materials such as aluminum and steel, which offer superior structural integrity compared to plastic alternatives.

The development of fast-charging technologies for EVs is driving the metal Li-based battery casing market growth. Fast-charging systems require batteries that handle higher currents without overheating. Metal Li-based battery casings provide better thermal management and structural integrity, making them ideal for high-power applications. Therefore, as the development of fast charging technologies for EVs expanded, the market for metal li-based battery casing also spurs.

To Understand More About this Research: Request a Free Sample Report

The government policies and incentives promoting the adoption of EVs are projected to fuel the metal li-based battery casing market. The government of India launched FAME, or Faster Adoption and Manufacturing of (Hybrid and) Electric vehicles flagship scheme to promote electric mobility. Incentives such as tax credits, rebates, and subsidies make EVs more affordable, leading to higher sales. More EVs on the road mean greater demand for batteries, including those with metal Li-based casings. Additionally, government support for charging infrastructure encourages EV adoption. This shift often necessitates batteries capable of fast charging, which are better suited to metal casings due to their superior thermal management and durability.

Metal Li-based Battery Casing Market Driver and Trend Analysis

Increasing Adoption of Smartphones

The increasing adoption of smartphones is projected to propel the global metal Li-based battery casing market growth during the forecast period. According to the GSMA’s annual State of Mobile Internet Connectivity Report 2023, over half (54%) of the global population, 4.3 billion people, owns a smartphone. Metal casings are widely used in smartphones to improve thermal management, allowing batteries to handle higher currents safely during fast charging and enhancing performance and user experience. Furthermore, smartphones are frequently exposed to drops and impacts. Metal Li-based casings provide superior protection compared to plastic alternatives, ensuring the battery remains safe and functional in various conditions.

Advancements in Battery Safety Technologies Coupled with Growing Regulatory Compliance

The advancements in battery safety technologies and growing regulatory compliance are estimated to fuel the global metal Li-based battery casing market in the coming years. There is a growing need for battery casings that withstand extreme conditions, such as overcharging or short circuits, as safety technologies improve. Metal casings offer better structural integrity and can better contain potential failures, reducing risks such as thermal runaway. Moreover, with increasing safety standards and regulations for batteries, manufacturers are likely to choose metal Li-based casings to meet stringent safety criteria, avoid penalties, and enhance product reputations.

Metal Li-Based Battery Casing Market Segment Insights

Metal Li-Based Battery Casing Market Breakdown by Type Insights

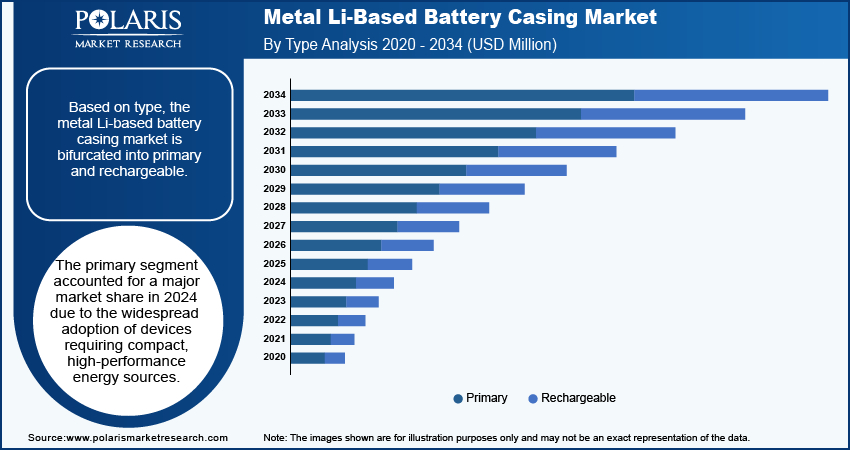

Based on type, the metal Li-based battery casing market is bifurcated into primary and rechargeable. The primary segment accounted for a major market share in 2024 due to the widespread adoption of devices requiring compact, high-performance energy sources. Primary batteries, known for their convenience and long shelf life, find extensive use in consumer electronics, medical devices, and various industrial applications. The growing demand for portable and lightweight products has fueled the preference for these batteries, as they provide reliable power without the need for recharging. Additionally, advancements in lithium technology have enhanced energy density and performance, making primary batteries an attractive choice for manufacturers seeking to deliver efficient and effective solutions.

The rechargeable segment is expected to grow at a robust pace in the coming years, owing to the increasing focus on sustainability and the shift toward electric vehicles (EVs). Manufacturers are investing heavily in the development of high-capacity rechargeable batteries that support longer usage between charges as governments and consumers prioritize eco-friendly alternatives. The rise of renewable energy systems, such as solar power, also drives demand for rechargeable solutions as users seek reliable storage options for harvested energy. Furthermore, innovations in battery management systems and rapid charging technologies enhance the appeal of rechargeable batteries, making them indispensable for modern applications.

Metal Li-Based Battery Casing Market Breakdown by Application Insights

In terms of application, the metal Li-based battery casing market is segmented into automotive, consumer electronics, industrial, and energy storage solutions. The automotive segment dominated the market in 2024 due to the Increasing adoption of electric vehicles (EVs) and the demand for high-performance batteries. The shift toward electric mobility, supported by government incentives and consumer awareness of environmental issues, has prompted automakers to invest heavily in lithium-based battery technologies. Additionally, innovations in battery design and integration with vehicle systems enhance overall performance, making the automotive segment a key segment in the market.

The energy storage solutions segment is projected to grow at a rapid pace during the forecast period owing to the rising demand for renewable energy sources, such as solar and wind power. Homeowners and businesses increasingly seek battery solutions that store excess energy for later use, promoting energy independence and sustainability. Furthermore, advancements in grid energy storage technologies enhance the reliability of renewable energy integration, driving investments in large-scale energy storage systems. The focus on energy storage solutions is estimated to grow, positioning the segment to grow at a rapid pace in the market as energy security and sustainability become paramount,

Metal Li-Based Battery Casing Regional Insights

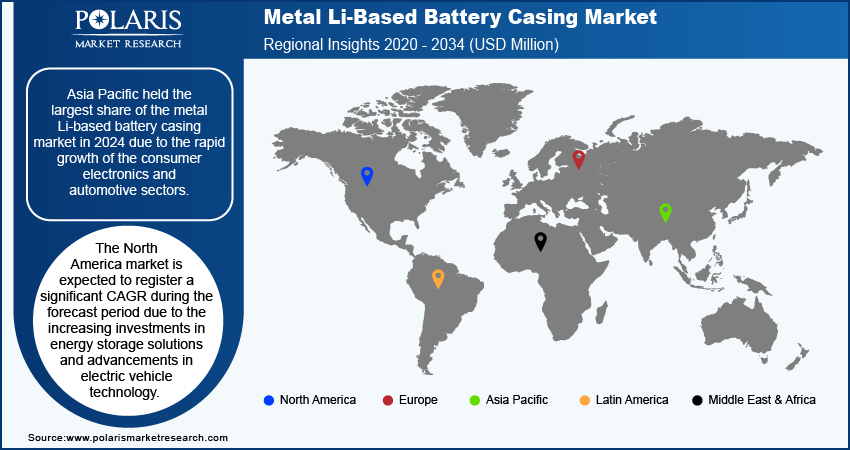

By region, the study provides the metal Li-based battery casing market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific held the largest market share in 2023 due to the rapid growth of the consumer electronics and automotive sectors. China dominated the regional market in 2024, benefiting from a robust manufacturing infrastructure and a strong focus on technological advancements. The high demand for smartphones, laptops, and electric vehicles influenced manufacturers to adopt metal Li-based battery casing, enhancing their performance and safety. Additionally, government initiatives in China aimed at promoting electric mobility and reducing carbon emissions have significantly boosted the adoption of these energy solutions, solidifying the country's position as a market leader.

The North America metal Li-based battery casing market is expected to record a significant CAGR during the forecast period due to the increasing investments in energy storage solutions and advancements in electric vehicle technology. The US leads the regional market, focusing on transitioning to renewable energy sources and enhancing grid stability through efficient storage systems. The growing trend of residential solar installations has created a substantial demand for effective energy storage, allowing homeowners to maximize their energy usage. Furthermore, supportive policies and incentives for EV adoption contribute to the rising need for metal Li-based battery casing.

Metal Li-Based Battery Casing Market – Key Players and Competitive Insights

Key market players are investing heavily in research and development to expand their offerings, which will help the metal Li-based battery casing market grow even more. Market participants are undertaking a variety of strategic activities to expand their global footprint, with important market developments such as innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations. To expand and survive in a more competitive and rising market environment, the market players must offer innovative solutions.

The metal Li-based battery casing market is fragmented, with the presence of numerous global and regional market players. A few major players in the market are Constellium; Gestamp Automoción, S.A.; GF Casting Solutions; Gränges; Magna International Inc.; MINTH GROUP; Nemak; UACJ Corporation; thyssenkrupp AG; Targray Technology International Inc.; Novelis; and Norsk Hydro ASA.

Gränges is a global player in the aluminum rolling and recycling industry, particularly recognized for its innovative solutions in various sectors, including automotive, energy storage, and packaging. The company has established a strong commitment to sustainability, focusing on circular and resource-efficient practices that align with modern environmental standards. This commitment is particularly relevant in the context of metal lithium-based battery casings, where Gränges plays a significant role in providing high-quality aluminum solutions. In January 2023, Gränges invested in increased battery foil production in Finspång.

UACJ Corporation is a global aluminum manufacturer based in Japan, formed through the merger of Furukawa-Sky Aluminum Corp. and Sumitomo Light Metal Industries, Ltd. in 2013. This strategic consolidation positioned UACJ as a major player in the aluminum industry, leveraging extensive expertise and technological capabilities to deliver high-quality aluminum products across various sectors. The company operates multiple production facilities worldwide, focusing on innovation and sustainability. UACJ's expertise in aluminum production positions it well to supply metal Li-based battery casing for EVs.

List of Key Companies in Metal Li-Based Battery Casing Market

- Constellium

- Gestamp Automoción, S.A.

- GF Casting Solutions

- Gränges

- Magna International Inc.

- MINTH GROUP

- Nemak

- UACJ Corporation

- thyssenkrupp AG

- Targray Technology International Inc.

- Novelis

- Norsk Hydro ASA

Metal Li-based Battery Casing Industry Developments

July 2024: Minth Group Co., Ltd, a global company that designs, manufactures, and sells automobile parts, including body parts, molds, and toolings, signed a memorandum of understanding with the Government of Serbia to set up a new manufacturing facility in Serbia. The focuses primarily on battery housings for electric vehicles, making the company a key supplier of battery enclosures and body structure components.

May 2024: Gränges, a global company that specializes in aluminum rolling and recycling, extends its long-term strategic partnership with Shandong Innovation Group (SIG) to strengthen competitiveness and gain further market share. The agreement will provide Gränges access to scalable downstream operations, enabling efficient manufacturing and delivery of battery housings to support Electric Vehicle (EV) production.

Metal Li-Based Battery Casing Market Segmentation

By Type Outlook (Revenue, USD Million, 2020–2034)

- Primary

- Rechargeable

By Application Outlook (Revenue, USD Million, 2020–2034)

- Automotive

- Consumer Electronics

- Industrial

- Energy Storage Solutions

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Metal Li-based Battery Casing Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 780.14 million |

|

Market Size Value in 2025 |

USD 917.53 million |

|

Revenue Forecast by 2034 |

USD 4,057.21 million |

|

CAGR |

18.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global metal Li-based battery casing market size was valued at USD 780.14 million in 2024 and is projected to grow to USD 4,057.21 million by 2034.

The global market is projected to register a CAGR of 18.0% during the forecast period.

Asia Pacific accounted for the largest share of the global market in 2024.

A few key players in the market are Constellium; Gestamp Automoción, S.A.; GF Casting Solutions; Gränges; Magna International Inc.; MINTH GROUP; Nemak; UACJ Corporation; thyssenkrupp AG; Targray Technology International Inc.; Novelis; and Norsk Hydro ASA.

The energy storage solutions segment is projected for significant growth in the global market during the forecast period.

The primary type segment dominated the market in 2024.