Medical Tapes and Bandages Market Size, Share, Trends, Industry Analysis Report

By Product (Adhesive, Gauze, Elastic, Cohesive, Others), By Application, By End-User, By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 130

- Format: PDF

- Report ID: PM2621

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

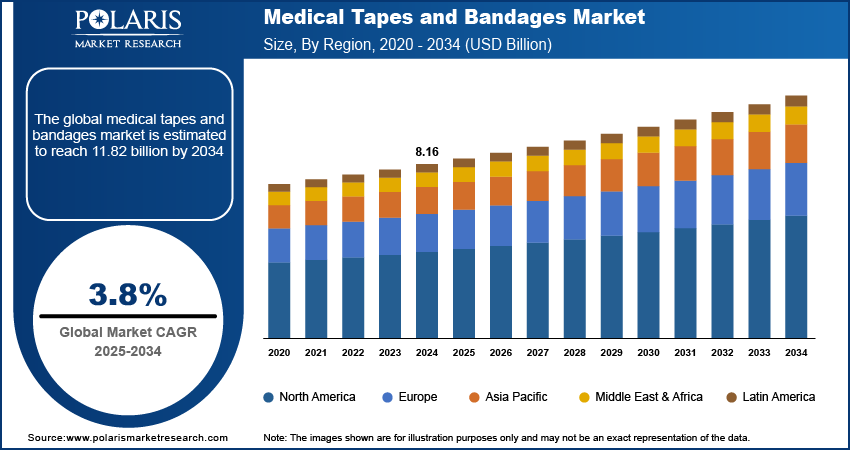

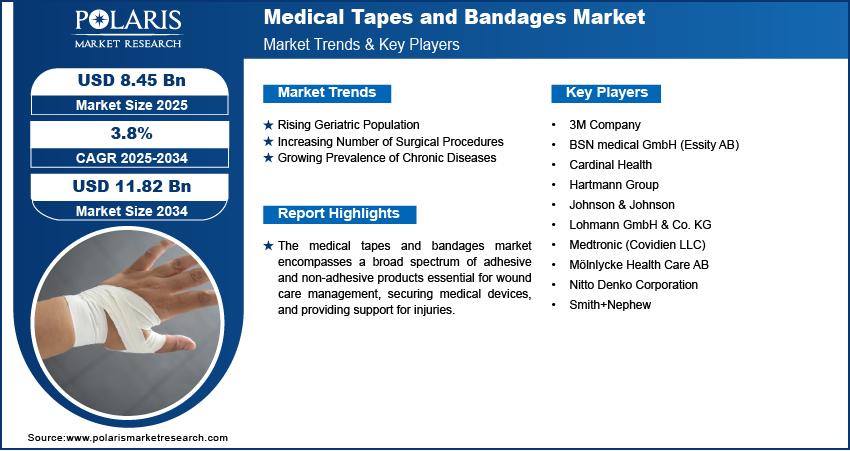

The medical tapes and bandages market size was valued at USD 8.16 billion in 2024, exhibiting a CAGR of 3.8% from 2025 to 2034. The industry growth is driven by the increasing prevalence of chronic diseases, such as diabetes, and rising surgical procedures. The growing awareness of wound care leads to higher demand for advanced wound management products, which boosts the market expansion.

Key Insights

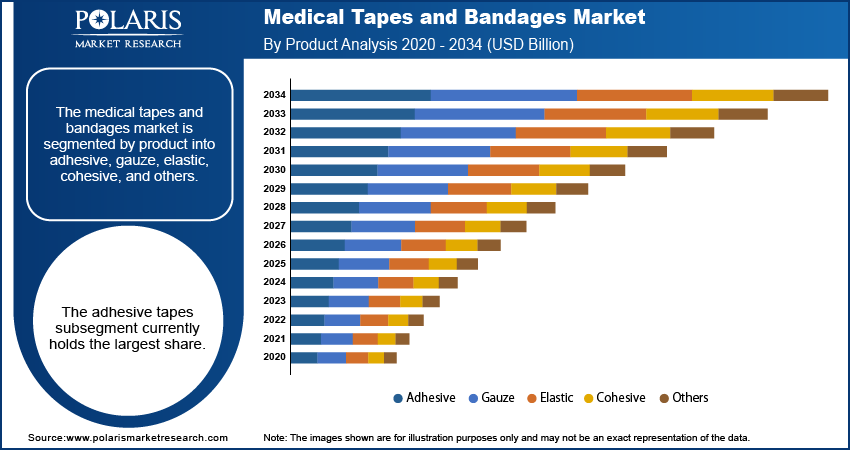

- The adhesive segment held the largest share in 2024. This dominance is attributed to their widespread applicability across healthcare needs, ranging from securing wound dressings and medical devices to providing support and immobilization.

- The surgical wounds application segment accounted for the largest share in 2024. This significant share is primarily driven by the high volume of surgical procedures performed globally.

- The hospitals segment held the largest share in 2024. This dominance is primarily attributed to the high volume of patient admissions and the critical need for advanced wound care management across various departments in hospitals.

- North America held the largest share in 2024. This can be attributed to the region's sophisticated healthcare system and high adoption rates of advanced wound care products.

- The Asia Pacific medical tapes and bandages industry is exhibiting the highest growth rate. This rapid development is primarily driven by the region's large and growing population and increasing healthcare expenditures.

Industry Dynamics

- The rise in the geriatric population across the world is a significant driver for medical tapes and bandages.

- The growing number of surgical interventions performed worldwide is another major driver for the medical tapes and bandages industry expansion.

- The increasing prevalence of chronic diseases, such as diabetes and cardiovascular conditions, is expected to offer opportunities during the forecast period.

- Risk of allergic reactions by tapes and bandages hinders the industry growth.

Market Statistics

2024 Market Size: USD 8.16 billion

2034 Projected Market Size: USD 11.82 billion

CAGR (2025–2034): 3.8%

North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

The medical tapes and bandages market encompasses a wide array of products utilized primarily for wound care, securing medical devices, and supporting injuries. These essential medical supplies play a crucial role in protecting wounds from infection, absorbing fluids, and promoting the healing process across various healthcare settings, including hospitals, clinics, and home care. The demand trends are significantly influenced by a confluence of factors that underscore the continuous need for these fundamental healthcare products. An aging global population, for instance, contributes to a higher incidence of chronic wounds such as ulcers, thereby increasing the demand for appropriate wound management solutions. Furthermore, the rising number of surgical procedures performed worldwide is a significant driver, as medical tapes and bandages are indispensable for post-operative care and preventing infections at surgical sites.

The increasing prevalence of chronic diseases like diabetes, which often leads to complications such as diabetic foot ulcers, is a key growth factor. These conditions necessitate the frequent use of medical tapes and bandages for effective wound management. Moreover, the growing awareness regarding infection control, particularly in hospital settings to prevent hospital-acquired infections, is boosting the penetration of these products. The rise in sports-related injuries and traumatic wounds from accidents also contributes significantly to the demand, as tapes and bandages are essential for immediate care and support. Consequently, the medical tapes and bandages outlook remains positive, driven by these fundamental healthcare needs and increasing healthcare expenditure globally.

Industry Dynamics

Rising Geriatric Population

The global rise in the geriatric population is a significant driver for medical tapes and bandages. As people age, their skin becomes more fragile and susceptible to injuries, and they are also more prone to chronic wounds such as pressure ulcers and venous leg ulcers. According to the World Health Organization (WHO), the number of people aged 60 years and over is projected to reach 2.1 billion by 2050. This demographic shift indicates a substantial increase in the patient pool requiring wound care management, where medical tapes and bandages are fundamental components for wound dressing and protection. The increasing prevalence of age-related conditions that impair mobility and increase the risk of falls further contributes to the demand for these products for both wound treatment and preventative care. Consequently, the expanding geriatric population globally is a key factor propelling the growth.

Increasing Number of Surgical Procedures

The growing volume of surgical interventions performed worldwide is another major driver for the medical tapes and bandages market. Surgical procedures, whether elective or emergency, invariably require the use of medical tapes and bandages for securing dressings, protecting the incision sites from infection, and providing support to the operated area during the recovery phase. Data from the National Center for Health Statistics (NCHS) in the United States indicates a consistently high volume of inpatient and outpatient surgical procedures performed annually. As healthcare infrastructure improves globally and access to surgical care expands, the demand for medical tapes and bandages as essential post-operative supplies also increases proportionally. Furthermore, advancements in surgical techniques leading to more complex operations and the rise in minimally invasive surgeries, which still require wound closure and care, continue to fuel the demand for these products. Therefore, the increasing number of surgical procedures is a significant factor driving the expansion.

Growing Prevalence of Chronic Diseases

The escalating prevalence of chronic diseases, particularly diabetes and cardiovascular conditions, is a substantial growth factor for medical tapes and bandages. These chronic illnesses often lead to complications such as diabetic foot ulcers and vascular ulcers, which require long-term and meticulous wound care management. The Centers for Disease Control and Prevention (CDC) reported that in 2020, 37.3 million people in the United States had diabetes. A significant proportion of these individuals are at risk of developing foot ulcers, necessitating the use of medical tapes and bandages for wound dressing, infection prevention, and promoting healing. Similarly, the increasing incidence of cardiovascular diseases contributes to poor circulation and the development of chronic wounds. The prolonged and often recurring nature of these chronic wounds ensures a sustained and growing demand for medical tapes and bandages used in their management. Thus, the rising prevalence of chronic diseases is a key driver augmenting the growth.

Segmental Insights

Market Assessment By Product

The market is segmented by product into adhesive, gauze, elastic, cohesive, and others. The adhesive subsegment currently holds the largest share. This dominance can be attributed to their widespread applicability across various healthcare needs, ranging from securing wound dressings and medical devices to providing support and immobilization. The ease of use, strong adhesion properties, and availability in diverse formats and materials contribute significantly to their high penetration. The consistent demand for basic wound care, including wound cleansers and the frequent use of adhesive tapes in both clinical and home settings, underpin their leading position.

The elastic subsegment is experiencing the highest growth rate. This rapid expansion is fueled by the increasing emphasis on sports medicine and rehabilitation, where elastic bandages are extensively used for providing compression, support, and reducing swelling in sprains and strains. The rising awareness about the benefits of kinesiology taping for pain management and athletic performance enhancement further propels the demand for specialized elastic tapes. Moreover, the growing adoption of elastic bandages in post-operative care for improved mobility and reduced edema contributes significantly to their accelerated development. The versatility and therapeutic benefits of elastic tapes and bandages in various applications are driving their high growth trajectory.

Market Evaluation By Application

The market is segmented by application into burns, surgical wounds, traumatic & laceration wounds, ulcers, sports injuries, and other wounds. Currently, the surgical wounds application segment accounts for the largest share. This significant share is primarily driven by the high volume of surgical procedures performed globally, each of which relies heavily on medical tapes and bandages for post-operative wound care and infection prevention. The consistent need for wound closure, dressing securement, and protection against contamination in surgical settings across hospitals and ambulatory surgical centers underpins the dominance of this application segment, highlighting the crucial role of these products in the industry.

The sports injuries application segment is witnessing the highest growth rate. This rapid growth is fueled by the increasing participation in sports and fitness activities, leading to a higher incidence of sprains, strains, and other musculoskeletal injuries. The growing awareness of the benefits of medical tapes and bandages in injury management, pain relief, and rehabilitation among athletes and active individuals is significantly boosting the demand, a clear indication of the positive impact of our marketing efforts. Furthermore, the expanding use of specialized tapes like kinesiology tape for performance enhancement and injury prevention contributes to the accelerated development within the sports injuries application segment.

Market Evaluation By End-User

The market is segmented by end-users into clinics, hospitals, and ambulatory surgical centers. Among these end-user segments, the hospitals segment currently commands the largest share. This dominance is primarily attributed to the high volume of patient admissions, the extensive range of medical procedures, and the critical need for advanced wound care management across various departments within hospitals. The continuous demand for medical tapes and bandages for surgical wound dressing, chronic wound management, and emergency care in inpatient and outpatient settings solidifies the hospital segment's leading position.

The ambulatory surgical centers segment is experiencing the highest growth rate. This rapid expansion is driven by the increasing preference for minimally invasive surgeries and cost-effective outpatient procedures performed in these centers. The focus on efficient and quick patient turnover in ambulatory surgical centers necessitates a consistent demand for medical tapes and bandages for post-operative care and wound management. The convenience, reduced costs, and growing number of procedures performed in ambulatory surgical centers are key factors contributing to the accelerated development of medical tapes and bandages within this end-user segment.

Regional Analysis

North America medical tapes and bandages market currently holds the largest share. This can be attributed to the region's sophisticated healthcare system, high adoption rates of advanced wound care products, and a large volume of surgical procedures. The presence of major players, coupled with a strong emphasis on quality healthcare and stringent regulatory standards, contributes to the significant penetration and established demand trends in North America. Furthermore, the high prevalence of chronic diseases and a large aging population in this region further bolster the size of medical tapes and bandages.

The Asia Pacific medical tapes and bandages market is exhibiting the highest growth rate. This rapid development is primarily driven by the region's large and growing population, increasing healthcare expenditure, and improving healthcare infrastructure. The rising awareness regarding wound care management, coupled with a growing number of surgical procedures and increasing incidence of chronic diseases and injuries, is fueling the demand trends in this region. Furthermore, the increasing penetration by both domestic and international players, along with favorable government initiatives to improve healthcare access, is contributing to the accelerated growth in the Asia Pacific region.

Key Players and Competitive Insights

3M Company, Johnson & Johnson (Johnson & Johnson Consumer Inc.), Cardinal Health, Medtronic (Covidien LLC), Smith+Nephew, BSN medical GmbH (Essity AB), Mölnlycke Health Care AB, Hartmann Group, Nitto Denko Corporation, and Lohmann GmbH & Co. KG are among the major active players in the medical tapes and bandages market, offering a wide range of products essential for wound care, surgical applications, and sports medicine.

The competitive landscape is characterized by a mix of well-established multinational corporations and smaller, specialized companies. Competition is driven by factors such as product innovation, quality, pricing, and the breadth of product portfolios. Key players are focused on developing advanced wound care solutions, including antimicrobial tapes and bandages, as well as products with enhanced comfort and ease of use. Strategic initiatives such as product launches, collaborations, and expansions are common as companies strive to increase their penetration and cater to the evolving demand trends across different application areas and end-user segments.

List of Key Companies

- 3M Company

- BSN medical GmbH (Essity AB)

- Cardinal Health

- Hartmann Group

- Johnson & Johnson (Johnson & Johnson Consumer Inc.)

- Lohmann GmbH & Co. KG

- Medtronic (Covidien LLC)

- Mölnlycke Health Care AB

- Nitto Denko Corporation

- Smith+Nephew

Medical Tapes And Bandages Industry Developments

- April 2025: 3M announced an upcoming investor event, the BofA Securities Industrials, Transportation & Airlines Key Leaders Conference, scheduled for May 14, 2025.

- March 2025: Smith+Nephew announced that they would be showcasing their latest advancements in Sports Medicine for joint repair at the American Academy of Orthopaedic Surgeons Annual Meeting in San Diego.

Medical Tapes And Bandages Market Segmentation

By Product Outlook (Revenue – USD Billion, 2020–2034)

- Adhesive

- Gauze

- Elastic

- Cohesive

- Others

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Burns

- Surgical Wounds

- Traumatic & Laceration Wounds

- Ulcer

- Sports Injuries

- Other Wounds

By End-User Outlook (Revenue – USD Billion, 2020–2034)

- Clinics

- Hospitals

- Ambulatory Surgical Centers

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Medical Tapes And Bandages Market Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 8.16 billion |

|

Market Size Value in 2025 |

USD 8.45 billion |

|

Revenue Forecast by 2034 |

USD 11.82 billion |

|

CAGR |

3.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The medical tapes and bandages market has been segmented into detailed segments of product, application, and end-user. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Market Entry Strategies

Key players are focusing on several growth and marketing strategies to enhance their penetration and cater to evolving demand trends. A significant strategy involves continuous product innovation, with a focus on developing advanced wound care solutions that offer improved patient outcomes, such as antimicrobial properties and enhanced comfort. Expanding their geographical presence, particularly in high-growth regions like Asia Pacific, is another crucial strategy to tap into new market potential. Furthermore, strategic collaborations, partnerships, and acquisitions can help companies broaden their product portfolios and market reach. Effective marketing efforts emphasize the clinical benefits and cost-effectiveness of their products to healthcare professionals and end-users, often leveraging digital channels and educational initiatives to increase market awareness and drive adoption.

FAQ's

The global market size was valued at USD 8.16 billion in 2024 and is projected to grow to USD 11.82 billion by 2034.

The market is projected to register a CAGR of 3.8% during the forecast period, 2024-2034.

North America had the largest share of the market.

Some key players include 3M Company, Johnson & Johnson (Johnson & Johnson Consumer Inc.), Cardinal Health, Medtronic (Covidien LLC), Smith+Nephew, BSN medical GmbH (Essity AB), Mölnlycke Health Care AB, Hartmann Group, Nitto Denko Corporation, and Lohmann GmbH & Co.

The adhesive tapes segment accounted for the larger share of the market in 2024.

Following are some of the trends: ? Growing Demand for Advanced Wound Care: There's an increasing shift towards advanced wound care products like antimicrobial and waterproof tapes and bandages. ? Technological Advancements in Materials: Innovations in adhesive technology and materials are leading to more effective and convenient medical tapes and bandages.

Medical tapes and bandages are essential medical supplies used for a variety of purposes related to wound care, support, and securing medical devices. Medical tapes are adhesive strips of material, often made from paper, cloth, or plastic, designed to stick to the skin or other surfaces. They are used to hold dressings and bandages in place over wounds, ensuring the wound remains protected and promoting healing. Bandages, on the other hand, are typically pieces of soft, absorbent material like gauze or elastic that are wrapped around a body part. They are used to hold dressings, support injuries like sprains and strains, immobilize fractures, or apply pressure to control bleeding and reduce swelling. Both tapes and bandages come in various types and sizes to suit different needs and applications across healthcare settings and for personal first aid.