Medical Equipment Maintenance Market Share, Size, Trends, Industry Analysis Report, By Service Type (Corrective Maintenance, Preventive Maintenance, Operational Maintenance); By Equipment; By End User; By Region; Segment Forecast, 2024- 2032

- Published Date:Jan-2024

- Pages: 114

- Format: PDF

- Report ID: PM4039

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

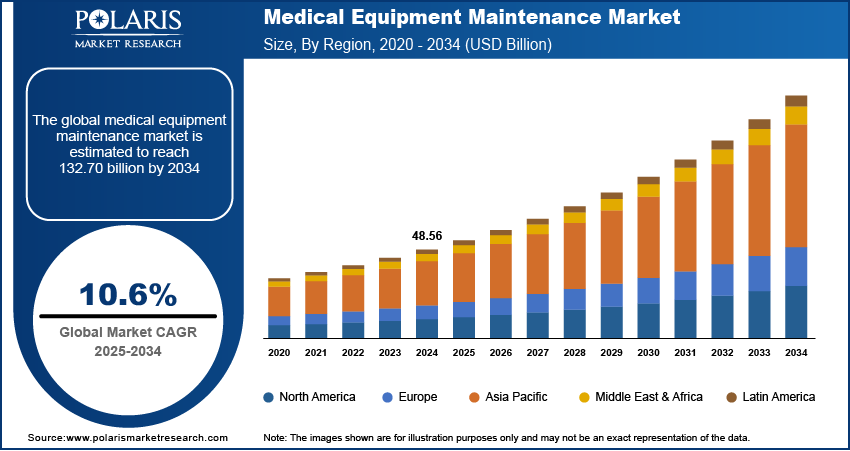

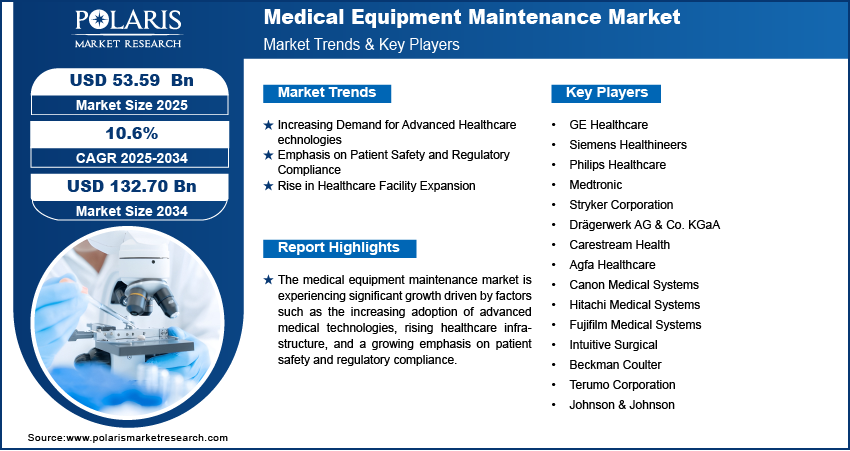

The global medical equipment maintenance market size and share was valued at USD 48.19 billion in 2023 and is expected to grow at a CAGR of 10.50% during the forecast period.

Product innovations, technological advancements, and the introduction of regulatory policies have been detailed in the report to enable businesses to make more informed decisions. Furthermore, the impact of the COVID-19 pandemic on the medical equipment maintenance market demand has been examined in the study. The report is a must-read for anyone looking to develop effective strategies and stay ahead of the curve.

The adoption of a proactive approach to equipment maintenance is becoming increasingly prevalent. Preventive maintenance involves regular inspections and maintenance activities to identify potential issues before they become critical. This approach minimizes equipment downtime and significantly improves equipment reliability, which is particularly valuable in healthcare settings where downtime can impact patient care.

Medical maintenance equipment indicates to the procedures and undertakings included in sanctioning that medical equipment is operating accurately and productively. It includes the arrangement, performance, and observation of maintenance enterprises to prohibit equipment crashes and sanction their impactful functioning.

Medical equipment maintenance involves chores such as organizing regime maintenance, executing restoration, and restoring equipment when essential. The medical equipment maintenance market size is expanding as it also includes the advancement and execution of maintenance strategies and approaches, as well as the instruction of staff on appropriate equipment usage and maintenance. The aim of medical equipment maintenance is to ensure that medical equipment is secure to use, encounters administrative excellence, and is obtainable when required to reinforce patient care.

To Understand More About this Research: Request a Free Sample Report

Healthcare organizations are under constant pressure to control costs. Regular maintenance is a cost-effective strategy that extends the life of expensive medical equipment. By reducing equipment downtime and the frequency of replacements, maintenance services help healthcare providers optimize their budgets.

In addition, companies operating in the medical equipment maintenance market are introducing new products to cater to the growing demand.

In July 2022, B. Braun Thailand unveiled its 'B. Braun Technical Service Center is dedicated to delivering top-tier medical equipment repair and maintenance services. This newly established facility is committed to strengthening Thailand's public healthcare system, ensuring uninterrupted healthcare services for its residents. Moreover, it also aligns with B. Braun's global vision of safeguarding and enhancing the well-being of individuals worldwide

Healthcare facilities are increasingly outsourcing their medical equipment maintenance to specialized service providers. This presents significant opportunities for companies offering comprehensive maintenance solutions, including preventive maintenance and equipment upgrades.

The integration of Internet of Things (IoT) technology into medical equipment enables predictive maintenance. Sensors can collect real-time data, predicting when maintenance is required based on equipment performance, usage, and wear and tear. This approach reduces unplanned downtime and enhances operational efficiency.

Rapid technological advancements in the medical equipment sector are a driver for maintenance services. As equipment becomes more complex and technologically sophisticated, maintenance providers must continuously adapt and enhance their expertise to address these advancements.

The research study offers an in-depth analysis of the competitive landscape in the industry. It examines the top players in the medical equipment maintenance market on the basis of multiple factors, including market position, sales, new developments, and products/services offered. Also, it details the key strategies like mergers, partnerships and collaborations that have been taken by the medical equipment maintenance industry key players to improve their position in the market.

Post-COVID-19, the medical equipment maintenance market has experienced a pronounced shift towards preventive maintenance to ensure equipment reliability. Telemedicine integration has driven demand for remote maintenance, while IoT-driven predictive maintenance is reducing downtime. Supply chain resilience and green solutions are on the rise, and remote training and education have gained momentum. Market consolidation, specialization, customized maintenance contracts, and the integration of data analytics and AI have become prominent trends. The market also saw global expansion and a stronger focus on patient-centric care. Remote monitoring services have witnessed increased demand, enhancing equipment reliability and patient safety.

Growth Drivers

Greater Focus on Patient Safety, Aging Medical Equipment, and Stringent Regulatory Requirements is Projected to Spur the Market Demand

Patient safety remains a paramount concern in healthcare. Regular maintenance and servicing of medical equipment are vital to ensure devices function as intended, reducing the risk of malfunctions that could lead to medical errors and adverse patient outcomes.

Many healthcare facilities deal with aging medical equipment. As these devices reach the end of their typical lifespan, the demand for maintenance and upgrades increases. Maintenance services are essential for extending the operational life of aging equipment reducing the need for costly replacements.

Stringent regulatory requirements, such as those outlined by agencies like the FDA and ISO, drive the demand for compliant medical equipment maintenance. Healthcare facilities must adhere to these regulations, ensuring that all medical devices are calibrated and function correctly to meet patient safety and quality standards.

Report Segmentation

The market is primarily segmented based on service type, equipment, end user, and region.

|

By Service Type |

By Equipment |

By End User |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Service Type Analysis

Corrective Maintenance Accounted for a Significant Market Share in 2022

The corrective maintenance segment accounted for a significant share in 2022. Corrective maintenance deals with unforeseen problems and breakdowns in medical equipment. When equipment encounters issues or malfunctions, immediate measures are undertaken to diagnose the problem and effect necessary repairs. The primary objective of corrective maintenance is to minimize equipment downtime. Swift issue resolution ensures that the equipment can be promptly reinstated to full operational capacity, averting disruptions in patient care. Corrective maintenance should adhere to well-documented procedures and protocols, ensuring consistency and compliance with regulatory requisites. Robust documentation also aids in monitoring equipment history and performance.

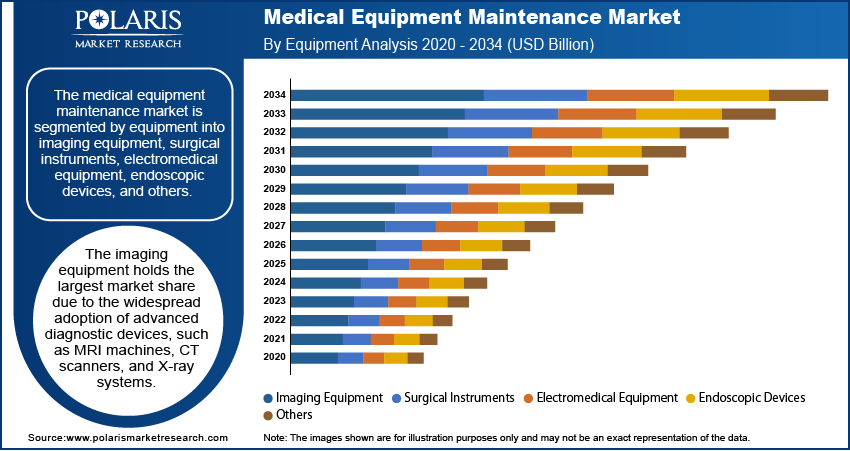

By Equipment Analysis

Imaging Equipment Accounted for a Significant Market Share in 2022

The imaging equipment segment accounted for a significant share in 2022. This domain encompasses a wide spectrum of diagnostic imaging equipment, including X-ray machines, MRI and CT scanners, ultrasound devices, and mammography systems. Maintenance is fundamental to uphold the precision and reliability of diagnostic outputs. Imaging equipment stands are essential in diagnosing an array of medical conditions and guiding therapeutic decisions. Ensuring the accuracy of diagnoses and the well-being of patients necessitates punctual and meticulous maintenance. The rapid evolution of imaging technology necessitates maintenance personnel to remain well-informed about the latest developments. Technicians and engineers must be adequately equipped to manage the intricacies of advanced imaging systems.

By End User Analysis

Hospitals Held a Significant Market Revenue Share in 2022

The hospitals segment accounted for a significant share in 2022. Within the hospital environment, a wide spectrum of medical equipment is deployed, spanning diagnostic imaging apparatus like MRI and X-ray machines, patient monitoring systems, surgical instruments, and laboratory devices. Maintenance is essential for ensuring the serviceability and upkeep of extensive equipment. Stringent healthcare regulations and standards cast a significant influence on the sector. Equipment maintenance is compelled to adhere to these legal stipulations, guaranteeing that the equipment functions within the bounds of statutory requirements and is capable of reliably serving healthcare needs. Hospitals face the choice of managing maintenance tasks in-house or outsourcing to specialized service providers. Outsourcing is a prevalent strategy due to its often cost-effective nature and the assurance of accessing expert technicians, alleviating the burden on internal resources.

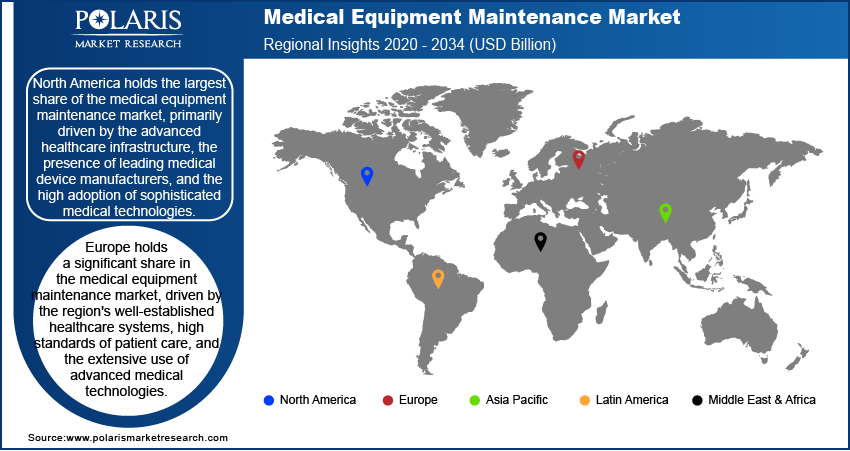

Regional Insights

Asia-Pacific is Expected to Experience Significant Growth During the Forecast Period

Asia-Pacific is expected to experience significant growth during the forecast period. The Asia-Pacific region is witnessing a surge in healthcare infrastructure expansion. The construction of new hospitals and medical centers, combined with the modernization of existing facilities, is driving the market growth. The rising healthcare spending fuels the acquisition of advanced medical equipment and devices, which, in turn, necessitates regular maintenance and servicing to ensure optimal functionality and longevity. The region is embracing cutting-edge medical technologies, including digital health systems, diagnostic equipment, and advanced treatment devices. These innovations require specialized maintenance services and trained technicians to manage and service these complex instruments effectively.

North America emerged as the largest region in 2022. The North America healthcare landscape is distinguished by its continual adoption of state-of-the-art medical technology. This includes diagnostic imaging equipment, robotic surgical systems, and electronic health records. The intricacy of these devices necessitates specialized maintenance to ensure they operate at peak performance and meet stringent safety standards. The region enforces rigorous regulatory standards to uphold patient safety and the efficacy of medical equipment. Compliance with these regulations is mandatory, driving the demand for meticulous maintenance and servicing. Equipment must be maintained to precise specifications to satisfy regulatory requirements. Many healthcare institutions in the U.S. continue to utilize aging medical equipment, particularly in the face of budget constraints. Preventive maintenance is critical to extend the lifespan and performance of these devices, preserving the cost-efficiency of their utilization.

Key Market Players & Competitive Insights

The medical equipment maintenance market is marked by its fragmented nature, anticipating increased rivalry owing to the abundance of industry participants. Key contenders in this market consistently introduce inventive offerings to strengthen their market foothold. These companies place significant emphasis on forming partnerships, improving products, and engaging in collaborative endeavors to establish a competitive edge over their peers and secure a substantial market share.

Some of the major players operating in the global market include:

- Agiliti

- Alliance Medical Group

- Althea Group

- Aramark

- Avensys UK Group

- B. Braun Melsungen AG

- BC Technical, Inc.

- Dragerwerk AG & Co. KGaA

- Elekta AB

- GE Healthcare

- Hitachi Healthcare

- Koninklijke Philips N.V.

- Medtronic

- Siemens Healthineers

- STERIS plc

Recent Developments

- In September 2022, Olympus announced an investment of 32 million euros, aimed at establishing new medical equipment repair facilities in Coimbra, Portugal.

- In April 2023, Advantus collaborated with GE HealthCare to establish a partnership for 10 years, under which, GE HealthCare would offer its Healthcare Technology Management (HTM) services to clients of Advantus.

Medical Equipment Maintenance Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 53.14 billion |

|

Revenue forecast in 2032 |

USD 118.08 billion |

|

CAGR |

10.50% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019-2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Service Type, By Equipment, By End User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

We strive to offer our clients the finest in market research with the most reliable and accurate research findings. We use industry-standard methodologies to offer a comprehensive and authentic analysis of the medical equipment maintenance market. Besides, we have stringent data-quality checks in place to enable data-driven decision-making for you.

Navigate through the intricacies of the 2024 medical equipment maintenance market with precision, thanks to the comprehensive statistics on market share, size, and revenue growth rate assembled by Polaris Market Research Industry Reports. This thorough analysis not only provides a glimpse into the historical context but also extends its reach with a market forecast outlook until 2032. Immerse yourself in the richness of this industry analysis by securing a complimentary PDF download of the sample report.

Browse Our Top Selling Reports

HERG Screening Market Size, Share 2024 Research Report

AI in Oncology Market Size, Share 2024 Research Report

Research Grade Proteins Market Size, Share 2024 Research Report

Term Insurance Market Size, Share 2024 Research Report

Healthcare Data Integration Market Size, Share 2024 Research Report