Membrane Separation Market Size, Share, Trends, Industry Analysis Report: By Technology (Reverse Osmosis, Microfiltration, Ultrafiltration, and Nanofiltration), Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 133

- Format: PDF

- Report ID: PM5185

- Base Year: 2024

- Historical Data: 2020-2023

Membrane Separation Market Overview

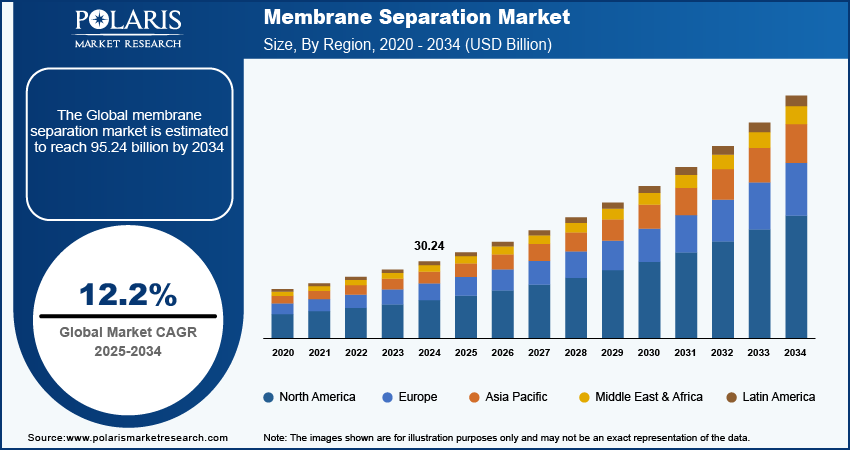

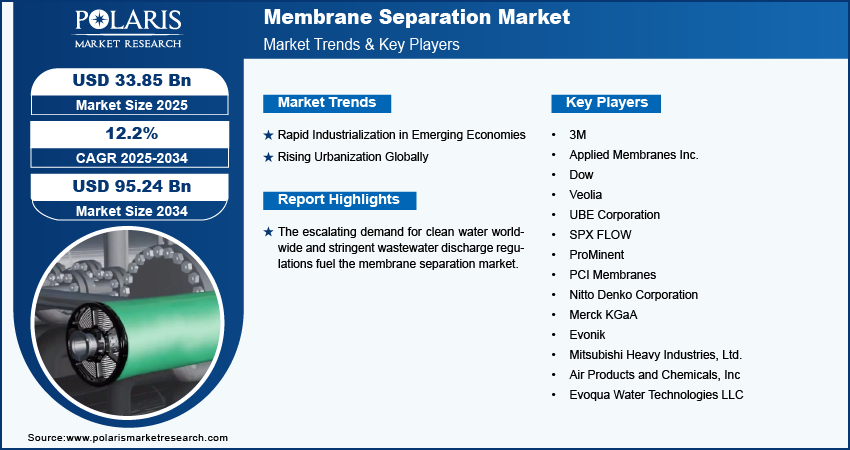

The membrane separation market size was valued at USD 30.24 billion in 2024. The market is projected to grow from USD 33.85 billion in 2025 to USD 95.24 billion by 2034, exhibiting a CAGR of 12.2% during 2025–2034.

Membrane separation is critical in modern industrial processes, offering efficient solutions for the separation of components in various mixtures. This technology utilizes membranes such as selective barriers that allow certain substances to pass while retaining others based on their size, charge, or chemical properties. The applications of membrane separation span multiple industries, including food processing, water treatment, and energy production.

The escalating demand for clean water worldwide is driving the membrane separation market. As per data published by the World Wildlife Fund, 1.1 billion people worldwide lack access to water, and a total of 2.7 billion find water scarce for at least one month of the year. Membrane processes, such as reverse osmosis and ultrafiltration, are highly efficient in removing contaminants from water. This efficiency makes them attractive for municipalities and industries looking to meet the rising demand for clean water.

To Understand More About this Research: Request a Free Sample Report

Stringent wastewater discharge regulations are projected to fuel the membrane separation market. Industries and municipalities are compelled to adopt advanced treatment technologies, including membrane separation, to comply with rising regulations regarding the levels of pollutants allowed in discharged wastewater.

The membrane separation market is driven by the expansion of food & beverages and healthcare sectors. Membrane technologies are used to concentrate and purify ingredients such as juices and dairy products in the food & beverages sector. Technologies that enhance product quality and shelf life, along with the need for ultrapure water in pharmaceuticals and medical devices, are driving demand for the membrane separation market. Membrane technologies are essential for producing sterile water and removing contaminants that compromise product integrity.

Membrane Separation Market Opportunity and Driver Analysis

Rapid Industrialization in Emerging Economies

The demand for clean water rises sharply for manufacturing processes, as industries expand. Membrane separation technologies provide efficient treatment solutions to meet this growing need. Furthermore, the challenge of managing wastewater arises with industrial growth. Membrane separation processes treat diverse industrial effluents, making them suitable for discharge or reuse. Therefore, rising industrialization is expanding the global membrane separation market.

Rising Urbanization Globally

The rising urbanization globally is estimated to fuel the global membrane separation market in the coming years. World Bank data states that 4.4 billion population live in cities, and the count is expected to double by 2050. Urban centers are increasingly focused on sustainable water management practices, including water reuse. It creates demand for membrane separation as it enables the treatment of wastewater to a high quality, making it suitable for various applications, such as irrigation and industrial processes. Additionally, urbanization often leads to economic growth, prompting investments in infrastructure and technology. Thus, rising urbanization across the world is expected to create opportunities for adopting advanced water treatment solutions, including membrane technologies.

Membrane Separation Market Segment Insights

Membrane Separation Market Breakdown by Technology Insights

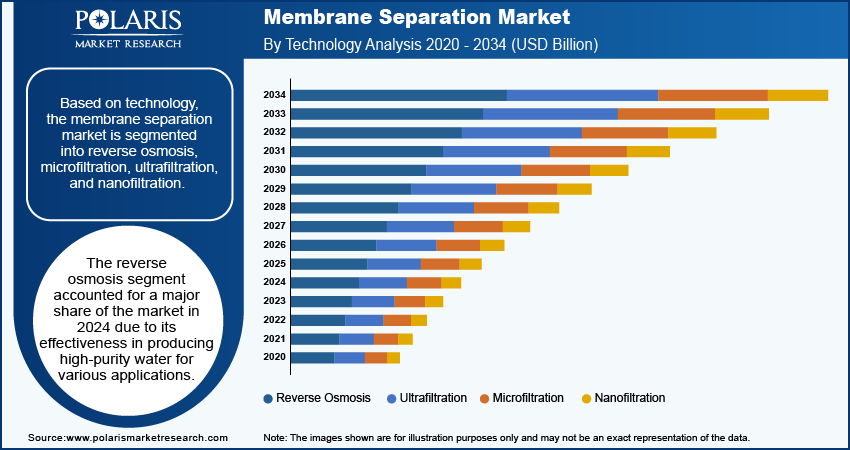

Based on technology, the membrane separation market is segmented into reverse osmosis, microfiltration, ultrafiltration, and nanofiltration. The reverse osmosis segment accounted for a major share of the market in 2024 due to its effectiveness in producing high-purity water for various applications. Industries such as desalination, water treatment, and food & beverage processing increasingly rely on reverse osmosis membranes to meet stringent quality standards. The growing demand for clean drinking water, particularly in arid regions facing water scarcity, significantly contributes to this trend. Additionally, advancements in membrane materials and configurations have enhanced the efficiency and cost-effectiveness of reverse osmosis systems, making them more attractive for large-scale installations. The technology’s ability to remove a wide range of contaminants, including salts, heavy metals, and organic compounds, further solidifies its position in the market.

The ultrafiltration segment is projected to grow at a robust pace in the coming years owing to its versatility in various applications, including municipal water treatment, wastewater management, and food and beverage processing. The increasing emphasis on sustainable practices and the need for efficient water recycling drive the adoption of UF systems, as they effectively remove suspended solids, bacteria, and larger organic molecules without the need for extensive chemical treatments. Furthermore, the rising focus on reducing operational costs in industrial processes positions ultrafiltration as an economically viable option.

Membrane Separation Breakdown by Application Insights

In terms of application, the membrane separation market is segmented into water & wastewater treatment, industry processing, food & beverage processing, pharmaceutical & medical, and others. The water & wastewater treatment segment dominated the market in 2024 due to the increasing global demand for clean water and the rising need for effective wastewater management. Rapid urbanization and industrial growth have intensified the strain on existing water resources, prompting municipalities and industries to seek efficient solutions for treating drinking water and wastewater. Stringent regulations regarding water quality and discharge standards further fuel this demand as organizations invest in advanced technologies to ensure compliance and minimize environmental impact. The emphasis on sustainability and water reuse also drives the growth of this segment, as treatment systems effectively recycle water for various applications, reducing overall consumption and promoting resource conservation.

The pharmaceutical & medical segment is estimated to grow at a rapid pace during the forecast period owing to the rising demand for high-purity water in drug manufacturing and healthcare applications. The pharmaceutical industry increasingly relies on advanced filtration technologies to produce ultrapure water essential for formulating medications and conducting laboratory research. Additionally, the growing focus on biopharmaceuticals and personalized medicine enhances the need for reliable water purification processes, ultimately boosting demand for membrane separation techniques.

Membrane Separation Regional Insights

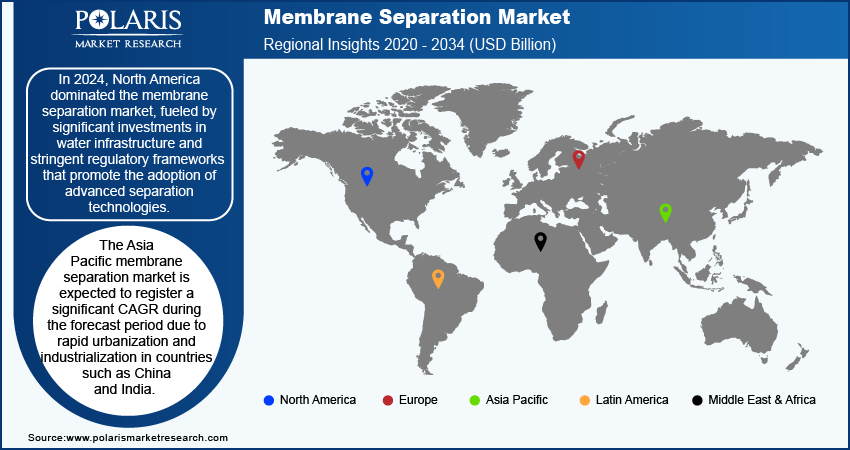

By region, the study provides the membrane separation market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America dominated the membrane separation market, fueled by significant investments in water infrastructure and stringent regulatory frameworks that promote the adoption of advanced separation technologies. The US, in particular, dominated this region, benefiting from a well-established industrial base and advanced technological capabilities. The growing concerns over water quality and scarcity prompted municipalities and industries to adopt advanced filtration technologies for drinking water treatment and wastewater management. Moreover, the increasing emphasis on sustainable practices and water reuse initiatives has led to significant demand for effective filtration solutions. Additionally, the presence of major players in the North American market fosters innovation and enhances competition, further contributing to the growth of the regional market.

The Asia Pacific membrane separation market is expected to grow at a significant CAGR during the forecast period due to rapid urbanization and industrialization in countries such as China and India. The rising population and expanding middle-class population in these countries create a pressing need for clean water and efficient wastewater treatment solutions. Furthermore, governments of the region are increasingly implementing stringent regulations to address water quality issues, driving investments in advanced filtration technologies. The growth of various industries, including pharmaceuticals, food & beverage, and manufacturing, further accelerates the demand for effective water treatment solutions, including membrane separation.

Membrane Separation Market – Key Players & Competitive Insights

Prominent market players are investing heavily in research and development to expand their offerings, which will help the membrane separation market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations. To expand and survive in a more competitive and rising market environment, the market players must offer innovative solutions.

The membrane separation market is fragmented, with the presence of numerous global and regional market players. A few major players in the market are 3M; Applied Membranes Inc.; Dow; Veolia; UBE Corporation; SPX FLOW; ProMinent; PCI Membranes; Nitto Denko Corporation; Merck KGaA; Evonik; Mitsubishi Heavy Industries, Ltd.; Air Products and Chemicals, Inc.; and Evoqua Water Technologies LLC.

Evoqua Water Technologies LLC is a prominent player in the clean technology sector, specializing in water and wastewater treatment solutions. The company is headquartered in Pittsburgh, Pennsylvania, and operates globally, with a presence in over 150 locations across ten countries. Evoqua has built a reputation for its commitment to quality, safety, and reliability, serving more than 38,000 customers and managing ∼200,000 installations worldwide. Evoqua's extensive portfolio includes wastewater treatment systems, filtration solutions, disinfection systems, and high-purity water systems. The company also provides specialized services such as carbon and ion exchange services, membrane separation technologies, and rental equipment services. In October 2019, Evoqua Water Technologies announced an agreement to divest its Memcor membrane product line to DuPont Safety & Construction.

3M, originally founded as Minnesota Mining and Manufacturing Company in 1902, has evolved into a global player in diversified technology and manufacturing. The company is headquartered in St. Paul, Minnesota, and operates in over 70 countries and sells products in more than 200 markets worldwide. The company’s extensive portfolio includes advanced materials, adhesives, medical devices, consumer products, and safety solutions. With a workforce of ∼85,000 employees, 3M is renowned for its culture of innovation, investing heavily in research and development to create innovative solutions that enhance daily life.

List of Key Companies in Membrane Separation Market

- 3M

- Applied Membranes Inc.

- Dow

- Veolia

- UBE Corporation

- SPX FLOW

- ProMinent

- PCI Membranes

- Nitto Denko Corporation

- Merck KGaA

- Evonik

- Mitsubishi Heavy Industries, Ltd.

- Air Products and Chemicals, Inc

- Evoqua Water Technologies LLC

Membrane Separation Industry Developments

May 2024: Air Products, the global player in the production of gas separation and purification membranes, announced the launch of the new PRISM GreenSep liquefied natural gas (LNG) membrane separator for bio-LNG production.

April 2024: Mitsubishi Heavy Industries, Ltd., a Japan-based multinational engineering, electrical equipment, and electronics corporation, collaborated with NGK INSULATORS, LTD. to develop a hydrogen purification system based on membrane separation technology.

February 2023: Evonik, a specialty chemicals company, announced the launch of a new production plant for gas separation membranes in Austria.

Membrane Separation Market Segmentation

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- Reverse Osmosis

- Microfiltration

- Ultrafiltration

- Nanofiltration

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Water & Wastewater Treatment

- Industry Processing

- Food & Beverage Processing

- Pharmaceutical & Medical

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Membrane Separation Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 30.24 billion |

|

Market Size Value in 2025 |

USD 33.85 billion |

|

Revenue Forecast by 2034 |

USD 95.24 billion |

|

CAGR |

12.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global membrane separation market size was valued at USD 30.24 billion in 2024 and is projected to grow to USD 95.24 billion by 2034.

The global market is projected to register a CAGR of 12.2% during the forecast period.

North America accounted for the largest share of the global market in 2024.

3M; Applied Membranes Inc.; Dow; Veolia; UBE Corporation; SPX FLOW; ProMinent; PCI Membranes; Nitto Denko Corporation; Merck KGaA; Evonik; Mitsubishi Heavy Industries, Ltd.; Air Products and Chemicals, Inc.; and Evoqua Water Technologies LLC are among the key players in the market.

The ultrafiltration technology segment is projected for significant growth in the global market during 2025–2034.

The water & wastewater treatment segment dominated the market in 2024.