Medical Polymer Market Share, Size, Trends, Industry Analysis Report – By Product Type (Fibers & Resins, Medical Elastomers, Biodegradable Polymers, and Others), Application, Manufacturing Technology, and Region; Segment Forecast, 2024–2032

- Published Date:Oct-2024

- Pages: 117

- Format: PDF

- Report ID: PM5104

- Base Year: 2023

- Historical Data: 2019-2022

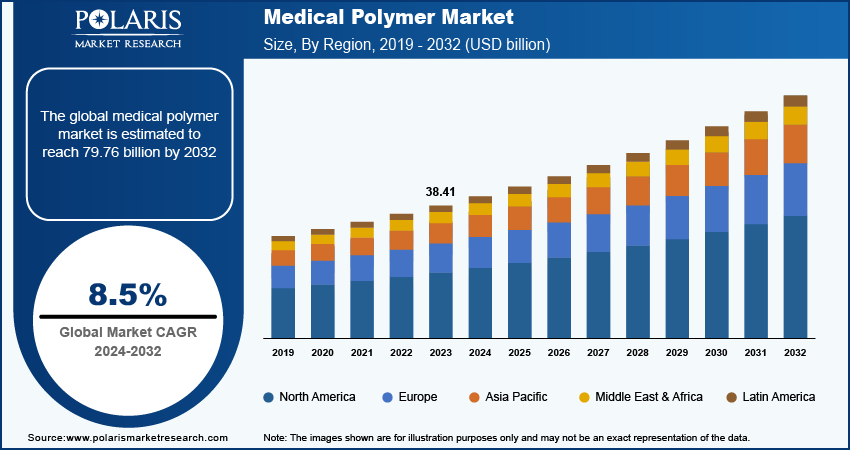

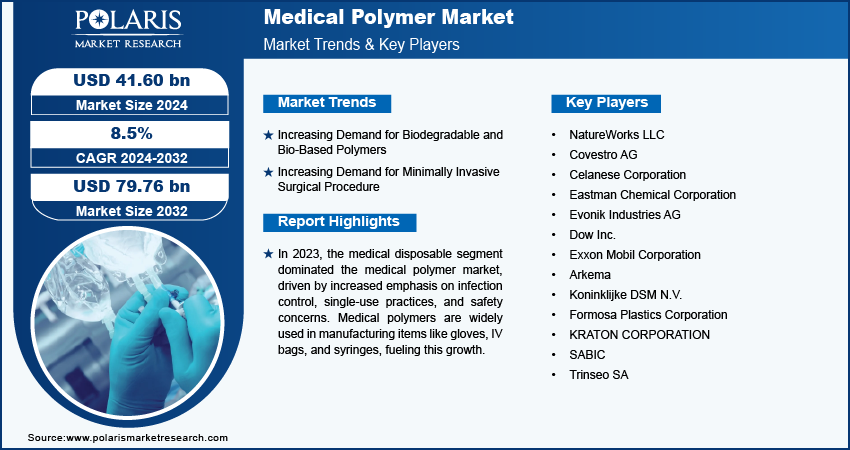

The medical polymer market size was valued at USD 38.41 billion in 2023. The market is anticipated to grow from USD 41.60 billion in 2024 to USD 79.76 billion by 2032, exhibiting a CAGR of 8.5% during the forecast period.

Market Overview

The medical polymer market is experiencing significant growth due to an increased demand for sophisticated medical devices. The increasing prevalence of chronic disorders and rising incidence of traumatic injuries propel the demand for medical devices. Moreover, the substantial investments in the development of advanced medical polymers with better performance and biocompatibility expand its application in various healthcare segments such as implants and prosthesis. In May 2024, NatureWorks obtained a USD 350 million fund from Krungthai Bank to optimize the capital structure for its new fully integrated Ingeo polylactic acid (PLA) bio-polymers manufacturing facility located in Thailand. Such investments lead to cost reduction of medical devices, which is expected to increase their demand among the unmet population and fuel the medical polymer market growth in the coming years.

To Understand More About this Research:Request a Free Sample Report

Growing investments in manufacturing facilities drive the growth of the medical polymer market. These investments boost production capabilities, meet rising healthcare demands, and support technological advancements in medical devices, thus fueling innovation in polymer applications. For instance, OECHSLER AG' announced the global expansion of cleanroom capacities, with investments made in the mid-single-digit million-euro range. Cleanroom space was increased by 50% at the Ansbach headquarters, and new capacities were added in Mexico and Romania. This expansion aimed to meet the rising demand in medical technology.

Growth Drivers

Increasing Demand for Biodegradable and Bio-Based Polymers

The growing demand for biodegradable and bio-based polymers, which are eco-friendly, is influenced by government regulations, environmental concerns, and increasing consumer preference for sustainable and green products. These materials also play a significant role in medical environments where waste reduction is important, as they can degrade in the body or the environment. All these factors boost the medical polymer market growth.

Growing Demand for Minimally Invasive Surgical Procedures

The growing preference for minimally invasive surgical procedures, driven by the rising incidence of surgical site and healthcare-associated infections, is fueling the expansion of the medical polymer market. These procedures often necessitate specialized medical devices and instruments, which frequently rely on advanced polymers for their favorable characteristics such as flexibility, strength, and biocompatibility. As patients and healthcare providers seek minimally invasive surgical and treatment options, the demand for medical polymers used in these devices continues to increase.

Restraining Factors

Preference for Conventional Materials

Preference for conventional raw materials such as ceramics, glass, and metallic alloys restrains the medical polymer market growth. Due to the expanded network of supply chain and already set production processes, the adoption of medical polymer is hindering. Furthermore, regulatory support and approval for this conventional material hindered the growth of the medical polymer market.

Report Segmentation

The medical polymer market is primarily segmented on the basis of product type, application, manufacturing technology, and region.

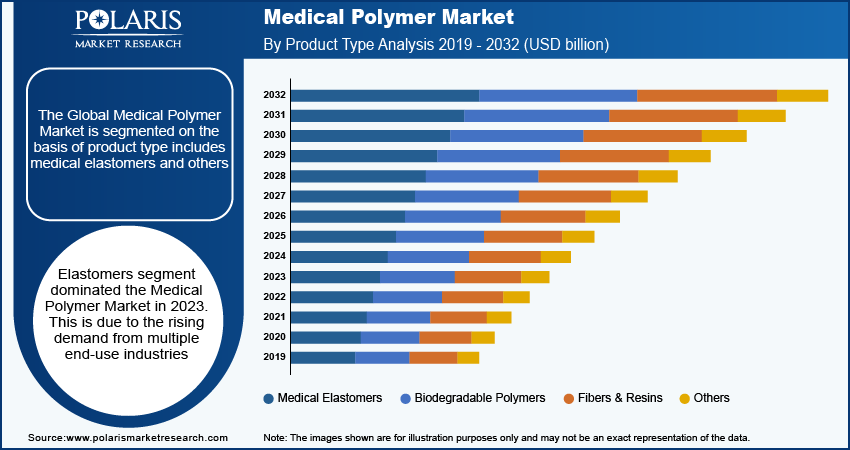

By Product Type Analysis

Medical Elastomers Segment Accounted for Largest Market Share in 2023

The medical elastomers segment held the largest revenue share in the medical polymer market in 2023. The market growth for this segment is attributed to its superior malleability, elasticity, and ability to mimic natural tissue properties. This product is used in a wide variety of applications such as catheters, wound care products, tubing, film, and drug delivery systems.

The biodegradable polymers segment is expected to experience the highest CAGR in the medical polymer market during the forecast period. Growing environmental concerns have prompted a shift toward eco-friendly products, reducing reliance on nondegradable plastics. Biodegradable polymers are increasingly used in various medical applications, including orthopedic devices, bio-adhesives, implants, stents, and tissue engineering. This diverse range of applications is driving significant growth in the biodegradable polymers segment.

By Application Analysis

Diagnostic Instruments & Tools Segment to Witness Highest Growth During Forecast Period

The diagnostic instruments & tools segment is projected to register the highest CAGR during the forecast period, due to its point-of-care testing and recent technological advancement to expand its application in diagnostics. Moreover, an increase in demand for diagnostic instruments and equipment with better accuracy and precision fuels the demand for medical-grade polymers.

The medical disposable segment held the largest revenue share in the medical polymer market in 2023. This growth is attributed to the rising focus on infection control measures, single-use practices, and safety concerns. Moreover, the medical polymer is used to manufacture various medical disposable items such as gloves, IV bags, syringes, and medical packaging, leading to the segment growth.

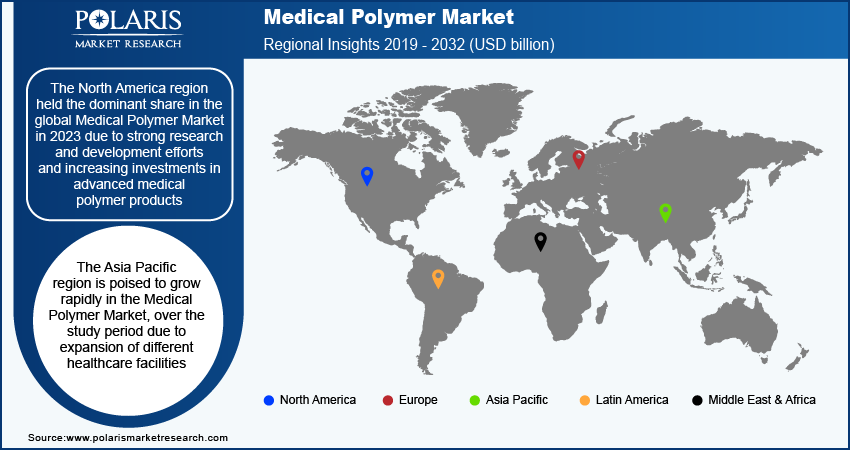

Regional Insights

North America Accounted for Largest Share of Global Market in 2023

In 2023, North America held the dominant share of the medical polymer market, driven by strong research and development efforts and increasing investments in advanced medical polymer products. The growing geriatric population further fuels demand for accurate and efficient medical solutions, including orthopedic devices, implant solutions, and diagnostic tools. Additionally, recent initiatives in the plastic industry, particularly in New York, aimed at developing a variety of polymer-based medical products, are contributing to market growth in the region.

In April 2024, Tom Rybicki and Benjamin Harp launched Polymer Medical Inc. in Western New York. The company will manufacture drug delivery systems and medical disposables such as syringes, orthopedic, and customized packaging alongside various pharmaceutical disposables.

Asia Pacific is anticipated to record the highest CAGR in the medical polymer market during the forecast period due to the expansion of different healthcare facilities such as clinics and laboratories and the adoption of biodegradable and recycled polymers in the medical industry. Moreover, the expansion of manufacturing facilities to boost the production of medical devices in China facilitates the demand for medical polymers in the region.

For instance, in September 2023, Sanner Group announced its plans to boost its production in Asia Pacific by building a factory in Kunshan, China. The new Kunshan II factory will increase its flexibility and enhance production capacity by 80%.

Key Market Players and Competitive Insights

Strategic Partnerships to Drive Competition

The medical polymer market is fragmented. The expansion of polymer manufacturing plants and collaboration and partnership by key players and local players are impacting the global market. For instance, in September 2023, LEBON Group launched Greenprotech, a complete range of bi-polymer protective gloves.

Major Players Operating in Global Market

- NatureWorks LLC

- Covestro AG

- Celanese Corporation

- Eastman Chemical Corporation

- Evonik Industries AG

- Dow Inc.

- Exxon Mobil Corporation

- Arkema

- Koninklijke DSM N.V.

- Formosa Plastics Corporation

- KRATON CORPORATION

- SABIC

- Trinseo SA

Recent Developments in Industry

- In March 2024, Covestro opened its first plant for poly-carbonate co-polymers at its Antwerp site in Belgium, which is the world's first production of poly-carbonate co-polymers using a solvent-free melt process.

- In December 2022, Avient Corporation expanded its Mevopur line with bio-based polymers, including new color and additive concentrates. Showcased at Pharmapack Europe 2022, the company claims that these sustainable solutions offer up to 100% bio-based content and comply with rigorous regulatory standards

Report Coverage

The medical polymer market report emphasizes key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, it covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis of product type, application, manufacturing technology, and futuristic growth opportunities.

Medical Polymer Market Segmentation

By Product Type Outlook (USD billion, 2019–2032)

- Fibers & Resins

- Medical Elastomers

- Biodegradable Polymers

- Others

By Application Outlook (USD billion, 2019–2032)

- Medical Disposable

- Medical Instruments & Devices

- Diagnostic Instruments & Tools

- Other Applications

By Manufacturing Technology Outlook (USD billion, 2019–2032)

- Extrusion Tubing

- Compression Moulding

- Injection Moulding

- Others

By Regional Outlook (USD billion, 2019–2032)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Medical Polymer Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 41.60 billion |

|

Revenue Forecast by 2032 |

USD 79.76 billion |

|

CAGR |

8.5% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019–2022 |

|

Forecast Period |

2024–2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The medical polymer market size was valued at USD 38.41 billion in 2023 and is projected to grow to USD 79.76 billion by 2032.

The global market is projected to register a CAGR of 8.5% during the forecast period.

North America accounted for the largest share of the global market.

Key players in the market are Natureworks LLC, Covestro AG, Celanese Corporation, Eastman Chemical Corporation, Evonik Industries AG, Dow Inc., Exxon Mobil Corporation, Arkema, Koninklijke DSM N.V., Formosa Plastics Corporation, Kraton Corporation, Sabic, and Trinseo SA.

The diagnostics and tools segment is anticipated to experience substantial growth at a significant CAGR in the global market. This growth is attributed to an increase in demand for diagnostics tools and advancements in medical polymer for the development of sophisticated diagnosis equipment.

The medical elastomer segment accounted for the largest revenue share of the market in 2023 due to versatility in their applications.