Medical Footwear Market Size, Share, Trends, Industry Analysis Report: By Product (Medical Shoes & Boots, Medical Sandals, and Others), End User, Distribution Channel, and Region (North America, Europe, Asia Pacific, Latin America and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 115

- Format: PDF

- Report ID: PM1743

- Base Year: 2024

- Historical Data: 2020-2023

Medical Footwear Market Overview

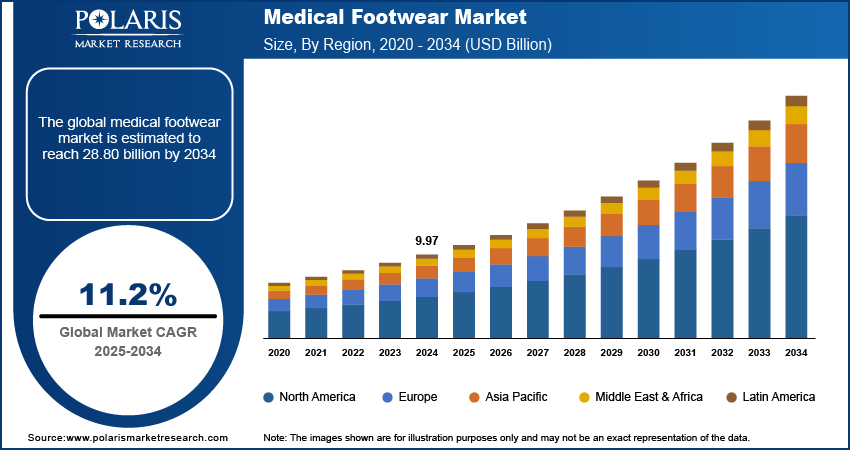

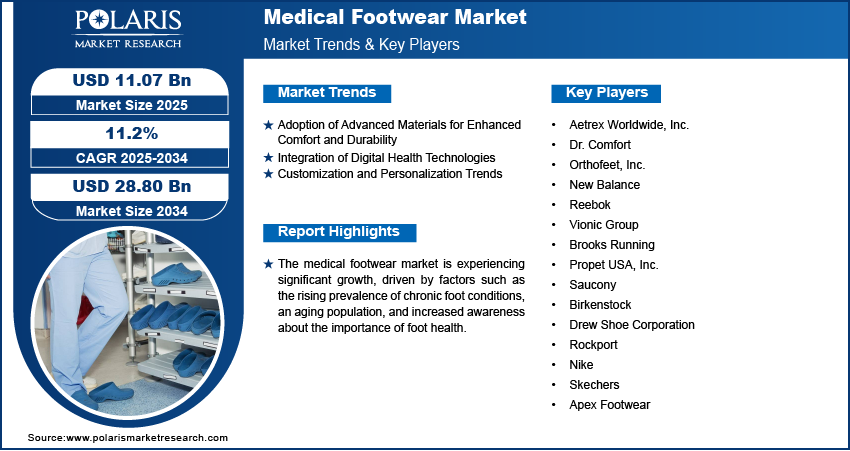

The global medical footwear market size was valued at USD 9.97 billion in 2024. The market is projected to grow from USD 11.07 billion in 2025 to USD 28.80 billion by 2034, exhibiting a CAGR of 11.2% from 2025 to 2034.

The medical footwear market focuses on the design, production, and distribution of shoes and footwear that support the treatment and management of medical conditions affecting the feet and lower limbs. This market includes products such as diabetic shoes, orthopedic shoes, and footwear designed for individuals with conditions like arthritis or plantar fasciitis.

To Understand More About this Research: Request a Free Sample Report

The rising prevalence of chronic foot conditions, an aging population, and increasing awareness about foot health are a few of the key factors driving the medical footwear market growth. Trends such as the adoption of advanced materials for comfort and durability, as well as the growing integration of digital health technologies in footwear for monitoring and managing health conditions, are also expected to influence market expansion. The demand for customizable and functional medical footwear is projected to continue growing as consumers seek personalized solutions to improve mobility and foot health.

Medical Footwear Market Dynamics

Adoption of Advanced Materials for Enhanced Comfort and Durability

Footwear designed for medical purposes is benefiting from innovations in material science, with manufacturers incorporating lightweight, breathable fabrics, memory foam, gel insoles, and ethylene vinyl acetate (EVA) to improve comfort. These materials help reduce pressure points, offering better support and providing superior shock absorption. For example, memory foam insoles are being increasingly used for their ability to mold to the shape of the foot, providing personalized comfort. The use of advanced materials not only enhances the wearer’s experience but also extends the lifespan of the product, making it more cost-effective in the long run. The preference for such materials is also driven by increased consumer demand for footwear that offers both therapeutic benefits and stylish design. Thus, the rising focus on the use of advanced materials to improve both comfort and durability is fueling the medical footwear market development.

Integration of Digital Health Technologies

The integration of digital health technologies into footwear products is a significant trend in the medical footwear market. Manufacturers are increasingly incorporating sensors and wearable technology into shoes that can track and monitor various health parameters, such as pressure distribution, gait, and step count. These technologies are particularly beneficial for managing chronic conditions like diabetes and arthritis, as they help prevent foot injuries and improve mobility. For instance, some medical footwear brands are developing smart shoes equipped with pressure sensors that alert users about potentially harmful pressure on specific areas of the foot. According to a study by the National Institutes of Health (NIH), the use of smart footwear for diabetic foot management has been shown to reduce the risk of ulcers and other complications. This growing focus on health monitoring devices aligns with the broader trend of digitization in healthcare and patient-centered care.

Customization and Personalization Trends

Consumers are seeking footwear that not only addresses specific health needs but also fits their personal preferences and lifestyles. In response, manufacturers are offering customizable options, such as adjustable insoles, orthotic-friendly shoes, and footwear tailored to individual foot shapes. This trend is driven by the recognition that medical conditions affecting the feet can vary widely between individuals, and a one-size-fits-all approach is no longer sufficient. Custom-fit shoes can provide greater comfort and support, helping to reduce the risk of further injury or discomfort. Advances in 3D printing technology also allow for the production of personalized insoles and shoe components, ensuring a more precise fit. According to the American Orthopedic Foot & Ankle Society (AOFAS), the demand for personalized orthotic footwear has risen significantly due to its role in managing and alleviating symptoms related to various foot disorders. This shift toward customization is expected to continue propelling the medical footwear market revenue as both consumers and healthcare professionals prioritize tailored solutions.

Medical Footwear Market Segment Insights

Medical Footwear Market Assessment Based on Product

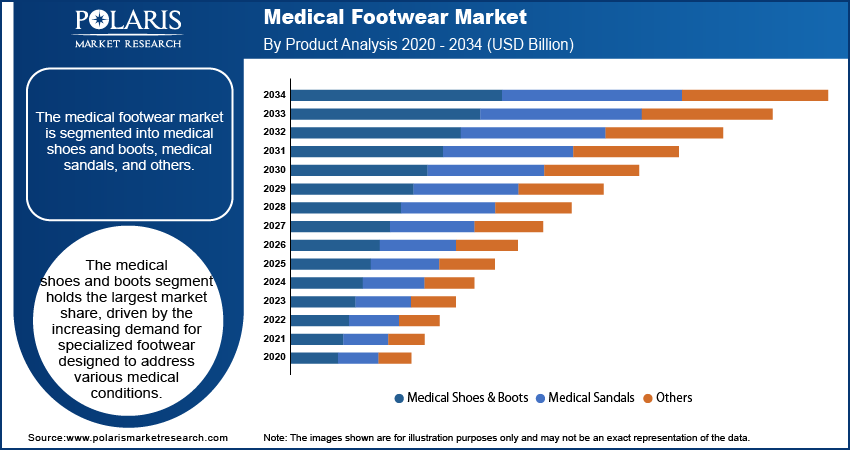

The medical footwear market, based on product, is segmented into medical shoes & boots, medical sandals, and others. The medical shoes & boots segment holds the largest market share, driven by the increasing demand for specialized footwear designed to address various medical conditions such as diabetes, arthritis, and plantar fasciitis. Medical shoes and boots offer enhanced support and protection, making them essential for individuals who require orthotic or therapeutic features such as extra support for heels and protection from putting pressure. As the population ages and the prevalence of chronic foot conditions rises, the demand for medical shoes and boots continues to increase. In addition, the segment benefits from advancements in design, comfort, and material technology, further solidifying its position as the dominant product category in the market.

The medical sandals segment, while smaller in comparison, is registering the highest growth due to rising consumer preference for more breathable, lighter footwear options, particularly in warmer climates or for use during the summer months. Medical sandals, which combine comfort with therapeutic features like arch support and cushioned soles, are gaining popularity among individuals with mild to moderate foot conditions. The others segment, which includes orthopedic slippers and therapeutic insoles, continues to grow steadily, catering to individuals seeking supplementary support and comfort without full medical footwear. While not as prominent as the other two segments, this segment is benefiting from growing consumer awareness about foot health and preventive care.

Medical Footwear Market Evaluation Based on End User

The medical footwear market, based on end user, is segmented into men and women. The women segment holds the largest market share, driven by the higher prevalence of foot-related health issues among women, such as bunions, plantar fasciitis, and other conditions associated with prolonged use of high heels or improperly fitted shoes. Women are more likely to seek medical footwear solutions that provide both therapeutic benefits and aesthetic appeal. Additionally, the growing awareness of the importance of foot health among women, particularly in managing conditions like diabetes or arthritis, is contributing to the strong demand for medical footwear in this segment.

The men segment, while holding a smaller market share, is registering the fastest growth. This can be attributed to the rising awareness of foot health issues, especially among older men, and the increasing recognition of the need for orthotic and therapeutic footwear to manage conditions such as diabetic foot problems and joint pain. With a growing aging population and an emphasis on preventative care, men are becoming more proactive in seeking footwear that offers comfort, support, and medical benefits.

Medical Footwear Market Outlook Based on Distribution Channel

By distribution channel, the medical footwear market is segmented into offline and online, with the offline segment holding the largest market share. This segment continues to dominate due to the long-established presence of brick-and-mortar stores such as pharmacies, medical supply stores, and specialized footwear retailers. Many consumers prefer to try on medical footwear in person to ensure proper fit and comfort, particularly for products designed to manage specific health conditions. Additionally, healthcare professionals, including podiatrists and orthopedic specialists, often recommend or prescribe medical footwear, driving foot traffic to physical retail locations.

The online segment, while smaller in comparison, is registering the highest CAGR. This trend is fueled by the increasing consumer preference for convenience, particularly among younger, tech-savvy individuals who value the ability to research, compare, and purchase medical footwear from the comfort of their homes. E-commerce platforms are benefiting from an expanding range of options and the ability to deliver directly to consumers, which appeals to those with limited access to physical stores or those seeking niche products. Moreover, the online segment’s growth is being supported by targeted digital marketing and the ease of access to consumer reviews, which help build trust in purchasing medical footwear online.

Medical Footwear Market Outlook Regional Analysis

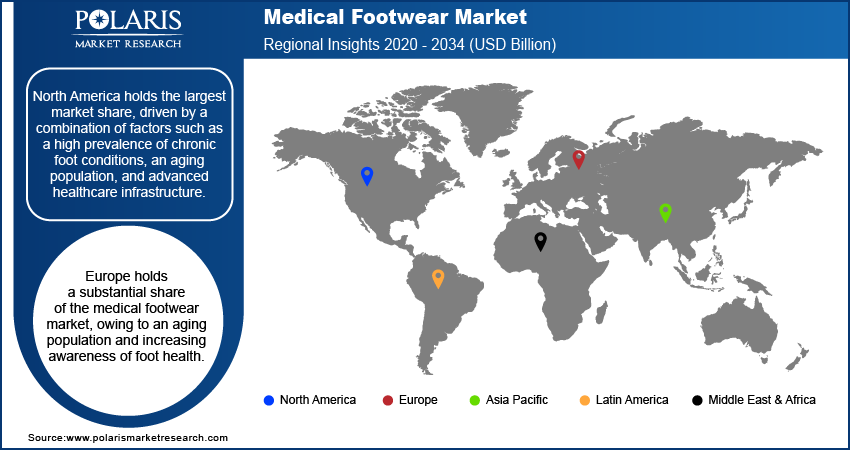

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest medical footwear market share, driven by a combination of factors including a high prevalence of chronic foot conditions, an aging population, and advanced healthcare infrastructure. The region’s strong awareness of foot health, along with the increasing adoption of medical footwear for managing conditions like diabetes and arthritis, contributes to its dominant position. Additionally, the presence of key market players, along with the widespread availability of both offline and online distribution channels, supports the growth of the medical footwear market in this region. Europe also holds a significant share due to similar demographic trends and growing consumer demand for therapeutic footwear, while Asia Pacific is witnessing the fastest growth due to rising healthcare awareness and improving economic conditions.

Europe holds a substantial share of the medical footwear market, driven by an aging population and increasing awareness of foot health. Countries such as Germany, the UK, and France have established healthcare systems that emphasize the management of chronic conditions like diabetes, which often require specialized footwear. The growing focus on preventive healthcare and the availability of advanced medical footwear products also support market growth in the region. Additionally, the rising demand for both functional and aesthetically appealing medical footwear has spurred innovation among manufacturers in the region. Government initiatives and healthcare policies encouraging foot health management, especially for the elderly, are further contributing to the regional market expansion.

The Asia Pacific medical footwear market is experiencing the fastest growth in the medical footwear market, driven by rapid economic development, improving healthcare awareness, and increasing disposable incomes. Countries such as China, India, and Japan are witnessing a rise in the prevalence of foot-related health issues, particularly among the aging population, which is creating greater demand for medical footwear. The region's expanding middle class and urbanization are contributing to higher demand for both therapeutic footwear and fashionable medical shoes. Additionally, the growth of the e-commerce sector is facilitating broader access to these products in the region. As healthcare systems improve and consumers become more aware of foot health, the demand for medical footwear in Asia Pacific is expected to continue its upward trajectory.

Medical Footwear Market – Key Players and Competitive Insights

Key players in the medical footwear market include Aetrex Worldwide, Inc.; Dr. Comfort; Orthofeet, Inc.; New Balance; Reebok; Vionic Group; Brooks Running; Propet USA, Inc.; Saucony; Birkenstock; Drew Shoe Corporation; Rockport; Nike; Skechers; and Apex Footwear. These companies are actively involved in designing and manufacturing footwear specifically tailored for individuals with various foot conditions. Many of these brands offer a range of products, including diabetic shoes, orthopedic shoes, and insoles designed to improve comfort and support for foot health. Some brands, such as New Balance and Reebok, also integrate advanced technologies into their medical footwear lines, while others, like Dr. Comfort and Orthofeet, specialize solely in orthopedic and therapeutic footwear.

In terms of competition, companies in this market focus on differentiating themselves through product innovation, design, and comfort features. While some brands emphasize the use of advanced materials like memory foam and gel insoles for superior comfort, others focus on offering specialized products that address specific medical conditions like diabetes or arthritis. Customization options are becoming increasingly important as consumers seek personalized footwear solutions that meet both their therapeutic needs and style preferences. Furthermore, the growth of e-commerce has leveled the playing field, allowing smaller brands with niche products to compete effectively with larger, well-established players.

The competitive landscape is also influenced by partnerships and collaborations between footwear manufacturers and healthcare providers. Companies are working to improve their product offerings by collaborating with healthcare professionals, such as podiatrists and orthopedists, to ensure that their footwear meets the specific needs of individuals with medical conditions. As the market expands, companies are also focusing on improving their distribution channels, both offline and online, to reach a wider customer base. This trend is particularly evident in regions like Asia Pacific, where growing awareness and demand for medical footwear are driving market expansion.

Aetrex Worldwide, Inc. is a company known for designing and producing medical footwear aimed at improving foot health. The company offers a range of products, including diabetic shoes, orthotic insoles, and footwear for people with medical conditions like arthritis and plantar fasciitis. Aetrex combines comfort with therapeutic features in its products and is focused on innovation through the use of advanced materials and technologies to enhance foot support and alleviate discomfort.

Orthofeet, Inc. is another prominent player in the medical footwear market, specializing in footwear that addresses a variety of foot health issues. The company designs shoes that provide comfort and support for people with conditions such as diabetes, arthritis, and plantar fasciitis. Orthofeet products include orthopedic shoes, sandals, and insoles designed to relieve pressure, reduce foot pain, and improve mobility.

List of Key Companies in Medical Footwear Market

- Aetrex Worldwide, Inc.

- Dr. Comfort

- Orthofeet, Inc.

- New Balance

- Reebok

- Vionic Group

- Brooks Running

- Propet USA, Inc.

- Saucony

- Birkenstock

- Drew Shoe Corporation

- Rockport

- Nike

- Skechers

- Apex Footwear

Medical Footwear Industry Developments

- In January 2024, Orthofeet introduced a new line of diabetic-friendly shoes with enhanced arch support and cushioning, designed to improve comfort for individuals with sensitive feet. The company’s focus on providing effective and comfortable solutions for foot care has helped establish its position in the medical footwear market.

- In February 2024, Aetrex announced a new partnership with a Heeluxe to expand its reach in the medical footwear market and provide more accessible options for individuals with foot health issues.

Medical Footwear Market Segmentation

By Product Outlook

- Medical Shoes & Boots

- Medical Sandals

- Others

By End User Outlook

- Men

- Women

By Distribution Channel Outlook

- Offline

- Online

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Medical Footwear Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 9.97 billion |

|

Market Size Value in 2025 |

USD 11.07 billion |

|

Revenue Forecast by 2034 |

USD 28.80 billion |

|

CAGR |

11.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The medical footwear market has been segmented into detailed segments of product, end user, and distribution channels. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy: The growth and marketing strategy in the medical footwear market focuses on product innovation, expanding distribution channels, and increasing consumer awareness. Companies are investing in the development of footwear that integrates advanced materials and technologies to enhance comfort and therapeutic benefits. To reach a broader audience, brands are enhancing their online presence, utilizing e-commerce platforms, and partnering with healthcare professionals to build credibility. Additionally, marketing efforts are increasingly targeting aging populations and individuals with chronic foot conditions, highlighting the health benefits of specialized footwear. Companies are also emphasizing customization and personalized solutions to cater to the diverse needs of consumers.

FAQ's

The medical footwear market size was valued at USD 9.97 billion in 2024 and is projected to grow to USD 28.80 billion by 2034.

The market is projected to register a CAGR of 11.2% from 2025 to 2034.

North America held the largest share of the market in 2024.

A few of the key players in the medical footwear market include Aetrex Worldwide, Inc.; Dr. Comfort; Orthofeet, Inc.; New Balance; Reebok; Vionic Group; Brooks Running; Propet USA, Inc.; Saucony; Birkenstock; Drew Shoe Corporation; Rockport; Nike; Skechers; and Apex Footwear.

The medical shoes & boots segment accounted for the largest market share in 2024.

The women segment accounted for the largest share of the market in 2024

Medical footwear refers to shoes designed specifically to support and manage various foot health issues. Individuals with medical conditions such as diabetes, arthritis, plantar fasciitis, or other foot-related disorders typically use these shoes. Medical footwear is engineered to provide additional comfort, support, and protection compared to regular shoes. Features may include cushioning, arch support, orthopedic insoles, and materials that reduce pressure points to prevent injury. The footwear can also help with mobility and pain relief, particularly for individuals who need specialized shoes to manage their condition or prevent complications related to chronic foot health issues.

A few key trends in the medical footwear market are described below: Use of Advanced Materials: Increasing adoption of lightweight, breathable, and durable materials like memory foam, gel insoles, and EVA to enhance comfort and longevity. Integration of Digital Health Technologies: Growing incorporation of smart features, such as sensors and wearable technologies, to monitor foot pressure, gait, and overall foot health. Customization and Personalization: Rising demand for customized medical footwear, including adjustable insoles and shoes tailored to specific foot shapes and medical conditions. Growing Popularity of Orthotic-Friendly Footwear: Increasing consumer demand for footwear that accommodates orthotic inserts and offers therapeutic support for various foot ailments.

A new company entering the medical footwear market could focus on product differentiation by leveraging advanced technologies, such as smart footwear integrated with health-monitoring sensors, to address the growing demand for personalized care. Additionally, offering customizable and orthotic-friendly footwear that caters to specific medical conditions could set the company apart. Focusing on sustainability by using eco-friendly materials and maintaining a strong online presence for easier accessibility can help reach a wider customer base. Collaborating with healthcare professionals to ensure the therapeutic effectiveness of the products and enhancing consumer education on foot health would further build credibility and trust in the market.