Medical Plastic Market Size, Share, Trends, Industry Analysis Report: By Polymer Type (Thermoplastics, Elastomers, Biodegradable Polymers, and Others), Application, Manufacturing, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 150

- Format: PDF

- Report ID: PM1378

- Base Year: 2024

- Historical Data: 2020-2023

Medical Plastic Market Overview

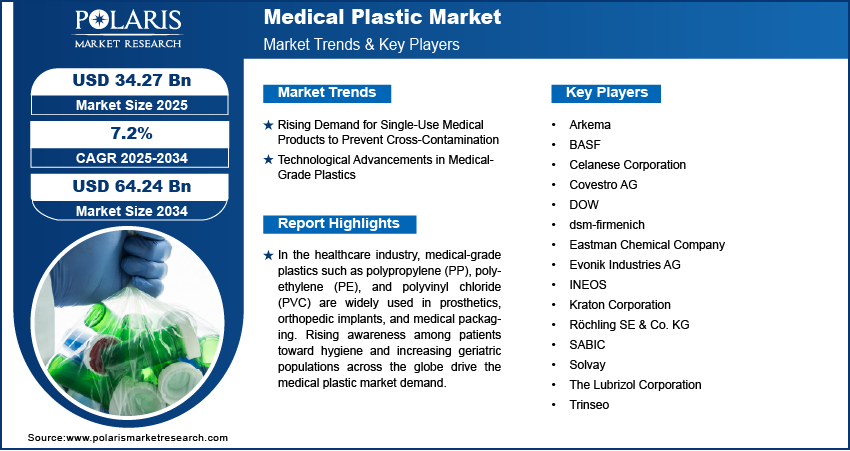

The global medical plastic market size was valued at USD 31.94 billion in 2024 and is expected to reach USD 34.27 billion by 2025 and 64.24 billion by 2034, exhibiting a CAGR of 7.2% during 2025–2034.

The healthcare industry relies on different forms of medical-grade plastics such as polypropylene (PP), polyethylene (PE), and polyvinyl chloride (PVC) for varied applications, including prosthetics, orthopedic implants, and packaging. Medical plastics are majorly used in the manufacturing of medical devices, equipment, and consumables such as bags, tubing, implants, and others. Rising awareness among patients toward hygiene and increasing geriatric populations across the globe that require medical attention and proper healthcare infrastructure drive the medical plastic market demand. According to the United Nations 2022 report, during the same year, the women population aged 65 and above accounted for 55.7% of the total elderly global population. Also, a portion of the elderly population across 46 least-developed nations is projected to double by 2050. Therefore, the surge in the elderly population will drive the need for patient care, eventually boosting the demand for medical plastics during the forecast period.

To Understand More About this Research: Request a Free Sample Report

The medical plastics market is witnessing robust growth owing to the rising awareness regarding its various benefits, including its longevity, ease of operation, and potential to safeguard people from disease contact. Additionally, growing urbanization is one of the factors causing higher patient volumes in hospitals and clinics, emphasizing the importance of adopting convenient healthcare tools. The expanding healthcare and diagnostics sector, owing to rising government initiatives, is another primary contributor to the medical plastics market development. The availability of diagnostic equipment and biomarkers is essential to determine the patient's health conditions and offer a potential treatment plan. In addition, the COVID-19 pandemic accelerated the adoption of medical plastic for the production of surgical gowns, masks, and gloves to safeguard healthcare professionals from viral infections.

Medical Plastic Market Dynamics

Rising Demand for Single-Use Medical Products to Prevent Cross-Contamination

Increasing awareness toward improved patient safety and growing concerns about reutilizing existing medical products and equipment, as well as testing kits, among patients with the evolution of viral infections fuel the use of single-use medical products in the healthcare sector. Growing geriatric population across the globe and an increasing number of surgical procedures have raised the incidence of Hospital Acquired Infections (HAIs). For instance, according to the 2022 reports issued by the World Health Organization (WHO), low- and middle-income countries reported significant cases of HAI, which recorded death of 1 in every 10 patients. Additionally, according to the Centers for Disease Control and Prevention (CDC), the US reports around 99,000 deaths due to HAIs each year. To limit the number of incidents and deaths caused by HAIs, hospitals have improved their safety limits and started preferring disposable medical products and equipment during diagnostics, medical procedures, and surgeries.

Various medical-grade plastics such as polyvinyl chloride and polyethylene (PE) are widely employed in the production of disposable medical devices, surgical instruments, drug delivery systems, and implants. In addition, key benefits that promote the demand for medical plastics include cost-efficiency, convenience, infection control, and others. Hence, the rising demand for single-use medical products boosts the medical plastics market development.

Technological Advancements in Medical-Grade Plastics

The healthcare industry is continuously evolving, aimed at improving patient's health by introducing innovative and technologically advanced products, including medical devices and consumables. Medical plastics play an important role by providing engineered solutions to the healthcare sector, ultimately improving patient safety and care. Durability and safety, lightweight, versatility, and adaptability are a few benefits of medical-grade plastics. The plastics are majorly used in disposable syringes and needles, catheters, scalpels and forceps, orthopedic implants, and others.

Governments across the world are establishing stringent regulations aimed at reducing plastic waste, such as the European Union's directive to ban single-use plastics. With rising environmental concerns and government regulations, healthcare providers are prioritizing eco-friendly and sustainable alternatives to traditional plastics. According to a report by the World Health Organization, approximately 16 billion medical syringes are used annually, contributing significantly to plastic waste. Thus, key players are focusing on innovating and developing biodegradable and recyclable medical plastics.

The market players are also focusing on the development of high-performance polymers such as polyethylene, acrylonitrile butadiene styrene (ABS), polyvinyl chloride (PVC), and others. The innovation of such polymers has helped the industry to manufacture innovative medical devices and products that are resistant to wear and tear, acids and alkalis, cleaning agents, disinfectants, and others. In the healthcare industry, polypropylene is used in the manufacturing of packaging, housings, and syringes. Thus, the growing technological advancements in medical-grade plastics that enhance device performance are boosting the medical plastic market expansion.

Medical Plastic Market Segment Insights

Medical Plastic Market Assessment by Polymer Type Outlook

The global medical plastic market segmentation, by polymer type, includes thermoplastics, elastomers, biodegradable polymers, and others. In 2024, the thermoplastics segment held the largest market share due to their biocompatibility, durability, and ease of processing. Materials, including polyethylene (PE), polypropylene (PP), polyvinyl chloride (PVC), and polyether ether ketone (PEEK), are widely employed in medical devices such as surgical instruments, implants, and drug delivery systems. Moreover, the increasing demand for lightweight, cost-effective, and sterilizable materials has significantly driven the adoption of thermoplastics in the healthcare industry.

Compared to traditional materials such as metals and ceramics, thermoplastics offer advantages such as lower production costs, ease of manufacturing, and compatibility with various sterilization techniques, including gamma radiation, ethylene oxide, and autoclaving. Therefore, the demand for high-performance thermoplastics is expected to grow as medical technology continues to advance, ensuring the development of safer and more efficient medical solutions that cater to the evolving needs of the healthcare industry.

Medical Plastic Market Evaluation by Application Outlook

The global medical plastic market, based on application, is divided into medical instruments & devices, medical disposables, diagnostic instruments & tools, and others. In 2024, the medical instruments & devices segment held significant market share due to growing demand for innovative, reliable, and cost-effective healthcare solutions.

Factors such as the rising number of medical procedures, increasing prevalence of chronic conditions, and surging aging populations are propelling the demand for medical instruments and devices. Healthcare providers are increasingly relying on these devices to deliver accurate diagnoses, enhance patient care, and improve outcomes.

The development of advanced polymer materials with enhanced properties such as high strength, chemical resistance, and sterilization compatibility has expanded the availability of medical devices. Polymers' flexibility and lightweight nature enable the creation of devices that reduce surgical risks, recovery times, and complications, all of which are critical for patient well-being. The medical instruments and devices segment is expected to expand during the forecast period, driven by technological advancements, increasing healthcare investments, rising demand for minimally invasive procedures, and a continuous focus on improving patient care and safety.

Medical Plastic Market Evaluation by Manufacturing Outlook

The global medical plastic market, based on manufacturing, is segregated into extrusion tubing, injection molding, compression molding, and others. The extrusion tubing segment is expected to witness the highest growth rate during the forecast period due to its precision and suitability for producing medical tubes with specific dimensions and complex multi-lumen designs.

Medical tubing extrusion is used to manufacture catheters, IV lines, dialysis tubing, and surgical drains. These tubes have to undergo rigorous safety and quality standards since they constantly come into contact with sensitive body parts or fluids.

One of the key drivers propelling the growth of this segment is the increasing demand for devices such as catheters and IV tubes owing to the rising prevalence of chronic diseases and the growing elderly population, both of which require consistent and specialized care. Moreover, advancements in polymer materials, such as the development of antimicrobial and kink-resistant formulations, have enhanced the performance and safety of these products, further fueling the market growth.

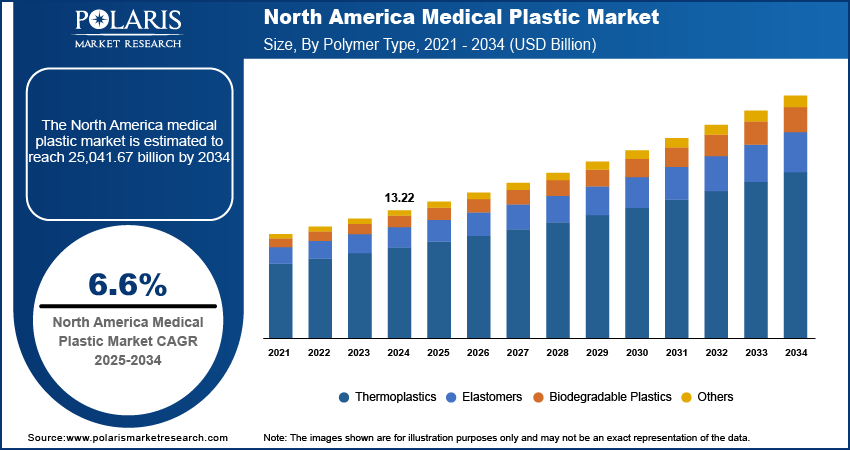

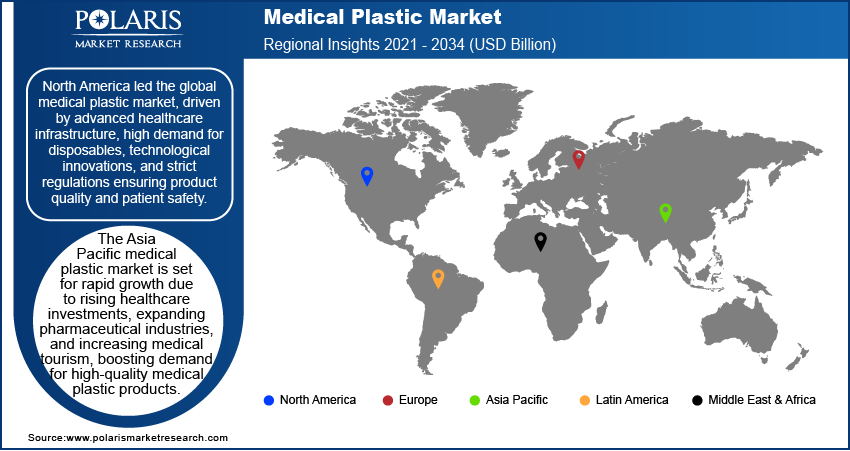

Medical Plastic Market Regional Analysis

by region, the study provides medical plastics market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest share of the global medical plastics market revenue. Growing demand for minimally invasive surgeries and devices for medical procedures drives the dominance of the regional market. According to the American Academy of Orthopedic Surgeons, in 2024, hip and knee replacements were widely performed in the US, with ∼1.3 billion knee replacement surgeries and up to 760,000 hip replacement surgeries. The use of medical polymers in implants, surgical tools, and prosthetics is expected to grow during the forecast period as the demand for minimally invasive procedures increases.

Market players in the US are actively collaborating and expanding to strengthen their presence in the medical plastic industry. In June 2022, Zeus increased its catheter manufacturing capacity by leveraging advanced polymer solutions to drive medical device innovation. Strategic expansions and technological advancements are expected to accelerate the North America medical plastics market expansion and improve patient care.

The US medical plastics market has experienced significant growth, largely driven by key government initiatives such as the Affordable Care Act (ACA) and Medicaid, which have expanded access to healthcare services for a large portion of the population. This increased accessibility to healthcare has boosted the demand for drugs, medical devices, and healthcare services, creating the need for medical polymers.

Canada holds a significant share of the North America medical plastic market revenue owing to the increasing demand for advanced healthcare solutions across the country. The need for high-quality medical devices and products continues to grow with the country’s expanding healthcare infrastructure and a rising aging population. As of July 1, 2024, Canada’s population of seniors aged 65 and above surpassed 7.8 billion, accounting for nearly 20% of the total population. This demographic shift emphasizes the increasing need for healthcare solutions tailored to an aging population, further driving the demand for advanced medical plastics in the country.

The medical plastics market in Asia Pacific is growing rapidly, fueled by rising healthcare demands, technological advancements, and increasing investments. China, India, and Japan are among the key players in the Asia Pacific medical plastics market, supported by a rising aging population and increasing prevalence of chronic diseases. Increasing demand for lightweight, durable, and sterile medical equipment has led to a surge in the use of high-performance polymers across various medical applications. According to the Asia Pacific Medical Technology Association (APACMed), the region consists of 25,000 medical device companies, collectively contributing 2% to the GDP. These companies depend on advanced medical plastics to develop solutions, ensuring safety, efficiency, and compliance with stringent regulatory standards. The reliance on medical plastics for surgical instruments, drug delivery systems, and diagnostic tools is expected to rise as technological advancements continue to reshape the healthcare industry, further strengthening the medical plastics market trends during the forecast period.

Medical Plastic Market – Key Players and Competitive Analysis Report

The competitive landscape of the medical plastic market is characterized by a mix of established players and emerging companies striving to capture market share in a rapidly growing industry. Key players focus on product innovation, strategic partnerships, and investments in research and development to expand their offerings and meet diverse consumer demands. However, the medical plastic market witness’s intense competition as new entrants introduce innovative solutions, leveraging breakthroughs in medical-grade plastics. While opportunities are abundant, challenges such as stringent regulatory requirements and competition from alternative products necessitate innovation from medical plastic market players.

Dow is a chemical manufacturing conglomerate with a wide range of products. The company offers consumer care, construction, and industrial materials science solutions across the US, Canada, Latin America, Europe, Africa, India, the Middle East, and Asia Pacific. Its portfolio includes six global business divisions, structured into three functioning segments, including industrial intermediates & infrastructure, packaging & specialty plastics, and performance material & coatings. The packaging & specialty plastics segment offers ethylene, polyolefin elastomers, propylene and aromatics products, ethylene propylene diene monomer rubbers, polyethylene, and ethylene-vinyl acetate.

Covestro AG is a global supplier and manufacturer of high-tech polymer materials and innovative application solutions. The company operates through two major segments—performance materials and solutions & specialties. It has a presence across Europe, the Middle East, Africa, Latin America, North America, and China, catering to diverse industries with advanced material technologies. The performance materials segment focuses on the development, production, and supply of high-performance materials, including polyurethanes and polycarbonates. Covestro also offers base chemicals such as diphenylmethane diisocyanate (MDI), long-chain polyols, toluylene diisocyanate, and polycarbonate resins.

List of Key Companies in Medical Plastic Market

- Arkema

- BASF

- Celanese Corporation

- Covestro AG

- DOW

- dsm-firmenich

- Eastman Chemical Company

- Evonik Industries AG

- INEOS

- Kraton Corporation

- Röchling SE & Co. KG

- SABIC

- Solvay

- The Lubrizol Corporation

- Trinseo

Medical Plastic Industry Developments

March 2024: Covestro launched a new polycarbonate copolymer plant in Antwerp, using a solvent-free melt process to enable customizable properties for applications in electronics and healthcare.

September 2024: Evonik launched a new spray drying facility for EUDRAGIT polymers in Darmstadt, enhancing supply security, reducing delivery times, and supporting sustainable production for pharmaceutical oral drug delivery solutions.

October 2022: Celanese expanded its market expansion with a new cleanroom in Edmonton for cryogenic micronization of VitalDose EVA, enhancing sustained-release drug delivery for conditions such as cancer, retinal, and CNS disorders.

Medical Plastic Market Segmentation

By Polymer Type Outlook (Revenue, USD Billion, 2021–2034)

- Thermoplastics

- Elastomers

- Biodegradable Polymers

- Others

By Application Outlook (Revenue, USD Billion, 2021–2034)

- Medical Instruments & Devices

- Medical Disposable

- Diagnostic Instruments & Tools

- Others

By Manufacturing Outlook (Revenue, USD Billion, 2021–2034)

- Extrusion Tubing

- Injection Molding

- Compression Molding

- Other

By Regional Outlook (Revenue, USD Billion, 2021–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Medical Plastic Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 31.94 billion |

|

Market Size Value in 2025 |

USD 34.27 billion |

|

Revenue Forecast by 2034 |

USD 64.24 billion |

|

CAGR |

7.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2021–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global medical plastic market size was valued at USD 31.94 billion in 2024 and is projected to grow to USD 64.24 billion by 2034.

• The global market is projected to register a CAGR of 7.2% during the forecast period.

• In 2024, North America accounted for the largest market share, driven by rising demand for safe-grade medical devices and maintaining hygiene.

• A few of the key players in the market are DOW, Covestro AG, Celanese Corporation, Eastman Chemical Company, Evonik Industries AG, SABIC, BASF, Arkema, dsm-firmenich, Kraton Corporation, INEOS, Solvay, The Lubrizol Corporation, Trinseo, and Röchling SE & Co. KG.

• In 2024, the thermoplastics segment held the largest market share due to their versatility, safety, and cost-effectiveness.

• by 2034, the medical disposable segment is expected to witness significant market growth due to the rising prevalence of diabetes, cardiovascular diseases, and cancer.