Medical Filtration Market Size, Share, Trends, Industry Analysis Report: By Material (Polysulfone & Polyethersulfone, Polyvinylidene Fluoride, Polytetrafluoroethylene, Polypropylene, and Others), Technology, End User, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 129

- Format: PDF

- Report ID: PM5514

- Base Year: 2024

- Historical Data: 2020-2023

Medical Filtration Market Overview

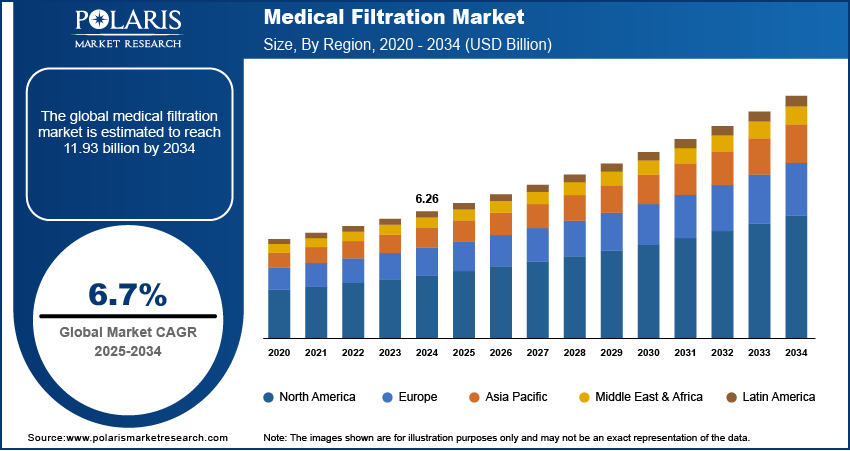

The global medical filtration market size was valued at USD 6.26 billion in 2024. The market is projected to grow from USD 6.67 billion in 2025 to USD 11.93 billion by 2034, exhibiting a CAGR of 6.7% during 2025–2034.

Medical filtration refers to the process of separating particles, pathogens, and impurities from fluids, particularly in healthcare and laboratory settings. This technique plays a crucial role in ensuring the safety and efficacy of medical treatments, as it helps maintain sterile environments and prevents contamination. Medical filtration also finds significant use in blood purification processes of patients with kidney failure, as it filters blood to remove waste products and excess fluids, thereby maintaining the patient's health.

The increasing incidence of chronic diseases across the globe is propelling the medical filtration market growth. According to data from the World Health Organization, noncommunicable diseases (NCDs), also known as chronic diseases, killed at least 43 million people in 2021. Chronic diseases such as diabetes, cardiovascular diseases, and kidney failure usually require ongoing management and treatment, which increases the need for medical procedures and interventions. These procedures, such as dialysis for kidney disease or surgeries for cardiovascular conditions, necessitate the use of medical filters to ensure the sterility and safety of medical equipment and fluids. Additionally, respiratory diseases, including chronic obstructive pulmonary disease (COPD) and asthma, drive the need for advanced medical filtration systems. Patients with these conditions are highly susceptible to airborne contaminants, allergens, and pathogens that trigger severe respiratory distress. This drives hospitals and healthcare facilities to install high-efficiency particulate air filters to maintain clean air in critical care units, operating rooms, and patient wards. Therefore, as the incidence of chronic diseases worldwide increases, the medical filtration market revenue also spurs.

To Understand More About this Research: Request a Free Sample Report

The medical filtration market demand is driven by the growing drug development activities. The process of developing new drugs involves rigorous testing and manufacturing procedures that require high levels of sterility and purity. Medical filtration provides this high level of sterility and purity, ensuring that drug substances remain free from contaminants during production. The regulatory bodies are further imposing strict guidelines on drug manufacturing processes to ensure patient safety. Medical filtration helps pharmaceutical companies comply with these regulations by providing reliable and efficient means of removing contaminants. Additionally, the rise in biopharmaceuticals, such as vaccines and monoclonal antibodies, further drives the demand for medical filtration. These complex biological drugs require sophisticated filtration processes to maintain their efficacy and safety. The production of biopharmaceuticals often involves multiple medical filtration steps to remove impurities and ensure the final product meets stringent regulatory standards.

Medical Filtration Market Dynamics

Increasing Healthcare Investment in Emerging Nations

Increased healthcare investments in emerging economies focus on improving healthcare infrastructure, including the construction of new hospitals and clinics. For instance, the share of Government Health Expenditure (GHE) in India’s GDP increased from 1.13% in 2014-15 to 1.84% in 2021-22. Modern healthcare facilities require advanced medical equipment and supplies, which include medical filters and filtration systems, to ensure the safety and sterility of medical procedures. Emerging nations further face unique healthcare challenges, such as higher rates of infectious diseases and limited access to clean water. This encourages them to invest in advanced medical filtration systems as they play a crucial role in addressing these challenges by providing clean and safe medical environments. Furthermore, increased investment in these nations leads to higher medical tourism, which boosts the demand for medical filtration to ensure clean surgical environments, contamination-free medical devices, and sterile operating rooms. Hence, the rising investment in healthcare in emerging nations such as such as India, Thailand, Brazil, and Mexico is propelling medical filtration market expansion.

Growing Advancement in Filtration Technology

Innovations such as nanofiber filtration technology have revolutionized the medical filtration market by providing superior particle capture and antimicrobial properties. These ultra-thin fibers enhance air and liquid filtration systems, offering higher efficiency in removing bacteria, viruses, and particulate matter. Hospitals, laboratories, and pharmaceutical manufacturers are increasingly adopting these nanofiber-based filters to improve air quality in operating rooms, protect healthcare workers, and ensure contamination-free drug production. This superior filtration capability of nanotechnology continues to drive the demand for advanced medical filtration products. Sustainability-focused filtration innovations further contribute to market growth. Many healthcare facilities and pharmaceutical companies are seeking eco-friendly filtration solutions that reduce energy consumption, minimize waste, and lower operational costs. Manufacturers are responding to this by developing biodegradable and reusable filtration materials to meet the rising demand for sustainable medical filtration products, thereby contributing to market development.

Medical Filtration Market Segment Insights

Medical Filtration Market Evaluation by Material Insights

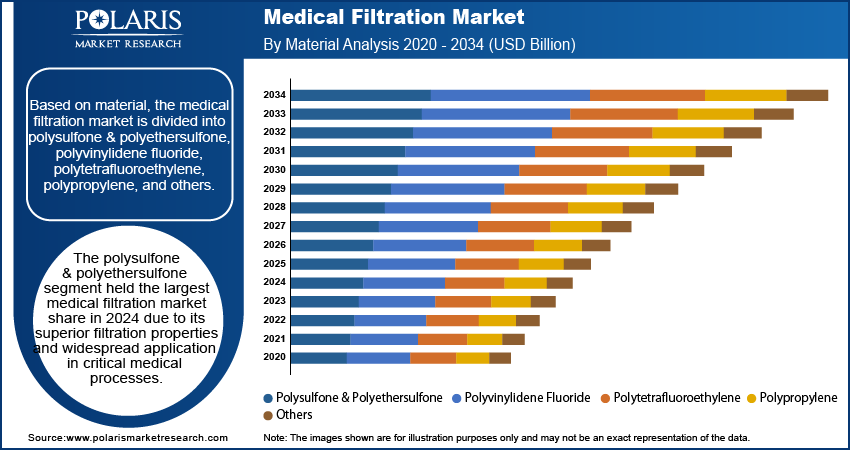

Based on material, the medical filtration market is divided into polysulfone & polyethersulfone, polyvinylidene fluoride, polytetrafluoroethylene, polypropylene, and others. The polysulfone & polyethersulfone segment held the largest medical filtration market share in 2024 due to its superior filtration properties and widespread application in critical medical processes. These materials offer high chemical resistance, thermal stability, and excellent biocompatibility, making them ideal for sterilization, dialysis membranes, and pharmaceutical filtration. The ability of polysulfone & polyethersulfone to withstand repeated sterilization cycles without degradation has driven their adoption in hospitals, laboratories, and biopharmaceutical manufacturing. The rising prevalence of chronic kidney disease and the increasing demand for dialysis treatments further contributed to the dominance of the segment. Additionally, the expansion of biopharmaceutical production, particularly for monoclonal antibodies and vaccine development, has fueled the need for high-performance membranes, which polysulfone & polyethersulfone provide to ensure sterility and purity in drug processing.

Medical Filtration Market Assessment by Application Insights

In terms of application, the medical filtration market is segregated into ultrafiltration, microfiltration, nanofiltration, gas filtration, and other. The ultrafiltration segment is expected to grow at the fastest pace in the coming years, owing to its expanding role in biotechnology, plasma separation, and advanced therapeutic applications. Ultrafiltration provides superior filtration efficiency by selectively removing viruses, endotoxins, and fine particulates while preserving essential biomolecules, making it crucial for the production of monoclonal antibodies, gene therapies, and recombinant proteins. The increasing focus on personalized medicine and biologic drug development has accelerated the demand for ultrafiltration membranes in pharmaceutical and research applications. Hospitals and dialysis centers also rely on this technology for blood purification and critical care treatments, further contributing to its anticipated growth.

Medical Filtration Market Regional Analysis

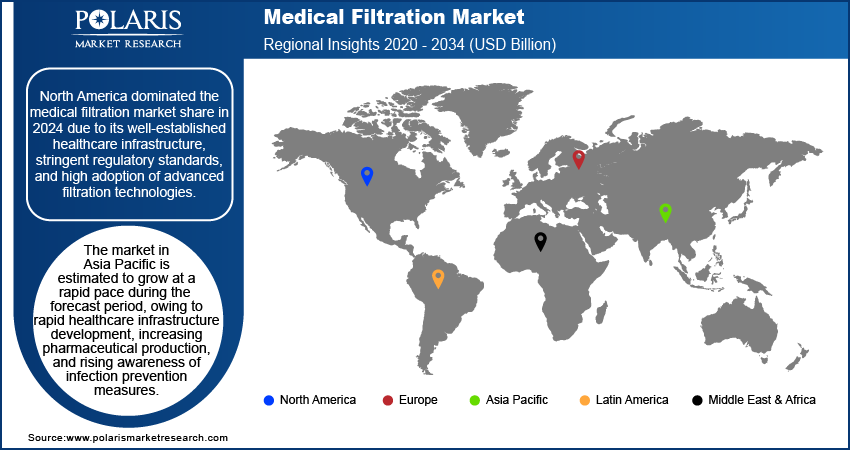

By region, the medical filtration market report provides insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the medical filtration market share in 2024 due to its well-established healthcare infrastructure, stringent regulatory standards, and high adoption of advanced filtration technologies. The region’s strong pharmaceutical and biotechnology industries have driven significant demand for high-performance filtration systems, particularly in drug manufacturing, bioprocessing, and hospital sterilization. The increasing prevalence of chronic diseases, along with a rising number of surgical procedures, has further fueled the need for superior contamination control in healthcare settings. For instance, the Centers for Disease Control and Prevention published a report stating that an estimated 129 million people in the US have at least one major chronic disease. These factors have led to increased adoption of medical filtration in the region.

The US dominated the market within the region, benefiting from the presence of major pharmaceutical companies, government funding for healthcare advancements, and strict FDA regulations mandating the use of high-quality filtration systems in medical applications. The growing emphasis on infection control, particularly in response to hospital-acquired infections (HAIs) and pandemic preparedness, has also contributed to the widespread adoption of medical filtration solutions across hospitals, research institutions, and diagnostic laboratories in the region.

The Asia Pacific medical filtration market is estimated to grow at a rapid pace during the forecast period, owing to rapid healthcare infrastructure development, increasing pharmaceutical production, and rising awareness of infection prevention measures. Countries such as China, India, and Japan have been heavily investing in biotechnology, biopharmaceuticals, and medical device manufacturing, leading to a surge in demand for advanced medical filtration solutions. The expansion of government healthcare programs, along with rising medical tourism in nations such as India and Thailand, has further accelerated the need for high-efficiency filtration technologies in hospitals and surgical centers. China is expected to dominate the market in the coming years within Asia Pacific, driven by its rapidly growing pharmaceutical industry, increased research and development spending, and stringent regulatory policies aimed at improving medical product safety. The rising incidence of infectious diseases and the growing demand for vaccines and biologics are estimated to fuel the adoption of medical filtration systems in the region.

Medical Filtration Market – Key Players and Competitive Insights

Major market players are investing heavily in research and development in order to expand their product portfolio, which will help the medical filtration market grow even more. These market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations.

The medical filtration market is fragmented, with the presence of numerous global and regional market players. Major players in the market are Asahi Kasei Corporation, Baxter, Danaher, Donaldson Company Inc., Entegris, MANN+HUMMEL, Merck KGaA, Parker Hannifin Corp., Sartorius AG, Thermo Fisher Scientific Inc., and Veolia.

Asahi Kasei Corporation is a multinational Japan-based company operating in various sectors, including chemicals, materials, homes, electronics, and healthcare. Founded in 1931, the company has evolved significantly over the years, expanding its operations globally and diversifying its product portfolio. Asahi Kasei is known for its innovative solutions across multiple industries, with a strong focus on contributing to life and living by understanding people's needs and delivering scientific, evidence-based solutions. The company's medical enterprises have developed new medical devices and therapeutic technologies, advancing biopharmaceutical and plasma derivative process engineering. One of the notable achievements in medical filtration by Asahi Kasei is the development of virus removal filters, such as the Planova series. These filters were designed to remove viruses from plasma-derived pharmaceutical products, utilizing the company's expertise in fibers and filtration technology. The company is involved in various healthcare-related fields, including blood transfusion devices, blood purification devices, orthopedics, urology pharmaceuticals, and critical care devices.

Thermo Fisher Scientific Inc. is a major global provider of scientific instruments, reagents, consumables, and software solutions, serving the life sciences, healthcare, and other industries. Founded in 2006 through the merger of Thermo Electron Corporation and Fisher Scientific International, the company has a rich history dating back to the early 20th century. The company's products and services are crucial for research and development in biotechnology and pharmaceuticals, which indirectly contribute to advancements in medical filtration technologies. Thermo Fisher Scientific operates in over 50 countries and serves customers in more than 180 countries, making it a global player in the scientific community.

List of Key Companies in Medical Filtration Market

- Asahi Kasei Corporation

- Baxter

- Danaher

- Donaldson Company Inc.

- Entegris

- MANN+HUMMEL

- Merck KGaA

- Parker Hannifin Corp.

- Sartorius AG

- Thermo Fisher Scientific Inc.

- Veolia

Medical Filtration Industry Developments

October 2024: Asahi Kasei, a Japan-based multinational company, launched the Planova FG1, a next-generation virus removal medical filter. According to Asahi Kasei, the filter features a higher flux for the manufacture of biotherapeutics products such as biopharmaceuticals and plasma derivatives, biosafety testing services, and biopharmaceutical CDMO operations.

December 2023: Asahi Kasei opened its third assembly plant for Planova virus removal filters in Nobeoka, Miyazaki, Japan.

January 2020: Argon Medical, a company that designs, develops, and manufactures medical devices for a variety of procedures, launched two new IVC filter retrieval kits for the prevention of pulmonary embolism.

Medical Filtration Market Segmentation

By Material Outlook (Revenue, USD Billion, 2020–2034)

- Polysulfone & Polyethersulfone

- Polyvinylidene Fluoride

- Polytetrafluoroethylene

- Polypropylene

- Others

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- Ultrafiltration

- Microfiltration

- Nanofiltration

- Gas Filtration

- Other

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Hospitals

- Diagnostic Centers

- Research Institutes

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Dialysis

- Drug Delivery

- IV Infusion & Sterile Filtration

- Endoscopy

- Sterile Processing

- Bio-Artificial Processes

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Medical Filtration Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 6.26 billion |

|

Market Size Value in 2025 |

USD 6.67 billion |

|

Revenue Forecast by 2034 |

USD 11.93 billion |

|

CAGR |

6.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global medical filtration market size was valued at USD 6.26 billion in 2024 and is projected to grow to USD 11.93 billion by 2034.

The global market is projected to register a CAGR of 6.7% during the forecast period.

North America had the largest share of the global market in 2024.

Some of the key players in the market are Asahi Kasei Corporation, Baxter, Danaher, Donaldson Company Inc., Entegris, MANN+HUMMEL, Merck KGaA, Parker Hannifin Corp., Sartorius AG, Thermo Fisher Scientific Inc., and Veolia.

The polysulfone & polyethersulfone segment held the largest medical filtration market share in 2024 due to its superior filtration properties and widespread application in critical medical processes.

The ultrafiltration segment is expected to grow at the fastest pace in the coming years, owing to its expanding role in biotechnology, plasma separation, and advanced therapeutic applications.