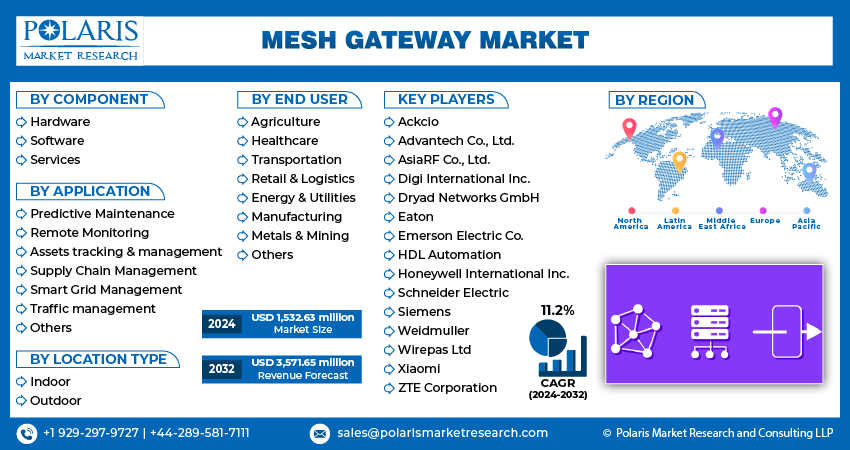

Mesh Gateway Market Size, Share, Trends, Industry Analysis Report: By Component (Hardware, Software, Services), By Location Type, By Application, By End User, and By Region (North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024-2032

- Published Date:Aug-2024

- Pages: 119

- Format: PDF

- Report ID: PM5020

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

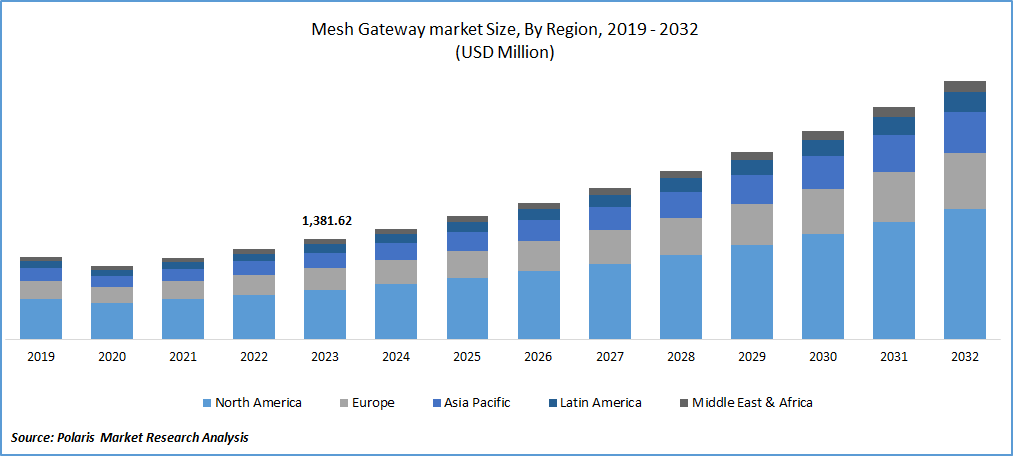

The global mesh gateway market size was valued at USD 1,381.62 million in 2023. The industry is projected to grow from USD 1,532.63 million in 2024 to USD 3,571.65 million by 2032, exhibiting a compound annual growth rate (CAGR) of 11.2% during the forecast period.

A mesh gateway is a critical component in a mesh network architecture, serving as a bridge between the mesh network and external networks, such as the Internet or other local networks. In a mesh network, multiple devices (nodes) are interconnected to facilitate data transmission across the network. Each node can communicate with other nodes directly or through intermediate nodes, ensuring robust and efficient network coverage.

The increasing number of cyber threats and the greater emphasis on securing home and business networks contribute to driving the demand for the mesh gateway market. Furthermore, advancements in mesh networking, such as improved routing algorithms and enhanced security features, make mesh gateways more efficient and appealing to consumers and businesses, thereby increasing the mesh gateway market.

To Understand More About this Research:Request a Free Sample Report

The increasing need for reliable and extensive network coverage in both residential and commercial settings propelled the demand for mesh gateway market. Traditional Wi-Fi networks often struggle with dead zones and weak signals, especially in larger homes, multi-story buildings, and office spaces with numerous walls and obstacles. Mesh gateways effectively address these challenges by creating a network of interconnected nodes that work together to ensure consistent and robust internet coverage throughout the entire area. This ability to eliminate dead zones and provide seamless connectivity is a major factor driving the demand for the mesh gateway market.

Mesh Gateway Market Trends:

Increasing Adoption of Smart Home Devices

The increasing popularity of smart home devices is a major driver of the mesh gateway market growth. Smart home technology, which includes smart lights, thermostats, security cameras, and home assistants, is becoming more popular due to its convenience, energy efficiency, and improved security. Mesh gateways offer a strong solution by creating a network of interconnected nodes, ensuring consistent and reliable internet access throughout the home. This seamless connectivity enhances the performance of all smart devices, contributing to the increasing demand for mesh gateways.

The trend toward home automation is also supported by growing consumer awareness and the availability of affordable smart home products. This change in consumer behavior, driven by the need to simplify household management is a key factor in the industry's development. As a result, major players are introducing new innovative product versions to meet these evolving consumer needs.

For example, in March 2024, the well-known Chinese tech giant Xiaomi launched an upgraded version of its Xiaomi Outdoor Camera CW500 in its home market. This advanced security camera is available for crowdfunding on the Xiaomi Youpin platform, enhancing home security. As the use of such technology increases, there is a growing demand for strong network solutions. Mesh gateways, with their extensive coverage and reliable connectivity, are well-suited to support these devices, significantly contributing to the growth of the mesh gateway market.

Rising Adoption of Mesh Gateway in Industrial Automation

The mesh gateway market is experiencing significant growth, driven by the rising adoption of industrial automation. As industries embrace automation to enhance efficiency, productivity, and safety, the need for robust and reliable network infrastructure becomes paramount. Mesh gateways provide the necessary connectivity by creating a network of interconnected nodes that ensure seamless and uninterrupted communication between various industrial devices, sensors, and control systems. This reliable connectivity is crucial for real-time data transmission, remote monitoring, and automated processes, all of which are essential components of modern industrial operations.

Various companies, like Siemens, are increasingly investing in automation technologies that require seamless connectivity provided by mesh gateways. These gateways facilitate real-time monitoring and control of equipment, enable predictive maintenance through continuous data collection and analysis, and support the seamless integration of new technologies such as Industrial Internet of Things (IIoT) devices.

For instance, in June 2023, Siemens unveiled its global investment strategy aimed at strengthening its management in industry automation, digitalization, electrification, and sustainability. This strategy includes significant investments totaling approximately €2 billion in new high-tech factories, innovation labs, and education centers across regions like China, Southeast Asia, Europe, and the U.S. Within these facilities, mesh gateways play a crucial role by providing scalability and flexibility. They enable industries to expand their networks seamlessly as their automation requirements evolve. Such investment and industry expansion further propelled the mesh gateway market revenue.

Mesh Gateway Market Segment Insights:

Mesh Gateway Application Insights:

The global mesh gateway market segmentation, based on application, includes predictive maintenance, remote monitoring, assets tracking & management, supply chain management, smart grid management, traffic management, and others. The predictive maintenance segment is anticipated to witness the highest growth during the forecast period. Predictive maintenance involves using data analytics, machine learning algorithms, and IoT sensors to predict when equipment maintenance is needed before failures occur. This approach offers several advantages over traditional reactive maintenance, including reduced downtime, lower maintenance costs, and improved asset reliability and lifespan.

Mesh gateways provide the infrastructure needed to support a growing number of IoT devices and sensors within industrial networks. Thus, as companies scale up their predictive maintenance initiatives and expand their IoT deployments, mesh gateways offer scalability and flexibility to accommodate evolving operational needs.

For instance, in January 2024, Infineon and Aurora Labs announced a partnership aimed at enhancing predictive maintenance solutions for the automotive industry, enabling in level of safety for drivers. This proactive approach enhances driver safety and also reduces downtime and maintenance costs for automotive manufacturers. Such initiatives by companies are expected to drive the demand for the mesh gateway market.

Mesh Gateway End User Insights:

The global mesh gateway market segmentation, based on end-user users, includes agriculture, transportation, retail & logistics, energy & utilities, manufacturing, metals & mining, and others. The retail & logistics category is expected to witness significant CAGR growth during the forecast years. The retail and logistics sectors are increasingly adopting IoT devices for inventory tracking, fleet management, and automation.

Mesh gateways serve as critical connectivity infrastructure, supporting a multitude of IoT devices across expansive retail stores or logistics hubs. In-home environments, these gateways facilitate smart retail applications, enabling personalized shopping experiences through IoT-connected devices like smart shelves and inventory management systems. This innovative solution enhances customer demand by ensuring seamless connectivity, thereby improving overall shopping experiences and operational efficiency.

For instance, in October 2020, Nokia introduced a new lineup of Mesh Wi-Fi 6 solutions designed to enhance Wi-Fi connectivity across homes and retail logistics environments. These solutions boast higher throughput, lower latency, and improved performance, ensuring seamless connectivity throughout every corner of the premises. Nokia's Wi-Fi 6 devices, which include 5G Fixed Wireless Access (FWA) gateways, fiber gateways, and mesh Wi-Fi beacons, feature a blend of local and cloud-based intelligence. Such innovations underscore that the key players are increasingly developing creative solutions and expanding the mesh gateway market share.

Global Mesh Gateway Market, Segmental Coverage, 2019 - 2032 (USD million)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

Mesh Gateway Regional Insights:

By region, the study provides market insights into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. The mesh gateway market in North America accounted for a significant share in 2023 due to the rising adoption of smart home technologies, such as connected appliances, security systems, and entertainment devices. Also, the region's robust IoT ecosystem spanning industries from healthcare to automotive, relies on mesh gateways to support the connectivity needs of diverse IoT devices. In addition, the presence of major companies such as Honeywell International Inc., Digi International Inc., and Emerson Electric Co. offering their solutions further strengthens the market landscape in North America.

Also, with the growth of remote work, online learning, and digital entertainment, there is a heightened demand for stable and high-performance internet connections in residential and commercial settings, further driving the market.

Global Mesh Gateway Market Regional Coverage, 2019 - 2032 (USD million)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

U.S. mesh gateway market held the largest market share due to the widespread adoption of smart home devices such as smart speakers, security cameras, and connected appliances is fueling the demand for robust and reliable network solutions. Various companies provide comprehensive coverage, overcoming Wi-Fi dead zones and ensuring seamless connectivity throughout homes of varying sizes.

For instance, in October 2023, Adtran launched its latest lineup of service delivery gateways (SDGs), including the SDG 8600 and 8700 Series, designed to optimize in-home connectivity with Wi-Fi 6, 6E, and seven technologies. These energy-efficient mesh routers are tailored to enhance revenue opportunities for operators, featuring a compact footprint and a processor that is twice as powerful as previous models. These advancements are poised to drive the mesh gateway market in the U.S.

The Canada mesh gateway market accounted for a significant market share due to the rapid expansion of IoT applications across various sectors. The shift towards telecommuting and remote work arrangements has amplified the need for stable and high-speed internet connections at residential locations. Mesh gateways key players in Canada enable them to maintain consistent internet access, supporting multiple devices concurrently without performance degradation.

For instance, the Canada-based Ackcio company offers its innovative Ackcio Mesh, a patented, long-range wireless mesh communication protocol. Nodes and Gateways use this protocol to communicate across impressive distances, even in noisy or challenging environments. Ackcio Mesh networks automatically choose the best communication paths and frequencies with minimal interference for data transmission. This ensures highly reliable data acquisition, meeting stringent data reliability regulatory requirements in all types of monitoring applications.

The Asia-Pacific mesh gateway market is expected to grow at the highest CAGR from 2024 to 2032. This is due to rapid urbanization which lead to the development of smart cities. These smart city projects require robust and scalable network infrastructure to support a wide range of IoT applications, from traffic management to public safety. Companies like NEXCOM International Co., Ltd., Advantech Co., Ltd., and HDL Automation are the major players in the mesh gateway market, driving the market forward with their advanced technologies and strategic initiatives.

For instance, in July 2019, Advantech launched its UNO-420 data gateway. Powered by an Intel Atom E3815 processor, the UNO-420 features three configurable two LAN ports (one with PoE), COM ports, eight programmable GPIO ports, one USB 3.0 port, and one HDMI port. This comprehensive connectivity makes the UNO-420 an ideal solution for integrating legacy equipment with new mesh networks.

India's mesh gateway market held a significant market share in 2023, driven by government initiatives. For instance, according to the NDCP (National Digital Communication Plan), the Central government aimed to establish 10 million Wi-Fi hotspots by 2022. To support this initiative, the Union Cabinet, led by the Hon’ble Prime Minister, approved the Department of Telecommunications' proposal to expand broadband access through public Wi-Fi networks under the Prime Minister’s Wi-Fi Access Network Interface framework on December 9, 2020. On the other hand, Japan's mesh gateway market is expected to continue its steady growth during the forecast period due to continuous advancements in mesh networking technologies.

Mesh Gateway Key Market Players & Competitive Insights

Leading market players are implementing a variety of strategies to gain market share and enhance their product offerings. These strategies include innovation, partnerships, acquisitions with important market developments, and expanding their geographical reach. Below are some insights into the competitive landscape and strategies adopted by leading companies in the mesh gateway industry.

Companies are continuously investing in research and development to introduce advanced technologies that improve performance, security, and ease of use, thereby driving mesh gateway industry growth and enhancing overall connectivity solutions.

Major players in the mesh gateway market, including Ackcio, Advantech Co., Ltd., AsiaRF Co., Ltd., Digi International Inc., Dryad Networks GmbH, Eaton, Emerson Electric Co., HDL Automation, Honeywell International Inc., Schneider Electric, Siemens, Weidmuller, Wirepas Ltd, Xiaomi, ZTE Corporation, etc.

Siemens is a technology company that operates in automation, electrification, and digitalization. Its products and services range from power generation systems, turbines, medical imaging equipment, trains, and automation software to building technologies and smart grid solutions. The company provides its products & services to technology, building technology, energy, healthcare, financing, industrial automation, services, mobility, software, and consumer products. In March 2020, Siemens launched a gateway based on the TI ARM processor family, designed to connect cloud services, in-company IT, and production systems. These new IoT gateways are equipped with remote edge functionality, facilitating seamless integration into Siemens Industrial Edge solutions.

AsiaRF Co., Ltd., established in 1997 and headquartered in Taipei, Taiwan, is a global player in wireless connectivity for Internet, enterprise, and IoT applications. The company offers an extensive product portfolio, including Wi-Fi HaLow, Wi-Fi 6E, Wi-Fi 7, 5G, LoRa WAN, BLE, antennas, and accessories, providing advanced solutions for its clients. To address the limitations of traditional networks, such as limited coverage and signal interference, as well as the technical and cost challenges faced by satellite networks, AsiaRF launched a Wi-Fi HaLow mesh gateway IoT solution kit. In June 2023, in collaboration with Morse Micro, AsiaRF introduced the AP7688-WHM Wi-Fi MESH Gateway HaLow End-product. This solution kit is specifically designed for AI and Industrial Internet of Things (IIoT) applications, providing enhanced connectivity and reliability for diverse industrial environments.

Key Companies in the Mesh Gateway market include:

- Ackcio

- Advantech Co., Ltd.

- AsiaRF Co., Ltd.

- Digi International Inc.

- Dryad Networks GmbH

- Eaton

- Emerson Electric Co.

- HDL Automation

- Honeywell International Inc.

- Schneider Electric

- Siemens

- Weidmuller

- Wirepas Ltd

- Xiaomi

- ZTE Corporation

Mesh Gateway Industry Developments

- February 2024: Kong Inc. announced the release of Kong Gateway 3.6, featuring six new open-source AI plugins. This update includes no-code AI plugins, multi-LLM support, advanced prompt engineering, and more, enhancing the capabilities and flexibility of the gateway.

- October 2022: Mesh Security Limited entered into a distribution partnership with Technology To Go (TTG) to provide mesh services to manage service providers in the UK and Ireland, expanding their market reach and service availability.

- December 2022: Qualcomm Technologies, Inc. unveiled its latest high-performance network solution for the home, the immersive home platform Qualcomm Wi-Fi 7. This platform introduces Qualcomm Multi-Link Mesh, a groundbreaking advancement in home networking connectivity.

Mesh Gateway Market Segmentation:

Mesh Gateway Component Outlook

- Hardware

- Software

- Services

Mesh Gateway, Location Type Outlook

- Indoor

- Outdoor

Mesh Gateway Application Outlook

- Predictive Maintenance

- Remote Monitoring

- Assets tracking & management

- Supply Chain Management

- Smart Grid Management

- Traffic management

- Others

Mesh Gateway End User Outlook

- Agriculture

- Healthcare

- Transportation

- Retail & Logistics

- Energy & Utilities

- Manufacturing

- Metals & Mining

- Others

Mesh Gateway Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Mesh Gateway Report Scope:

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 1,381.62 million |

|

Market size value in 2024 |

USD 1,532.63 million |

|

Revenue Forecast in 2032 |

USD 3,571.65 million |

|

CAGR |

11.2% from 2024 – 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global mesh gateway market size was valued at USD 1,381.62 million in 2023 and is expected to witness 3,571.65 million in 2032

The global market is projected to grow at a CAGR of 11.2% during the forecast period, 2023-2032

The mesh gateway market in North America accounted for a significant share in 2023.

The key players in the market are Ackcio, Advantech Co., Ltd., AsiaRF Co., Ltd., Digi International Inc., Dryad Networks GmbH, Eaton, Emerson Electric Co., HDL Automation, Honeywell International Inc., Schneider Electric, Siemens, Weidmuller, Wirepas Ltd, Xiaomi, ZTE Corporation, etc.

The predictive maintenance segment is anticipated to witness the highest growth during the forecast period.

The retail & logistics category is expected to witness significant CAGR growth during the forecast years.