Medical Lasers Market Size, Share, Trends, Industry Analysis Report: By Product (Diode Laser, Solid State Laser, Gas Laser, and Dye Laser), Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 119

- Format: PDF

- Report ID: PM5432

- Base Year: 2024

- Historical Data: 2020-2023

Medical Lasers Market Overview

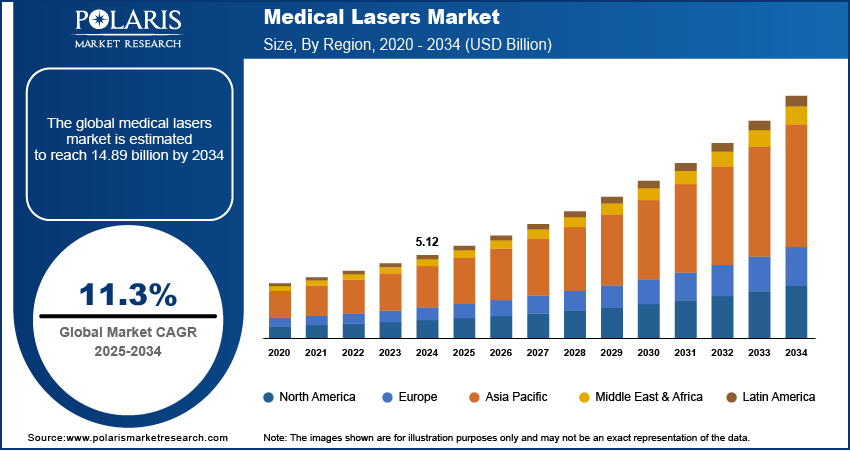

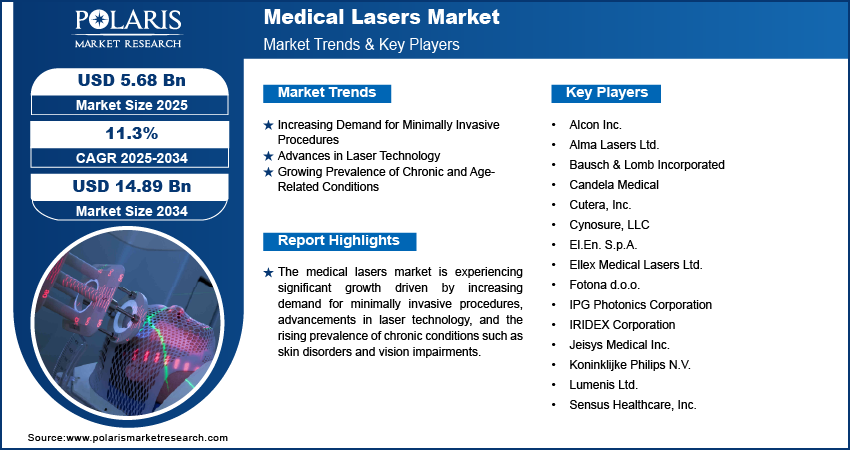

The medical lasers market size was valued at USD 5.12 billion in 2024. The market is projected to grow from USD 5.68 billion in 2025 to USD 14.89 billion by 2034, exhibiting a CAGR of 11.3% during 2025–2034.

The medical lasers market refers to the industry focused on the development, manufacturing, and application of laser technologies for medical purposes, including surgical procedures, aesthetic treatments, and diagnostic applications. Key drivers of this market include the increasing prevalence of chronic diseases, advancements in laser technology, and the growing demand for minimally invasive procedures. Additionally, the rise in aesthetic and cosmetic treatments, along with the expanding adoption of laser-based therapies across dermatology, ophthalmology, and dentistry, further supports the medical lasers market demand. Notable trends include the integration of AI for precision in laser-based treatments and the development of portable and user-friendly laser devices.

To Understand More About this Research: Request a Free Sample Report

Medical Lasers Market Dynamics

Increasing Demand for Minimally Invasive Procedures

Minimally invasive procedures are associated with reduced pain, faster recovery times, and minimal scarring, making them increasingly attractive to both patients and healthcare providers. Medical lasers are widely utilized in procedures such as laser-assisted surgeries, photorejuvenation, and hair removal, which require precision and minimal tissue damage. According to a 2023 report by the American Society of Plastic Surgeons, minimally invasive cosmetic procedures grew by 5% annually over the past five years, reflecting rising consumer interest in noninvasive and laser-based treatments. Therefore, the growing demand for minimally invasive procedures significantly fuels the medical lasers market development.

Advances in Laser Technology

Technological advancements have enhanced the efficiency, safety, and precision of laser systems, driving their adoption in medical applications. Innovations such as fractional lasers, picosecond lasers, and diode lasers have expanded the scope of laser-based treatments, enabling their use in oncology, ophthalmology, dermatology, and other areas. Additionally, the development of portable and compact laser devices has facilitated their use in outpatient settings, further boosting accessibility. For instance, the introduction of advanced excimer lasers has significantly improved outcomes in refractive eye surgeries, such as LASIK. Thus, rising advances in laser technology are contributing to the medical lasers market demand.

Growing Prevalence of Chronic and Age-Related Conditions

The rising prevalence of chronic diseases and age-related conditions, including skin disorders, vascular lesions, and vision impairments, is fueling the medical lasers market growth. Lasers are widely used for therapeutic and diagnostic purposes in these areas, particularly in dermatology and ophthalmology. For example, the World Health Organization (WHO) reported that over 2.2 billion people globally experience vision impairment, with many cases preventable or treatable through advanced technologies, such as laser-based interventions. Similarly, the prevalence of skin conditions such as psoriasis and rosacea has led to increased use of laser therapies for effective management. Hence, the growing prevalence of chronic and age-related conditions drives the medical lasers market growth.

Medical Lasers Market Segment Insights

Medical Lasers Market Assessment – Product-Based Insights

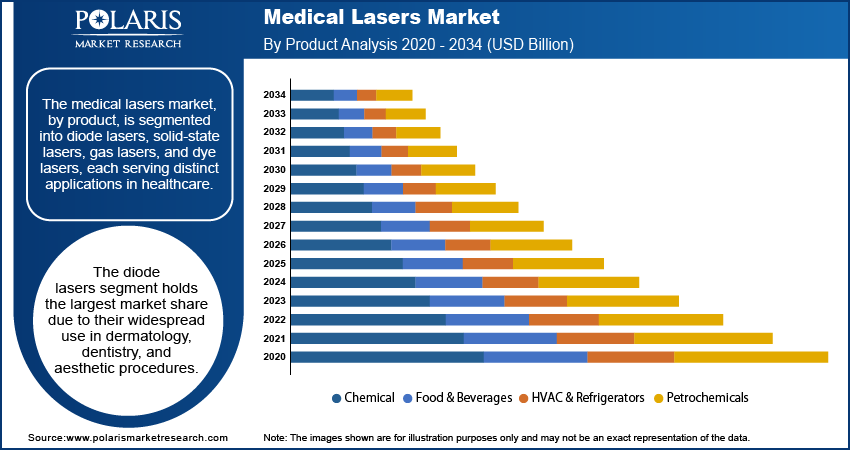

The medical lasers market, by product, is segmented into diode lasers, solid-state lasers, gas lasers, and dye lasers. The diode lasers segment holds the largest market share due to their widespread use in dermatology, dentistry, and aesthetic procedures. Their compact design, high efficiency, and ability to target specific tissues with minimal collateral damage make them highly preferred for hair removal, vascular lesion treatment, and photodynamic therapy. Furthermore, advancements in diode laser technology, such as higher power output and improved wavelength customization, have enhanced their effectiveness in various medical applications, contributing to their dominance in the market.

The solid-state lasers segment is registering the highest growth, driven by their increasing adoption in ophthalmology and surgical applications. These lasers, such as neodymium-doped yttrium aluminum garnet (Nd:YAG) lasers, are widely used for cataract surgeries and other precision treatments requiring high energy and focused beams. The growing prevalence of vision-related disorders and the rising demand for advanced laser systems in eye care significantly boost this segment's growth. Additionally, advancements in solid-state laser systems, including frequency-doubled and mode-locked technologies, are expanding their therapeutic potential and driving adoption in minimally invasive surgical procedures.

Medical Lasers Market Outlook – Application-Based Insights

The medical lasers market segmentation, by application, includes dermatology, ophthalmology, gynecology, urology, cardiovascular, and others. The dermatology segment holds the largest market share, primarily driven by the increasing demand for aesthetic and cosmetic procedures, such as skin resurfacing, tattoo removal, and hair removal. The growing prevalence of skin disorders, including psoriasis, acne scars, and vascular lesions, has further fueled the adoption of laser-based treatments in dermatology. Technological advancements, such as fractional lasers and picosecond lasers, have enhanced treatment outcomes, making them a preferred choice for patients seeking minimally invasive solutions. The rising awareness and accessibility of aesthetic treatments, combined with the growing popularity of medical tourism in dermatology, significantly contribute to the segment's dominance.

The ophthalmology segment is experiencing the highest growth, fueled by the rising incidence of vision disorders, including cataracts, glaucoma, and refractive errors. Laser technologies, such as excimer lasers and femtosecond lasers, are extensively used in corrective eye surgeries such as LASIK and photorefractive keratectomy (PRK). The increasing adoption of laser-based interventions for age-related macular degeneration and diabetic retinopathy further supports the segment's rapid growth. Advancements in precision and safety, along with the rising global demand for vision correction surgeries, are key factors driving the expansion of laser applications in ophthalmology.

Medical Lasers Market Regional Insights

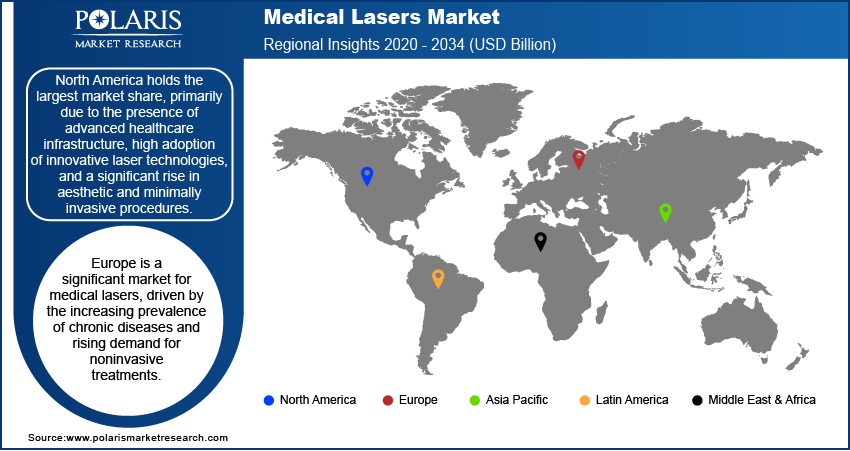

By region, the study provides medical lasers market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest market share, primarily due to the presence of advanced healthcare infrastructure, high adoption of innovative laser technologies, and a significant rise in demand for aesthetic and minimally invasive procedures. The increasing prevalence of chronic diseases, such as skin disorders and vision impairments, further drives demand for laser-based treatments in the region. Additionally, favorable reimbursement policies, extensive research and development activities, and the availability of skilled professionals contribute to North America's dominance in the market. The strong presence of key market players and consistent advancements in laser technologies further solidify the region’s leading position.

Europe is a significant market for medical lasers, driven by the increasing prevalence of chronic diseases and rising demand for non-invasive treatments. Countries such as Germany, France, and the UK are leading contributors due to advanced healthcare systems, growing adoption of aesthetic procedures, and favorable government policies promoting the use of innovative medical technologies. The region's aging population and increased focus on dermatological and ophthalmological treatments are also key factors fueling the regional market growth. Additionally, the presence of established medical laser manufacturers in Europe strengthens its market position.

The Asia Pacific medical lasers market is experiencing the fastest growth, attributed to the rising prevalence of skin disorders, vision impairments, and other chronic conditions in densely populated countries such as China and India. Increasing disposable income, growing awareness about advanced medical treatments, and the expanding medical tourism industry are significant drivers in the region. Government investments in healthcare infrastructure and the rising adoption of aesthetic treatments in emerging economies further contribute to market expansion. Moreover, local manufacturing and cost-effective laser devices make advanced laser technologies more accessible across Asia Pacific.

Medical Lasers Market – Key Players and Competitive Insights

The medical lasers market comprises several key players actively contributing to advancements in laser technologies for various medical applications. Lumenis Ltd. is renowned for its innovative solutions in surgical, ophthalmology, and aesthetic fields. Alcon Inc. specializes in eye care products, including advanced laser systems for ophthalmic procedures. Bausch & Lomb Incorporated offers a range of ophthalmic laser devices addressing various vision disorders. Candela Medical focuses on aesthetic laser systems for hair removal, skin rejuvenation, and tattoo removal. El.En. S.p.A. provides medical laser equipment for dermatology, surgery, and dentistry applications. Cutera, Inc. develops laser and energy-based systems for aesthetic treatments.

In the competitive landscape, companies are focusing on innovation and strategic partnerships to enhance their market positions. For instance, Lumenis Ltd. continues to expand its product portfolio through research and development, aiming to introduce advanced laser solutions across various medical fields. Alcon Inc. leverages its expertise in ophthalmology to provide advanced laser technologies for eye care professionals. Bausch & Lomb Incorporated emphasizes the development of laser devices that address a wide range of vision disorders, catering to the growing demand for ophthalmic treatments. Candela Medical focuses on delivering reliable and effective aesthetic laser systems, maintaining a strong presence in the aesthetic medicine market. El.En. S.p.A. invests in developing versatile medical laser equipment, catering to diverse medical specialties.

These companies' commitment to innovation and quality has solidified their positions in the medical lasers market. Their diverse product offerings and focus on addressing specific medical needs contribute to the overall growth and advancement of laser-based medical treatments. By continuously enhancing their technologies and expanding their applications, these key players play a crucial role in shaping the future of medical laser solutions.

Lumenis Ltd. is a well-known player in the medical lasers market, specializing in energy-based solutions, including laser technologies for aesthetic, ophthalmic, and surgical applications. The company develops laser systems used in dermatology, ophthalmology (such as laser vision correction), and various surgical procedures.

Alcon Inc. is primarily focused on ophthalmic medical devices and is a key player in the ophthalmic laser segment of the medical lasers market. Alcon offers laser technologies for procedures such as cataract surgery, LASIK, and other vision correction treatments.

List of Key Companies in Medical Lasers Market

- Alcon Inc.

- Alma Lasers Ltd.

- Bausch & Lomb Incorporated

- Candela Medical

- Cutera, Inc.

- Cynosure, LLC

- El.En. S.p.A.

- Ellex Medical Lasers Ltd.

- Fotona d.o.o.

- IPG Photonics Corporation

- IRIDEX Corporation

- Jeisys Medical Inc.

- Koninklijke Philips N.V.

- Lumenis Ltd.

- Sensus Healthcare, Inc.

Medical Lasers Industry Developments

- In January 2024, MERIDIAN received US Food and Drug Administration (FDA) approval for their MR Q series, providing a high-quality and inventive healthcare solution that meets the needs of patients and physicians worldwide.

- In September 2021, Lumenis announced the completion of the sale of its surgical business to Boston Scientific Corporation.

Medical Lasers Market Segmentation

By Product Outlook

- Diode Laser

- Solid State Laser

- Gas Laser

- Dye Laser

By Application Outlook

- Dermatology

- Ophthalmology

- Gynecology

- Urology

- Cardiovascular

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Medical Lasers Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 5.12 billion |

|

Market Size Value in 2025 |

USD 5.68 billion |

|

Revenue Forecast by 2034 |

USD 14.89 billion |

|

CAGR |

11.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The medical lasers market has been segmented into detailed segments of product and application. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy

The medical lasers market growth strategy focuses on technological advancements, product innovation, and expanding application areas across medical specialties such as dermatology, ophthalmology, and urology. Companies are investing in research and development to enhance laser precision, safety, and efficiency, catering to the growing demand for minimally invasive procedures. Strategic collaborations and mergers and acquisitions are also prominent to strengthen market presence and expand product portfolios. Additionally, manufacturers are leveraging digital marketing and training programs to educate healthcare professionals and end users, driving the adoption of laser-based medical solutions globally.

FAQ's

The medical lasers market size was valued at USD 5.12 billion in 2024 and is projected to grow to USD 14.89 billion by 2034.

The market is projected to register a CAGR of 11.3% during the forecast period.

North America held the largest share of the market in 2024.

A few key players in the medical lasers market include Alcon Inc.; Alma Lasers Ltd.; Bausch & Lomb Incorporated; Candela Medical; Cutera, Inc.; Cynosure, LLC; El.En. S.p.A.; Ellex Medical Lasers Ltd.; Fotona d.o.o.; IPG Photonics Corporation; IRIDEX Corporation; and Jeisys Medical Inc..

The diode lasers segment accounted for the largest share of the market in 2024.

The dermatology segment accounted for the largest share of the market in 2024.

Medical lasers refer to laser devices used in various medical procedures for diagnosis, treatment, and surgery. These lasers utilize focused light energy to target specific tissues with precision, allowing for minimally invasive treatments in areas such as dermatology, ophthalmology, urology, and surgery. Medical lasers are employed in a wide range of applications, including skin resurfacing, eye surgeries such as LASIK, hair removal, cancer treatment, and dental procedures. Key benefits of medical lasers include reduced recovery time, minimal scarring, and enhanced precision compared to traditional surgical methods.

A few key trends in the market are described below: Integration of AI and Automation: Increasing use of AI and automation to enhance the precision and efficiency of laser-based treatments. Growing Demand for Noninvasive Procedures: Rising preference for minimally invasive treatments in dermatology, ophthalmology, and aesthetics due to their quicker recovery times and reduced risks. Advancements in Laser Technologies: Development of more powerful, precise, and versatile laser systems, such as picosecond and fractional lasers, for various medical applications. Expansion in Aesthetic Treatments: Growing adoption of laser technologies in aesthetic medicine, including skin rejuvenation, hair removal, and tattoo removal.

A new company entering the medical lasers market must focus on developing innovative, cost-effective solutions that address emerging needs in minimally invasive treatments, particularly in dermatology and ophthalmology. Emphasizing advancements such as AI-driven precision, portability, and user-friendly designs could help differentiate its offerings. Additionally, exploring niche applications such as laser treatments for chronic conditions or personalized therapies tailored to individual patients could provide a competitive edge. Building strong partnerships with healthcare providers and offering comprehensive training and support services could further enhance market adoption and brand loyalty.

Companies manufacturing, distributing, or purchasing medical lasers and related products and other consulting firms must buy the report.