Medical Plastic Compounds Market Size, Share, Trends, Industry Analysis Report: By Product (Polyvinylchloride, Polyethylene, Polypropylene, Polystyrene, Polyester, Polycarbonate, Polyurethane, Acrylics, and Others), Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 129

- Format: PDF

- Report ID: PM5421

- Base Year: 2024

- Historical Data: 2020-2023

Medical Plastic Compounds Market Overview

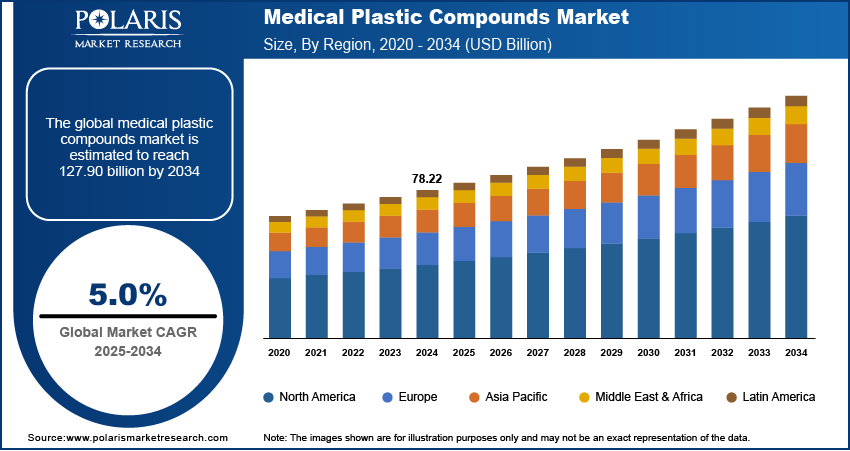

The global medical plastic compounds market size was valued at USD 78.22 billion in 2024 and is expected to reach USD 82.10 billion by 2025 and 127.90 billion by 2034, exhibiting a CAGR of 5.0% during 2025–2034.

The medical plastic compounds market encompasses the production and application of specialized plastic materials engineered for use in the healthcare and medical industry. These compounds are formulated to meet stringent medical-grade standards, ensuring biocompatibility, sterilizability, and durability.

To Understand More About this Research: Request a Free Sample Report

Increasing preference for single-use medical products, such as syringes, catheters, and IV bags, to prevent cross-contamination and infections boosts the medical plastic compounds market growth. Moreover, innovations in medical devices and drug delivery systems are driving the need for advanced, durable, and lightweight medical plastic compounds, which is driving market demand.

Rising investments in healthcare infrastructure across emerging economies enhance the need for advanced medical devices and materials, fueling the medical plastic compounds market demand. Furthermore, the rising development of high-performance medical plastics with enhanced strength, flexibility, and chemical resistance fuels the market expansion.

Medical Plastic Compounds Market Dynamics

Growing Aging Population

The aging population across the world is rising significantly. According to the World Health Organization, about 16.7% of the global population will be aged 60 and above, increasing from 1 billion in 2020 to 1.4 billion by 2030. Moreover, by 2050, this demographic is expected to reach 2.1 billion, effectively doubling in just 30 years. The geriatric population is prone to various diseases, requiring a higher volume of medical procedures and devices. As a result, there is a rising demand for advanced medical-grade plastics used in surgical instruments, diagnostic equipment, and mobility aids. Additionally, the rising need for specialized packaging solutions for pharmaceuticals and medical supplies further enhances the need for plastic compounds. As the global aging population is set to increase steadily, the demand for safe, durable, and efficient medical products is expected to rise. Hence, the growing aging population is projected to boost the medical plastic compounds market growth during the forecast period.

Favorable Regulatory Support for Biocompatible Plastics

Favorable regulations supporting the use of biocompatible and nontoxic plastics are driving significant medical plastic compounds market expansion. For instance, in November 2024, the Biden-Harris Administration launched a comprehensive National Strategy aimed at mitigating plastic pollution. The strategy highlights collaboration with industry stakeholders, local governments, and environmental organizations to boost sustainable practices and promote research into biodegradable alternatives. The administration aims to reduce the environmental impact of plastic pollution and advance the transition toward a circular economy. These regulations promote the adoption of materials that meet stringent safety and compatibility standards for medical applications, including implants, surgical instruments, and drug delivery systems. The focus on reducing patient risks and enhancing product efficacy has led to growing market demand for advanced biocompatible plastics. This regulatory support ensures compliance with global safety standards and fuels innovation, creating substantial growth opportunities for manufacturers to meet the rising demand for safer and more sustainable medical solutions.

Medical Plastic Compounds Market Segment Insights

Medical Plastic Compounds Market Assessment by Product Outlook

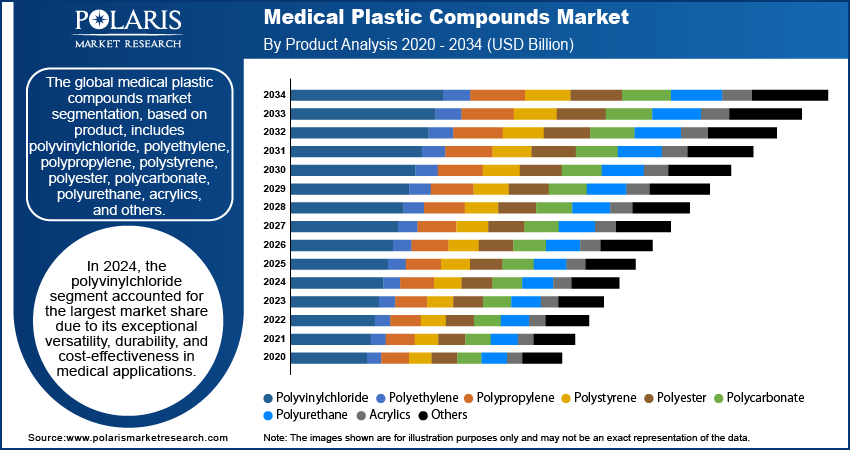

The global medical plastic compounds market segmentation, based on product, includes polyvinylchloride, polyethylene, polypropylene, polystyrene, polyester, polycarbonate, polyurethane, acrylics, and others. In 2024, the polyvinylchloride segment accounted for the largest share of the medical plastic compounds market revenue due to its exceptional versatility, durability, and cost-effectiveness in medical applications. PVC’s inherent properties, such as chemical resistance, flexibility, and compatibility with sterilization methods, make it a preferred material for manufacturing medical devices, including IV bags, tubing, catheters, and blood bags. Additionally, its ability to be customized to meet specific performance requirements further drives market demand. The dominance of the polyvinylchloride segment is also supported by its established role in healthcare, compliance with stringent safety standards, and affordability, which supports broader adoption in cost-sensitive medical markets.

Medical Plastic Compounds Market Evaluation by Application Outlook

The global medical plastic compounds market segmentation, based on application, includes disposables, catheters, surgical instruments, medical bags, implants, drug delivery systems, and others. In 2024, the disposables segment led the medical plastic compounds market share due to the increasing use of single-use medical devices and consumables in healthcare settings. Rising concerns over cross-contamination and healthcare-associated infections (HAIs) have driven the demand for disposable products such as syringes, IV tubes, catheters, and surgical gloves, which are primarily made from medical-grade plastics. The growing emphasis on infection control and patient safety, coupled with the convenience and cost-efficiency of disposables, has fueled market demand. Additionally, advancements in plastic compounds tailored for disposable applications have further contributed to the segment's dominance.

Medical Plastic Compounds Market Regional Analysis

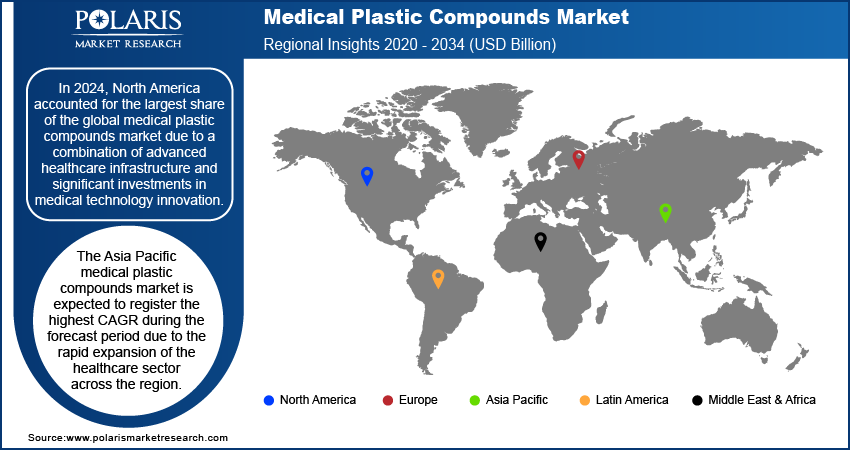

By region, the study provides medical plastic compounds market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest market share due to a combination of advanced healthcare infrastructure and significant investments in medical technology innovation. Moreover, strict regulatory frameworks mandating the use of biocompatible and high-quality materials boost the regional market growth. The region's rapidly aging population and increasing prevalence of chronic diseases have driven the demand for medical devices, disposables, and diagnostic equipment, thereby boosting market demand. According to the Centers for Disease Control and Prevention, in the US, approximately 1.7 million people are diagnosed with cancer each year, resulting in over 600,000 deaths, making it the second leading cause of death. The cost of cancer care is rising and is expected to surpass USD 240 billion by 2030. Additionally, the strong presence of leading medical plastic manufacturers and rising research and developments in plastic compounds have further accelerated the North America medical plastic compounds market expansion. The region’s focus on sustainability, including the adoption of recyclable and eco-friendly medical plastics, has also contributed to its leadership position. Moreover, the emphasis on patient safety and infection control in hospitals and healthcare settings has amplified the use of disposable products, fueling the market growth. This dynamic ecosystem of innovation, regulation, and demand firmly establishes North America as a dominant player in the global medical plastic compounds market.

The Asia Pacific medical plastic compounds market is expected to register the highest CAGR during the forecast period due to the rapid expansion of the healthcare sector, increasing government investments in healthcare infrastructure, and the rising demand for advanced medical devices and disposables. The World Bank is advancing health sector investments in East Asia and the Pacific to enhance human capital, protect lives, and promote economic resilience post-pandemic. This support focuses on expanding coverage, improving primary healthcare quality, and strengthening essential public health functions through evidence-based reforms and innovative practices. The region's growing population, coupled with a surging prevalence of chronic and lifestyle-related diseases, is driving demand for efficient and cost-effective medical solutions. Additionally, the adoption of advanced manufacturing technologies, such as 3D printing and biocompatible materials, is contributing to market expansion. Favorable policies promoting domestic production and the influx of foreign investments in emerging economies such as China and India are further accelerating the medical plastic compounds market growth. Also, the increasing awareness of hygiene and infection prevention is boosting the demand for disposable medical products and supporting the requirement for medical plastic compounds across the region.

Medical Plastic Compounds Market – Key Players & Competitive Analysis Report

The competitive landscape of the medical plastic compounds market is characterized by the presence of several key global players, including companies that specialize in producing advanced polymer compounds, as well as those offering customized solutions for the medical and healthcare industries. Leading companies in the market focus on enhancing their market share by investing in R&D, expanding production capacities, and developing innovative, biocompatible, and sustainable materials for medical applications. Major players such as BASF SE, Covestro AG, DSM Engineering Plastics, and Sabic are at the forefront, competing by offering high-performance plastics used in medical devices, packaging, and diagnostics. Additionally, these companies are increasingly integrating digital technologies such as smart polymers and 3D printing in their product offerings to cater to the growing demand for personalized medicine and patient-specific treatments. Strategic partnerships and mergers and acquisitions are common strategies used by market leaders to enhance their technological capabilities and market presence.

The medical plastic compounds market experiences intense competition from regional players who focus on specific geographic areas, driving innovation and market demand with locally tailored solutions. The dynamic competitive landscape is further influenced by regulatory changes, as companies are required to comply with stringent standards such as FDA and ISO certifications for medical-grade materials. This competition is pushing companies to continuously innovate and provide more efficient, cost-effective solutions, thereby driving the medical plastic compounds market expansion.

BASF is a chemical corporation that operates across the world. The company operates through seven segments—chemicals, industrial solutions, materials, surface technologies, nutrition & care, agricultural solutions, and others. Petrochemicals and intermediates are provided in the chemicals section. BASF offers high-performance medical-grade plastic compounds with excellent biocompatibility, sterilizability, and durability. These materials meet stringent healthcare standards, ensuring safety and reliability for medical devices, diagnostic equipment, and pharmaceutical packaging. Polymer dispersions, resins, electronic materials, pigments, antioxidants, light stabilizers, oilfield chemicals, mineral processing, and hydrometallurgical chemicals are among the ingredients and additives developed and sold by the industrial solutions sector.

Evonik Industries AG specializes in the production of high-performance specialty chemicals across global regions, including Asia Pacific, Europe, the Middle East, Africa, Central & South America, and North America. The company's operations are segmented into five key areas—specialty additives, nutrition & care, smart materials, performance materials, and technology & infrastructure. The specialty additives component focuses on providing fumed silicas, advanced additives for polyurethane, matting agents, and specialty resins tailored for coatings, paints, and printing inks. The company also supplies isophorone and epoxy curing agents utilized in adhesives, coatings, and composites. Evonik Industries AG offers high-performance medical plastic compounds, including biocompatible and sterilizable materials for medical devices, implants, and drug delivery systems, ensuring durability, safety, and compliance with stringent healthcare regulations.

List of Key Companies in Medical Plastic Compounds Market

- BASF

- Celanese Corporation

- Covestro AG

- Dow

- DuPont

- Eastman Chemical Company

- Evonik Industries AG

- Mitsubishi Chemical Group Corporation.

- RAUMEDIC AG

- SABIC

- Saint-Gobain Performance Plastics Pampus GmbH.

- Solvay

- Tekni-Plex, Inc.

- Teknor Apex

- Trelleborg Group.

Medical Plastic Compounds Industry Developments

In June 2024, Evertis, a PET film manufacturer, launched its Evercare brand for healthcare packaging. This initiative aims to deliver innovative, eco-friendly solutions that meet the strict demands of medical and pharmaceutical applications.

In January 2024, Peak Performance Compounding introduced Synergy, advanced low-friction combinations optimized for single and dual-layer tube extrusion, injection molding, and blow molding applications. These advanced materials enhance processing efficiency and product performance across various industrial uses.

Medical Plastic Compounds Market Segmentation

By Product Outlook (Volume, Kilotons; Revenue, USD Billion; 2020–2034)

- Polyvinylchloride

- Polyethylene

- Polypropylene

- Polystyrene

- Polyester

- Polycarbonate

- Polyurethane

- Acrylics

- Others

By Application Outlook (Volume, Kilotons; Revenue, USD Billion; 2020–2034)

- Disposables

- Catheters

- Surgical Instruments

- Medical Bags

- Implants

- Drug Delivery System

- Other

By Regional Outlook (Volume, Kilotons; Revenue, USD Billion; 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Medical Plastic Compounds Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 78.22 Billion |

|

Market Size Value in 2025 |

USD 82.10 Billion |

|

Revenue Forecast by 2034 |

USD 127.90 Billion |

|

CAGR |

5.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume in Kilotons; Revenue in USD Billion, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global medical plastic compounds market size was valued at USD 78.22 billion in 2024 and is projected to grow to USD 127.90 billion by 2034.

The global market is projected to register a CAGR of 5.0% during the forecast period.

In 2024, North America accounted for the largest market share due to a combination of advanced healthcare infrastructure and significant investments in medical technology innovation.

A few of the key players in the market are BASF; Celanese Corporation; Covestro AG; Dow; DuPont; Eastman Chemical Company; Evonik Industries AG; Mitsubishi Chemical Group Corporation; RAUMEDIC AG; SABIC; Saint-Gobain Performance Plastics Pampus GmbH; Solvay; Tekni-Plex, Inc.; Teknor Apex; and Trelleborg Group.

In 2024, the polyvinylchloride segment accounted for the largest market share due to its exceptional versatility, durability, and cost-effectiveness in medical applications.

In 2024, the disposables segment accounted for the largest market share due to the increasing use of single-use medical devices and consumables in healthcare settings