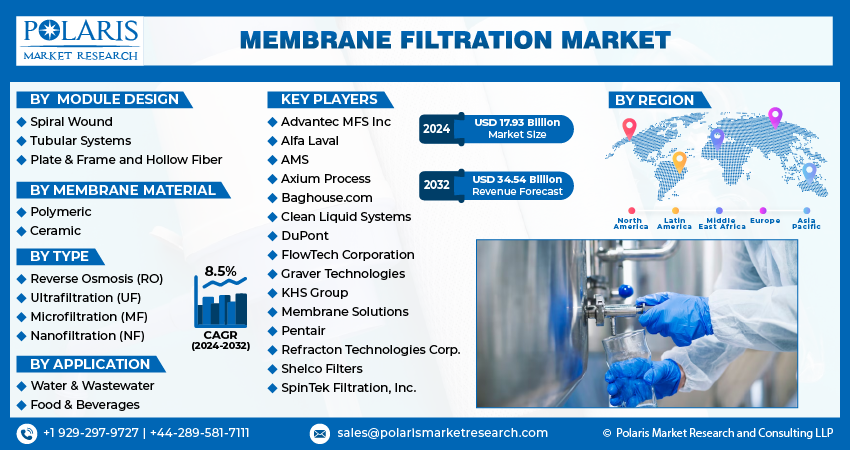

Membrane Filtration Market Share, Size, Trends, Industry Analysis Report, By Module Design (Spiral Wound, Tubular Systems, Plate & Frame and Hollow Fiber); By Membrane Material; By Type; By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Feb-2024

- Pages: 115

- Format: PDF

- Report ID: PM1646

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

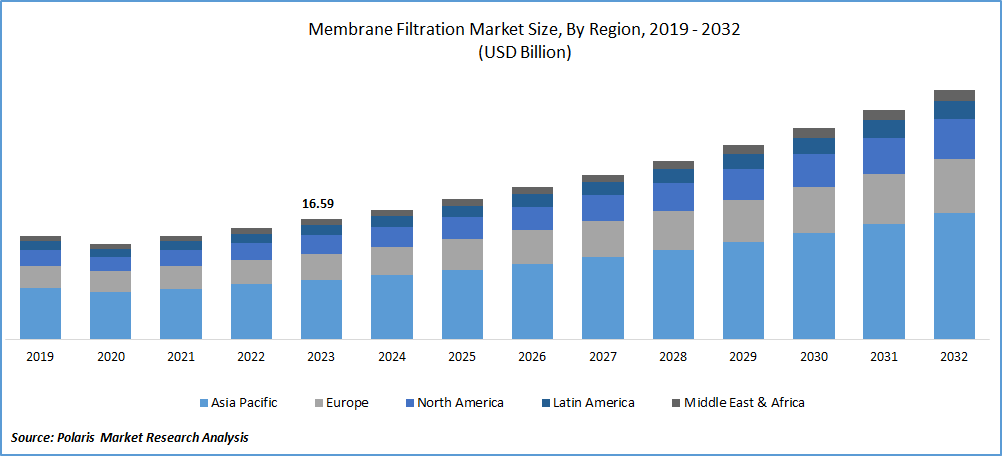

The global membrane filtration market was valued at USD 16.59 billion in 2023 and is expected to grow at a CAGR of 8.5% during the forecast period.

Membrane filtration is a process that uses thin layers of material, known as membranes, to separate particles, ions, or molecules from a fluid. The membrane acts as a barrier, allowing certain substances to pass through while rejecting others based on their size, charge, or other properties. This technology has become increasingly important in various industries, such as water treatment, biotechnology, food processing, and pharmaceuticals.

A major driver of the membrane filtration market is the increasing demand for clean water. As the global population continues to grow, the need for safe and reliable water sources becomes more critical. Membrane filtration systems are widely used in water treatment plants to remove impurities, bacteria, viruses, and other contaminants from water, ensuring that they meet the safety standards set by regulatory authorities. Also, the increasing awareness of water conservation and sustainability has further fueled the demand for membrane filtration systems. Another significant driver of the membrane filtration market is the growing demand for wastewater treatment. Membrane filtration systems play a vital role in removing pollutants and contaminants from wastewater, making it suitable for reuse or safe disposal. The growing demand for biopharmaceuticals and vaccines has led to an increased use of membrane filtration systems in these industries.

To Understand More About this Research: Request a Free Sample Report

Despite this, the membrane filtration market faces some challenges, such as high initial costs and energy consumption. The high initial investment required for installing membrane filtration systems can be a significant barrier for many small and medium-sized enterprises, as well as for some municipalities. Also, membrane filtration processes require energy to operate, which can lead to substantial operating costs over time.

Growth Drivers

- Increasing demand for premium products fuels the need for membrane filtration.

As consumers increasingly seek high-quality and pure end products, manufacturers are made to implement advanced filtration processes to meet these evolving expectations. Membrane filtration, with its ability to separate and purify fluids based on size or molecular weight, plays an important role in ensuring the production of premium goods. In sectors such as food and beverage, pharmaceuticals, and biotechnology, where product quality is paramount, membrane filtration is adopted to remove impurities, contaminants, and unwanted particles, thereby enhancing the overall quality and purity of the final output. Whether it is achieving superior taste in beverages, ensuring the efficacy of pharmaceutical formulations, or meeting stringent quality standards in biotech processes, membrane filtration emerges as an important technology to satisfy the increasing demands of consumers for premium products.

Report Segmentation

The market is primarily segmented based on module design, membrane material, type, application, and region.

|

By Module Design |

By Membrane Material |

By Type |

By Application |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Module Design Analysis

- The spiral wound type of module design accounted for the highest market share in 2023

In 2023, the spiral wound segment of module design appeared as the dominant and highest-contributing segment. The spiral wound configuration represents a widely adopted design in membrane filtration systems, particularly in applications such as water treatment, desalination, and industrial processes. This importance is attributed to the design's advantages, including compactness, efficiency, and cost-effectiveness. Permeate tubes, permeate spacers, feed spacers, and membranes comprise a spiral wound system. Oil separation in wastewater applications, sulfate removal, dye desalting and concentration, cathodic/anodic paint recovery, lactose concentration, and whey protein concentration are all possible applications for the product. The spiral wound is used in microfiltration, ultrafiltration, and nanofiltration.

By Membrane Material Analysis

- The polymeric material of membrane filtration dominated the market in 2023

The polymeric segment held the largest market share and is expected to dominate throughout the forecast period. Polymer membranes are inexpensive, simple to use, and have a high degree of flexibility. They are less expensive than their counterparts, such as ceramic and other inorganic types. Furthermore, when used as a pure polymer formulation, polymer filters have a high degree of robustness and good chemical resistance. Polymer-derived alloys do not provide the same level of benefit.

Polymeric materials, such as polyamide, polyether-sulfone, and polypropylene, are widely used in membrane filtration due to their excellent chemical stability, durability, and selectivity. They are also relatively cheaper than other materials, making them a preferred choice for many end-use industries. Polymeric membranes are commonly used in various applications, including water treatment, wastewater treatment, and biotechnology.

In water treatment, they are used to remove suspended solids, bacteria, viruses, and other contaminants from water, ensuring that they meet the safety standards set by regulatory authorities. In wastewater treatment, they are used to treat industrial and domestic wastewater, removing pollutants and contaminants before they can be safely discharged into the environment.

In biotechnology, polymeric membranes are used in various applications, such as cell separation, protein purification, and virus removal. They offer high selectivity and purity, making them ideal for biotechnology applications where high levels of purity are required. Thus, the polymeric segment is expected to dominate the membrane filtration market over the forecast period.

By Type Analysis

The reverse osmosis segment is accounted to hold the highest market share over the forecasted period.

The reverse osmosis segment is accounted to hold the highest market share because reverse osmosis is a very efficient method of water purification that can remove 99% of the total mineral contaminants. Reverse osmosis is a method of water filtration that requires pressure to push water through a semi-permeable membrane, discarding impurities such as flavors, particles, odors, and colors. Reverse osmosis is also becoming popular in the beverage industry. Because water is an important component of beverages, assuring water quality and sterility is critical for suppliers. Water in the beverage industry is typically acquired from municipal sources, which contain hardness or heavy metal deposits, which often originate in transportation pipes. These elements in water can affect the taste of both the water and the beverages made with it. Hence reverse osmosis gained traction and held a significant market share in the membrane filtration market.

Regional Insights

- Asia Pacific region dominated the global market in 2023

Asia-Pacific region dominated the market due to the rapid growth of the water and wastewater industry in this region. Rapid urbanization, increased R&D activities, the expansion of international players in this region, and technological advancements are some of the other factors contributing to the growth of this regional segment. A large presence of key players operating in this industry, as well as rapid advancements in filtration technology, are factors attributed to this region's massive market.

The United States leads North America, and Canada is expected to grow significantly during the assessment period. Reusing water to meet the growing need to reduce water scarcity and the drought situation has boosted market adoption of membrane filtration technology. Also, consistent pollution growth, as well as water pollution, are key factors resulting in less water availability in the region.

Key Market Players & Competitive Insights

Companies are taking a one-stop approach to provide customers with complete water treatment solutions. End users benefit from this trend since it eliminates the need to conduct transactions with multiple suppliers. To expand their customer base and strengthen their market presence, players are expanding their presence across various geographies and entering new markets in developing regions. To meet the growing consumer demand, the companies are also introducing new innovative products to the market.

Some of the major players operating in the global market include:

- Advantec MFS Inc

- Alfa Laval

- AMS

- Axium Process

- Baghouse.com

- Clean Liquid Systems

- DuPont

- FlowTech Corporation

- Graver Technologies

- KHS Group

- Membrane Solutions

- Pentair

- Refracton Technologies Corp.

- Shelco Filters

- SpinTek Filtration, Inc.

Recent Developments

- In November 2023, Alfa Laval, a global provider of industrial machinery, launched the Multipurpose Membrane Filtration System, which is compatible with Alfa Laval’s 8.0” spiral membranes.

- In November 2023, KHS Group, a manufacturer of filling and packaging systems for the beverage and liquid food industries, introduced Innopro EcoClear, a new beer membrane filtration concept.

Membrane Filtration Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 17.93 billion |

|

Revenue Forecast in 2032 |

USD 34.54 billion |

|

CAGR |

8.5% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Module Design, By Membrane Material, By Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements concerning countries, regions, and segmentation. |

FAQ's

Membrane Filtration Market report covering key segments are module design, membrane material, type, application, and region.

Membrane Filtration Market Size Worth USD 34.54 billion By 2032

The global membrane filtration market is expected to grow at a CAGR of 8.5% during the forecast period.

Asia Pacific is leading the global market.

The key driving factors in Membrane Filtration Market Increasing demand for premium products fuels the need for membrane filtration.