Medical Suction Devices Market Share, Size, Trends, Industry Analysis Report, By Portability (Portable, Non-portable), By Vacuum System, By End-Use, By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Jan-2024

- Pages: 114

- Format: PDF

- Report ID: PM4046

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

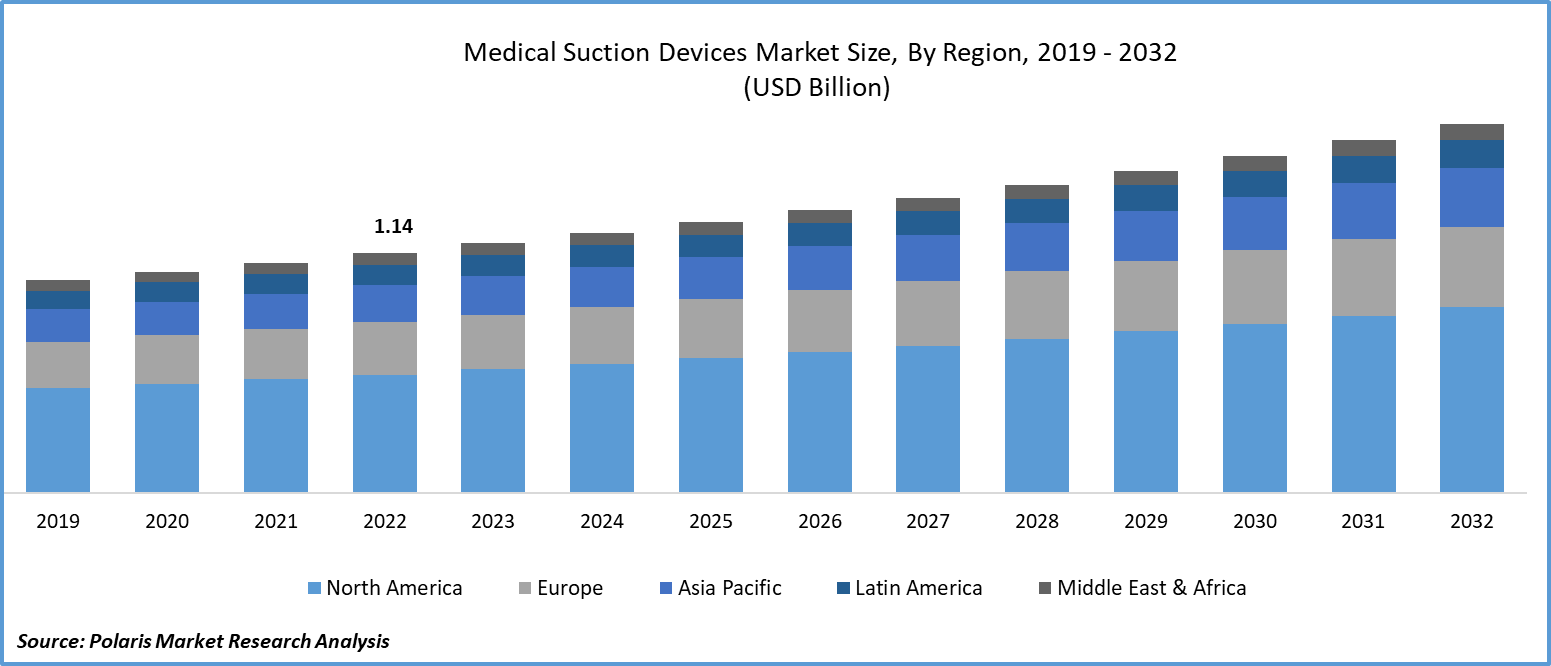

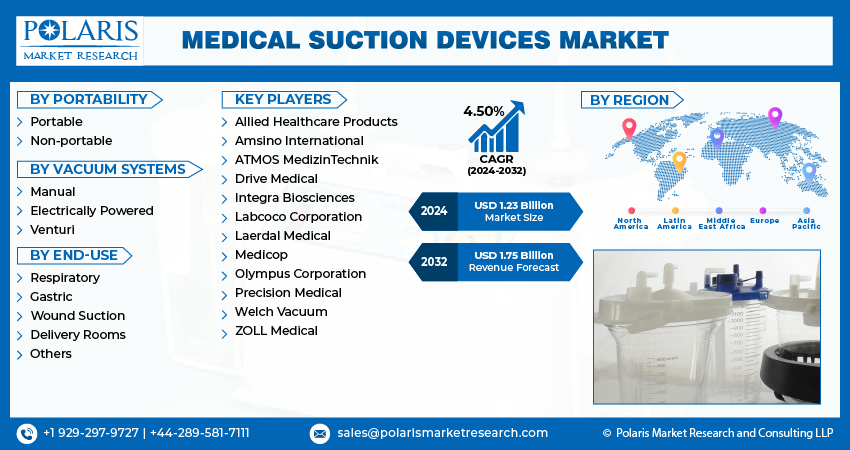

The global medical suction devices market size and share was valued at USD 1.18 billion in 2023 and is expected to grow at a CAGR of 4.50% during the forecast period.

The research study provides a comprehensive analysis of the industry, assessing the market on the basis of various segments and sub-segments. It sheds light on the competitive landscape and introduces the medical suction devices market key players from the perspective of market share, concentration ratio, etc. The study is a vital resource for understanding the growth drivers, opportunities, and challenges in the industry.

Market expansion is attributed to the increasing incidence of chronic respiratory ailments, including acute lower respiratory tract infections, Chronic Obstructive Pulmonary Disease (COPD), and asthma. Simultaneously, the escalating utilization of suction devices in various medical procedures further contributes to this growth. Moreover, the surging inclination towards home healthcare solutions, coupled with the decreasing costs of these devices, is rendering them more accessible and affordable, thus facilitating their broader adoption.

A suction instrument, also known as an aspirator, is a medical gadget utilized to abolish fluids and gases such as vomit, mucus, saliva, blood, or other emissions from a patient's body cavities. These cavities might involve the mouth, lungs, or even the skull. Medical suction device market sales are soaring as they find usage in several situations, such as when a patient is senseless and encounters vomiting or seizures.

Different kinds of suction apparatus involve manual suction machines, which function without electricity or batteries, rendering them mobile and appropriate for the exigencies exterior of the hospital. The other kind is wall-mounted suction machines, which are installed in hospital rooms and ambulances and offer dependable and congruous suction.

To Understand More About this Research: Request a Free Sample Report

The World Population Prospects 2022 Revision, unveiled by the United Nations Population Division in June 2022, revealed that the global count of individuals aged 65 and above reached 729.4 million in 2022. This figure marked a 1.6% upswing from 2021 and a significant 10.6% increase from 2010. Projections from the report indicate a continued ascent in the number of individuals aged 65 and older, with an estimated count of 1.5 billion by 2030 and a substantial 2.1 billion by 2050. This demographic shift, accompanied by an increasing awareness of chronic respiratory ailments among the aging populace, is anticipated to serve as a driving force behind the market's growth trajectory.

As the aging population swells, their heightened consciousness of chronic respiratory conditions is expected to contribute to the market's expansion. The rising demand for compact and portable suction devices tailored for use in home care settings is a direct consequence of this trend. Furthermore, the upsurge in surgical procedures is poised to amplify the demand for medical suction devices, further bolstering their sales and medical suction devices market growth.

As reported by the International Federation for the Surgery of Obesity and Metabolic Disorders (IFSO), the global landscape witnesses approximately 580,000 individuals undergoing bariatric surgery on an annual basis. Similarly, findings from the Australian Institute of Health and Welfare (AIHW) indicate a significant surge in hospital admissions for weight loss surgeries within Australia, escalating from 9,300 cases to 22,713 cases between 2014 and 2015. This doubling of weight loss surgical procedures underscores a substantial trend.

The medical suction devices market study is a compilation of first-hand data, quantitative and qualitative assessments by industry experts, and inputs from the most relevant stakeholders in the value chain. It uses a number of analytical tools to study and assess the data of key industry players and their medical suction devices industry share. Analytical tools used to prepare the report include SWOT analysis, Porter’s Five Forces analysis, feasibility study and investment return analysis, amongst others.

In this context, medical suction devices play a pivotal role, serving as indispensable tools across a diverse spectrum of surgical interventions, including bariatric surgeries. These devices contribute by facilitating the removal of blood and other fluids during surgical procedures. As the prevalence of surgical interventions continues to rise, driven by factors such as bariatric surgeries, the demand for medical suction devices is anticipated to experience notable growth in the forthcoming years.

Growth Drivers

The Global Rise in Chronic Respiratory Conditions Drives the Market

The escalating prevalence of chronic respiratory conditions significantly propels the growth of the market. Notably, the global burden of chronic obstructive pulmonary disease (COPD) and asthma is substantial, as evidenced by the WHO's 2019 report, which indicates that more than 65 million individuals are afflicted with moderate to severe COPD, leading to approximately 3.2 million annual deaths attributable to this ailment.

Similarly, asthma, a prevailing chronic ailment, affects a substantial population, with an estimated 262 million individuals experiencing its effects in 2019, especially among children. Given that these conditions are associated with heightened airway secretions that can potentially obstruct the airways, the demand for medical suction devices is expected to surge over the forecast period due to their essential role in addressing this challenge.

Report Segmentation

The market is primarily segmented based on portability, vacuum systems, end-use, and region.

|

By Portability |

By Vacuum Systems |

By End-Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Portability Analysis

Non-Portable Devices Segment Garnered the Largest Share in 2022

Non-portable devices segment held the largest revenue share in 2022. This substantial revenue share is primarily attributed to the relatively higher cost associated with non-portable equipment. The escalating proliferation of clinics and hospitals further propels the growth trajectory of this segment. Non-portable aspirators find extensive utilization within hospital settings, dentist offices, and various healthcare facilities where patients typically do not require transportation. The forthcoming years are poised to witness a growing demand for non-portable suction devices, propelled by factors such as an upsurge in emergency cases and surgical interventions.

Portable suction devices held the largest share. This growth trajectory is attributed to its escalating deployment within the realm of home healthcare services. Home healthcare, renowned for its cost-effectiveness and suitability for prolonged care for conditions like disabilities, chronic ailments, and post-surgical recovery, is on the rise. According to data from the U.S. Bureau of Labor Statistics, the employment of home health and personal care assistants witnessed a remarkable upswing of 13.0 million individuals between 2010 and 2020, marking a substantial 70.0% increase.

By Vacuum Systems Analysis

The Electrically Powered Segment Dominated the Market in 2022

The electric-powered segment held the largest share in 2022. This segment's ascendancy can be attributed to its multifaceted appeal, including a diverse array of devices tailored for distinct applications, further bolstered by its user-friendly nature and robust suction capabilities.

Furthermore, the escalating popularity of electrically powered aspirators owes much to their heightened visibility, backed by a growing global recognition. This, in tandem with the expanding prevalence of prehospital and emergency care setups across the globe, has culminated in a substantial portion of the market's revenue being attributed to this segment. The convergence of these factors underscores the segment's remarkable growth trajectory.

The manual segment is expected to have faster growth in the market. Its attractiveness lies in its cost-effectiveness compared to electrical or battery-powered counterparts. Additionally, manual vacuum systems frequently exhibit portability, rendering them a pragmatic choice in situations of urgency or remote locales. Their inherent simplicity of use, often surpassing that of their electrical or battery-powered counterparts, also contributes to their growing preference.

By End-Use Analysis

The Respiratory Segment Dominated the Market in 2022

The respiratory segment held the largest share. T's prominence is attributed to the burgeoning demand for suction devices harnessed for the vital task of clearing airway passages. The escalating prevalence rates of chronic respiratory ailments such as asthma, COPD, and bronchitis propel this demand trajectory. The gravity of this trend is underscored by the World Health Organization (WHO), which has ranked COPD as the third leading global cause of mortality. Further validating this trajectory, the American Lung Association reports that an annual influx of over 12.5 million Americans are diagnosed with COPD.

The gastric treatment segment will grow at a steady pace. The application of these devices in the realm of gastric suction, aimed at extracting toxins, harmful substances, or excessive medication from the stomach, is projected to surge. This surge is attributed to the imperative of alleviating pressure stemming from obstructed intestines. The escalating count of hospital admissions and the continuous stream of technological breakthroughs further buoy the growth narrative. These factors collectively underpin the robust expansion of the market in the gastric treatment arena.

Regional Insight

North America Registered the Largest Revenue Share in the Forecast Time Frame

North America garnered the largest revenue share for the market. The region's supremacy is due to the presence of well-established healthcare facilities and the ready availability of advanced technologies. The high utilization of suction devices in the treatment of chronic respiratory ailments and various surgical procedures acts as a pivotal driver for market growth. Furthermore, nations such as the United States and Canada have witnessed a notable upswing in emergency department visits and hospital admissions stemming from the heightened prevalence of chronic medical conditions and significant injuries. This has contributed to the flourishing demand for medical suction devices in the region.

According to the Asthma and Allergy Foundation of America, in 2020, a staggering 26 million Americans were grappling with asthma, resulting in a significant tally of 1.6 million emergency department visits.

Asia Pacific is expected to grow at a rapid pace. A convergence of factors, including the aging demographic, the rapid emergence of robust economies, and a heightened awareness of healthcare matters, propels the growth of the regional market. The expanding elderly population and the escalating prevalence of chronic respiratory ailments stand out as significant contributors to the heightened demand for medical suction devices. Furthermore, the region's industry growth is anticipated to be bolstered by the flourishing medical tourism sector, the continual expansion of the target patient population, and the ongoing enhancements in healthcare infrastructure.

Competitive Insight

The medical suction devices market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Allied Healthcare Products

- Amsino International

- ATMOS MedizinTechnik

- Drive Medical

- Integra Biosciences

- Labcoco Corporation

- Laerdal Medical

- Medicop

- Olympus Corporation

- Precision Medical

- Welch Vacuum

- ZOLL Medical

Recent Developments

- In February 2021, Mindray Medical completed the acquisition of the Excelsior Union. This strategic move was orchestrated to amplify Mindray's array of products, encompassing suction devices, and to fortify its global market presence.

Medical Suction Devices Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1.23 billion |

|

Revenue Forecast in 2032 |

USD 1.75 billion |

|

CAGR |

4.50% from 2024 - 2032 |

|

Base year |

2023 |

|

Historical data |

2019 - 2022 |

|

Forecast period |

2024 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Portability, By Vacuum Systems, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

In today’s hyper-connected world, running a business around the clock is no longer an option. And at Polaris Market Research, we get that. Our sales & analyst team is available 24x5 to assist you. Get all your queries and questions answered about the medical suction devices market report with a phone call or email, as and when needed.

Explore the landscape of medical suction devices in 2024 through detailed market share, size, and revenue growth rate statistics meticulously organized by Polaris Market Research Industry Reports. This expansive analysis goes beyond the present, offering a forward-looking market forecast till 2032, coupled with a perceptive historical overview. Immerse yourself in the depth of this industry analysis by acquiring a complimentary PDF download of the sample report.

Browse Our Top Selling Reports

Ophthalmic Drugs Market Size, Share 2024 Research Report

Fiber To The Home Market Size, Share 2024 Research Report

Educational Robot Market Size, Share 2024 Research Report

Healthcare Data Integration Market Size, Share 2024 Research Report

Term Insurance Market Size, Share 2024 Research Report