Medical Marker Bands Market Share, Size, Trends, Industry Analysis Report, By Material (Gold, Platinum-Iridium, Platinum, Polymers, Palladium, Tantalum, and Others); By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 119

- Format: PDF

- Report ID: PM3684

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

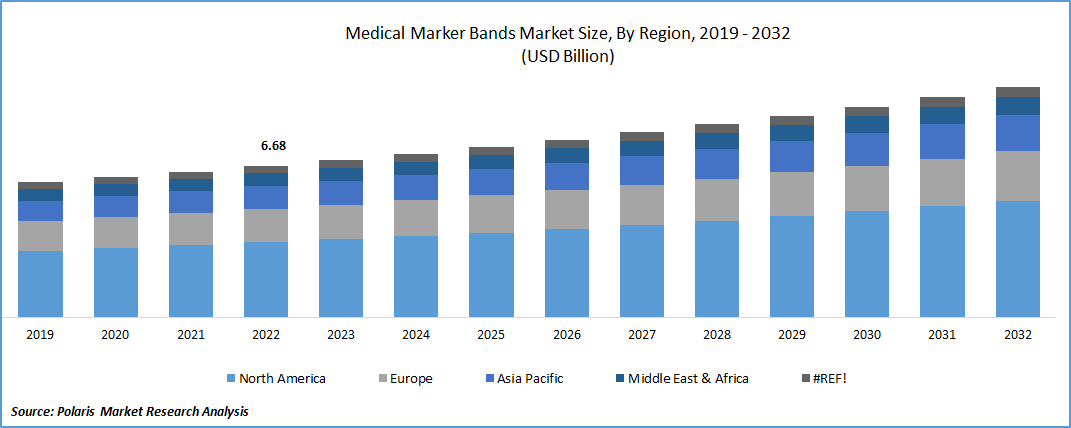

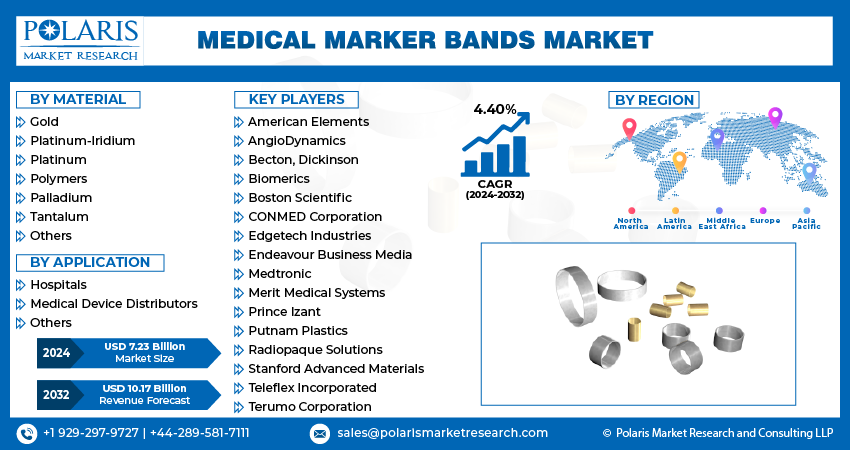

The global medical marker bands market was valued at USD 6.95 billion in 2023 and is expected to grow at a CAGR of 4.40% during the forecast period.

The rapidly increasing adoption of minimally invasive procedures globally, as it offers several advantages over traditional open surgeries including reduced scarring, shorter recovery time, and lower risk of complications and growing utilization of marker bands in various types of diagnostic procedures such as biopsy and localization of abnormal tissues, are key factors contributing to the market growth.

To Understand More About this Research: Request a Free Sample Report

In addition, the rising number of government and private healthcare institutions investing heavily for the development of new products with advanced characteristics, which increases the application area of marker bands, are further likely to enhance the medical marker bands market growth.

- For instance, in April 2023, Penumbra, announced the expansion of its RED family of catheter devices for mechanical thrombectomy, which include features like articulating marker bands with short polymer tip design, low profile and atraumatic design, lumen integrity, and softer profile atraumatic navigation. The newly developed device has gained approval from the US Food and Drug Administration, as per the 510(k) premarket notification.

Moreover, significant advancements and improvements in marker band design and manufacturing techniques, which have improved their visibility under imaging modalities like X-ray, computed tomography, and magnetic resonance imaging, allowing for accurate localization and positioning during procedures, enhancing precision and reducing potential errors, is likely to create new revenue opportunities for the companies operating in the market.

The outbreak of the COVID-19 pandemic has significantly impacted the growth of the medical marker bands market. With the spread of the pandemic, most of the large hospitals have started focusing on treatment of COVID-19 patients, which resulted in postponement of elective procedures and several other treatments, leading to declined demand for marker bands. Patients were also hesitant to visit hospitals or clinics for non-emergency treatments due to fear of exposure to the virus, that negatively influenced the market.

Industry Dynamics

Growth Drivers

Rising popularity of regenerative medicine treatments, an increase in cancer cases worldwide drives the industry growth

The rising popularity and prevalence of regenerative medicine treatment across the globe, drastic increase in number of cancer cases worldwide, and widespread need for precise & minimally invasive surgeries owing to its ability to reduce morbidity, shorter recovery time, and enhanced clinical outcomes compared to several traditional or conventional methods like open-heart surgery, are among the major factors boosting the market growth and demand at rapid pace. Furthermore, with the constant surge in global population and rising health issues leading to higher need for effective treatment procedures, the healthcare expenditure across both developed and developing economies to cater the demand for healthcare products has grown drastically in the recent years, which in turn, propelling the growth of the market over the years.

- For instance, according to a report from CMS, the total health care spending across the United States grew to USD 4.3 trillion or 4.2% in 2021 and the report also estimates that the country’s health care spending will be growing at an average rate of 4.9% from 2022 to 2024 and will hit USD 6.8 trillion in 2030.

Report Segmentation

The market is primarily segmented based on material, application, and region.

|

By Material |

By Application |

By Region |

|

|

|

For Specific Research Requirements: Request for Customized Report

By Material Analysis

Polymers segment accounted for the largest market share in 2022

The polymers segment accounted for largest market share in 2022, and is likely to retain its market position throughout the anticipated period, on account of growing preference for the material due to its high durability and excellent strength and its prevalence as an environmentally friendly material that can be easily recycled without losing any of its qualities. Additionally, polymers are well known because of its ability to offer a high degree of customization in terms of size, shape, and color, which enables the development of marker bands tailored to specific medical devices, procedures, or patient requirements, facilitating precise localization and identification, which in turn, pushing the segment market forward at rapid pace.

The platinum-iridium segment is projected to grow at significant growth rate over the next coming years, mainly attributable to its numerous beneficial properties including better stability and biocompatibility, that makes its suitable to be used in medical applications like marker bands used in procedures like vascular interventions and stenting. The rising incidences of cardiovascular diseases such as coronary artery disease, peripheral arterial disease, and heart valve disorders, resulting in high demand for medical devices like stents, catheters, and guidewires that uses platinum-iridium, is also contributing towards the market growth.

- For instance, European Society of Cardiology stated that currently there are over 6 million new cases of cardiovascular diseases in the European Union every year, with around 49 million people are living with the diseases in EU. Every year, the disease cause over 3.9 million deaths in Europe and over 1.8 million deaths in the EU.

By Application Analysis

Hospitals segment held the maximum market share in 2022

The hospitals segment held the maximum market share in terms of revenue in 2022, which is mainly driven by widespread use of these devices in applications like hospital identification bracelets and patient wristbands and the increasing prevalence of chronic diseases such as cancer, cardiovascular disorders, and neurological conditions, which necessitates frequent medical interventions and surgeries. Along with this, the significant expansion of healthcare infrastructure including the establishment of new hospitals, creates a higher demand for medical marker bands. As healthcare facilities increase in number, the requirement for marker bands for various medical procedures also rises.

The medical device distributors segment is likely to gain substantial growth rate over the next coming years, that is largely accelerated by exponential growth in the usage of medical devices in various procedures and treatment and growing focus on major market players towards optimizing the supply chains through consolidating and streamlining distribution processes.

Regional Insights

North America region dominated the global market in 2022

The North America region dominated the global market with healthy market share in 2022, and is anticipated to continue its market dominance throughout the forecast period, mainly due to increasing implementation on R&D activities to develop products which could be widely used within hospital and clinics and surging people awareness regarding the benefits of marker bands. Beside this, the region has well-established healthcare systems and reimbursement policies that support and encourage the usage of medical marker bands, further contributing to market growth.

The Asia Pacific region is projected to be the fastest growing region with a significant CAGR over the study period, owing to rapid adoption of new product with advanced capabilities, continuously rising geriatric population, and public awareness of health issues along with the number of government authorities promoting the medical research & innovation, creating a supportive environment for the growth of the market.

- For instance, the number of people aged 60 and above or elderly population in India, is estimated to reach 194 million by 2031 with a significant increase from 138 million in 2021, approx. 41% rise in just a decade. The percentage share of elderly population in total population is projected to grow from 10.1% in 2021 to 13.1% by 2031.

Key Market Player & Competitive Insight

Leading players use advanced engineering technologies to enhance extrusion processes for embedding medical marker bands into catheters. They prioritize using durable materials to fight bodily fluids exposure during procedures. Significant stakeholders are carefully considering the strict regulatory guidelines regarding the surface and edge conditions of medical marker bands.

Some of the major players operating in the global market include:

- American Elements

- AngioDynamics

- Becton, Dickinson

- Biomerics

- Boston Scientific

- CONMED Corporation

- Edgetech Industries

- Endeavour Business Media

- Medtronic

- Merit Medical Systems

- Prince Izant

- Putnam Plastics

- Radiopaque Solutions

- Stanford Advanced Materials

- Teleflex Incorporated

- Terumo Corporation

Recent Developments

- In November 2022, Resonetics, announced the launch of its new Contego 20 mAh lithium-ion battery, a lightweight, implantable, miniature D-shaped cell with a longer shelf life and will be used for large range of medical applications like cardiac monitors, stimulators, and neuromodulators. The company has been heavily investing in implantable technology that will help their customers to develop various groundbreaking bioelectronic devices.

- In February 2021, Teleflex, announced about the acquisition of Z-Media & the company has been helping hospitals, militaries, law enforcement, and first responders across the world to save lives and improves the outcomes with its QuikClot brand. The acquisition has done against a cash consideration of USD 500 million and additional USD 25 million upon the achievement of certain milestones.

Medical Marker Bands Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 7.23 billion |

|

Revenue forecast in 2032 |

USD 10.17 billion |

|

CAGR |

4.40% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Material, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation |

FAQ's

key companies in medical marker bands market are American Elements, AngioDynamics, Becton, Dickinson, Biomerics.

The global medical marker bands market is expected to grow at a CAGR of 4.3% during the forecast period.

The medical marker bands market report covering key segments are material, application, and region.

key driving factors in medical marker bands market are rising popularity of regenerative medicine treatments, an increase in cancer cases worldwide.

The global medical marker bands market size is expected to reach USD 10.17 billion by 2032.