Medical Telepresence Robots Market Size, Share, Trends, Industry Analysis Report: By Type (Stationary and Mobile), Component, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 128

- Format: PDF

- Report ID: PM5175

- Base Year: 2024

- Historical Data: 2020-2023

Medical Telepresence Robots Market Overview

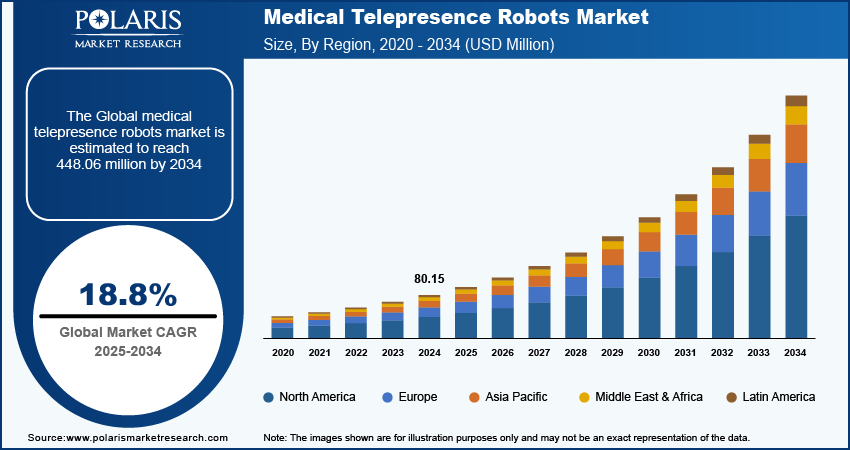

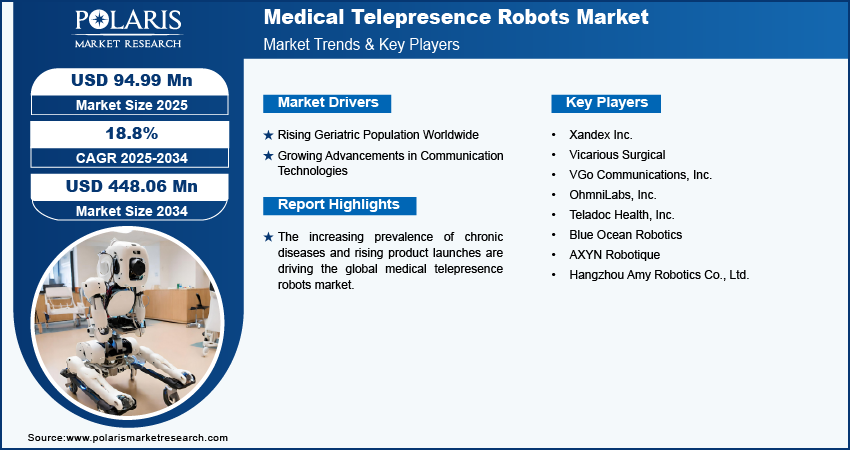

The medical telepresence robots market size was valued at USD 80.15 million in 2024. The market is projected to grow from USD 94.99 million in 2025 to USD 448.06 million by 2034, exhibiting a CAGR of 18.8% during 2025–2034.

Medical telepresence robots represent a transformative advancement in healthcare, enabling remote communication and interaction between patients and healthcare providers. These robots, equipped with high-definition cameras, microphones, and speakers, allow medical professionals to engage with patients in real time, regardless of their physical location. This capability is particularly beneficial in scenarios where immediate medical attention is required, but physical presence is not feasible.

The increasing prevalence of chronic disease is driving the global medical telepresence robots market growth. According to data published by the National Library of Medicine, approximately 1 in 3 of all adults suffer from multiple chronic conditions (MCCs) globally. Chronic diseases generally require ongoing management and regular check-ups. Thus, there is an increasing adoption of telepresence robots as they enable healthcare professionals to monitor patients remotely, facilitating timely interventions without requiring patients to travel. Furthermore, telepresence robots facilitate the collection of health data over time, allowing for better tracking of chronic disease progression and treatment effectiveness.

To Understand More About this Research: Request a Free Sample Report

The medical telepresence robots market growth is driven by increasing product launches. Healthcare providers have a wider range of telepresence robots to choose from, with more companies entering the market and launching new products. This variety allows healthcare organizations to select solutions that best fit their specific needs, enhancing adoption rates. In April 2020, RoboAds Inc., a UAE-based Robotics startup, launched a new generation of telepresence robots to aid healthcare and security staff on virus frontlines.

Medical Telepresence Robots Market Driver Analysis

Rising Geriatric Population Worldwide

Elderly individuals usually face mobility issues that make it difficult to travel to healthcare facilities. Telepresence robots allow them to receive care from the comfort of their homes, reducing the need for travel and improving their overall quality of life. Additionally, many older adults rely on family members or caregivers for assistance. The robots support caregivers by allowing them to consult with healthcare providers remotely, improving care coordination and reducing the burden on caregivers. This increases the adoption of telepresence robots for taking care of the elderly population. According to data published by the United Nations, the number of people aged 65 years and above worldwide is projected to more than double, rising from 761 million in 2021 to 1.6 billion by 2050. Therefore, the rising geriatric population worldwide propels the growth of the medical telepresence robots market.

Growing Advancements in Communication Technologies

The growing advancements in communication technologies such as 4G and 5G fuel the global medical telepresence robots market. 4G and 5G provide faster data transmission speeds, enabling high-definition video and audio quality for real-time interactions between patients and healthcare providers. This enhances the effectiveness of remote consultations of telepresence robots, thereby boosting its adoption among healthcare facilities.

Medical Telepresence Robots Market Segment Insights

Medical Telepresence Robots Market Breakdown by Type Insights

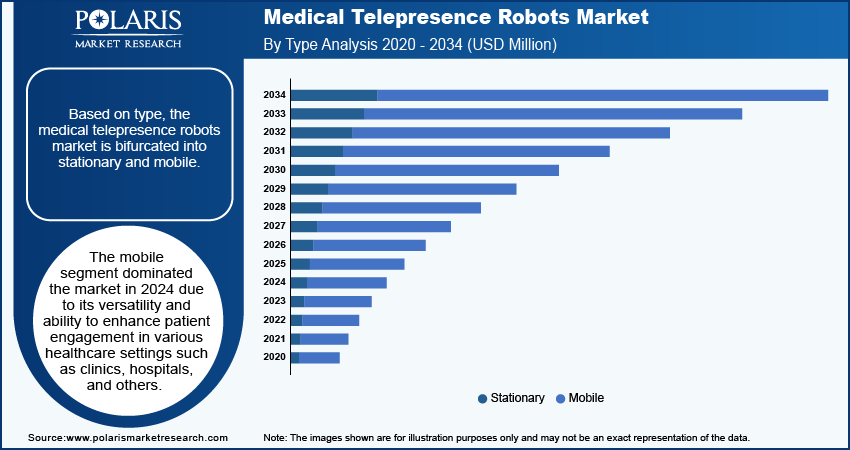

Based on type, the medical telepresence robots market is bifurcated into stationary and mobile. The mobile segment dominated the market in 2024 due to its versatility and ability to enhance patient engagement in various healthcare settings such as clinics, hospitals, and others. Mobile robots enable healthcare providers to move freely within facilities or even remotely to patients' homes, facilitating real-time consultations and assessments. The growing demand for remote healthcare solutions, driven by an aging population and an increase in prevalence of chronic diseases, significantly contributes to the preference for mobile systems. The ability of mobile robots to navigate diverse environments, coupled with advanced features such as video conferencing, health monitoring, and the capacity to integrate with other medical devices, makes them crucial to modern healthcare delivery.

Medical Telepresence Robots Market Breakdown by Components Insights

In terms of components, the medical telepresence robots market is segmented into cameras, displays, speakers, microphones, power sources, and sensors & control systems. The cameras segment accounted for a major market share in 2024 due to its critical role in enabling high-quality visual communication between healthcare providers and patients. The demand for high-definition imaging and video conferencing capabilities has surged as telemedicine becomes increasingly prevalent, leading to increased adoption of cameras equipped with advanced features, such as zoom, pan, and tilt functionalities. Additionally, the integration of cameras with artificial intelligence for features such as facial recognition and analytics propels their demand.

The sensors & control systems segment is anticipated to grow at a robust pace in the coming years owing to the increasing emphasis on personalized healthcare. These components enhance the functionality of telepresence solutions by enabling real-time data collection and analysis, which is essential for remote patient monitoring and personalized healthcare. Moreover, advancements in control systems propel the segment's growth as they allow for more automatic user interfaces and seamless integration with other healthcare technologies.

Medical Telepresence Robots Market Regional Insights

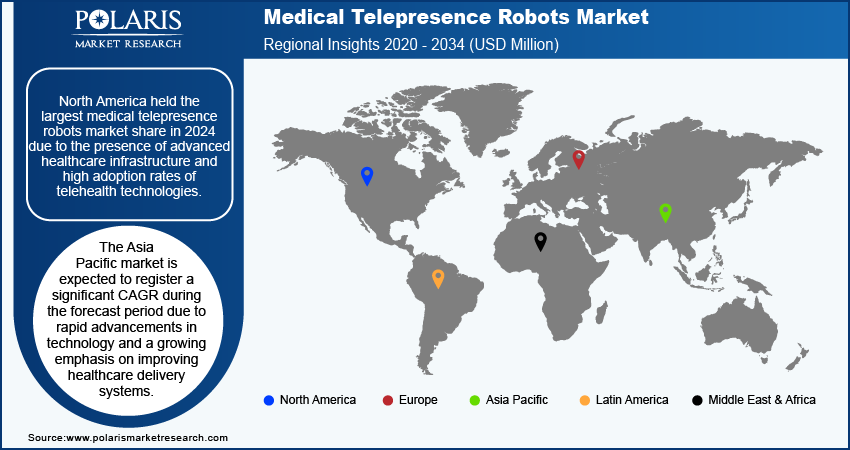

By region, the study provides the medical telepresence robots market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America held the largest market share in 2024 due to the presence of advanced healthcare infrastructure and high adoption rates of telehealth technologies. The US, in particular, dominated the regional market due to its strong investments in healthcare innovation, widespread internet connectivity, and the growing acceptance of remote healthcare solutions. The demand for medical telepresence robots has surged in the region as healthcare providers increasingly recognize the benefits of telepresence technologies for improving patient access and outcomes. The presence of key players and significant funding for research and development further expand the region’s market position.

The Asia Pacific medical telepresence robots market is expected to register a significant CAGR during the forecast period due to rapid advancements in technology and a growing emphasis on improving healthcare delivery systems. Countries such as China and India are contributing to this growth trajectory due to their large populations and increasing demand for efficient healthcare solutions. The expansion of telemedicine initiatives, driven by government support and rising investments in healthcare technology, significantly contributes to the market growth. According to the World Health Organization, the population of people over 60 years old in China is projected to reach 28% by 2040. The growing geriatric population in these countries highlights the need for innovative remote care solutions, thereby propelling demand for medical telepresence robots.

Medical Telepresence Robots Market Key Players and Competitive Insights

Prominent market players are investing heavily in research and development to expand their offerings, which will help the medical telepresence robots market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments such as innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations.

The medical telepresence robots market is fragmented, with the presence of numerous global and regional market players. A few major players in the market are Xandex Inc.; Vicarious Surgical; VGo Communications, Inc.; OhmniLabs, Inc.; Teladoc Health, Inc.; Blue Ocean Robotics; AXYN Robotique; and Hangzhou Amy Robotics Co., Ltd.

Xandex Inc., founded in 1981, has emerged as a notable player in the field of medical telepresence robots, particularly through its acquisition of Revolve Robotics and the development of the Kubi telepresence robot. Xandex initially focused on semiconductor testing solutions but has diversified its portfolio over the years to include innovative technologies that enhance remote communication in healthcare settings. The Kubi robot, designed to hold a tablet for video conferencing, allows healthcare professionals to interact with patients remotely more engagingly.

Vicarious Surgical, founded in 2014 by Adam Sachs, Sammy Khalifa, and Dr. Barry Greene, is revolutionizing surgical procedures through its innovative approach to medical telepresence robots. The company's proprietary robotic system, which utilizes human-like robotic arms capable of performing minimally invasive surgeries through incisions as small as 1.5 centimeters, minimizes trauma to patients as well as significantly reduces recovery times compared to traditional open surgeries.

Key Companies in Medical Telepresence Robots Market

- Xandex Inc.

- Vicarious Surgical

- VGo Communications, Inc.

- OhmniLabs, Inc.

- Teladoc Health, Inc.

- Blue Ocean Robotics

- AXYN Robotique

- Hangzhou Amy Robotics Co., Ltd.

Medical Telepresence Robots Industry Developments

April 2022: OhmniLabs, a Silicon Valley-based robotics company, announced a partnership with Lovell Government Services, a Service-Disabled Veteran-Owned Small Business (SDVOSB), to add OhmniClean and Ohmni telepresence robot to major government contract vehicles.

February 2021: The US government launched the National Robotics Initiative (NRI) for fundamental robotics R&D by funding USD 14 million.

February 2021: The United Nations Development Programme (UNDP), in collaboration with the Ministry of Health of Kenya, launched the piloting of smart anti-epidemic robotic solutions to aid the health response and management of the COVID-19 pandemic in Kenya. The deployment of these smart anti-epidemic robots was aimed at limiting direct human contact with patients and supporting preventive measures.

Medical Telepresence Robots Market Segmentation

By Type Outlook (Revenue, USD Million, 2020–2034)

- Stationary

- Mobile

By Component Outlook (Revenue, USD Million, 2020–2034)

- Camera

- Display

- Speaker

- Microphone

- Power Source

- Sensors & Control System

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Hospitals & Assisted Living Facilities

- Home Use

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Medical Telepresence Robots Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 80.15 Million |

|

Market Size Value in 2025 |

USD 94.99 Million |

|

Revenue Forecast by 2034 |

USD 448.06 Million |

|

CAGR |

18.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global medical telepresence robots market size was valued at USD 80.15 million in 2024 and is projected to grow to USD 448.06 million by 2034.

The global market is projected to register a CAGR of 18.8% during the forecast period.

North America had the largest share of the global market in 2024.

A few key players in the market are Xandex Inc.; Vicarious Surgical; VGo Communications, Inc.; OhmniLabs, Inc.; Teladoc Health, Inc.; Blue Ocean Robotics; AXYN Robotique; and Hangzhou Amy Robotics Co., Ltd.

The sensors & control systems segment is projected for significant growth in the global market during the forecast period.

The stationary segment dominated the market in 2024.