Mental Health Teletherapy Platform Solutions Market Size, Share, Trends, Industry Analysis Report: By Type, Age (Pediatric, Adult, and Geriatric), Application, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 129

- Format: PDF

- Report ID: PM5449

- Base Year: 2024

- Historical Data: 2020-2023

Mental Health Teletherapy Platform Solutions Market Overview

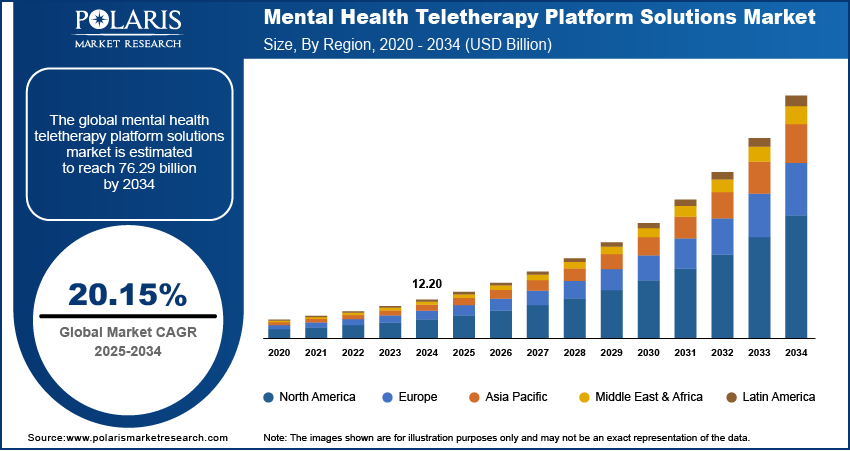

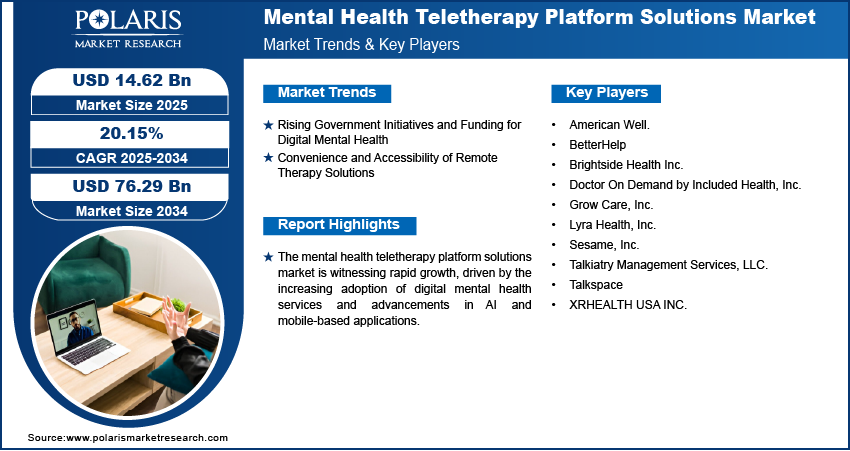

The global mental health teletherapy platform solutions market size was valued at USD 12.20 billion in 2024. It is expected to grow from USD 14.62 billion in 2025 to USD 76.29 billion by 2034, at a CAGR of 20.15% during 2025–2034.

Mental health teletherapy platform solutions are digital services that enable remote mental health counseling and therapy through video, audio, and messaging tools. The mental health teletherapy platform solutions market growth is driven by the rising awareness and demand for mental health services. According to the APA, in 2024, 90% of the US public witnessed a mental health crisis, with high anxiety rates and barriers such as cost, stigma, and therapy provider shortages, further boosting the market demand. Over recent years, the stigma surrounding mental health issues has diminished, encouraging more individuals to seek help. The growing exposure of mental health's impact on overall well-being has led to an increase in therapy adoption, which further contributes to revenue growth. Additionally, the accessibility of teletherapy platforms eliminates geographical barriers and offers greater convenience and privacy, making them a preferred choice for diverse age groups. This shift is further supported by employers and institutions incorporating mental health support into their well-being programs, boosting industry insights for effective teletherapy solutions.

To Understand More About this Research: Request a Free Sample Report

Another driver propelling the mental health teletherapy platform solutions market demand is the technological advancements in teletherapy platforms. Innovations such as AI-driven chatbots, automated appointment scheduling, and data analytics improve user experience and streamline therapist's workflows. High-quality video and audio capabilities, coupled with secure data encryption, have improved the effectiveness and confidentiality of remote therapy sessions. In May 2024, JD Health launched AI-driven mental health services, such as an empathetic chatbot and diagnostic tools. It offers 24/7 support and sleep monitoring software with over 7,000 professionals. Moreover, the integration of mobile apps with personalized mental health resources has raised accessibility for users seeking immediate support. Therefore, as these platforms continue to evolve, they offer a more interactive and user-friendly approach to mental health care, further driving growth opportunities in teletherapy as a strong component of modern healthcare services.

Mental Health Teletherapy Platform Solutions Market Dynamics

Rising Government Initiatives and Funding for Digital Mental Health

Governments worldwide are increasingly recognizing the importance of mental health as a public health priority and are allocating funds to improve digitalization in mental health infrastructure. Financial support and favorable policies aimed at expanding teletherapy services have enabled providers to scale their platforms, improve technology integration, and reach underserved populations. For instance, in February 2023, IMHO reported a 16% increase in India’s mental health budget under MoHFW, rising from USD 96.46 million in FY 2022–23 to USD 112.07 million for FY 2023–24, supporting mental health institutions and the National Tele-Mental Health Programme (T-MANAS). Such initiatives validate the effectiveness of teletherapy and also boost its credibility and adoption among individuals and healthcare institutions alike, thereby driving the mental health teletherapy platform solutions market demand.

Convenience and Accessibility of Remote Therapy Solutions

Teletherapy eliminates the need for in-person visits, saving time and reducing logistical challenges for patients and therapists, contributing to the convenience and accessibility of remote therapy solutions. In November 2024, Hedonia’s economic model, developed by Arbital Health, and their research assumptions revealed its Mood Bloom app delivers a 5:1 ROI for employers by reducing depression and anxiety costs. Clinical trials showed a 45% reduction in depressive symptoms, supported by high engagement and cost savings. These disruptive technologies are particularly beneficial for individuals with mobility issues, those in remote areas, or those with busy schedules by improving accessibility and engagement. Additionally, the flexibility to access therapy from home offers a sense of privacy and comfort, encouraging more people to seek help without feeling discriminated against when visiting a therapist’s office. The ability to schedule sessions outside of traditional office hours further improves the appeal of teletherapy, making it a practical and accessible solution for a wider audience. Thus, convenience and accessibility of remote therapy solutions boost the mental health teletherapy platform solutions market development.

Mental Health Teletherapy Platform Solutions Market Segment Insights

Mental Health Teletherapy Platform Solutions Market Assessment by Type Outlook

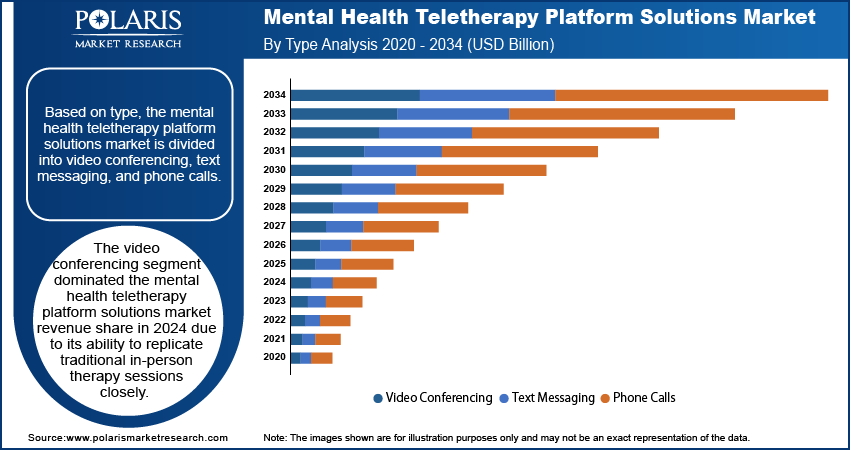

The global mental health teletherapy platform solutions market segmentation, based on type, includes video conferencing, text messaging, and phone calls. The video conferencing segment dominated the market share in 2024 due to its ability to replicate traditional in-person therapy sessions closely. Video conferencing allows therapists to observe non-verbal cues, body language, and facial expressions, which are crucial for effective diagnosis and treatment. The interactive nature of video-based therapy enhances the therapeutic alliance between patients and therapists, leading to better outcomes. Moreover, technological advancements in video quality, secure data encryption, and user-friendly interfaces have improved the reliability and appeal of video conferencing, making it the preferred choice among both providers and patients for better expansion opportunities.

Mental Health Teletherapy Platform Solutions Market Evaluation by Age Outlook

The global mental health teletherapy platform solutions market segmentation, based on age, includes pediatric, adult, and geriatric. The geriatric segment is expected to witness the fastest growth during the forecast period, driven by the rising prevalence of mental health issues such as depression and anxiety among older adults. The convenience of remote therapy is particularly beneficial for older people who face mobility challenges or reside in long-term care facilities. Additionally, teletherapy helps overcome the stigma often associated with seeking mental health support in this age group. The integration of simplified user interfaces and personalized care options further enhances the appeal of teletherapy for geriatric patients, contributing to the future demand and outlook of this segment.

Mental Health Teletherapy Platform Solutions Market Regional Analysis

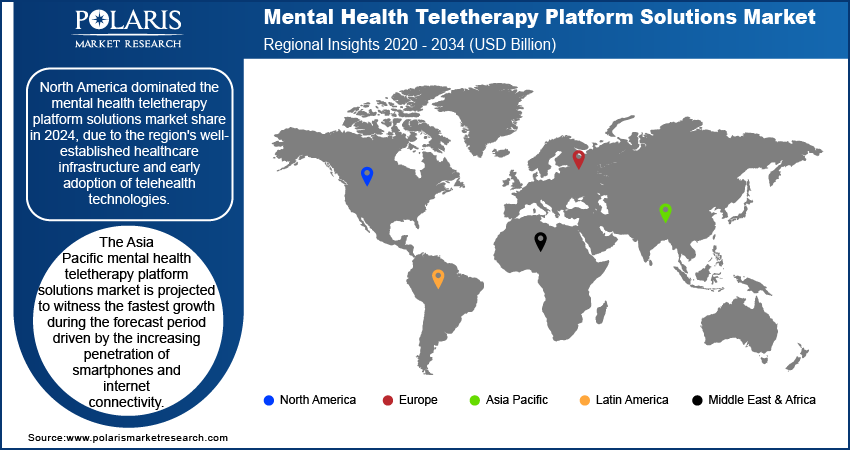

By region, the report provides the mental health teletherapy platform solutions market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the mental health teletherapy platform solutions market revenue in 2024 primarily due to the region's well-established healthcare infrastructure and early adoption of telehealth technologies. The high awareness of mental health issues, coupled with a favorable regulatory environment, has accelerated the adoption of teletherapy solutions across the region. Furthermore, the presence of major market players and widespread insurance coverage for telehealth services have contributed to the North America mental health teletherapy platform solutions market expansion. In March 2023, Mantra Health and Togetherall partnered to offer college students a comprehensive mental health ecosystem. This approach integrates peer-to-peer support, therapy, psychiatry, and skill-building programs. The collaboration aims to provide accessible, culturally sensitive care for students, including underrepresented groups, across the US. These factors, combined with increasing investments in digital health innovations, have solidified North America's leading position in the global market.

The Asia Pacific mental health teletherapy platform solutions market is projected to witness the fastest growth during the forecast period, driven by the increasing penetration of smartphones and internet connectivity. Rising awareness about mental health and the growing acceptance of digital healthcare solutions are encouraging adoption across diverse demographics. Governments and private sectors in countries such as India, China, and Japan are actively investing in digital health infrastructure to address the mental health crisis. For instance, in February 2023, India’s Union Budget allocated USD 10.87 billion to the Ministry of Health & Family Welfare (MoHFW), a 3% increase from the previous year’s Budget Estimate and a 13% rise from the Revised Estimate for FY 2022–23. The cost-effectiveness and accessibility of teletherapy platforms also make them an attractive option for the region's large and diverse population, fueling rapid mental health teletherapy platform solutions market expansion.

Mental Health Teletherapy Platform Solutions Market Players & Competitive Analysis Report

The competitive landscape of the mental health teletherapy platform solutions market is shaped by rapid technological advancements, evolving consumer demands, and a growing emphasis on accessible, personalized care. Competition revolves around innovation in user experiences, such as AI-driven matching algorithms, real-time analytics, and integrations with wearable devices to monitor mental health metrics. Platforms differentiate by offering tailored solutions, including specialized therapeutic approaches, multilingual services, and flexible pricing models such as subscriptions or pay-per-session structures. Scalability and interoperability with existing healthcare systems or employer wellness programs are critical differentiators and is adherence to stringent data privacy regulations and certifications. Emerging entrants often prioritize agile development and niche markets, while established players leverage existing infrastructure and partnerships to broaden their reach. A few key players in the market are American Well; BetterHelp; Brightside Health Inc.; Doctor On Demand by Included Health, Inc.; Grow Care, Inc.; Lyra Health, Inc.; Sesame, Inc.; Talkiatry Management Services, LLC.; Talkspace; and XRHEALTH USA INC.

American Well Corporation, known as Amwell, is a telehealth platform founded in 2006 and headquartered in Boston, Massachusetts. The company provides a wide digital healthcare solution through its cloud-based platform, Converge, allowing healthcare providers, payers, and innovators to deliver hybrid care. Amwell specializes in virtual services such as primary care, post-discharge follow-ups, chronic condition management, and behavioral health therapy. Its mental health teletherapy solutions include on-demand and scheduled consultations with licensed therapists and psychiatrists, addressing essential gaps in mental healthcare access. The company expanded its behavioral health offerings through the acquisition of Aligned Telehealth, improving capabilities in telepsychiatry. Amwell’s platform integrates advanced technologies, such as AI-enabled clinical tools and HIPAA-compliant video consultations, while supporting enterprise-level telehealth infrastructure. The platform collaborates with 180+ healthcare partners, such as hospitals, insurers, and employers, serving over 150 million lives globally. Additionally, Amwell offers professional services for implementation, workflow design, and patient engagement. Amwell is transforming the delivery of behavioral health services across the healthcare continuum by breaking traditional barriers to mental health care, such as stigma and accessibility challenges.

Brightside Health, Inc. is a teletherapy platform specializing in mental health care for individuals experiencing mild to severe depression, anxiety, and mood disorders, including those at elevated suicide risk. Founded in 2017 and headquartered in California, Brightside integrates advanced AI technology, precision psychiatry, and evidence-based therapeutic techniques to deliver personalized and scalable care. The platform offers a seamless combination of online therapy and medication management, with services available across all 50 US states. Brightside accepts most major insurance plans, such as Medicare and Medicaid, making its services accessible to over 130 million insured individuals. The platform employs cognitive behavioral therapy (CBT) as its primary therapeutic approach and provides weekly live video sessions with licensed therapists alongside unlimited messaging support. Brightside’s mobile app improves user experience with interactive lessons, progress tracking, and self-care resources. Notably, 86% of users report improvement within 12 weeks.

List of Key Companies in Mental Health Teletherapy Platform Solutions Market

- American Well.

- BetterHelp

- Brightside Health Inc.

- Doctor On Demand by Included Health, Inc.

- Grow Care, Inc.

- Lyra Health, Inc.

- Sesame, Inc.

- Talkiatry Management Services, LLC.

- Talkspace

- XRHEALTH USA INC.

Mental Health Teletherapy Platform Solutions Industry Development

July 2024: AMN Healthcare launched Televate, a teletherapy platform that allows school therapists to conduct virtual sessions, manage schedules, and streamline documentation, improving access to therapy services for students in underserved areas.

April 2024: Talkspace launched its Behavioral Health Consortium, a network focused on providing specialized care for substance use and eating disorders. This initiative aims to increase access to affordable mental health services for over 130 million insured individuals.

Mental Health Teletherapy Platform Solutions Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Video Conferencing

- Text Messaging

- Phone Calls

By Age Outlook (Revenue, USD Billion, 2020–2034)

- Pediatric

- Adult

- Geriatric

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Depression and Anxiety

- Stress

- Meditation & Wellness

- Others

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Community Centers

- Specialty Care

- Homecare

- Clinics and Hospitals

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Mental Health Teletherapy Platform Solutions Market Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 12.20 billion |

|

Market Size Value in 2025 |

USD 14.62 billion |

|

Revenue Forecast in 2034 |

USD 76.29 billion |

|

CAGR |

20.15% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global mental health teletherapy platform solutions market size was valued at USD 12.20 billion in 2024 and is projected to grow to USD 76.29 billion by 2034.

The global market is projected to register a CAGR of 20.15% during the forecast period.

North America dominated the market revenue share in 2024.

The Asia Pacific mental health teletherapy platform solutions market is projected to witness the fastest growth during the forecast period.

A few of the key players in the market are American Well; BetterHelp; Brightside Health Inc.; Doctor On Demand by Included Health, Inc.; Grow Care, Inc.; Lyra Health, Inc.; Sesame, Inc.; Talkiatry Management Services, LLC.; Talkspace; and XRHEALTH USA INC

The video conferencing segment dominated the market share in 2024.

The geriatric segment is expected to witness the fastest market growth during the forecast period.