Medical Flexible Packaging Market Share, Size, Trends, Industry Analysis Report, By Product Type (Seals, High Barrier Films, Wraps, Pouches & Bags, Lids & Labels, Others); By Material Type; By End-User; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jun-2024

- Pages: 120

- Format: PDF

- Report ID: PM4959

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

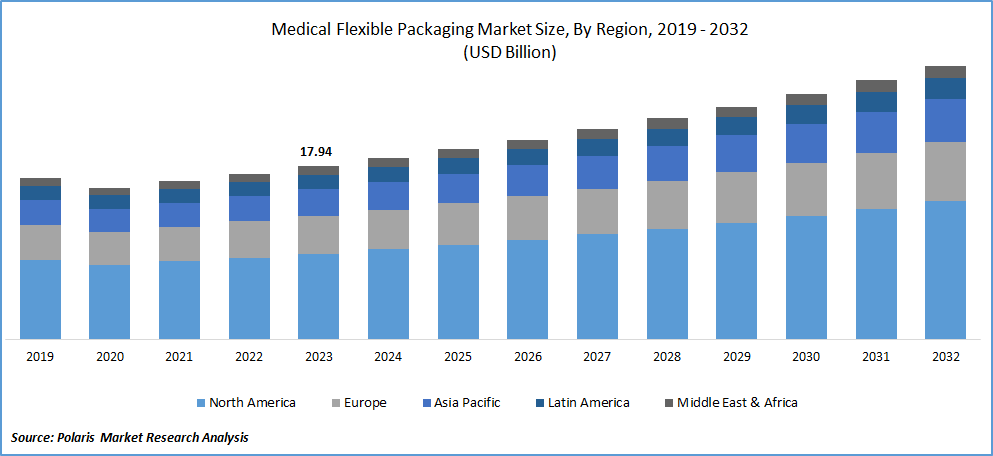

Medical Flexible Packaging Market size was valued at USD 17.94 billion in 2023. The market is anticipated to grow from USD 18.80 billion in 2024 to USD 28.32 billion by 2032, exhibiting the CAGR of 5.2% during the forecast period.

Medical Flexible Packaging Market Overview

Growing product damages in the pharmaceutical space, increasing shipping costs, and the rising need to extend healthcare product longevity are contributing factors driving medical flexible packaging adoption globally. Additionally, growing measures to reduce unauthorized access to medical equipment, protect against bacterial exposure and other insect bioactivity, and increase the availability of flexible and easy-to-use packaging options are driving market growth. Furthermore, ongoing acquisitions and partnerships to gain a competitive edge, expand their production capacity, and expand their market coverage area are expected to drive new product launches around the world.

To Understand More About this Research:Request a Free Sample Report

- For instance, in August 2023, Amcor announced the acquisition of Phoenix Flexibles, a packaging solutions provider for food, personal, and homecare applications, to expand its medical packaging solutions reach to India.

Moreover, the growing demand for sustainable packaging solutions from healthcare providers to meet stringent government regulations is altering production activities and fueling the launch of the eco-friendly medical packaging industry in the market. For instance, in January 2023, Nelipak Healthcare Packaging announced its agreement with Eastman to purchase medical-grade Eastar Renew 6763 to manufacture sustainable sterile barrier packaging for medical device utility for classes II and III.

Growth Drivers

The Increasing Usage of Pharmaceutical Medicines and Machinery

The ongoing cost-cutting moves taken by the companies to enhance their production and distribution potential with the increasing demand for medicines and healthcare equipment on the market, specifically for one-time use healthcare device packaging, are showcasing significant expansion opportunities for the global medical flexible packaging market. For instance, in July 2023, Riverside Medical Packaging announced the expansion of its warehouse capacity in Derby, UK, which is less than one mile from its headquarters and production facility, to improve its business operations.

A Significant Uptick in Investments in Medical Packaging

The growing expansion of pharmaceutical and healthcare fields in the world with growing numbers of health problems is significantly fueling the production of new life-saving therapeutics, medicines, and healthcare equipment. The rising research and development activities in disease monitoring, treating, and diagnostic devices are driving innovations in the healthcare domain, fueling the production and consumption of devices among healthcare providers. This, in a way, boosts the need for flexible medical packaging, driven by its ability to safeguard its functioning and promote user safety.

The increasing investments in medical packaging companies are likely to promote the launch of new products and drive new business opportunities for the market over the study period. For instance, in October 2023, Macpac announced that it had completed the second-phase investment of GBP 1.5 million, along with the installation of the Illig RDKP 72 automatic pressure at its stockport-based manufacturing plant, due to growing demand from the food and pharmaceutical industries.

Restraining Factors

Growing Concerns about Environmental Pollution

The growing environmental pollution and utility of plastics in production and packaging activities are showing critical concern for medical flexible packaging adoption. This is encouraging pharmaceutical and healthcare technology providers to consider alternative options, limiting demand for flexible packaging industries and the medical industry. According to the ABC news channel, medical waste accounts for 7% of Australia’s carbon emissions, which is double that of the aviation industry in Australia. However, the increasing efforts of companies to produce sustainable flexible packaging products for the global market are expected to drive significant adoption over the coming years.

Report Segmentation

The Medical Flexible Packaging Market is primarily segmented based on product type, material type, end-user, and region.

|

By Product Type |

By Material Type |

By End-User |

By Region |

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Product Analysis

Pouches & Bags Segment is Expected to Witness the Highest Growth During the Forecast Period

The pouches & bags segment is projected to grow at a CAGR during the projected period, mainly driven by their ease of application and ability to provide safety by working as an entry barrier to living and nonliving organisms. In addition, the increasing launch of effective and flexible packaging solutions is projected to drive market growth in the long run. For instance, in March 2024, Capsa Healthcare announced the launch of the NexPack autonomous packaging system to enhance accuracy and efficiency in patient pharmaceutical drug applications.

By Material Type Analysis

Plastics Segment Accounted for the Largest Market Share in 2023

The plastic segment accounted for the largest market share in 2023 and is likely to retain its market position throughout the forecast period. This is due to its moisture resistance and ability to extend the shelf life of medical products. The growing initiatives to boost the use of plastic packaging and the rising launch of effective plastic packaging solutions are likely to drive significant growth in the coming years. For instance, in August 2023, Refill System announced its plan to introduce reusable packaging and refill devices to reduce single-use plastic usage and promote a circular economy.

By End-User Analysis

Pharmaceutical Packaging Segment Held the Significant Market Revenue Share in 2023

The pharmaceutical packaging segment held a significant market share in revenue in 2023, which is highly accelerated due to the continuous rise in the incidence of chronic health conditions such as cancer, kidney diseases, and obesity. This is leading to an increase in the development of medicines and therapeutics, providing demand for packaging solutions in the market.

Regional Insights

North America Region Registered the Largest Share of The Global Market in 2023

The North America region held the dominant share in 2023. The growing demand for medical flexible packaging is driving its demand, forcing companies to engage in production expansion activities. For instance, in January 2023, Nelipak Healthcare Packaging announced the launch of its new production facility in North Carolina, US. The presence of well-established healthcare providers in the region, particularly in the United States and Canada, is expected to create significant demand for medical flexible packaging over the forecast period.

The Asia Pacific region is expected to be the fastest growing region with a healthy CAGR during the projected period, owing to the growing demand for medication and the presence of a growing geriatric population, specifically in China and India. The growing government policies to promote healthcare accessibility and rising investments in pharmaceutical development are likely to create demand for medical packaging solutions over the forecast period. According to Dr. Reddy’s Laboratories, the Indian pharmaceutical industry is expected to grow at a compound annual growth rate of 10.7% by 2030. This trend is likely to bolster the medical flexible packaging market in the coming years.

Key Market Players & Competitive Insights

Strategic Innovations to Drive the Competition

The medical flexible packaging market is slightly fragmented and is registering moderate competition in the marketplace. Major companies in the flexible packaging business are investing and conducting research activities to develop sustainable and effective packaging solutions to meet changing global demands. For instance, in April 2023, Sudpack announced the launch of its new recyclable mono-polypropylene-based blister packaging for the pharmaceutical, life science, and medical industries.

Some of the major players operating in the global market include:

- Amcor Limited

- Aptar Group Inc.

- Becton Dickinson & Company Catalent Inc.

- Berry Group Inc.

- Bemis Company Inc.

- Constantia Flexibles Group GmbH

- Coveris Holdings S.A.

- Datwyler Holdings

- Huhtamaki Oyj

- Mondi Group Plc

- Reynolds Group Holdings

- Sealed Air Corporation

- Sonoco Products Company

Recent Developments in the Industry

- In April 2023, Vinco Products announced the acquisition of Indian-based Genesis Plastics Welding, an ISO 13485-certified thermoplastics producer, which offers sealing and high-frequency wedding for medical devices.

Medical Flexible Packaging Market Report Coverage

The medical flexible packaging market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, product type, material type, end-user, and their futuristic growth opportunities.

Medical Flexible Packaging Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 18.80 billion |

|

Revenue forecast in 2032 |

USD 28.32 billion |

|

CAGR |

5.2% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

Medical Flexible Packaging Market report covering key segments are product type, material type, end-user, and region.

Medical Flexible Packaging Market Size Worth $ 28.32 Billion By 2032

Medical Flexible Packaging Market exhibiting the CAGR of 5.2% during the forecast period.

North America is leading the global market

The key driving factors in Medical Flexible Packaging Market are The increasing usage of pharmaceutical medicines and machinery