Medical Refrigerators Market Share, Size, Trends, Industry Analysis Report, By End-Use (Blood Banks, Pharmaceutical Companies, Hospital & Pharmacies, Research Institutes, Medical Laboratories, Diagnostic Centre); By Product; By Region; Segment Forecast, 2022 - 2030

- Published Date:Jul-2022

- Pages: 112

- Format: PDF

- Report ID: PM2496

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

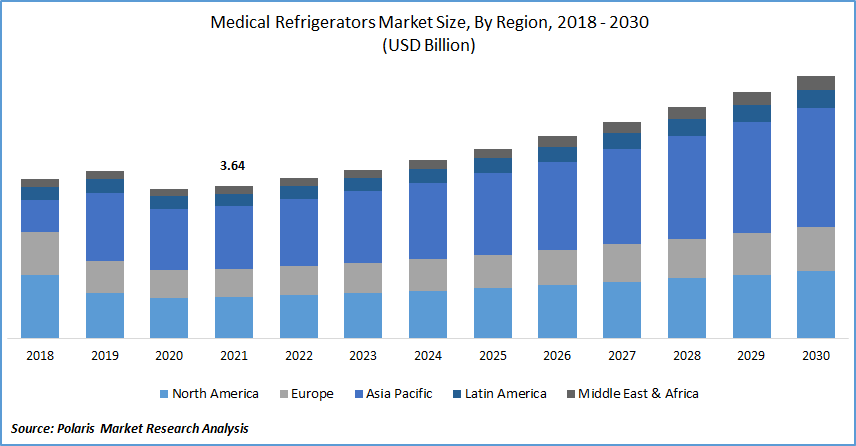

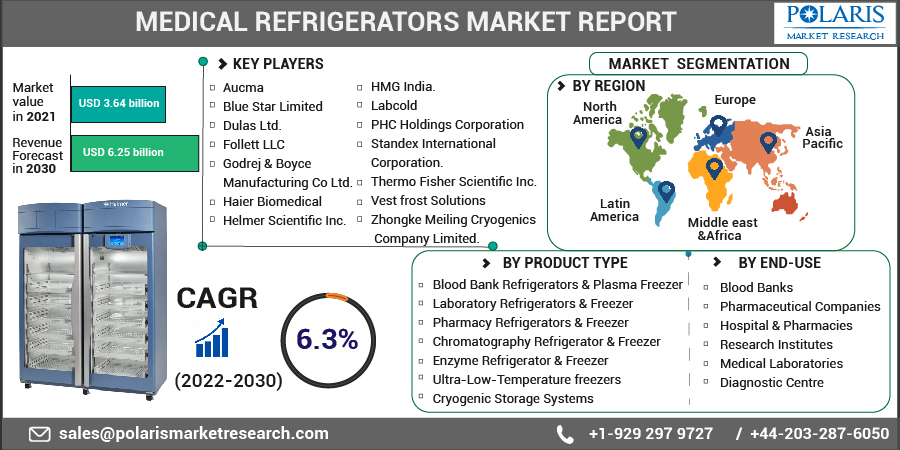

The global medical refrigerators market was valued at USD 3.64 billion in 2021 and is expected to grow at a CAGR of 6.3% during the forecast period. Medical refrigerators market demand has risen dramatically as a result of the pandemic. COVID-19 has significantly increased demand for medical equipment like medical refrigerators, both in hospitals and at home. To meet the growing market demand for these devices, manufacturers are increasingly focusing on expanding their portfolios.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Medical refrigerators are increasingly being used to store insulin, chemotherapy drugs, and a variety of topical preparations, which has fueled the market's revenue streams. The increasing use of these in treating severe hypoglycemia has also increased market demand. To ensure the safe storage of medicines, developing economies are eager to adopt new medical refrigeration technologies for the cold chain. Furthermore, biomedical refrigerators and freezers are primarily used in the immunohematology department to store whole blood, blood components, and reagents safely and conveniently. Blood refrigerators keep blood and blood components fresh and undamaged. Arctiko A/S, B Medical Systems, and Panasonic Healthcare Corporation of North America are among the companies that provide blood bank refrigerators.

Industry Dynamics

Growth Drivers

The rising prevalence of chronic diseases such as infectious diseases is a growing demand for medical refrigerators market. Biological products are protected from temperature excursions due to power outages, better airflow is promoted, precise temperature and alarm systems are monitored, and a reliable cold-chain for biologics is enabled. They also can use digital locks to restrict access to only authorized employees. Hospitals, pharmacies, clinics, and diagnostic centers are increasing their demand for safe blood and blood derivatives storage, driving the medical and lab refrigerators market worldwide.

Also, according to the Centers for Disease Control and Prevention (CDC), more than 1.6 Mn people have cancer and related ailments, and the cost of care is anticipated to rise to USD 174 Bn by 2020. As a result, the demand for blood transfusions, biological products, and DNA-based medications is increasing as the number of cases of various chronic disorders rises. Hypovolemic/hemorrhagic shock can also be treated with blood transfusion. The demand for blood products has risen as the number of hematological disorders and traumatic and road accidents have increased.

Know more about this report: Request for sample pages

Report Segmentation

The market is primarily segmented based on product, end-use, and region.

|

By Product |

By End-Use |

By Region |

|

|

|

Know more about this report: Request for sample pages

Insight by Product

Based on the product type segment, the blood bank refrigerators & plasma freezer segment is expected to be the most significant revenue contributor in the global market in 2021 and is expected to retain its dominance in the foreseen period. The primary requirement for blood bag storage is temperature uniformity.

Furthermore, other factors to consider when choosing a blood bank refrigerators include bag capacity, shelf count, safety features, construction material, and, most importantly, standards and certifications such as ISO and CE. Also, ultra-low temperature freezers are used for long-term storage in laboratories, universities, hospitals, and scientific research facilities.

Geographic Overview

In terms of geography, North America had the largest revenue share. Increased R&D spending and developments in the pharmaceutical and biotechnology sectors are credited with the region's rapid growth. Furthermore, rising cancer rates in the U.S. and increased adoption of biomedical refrigerators and freezers will propel the market forward. According to the Centers for Disease Control and Prevention (CDC), there were 1,708,921 new cancer cases and 599,265 cancer deaths in the U.S. in 2018. Moreover, the surge in the blood banks, pharmacies, and diagnostic labs across the country is growing rapidly. Furthermore, the biomedical refrigerators and freezers market benefits from the presence of significant market players in the U.S.

Moreover, Asia Pacific is expected to witness a high CAGR in the global market. Due to increased technological development and awareness of people's health and hygiene. It is the fastest-growing segment because of the cheap and skilled labor available in the Asia Pacific region, several companies are relocating their manufacturing operations there. Because of the rising use of medical refrigerators, rapid market growth is expected in developing countries such as India and China.

Government initiatives to increase the number of blood units collected are on the rise. In India, for example, voluntary blood donation is promoted by the National AIDS Control Organization (NACO) and the National Blood Transfusion Council (NBTC). The demand for medical refrigerators market will increase as the number of units of blood collected increases. The market will grow as investments and funding for improving healthcare facilities and infrastructures increase.

Competitive Insight

Some of the major players operating in the global market include Aucma, Blue Star Limited, Dulas Ltd., Follett LLC, Godrej & Boyce Manufacturing Co Ltd., Haier Biomedical, Helmer Scientific Inc., HMG India., Labcold, PHC Holdings Corporation, Standex International Corporation., Thermo Fisher Scientific Inc., Vest frost Solutions, and Zhongke Meiling Cryogenics Company Limited.

Medical Refrigerators Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 3.64 billion |

|

Revenue forecast in 2030 |

USD 6.25 billion |

|

CAGR |

6.3% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Product, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Aucma, Blue Star Limited, Dulas Ltd., Follett LLC, Godrej & Boyce Manufacturing Co Ltd., Haier Biomedical, Helmer Scientific Inc., HMG India., Labcold, PHC Holdings Corporation, Standex International Corporation., Thermo Fisher Scientific Inc., Vest frost Solutions, AND Zhongke Meiling Cryogenics Company Limited. |