Membrane Bioreactor Market Share, Size, Trends, Industry Analysis Report, By Configuration (External, Submerged); By Type of Membrane (Flat Sheet, Hollow Fiber, Multi-tubular); By End-Use; By Region; Segment Forecast, 2022 - 2030

- Published Date:Oct-2022

- Pages: 115

- Format: PDF

- Report ID: PM2648

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

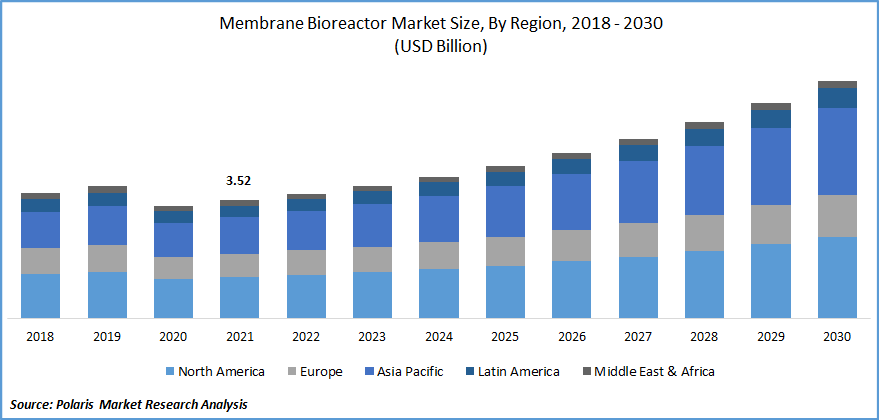

The global membrane bioreactor market is valued at USD 3.52 billion in 2021 and is expected to grow at a CAGR of 8.4% in the forecast period. Membrane bioreactors are used for treatment processes. These bioreactors are incorporated with perm-selective or semi-permeable membranes for effective filtration. It is increasingly being used for the treatment of municipal and industrial wastewater through membrane processes such as ultrafiltration and microfiltration.

Know more about this report: Request for sample pages

It is also being utilized for the upgradation of old wastewater plants. They offer higher efficiency while eliminating the need for tertiary filtration processes and secondary clarifiers, which further results in decreased plant footprint. It also assists in reducing footprint by further minimizing the need for digesters or UV disinfection.

Their use has increased across the world, especially in developing countries, to achieve high effluent quality along with greater loading rate capability. However, some disadvantages associated with membrane bioreactors include membrane fouling, superior capital and operation costs, and high energy costs.

They provide highly efficient solid-liquid separation through the use of microfiltration or ultrafiltration membranes. The different membranes used in membrane bioreactors include hollow fiber, spiral-wound, plate-and-frame, pleated filter cartridge, and tubular. The tubular membrane provides porous walls similar to tube-like construction.

These membranes make use of tangential crossflow and are used in feed streams with dissolved solids, grease, and suspended solids, among others. Spiral wound systems are developed using membranes, permeate tubes and spacers, and feed spacers. It is widely used for oil separation and sulfate removal from wastewater.

The COVID-19 outbreak influenced the growth of the membrane bioreactor market. There was a decline in the demand for the industry observed from industries such as automotive, textile, oil and gas, and chemicals. The industry experienced disrupted supply chain and distribution networks, limited availability of raw materials, and operational challenges.

Manufacturing activities were highly restricted to essential goods and the healthcare sector, limiting the demand for membrane bioreactors from the industrial sectors. However, there was an increase in demand from the municipal sector due to lockdown impositions causing people to stay indoors, leading to a greater generation of municipal waste.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The increasing population, industrialization, and urbanization contribute to the growth of the global membrane bioreactor market. Greater pollution of surface and groundwater resources has been observed across the globe, increasing the demand for the industry. There has been a reduction in water reserves and a decline in the availability of fresh water.

Greater demand for membrane bioreactors for industrial applications from the chemical, automotive, and oil and gas sectors boosts the growth of the industry. The rise in environmental concerns and the introduction of stringent environmental regulations across the world have increased the demand for membrane bioreactors.

Technological advancements and investments in research and development enable market players to introduce efficient products in the market. The rise in demand for membrane bioreactors from developing countries and rising application in the industrial sector would further contribute to the market growth during the forecast period.

Report Segmentation

The market is primarily segmented based on configuration, type of membrane, end-use, and region.

|

By Configuration |

By Type of Membrane |

By End-Use |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Submerged segment to hold a major share

The submerged segment dominated the global market in 2021. The submerged membrane bioreactor involves filtration membranes that are submerged in biomass. This configuration prevents membrane fouling through the flow of coarse air bubbles. This configuration is cost-effective and compact. Some other advantages offered by this configuration include quicker delivery time, easy operation, and alternatives for water reuse.

Hollow fiber segment to hold a major share in 2021

The hollow fiber dominated the global market in 2021. These fibers offer high efficiency along with ease of use and affordability. These are comparatively easier to operate and maintain. These are widely used by municipal corporations around the world.

These fibers offer superior strength, high elimination effectiveness, and greater fouling resistance. Growth in economic development and urbanization has resulted in higher demand for a membrane bioreactor. An increase in the introduction of environmental regulations and a rise in industrial water consumption offer growth opportunities to this segment.

The municipal segment is expected to remain dominant during the forecast period

The municipal segment accounted for a major share of the market in 2021. The growth in urban population, government initiatives, and the introduction of stringent environmental regulations boost the growth of this segment. An increase in concerns regarding water scarcity and a greater need for new water resources drives the growth of this segment.

The industrial segment is expected to grow during the forecast period owing to greater demand for membrane bioreactors from industries such as chemicals, automotive, oil and gas, and food and beverages, among others. A rise in industrialization in emerging economies, technological advancements, and excessive waste generation from these sectors would contribute to market growth in the coming years.

Asia Pacific is expected to grow at the fastest rate during the forecast period

Asia Pacific is expected to grow at a significant rate in the coming years on account of a growing population and industrial growth in the region. There has been greater awareness in the developing countries in the region regarding the reuse and recycling of water. Growing initiatives to streamline and improve the efficiency of municipal wastewater management boosts the demand for membrane bioreactors.

Several global players are expanding their presence in Asia-Pacific to leverage the growing opportunities in developing countries of China, Japan, and India. Technological advancements, growth in environmental awareness, and stringent regulations associated with effluent treatment would contribute to market growth in the coming years.

Competitive Insight

Some major players operating in the global market include Aquatech International Corporation, B&P Water Technologies s.r.l, Buckman Laboratories, Calgon Carbon Corporation, CITIC Envirotech Ltd, Culligan International Company, Danaher Corporation, General Electric Energy LLC, Kemira, Kubota Corporation, MANN+HUMMEL Water & Fluid Solutions, Mitsubishi Chemical Corporation, Suez Environnement S.A.,Toray Industries, and Veolia Environnement S.A.

These leading players operating in the global membrane bioreactor market are introducing new and innovative products in the market to serve a wider customer base and strengthen market position. Acquisitions and collaborations further offer growth opportunities to these companies.

Recent Developments

In October 2020, Thermax introduced atoM, which is a sewage recycle system. It includes membrane bioreactor-based technology for biological degradation. It has been developed for commercial and residential applications.

In May 2022, MANN+HUMMEL Water & Fluid Solutions presented BIO-CEL M+ filtration module at IFAT 2022. The new product is integrated with BIO-CEL UV400T ultrafiltration membrane for prevention of antibiotic-resistant bacteria.

Membrane Bioreactor Market Report Scope

|

Report Attributes |

Details |

|

The market size value in 2022 |

USD 3.72 billion |

|

Revenue forecast in 2030 |

USD 7.08 billion |

|

CAGR |

8.4% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Configuration, By Type of Membrane, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Aquatech International Corporation, B&P Water Technologies s.r.l, Buckman Laboratories, Calgon Carbon Corporation, CITIC Envirotech Ltd, Culligan International Company, Danaher Corporation, General Electric Energy LLC, Kemira Kubota Corporation, MANN+HUMMEL Water & Fluid Solutions, Mitsubishi Chemical Corporation, Suez Environnement S.A.,Toray Industries, and Veolia Environnement S.A. |