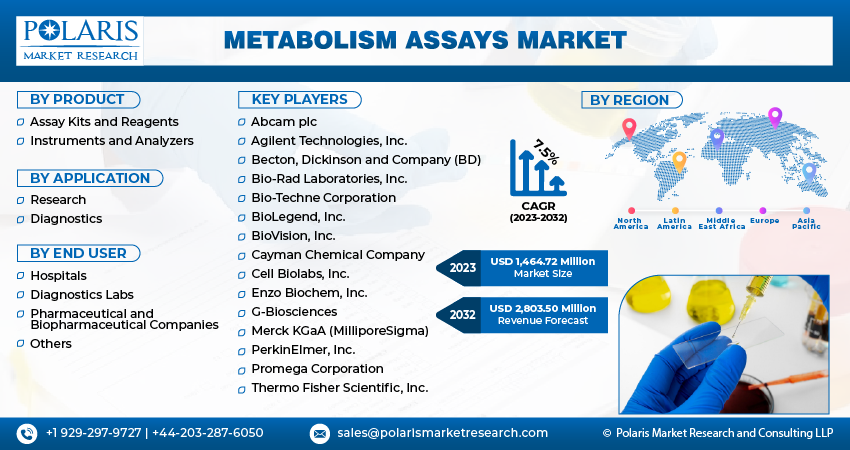

Metabolism Assays Market Share, Size, Trends, Industry Analysis Report, By Product (Assay Kits and Reagents, Instruments and Analyzers); By Application; By End User; By Region; Segment Forecast, 2023- 2032

- Published Date:Nov-2023

- Pages: 114

- Format: PDF

- Report ID: PM4040

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

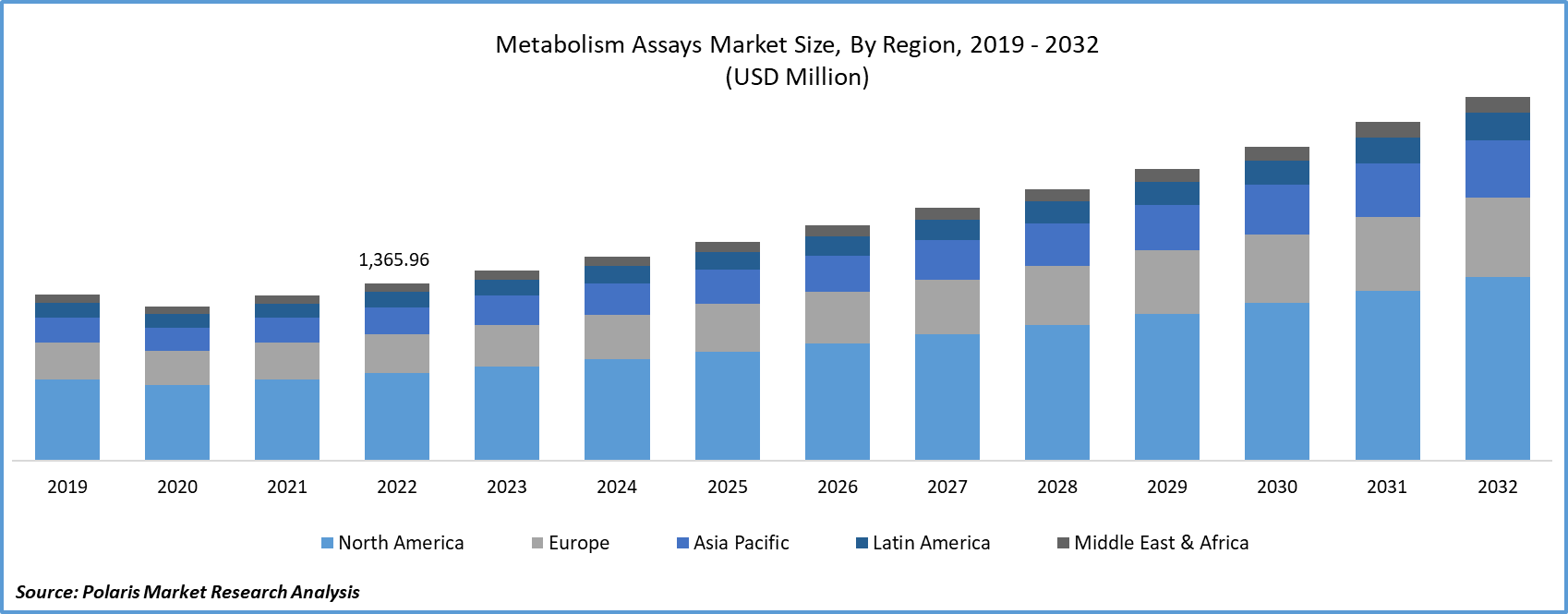

The global metabolism assays market was valued at USD 1,365.96 million in 2022 and is expected to grow at a CAGR of 7.5% during the forecast period.

The identification and validation of metabolic biomarkers associated with various diseases, such as cancer, neurodegenerative conditions, and cardiovascular disorders, present promising opportunities for early diagnosis and the development of novel therapies.

To Understand More About this Research: Request a Free Sample Report

The metabolism assays market benefits from continuous technological advancements, enhancing assay accuracy, sensitivity, and speed. Innovations in assay methodologies and equipment, such as the adoption of microfluidic systems and high-throughput screening technologies, bolster the market's capacity for comprehensive metabolic profiling.

In addition, several companies are acquiring other players in the market to expand their offerings and cater to the growing consumer demand.

- For instance, in July 2020, Nexelis announced the acquisition of AIT Bioscience. The acquisition enabled the company to enhance its service offering in the bioanalytical segment.

Advanced data analytics tools have the potential to unlock valuable insights from metabolic profiles, furthering the prospects of precision medicine. As data analytics capabilities continue to grow, the demand for skilled professionals to interpret and utilize metabolic data is on the rise.

For Specific Research Requirements: Request for Customized Report

The post-COVID-19 Metabolism Assays Market has evolved in response to the pandemic's impact. It has witnessed an upsurge in metabolic research, particularly in understanding the metabolic aspects of infectious diseases. Telehealth integration and remote monitoring using metabolism assays have become prevalent, enhancing accessibility to diagnostics. Point-of-care testing has expanded, enabling quick and on-the-spot metabolic assessments, particularly for COVID-related complications. Biotechnology advancements have led to more efficient assay technologies, while data analytics plays a critical role in deriving actionable insights. Regulatory agencies have adapted, facilitating the introduction of COVID-related metabolic tests. The market has grown with increased consumer awareness of metabolic health, and global collaborations in research have intensified.

Growth Drivers

- Rise in chronic conditions, evolution of precision medicine, and greater demand from pharmaceutical companies are factors projected to spur the market demand

The rise in chronic conditions, such as diabetes, obesity, cardiovascular diseases, and metabolic syndrome, necessitates metabolic assessments for both diagnosis and continuous monitoring. The Global Burden of Disease Study highlights that those non-communicable diseases, closely linked to metabolic health, are responsible for 71% of all global deaths.

The evolution of precision medicine relies on metabolic profiling to provide a highly individualized approach to treatment. Genomic medicine and metabolomics disciplines leverage metabolic data to tailor medical interventions to a patient's unique metabolic profile, promoting more effective and targeted therapies.

The pharmaceutical industry's demand for metabolic assays remains robust. These assays are indispensable in drug development, helping researchers assess drug efficacy, toxicity, and metabolic interactions.

Report Segmentation

The market is primarily segmented based on product, application, end user, and region.

|

By Product |

By Application |

By End User |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Analysis

- Assay kits and reagents segment accounted for a significant share in 2022

The assay kits and reagents segment accounted for a significant share in 2022. Metabolism assay kits and reagents are essential tools in laboratories and clinical settings for assessing metabolic processes. They consist of specialized reagents, enzymes, and detection systems designed for specific metabolic assays. These kits are used to measure cellular metabolism, enzyme activity, and the levels of various metabolites such as glucose and lactate. They find applications in drug screening, nutrient uptake studies, toxicology assessments, and the diagnosis and monitoring of metabolic disorders. Additionally, they contribute to personalized medicine by identifying individual variations in metabolic profiles and play a pivotal role in biomarker discovery for early disease diagnosis and treatment monitoring.

By Application Analysis

- Diagnostics emerged as the largest segment in 2022

The diagnostics emerged as the largest segment in 2022. Metabolism assays are pivotal in diagnostics, facilitating early disease detection, personalized treatment, and monitoring treatment efficacy. They identify metabolic disorders like diabetes and genetic conditions by analyzing metabolic markers. These assays help in discovering metabolic biomarkers linked to diseases, enabling early diagnosis. They also ensure patient safety by screening drugs for potential metabolic interactions and toxicity. In addition, metabolism assays assess health risks by examining parameters like cholesterol and glucose levels, offering valuable insights. Furthermore, they monitor disease progression, guiding treatment adjustments and evaluating therapeutic impacts. Overall, these assays are integral to the diagnostic landscape, enhancing healthcare practices.

By End User Analysis

- Pharmaceutical and biopharmaceutical companies segment held the significant market revenue share in 2022

The pharmaceutical and biopharmaceutical companies segment accounted for a significant share in 2022. Metabolism assays are integral tools extensively employed by pharmaceutical and biopharmaceutical enterprises for a diverse array of critical functions. In the initial stages of drug development, these assays are indispensable for recognizing potential compounds and gauging their metabolic stability, enabling the selection of promising drug candidates. Pharmaceutical entities utilize metabolism assays to investigate potential interactions between novel drugs and existing medications. This investigation helps pinpoint potential drug-drug interactions, ensuring patient well-being and the efficacy of treatments. Metabolism assays contribute significantly to the realization of precision medicine by allowing tailored drug therapies that consider the individual metabolic profiles of patients.

Regional Insights

- North America emerged as the largest region in 2022

North America emerged as the largest region in 2022. The metabolism assay market in the region is a dynamic sector of the life sciences and biotechnology industry. It involves the development, manufacturing, and distribution of various assays, kits, and reagents that are essential for metabolic research, drug discovery, and clinical diagnostics. The presence of numerous world-renowned research institutions and universities in the U.S. drives the demand for metabolism assays. The U.S. is home to a significant number of pharmaceutical and biotechnology companies that are actively engaged in drug discovery and development. Metabolism assays are pivotal for drug screening and development processes, making them indispensable to these enterprises. Government agencies, notably the National Institutes of Health (NIH), allocate substantial funding to support metabolic research projects. This financial support significantly boosts the demand for metabolism assays, facilitating cutting-edge research.

Asia-Pacific is expected to experience significant growth during the forecast period. In the Asia-Pacific region, there is a burgeoning presence of esteemed research institutions and universities that are shifting their primary focus toward metabolic research. This transformation has sparked a surge in cutting-edge studies, thereby driving an increased demand for metabolism assays. Concurrently, the healthcare landscape in the region is transforming, with a growing emphasis on personalized medicine and diagnostics. In this evolving healthcare environment, metabolism assays assume a critical role, providing essential insights into individual health conditions and influencing treatment decisions. Asian countries such as Singapore, South Korea, and China are emerging as key biotechnology hubs. These hubs attract a wealth of research talent and companies, both of which heavily rely on metabolism assays to advance their research initiatives and bolster their product development efforts.

Key Market Players & Competitive Insights

The metabolism assays market exhibits a fragmented landscape, and competition is expected to intensify due to the active participation of numerous players. Prominent firms in this industry consistently introduce innovative strategies to bolster their market position. These key players prioritize strategies like forming partnerships and fostering collaborations to gain a competitive edge over their peers and establish a significant market presence.

Some of the major players operating in the global market include:

- Abcam plc

- Agilent Technologies, Inc.

- Becton, Dickinson and Company (BD)

- Bio-Rad Laboratories, Inc.

- Bio-Techne Corporation

- BioLegend, Inc.

- BioVision, Inc.

- Cayman Chemical Company

- Cell Biolabs, Inc.

- Enzo Biochem, Inc.

- G-Biosciences

- Merck KGaA (MilliporeSigma)

- PerkinElmer, Inc.

- Promega Corporation

- Thermo Fisher Scientific, Inc.

Recent Developments

- In December 2022, Reaction Biology Corporation announced the acquisition of Bioassay Labor für biologische Analytik GmbH. The acquisition is aimed at enhancing the company’s offerings and strengthening market presence.

Metabolism Assays Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 1,464.72 million |

|

Revenue forecast in 2032 |

USD 2,803.50 million |

|

CAGR |

7.5% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019-2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments covered |

By Product, By Application, By End User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |