Medical Drones Market Size, Share, Trends, Industry Analysis Report: By Type (Fixed Wing, Rotor Drones, and Hybrid Drones), Technology, Application, Package Size, End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 129

- Format: PDF

- Report ID: PM1727

- Base Year: 2024

- Historical Data: 2020-2023

Medical Drones Market Overview

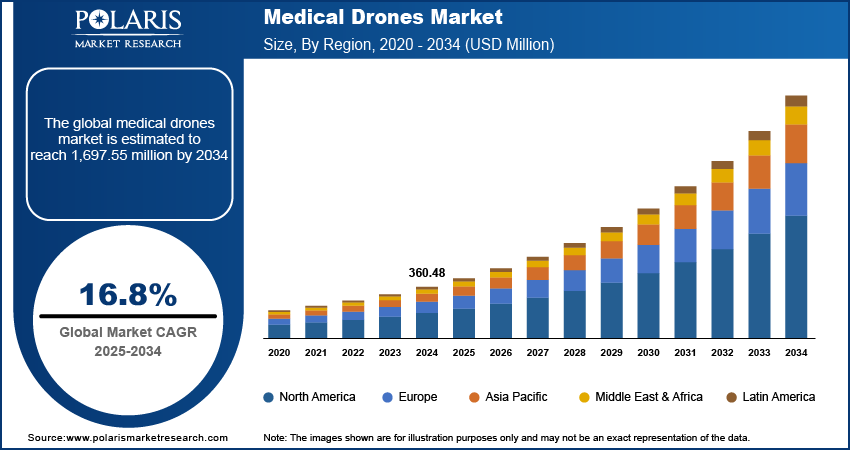

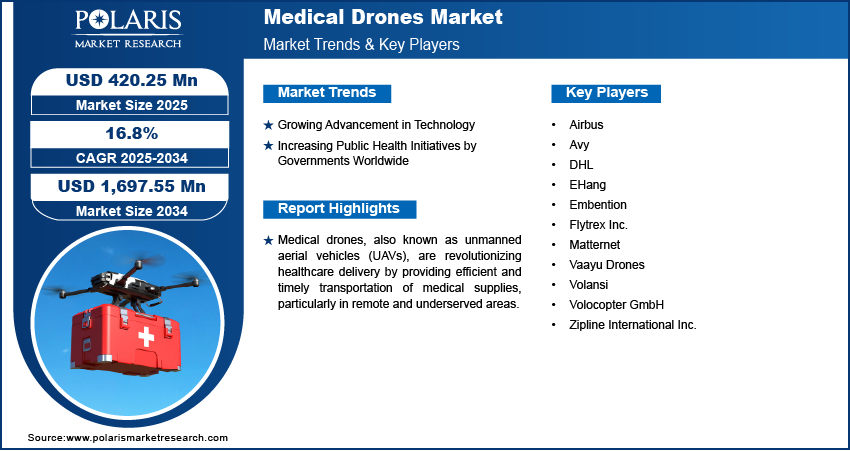

The global medical drones market size was valued at USD 360.48 million in 2024. The market is projected to grow from USD 420.25 million in 2025 to USD 1,697.55 million by 2034, exhibiting a CAGR of 16.8% during 2025–2034.

Medical drones, also known as unmanned aerial vehicles (UAVs), are revolutionizing healthcare delivery by providing efficient and timely transportation of medical supplies, particularly in remote and underserved areas. These advanced technologies help deliver a variety of essential items, including blood, organs, vaccines, and laboratory samples.

The increasing demand for telemedicine is driving the global medical drones market growth. Telemedicine relies on rapid and reliable delivery of medical supplies, such as medications, diagnostic kits, and even blood samples, to remote or underserved areas. Medical drones play a critical role in bridging the logistical gap by providing swift, cost-effective, and contactless transportation of these essentials. Therefore, as telemedicine expands, particularly in rural or disaster-stricken regions, drones need increases to offer seamless treatments via virtual consultations and follow-ups.

To Understand More About this Research: Request a Free Sample Report

The rising partnerships with drone manufacturers and healthcare providers are propelling the global medical drones market expansion. Collaborations between healthcare providers and drone manufacturers accelerate the development of specialized drones tailored for medical use, such as those designed for transporting vaccines, blood samples, or life-saving medications. These partnerships also facilitate pilot programs and large-scale deployments, demonstrating the effectiveness of drones in addressing logistical challenges in healthcare delivery. In November 2024, Skye Air, a company that uses drones to deliver packages, food, and other items, announced its collaboration with the Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (PMJAY) to provide drone-led healthcare logistics at five AIIMS facilities at Jodhpur, Patna, Deoghar, Manipur, and Mangalagiri.

Medical Drones Market Dynamics

Growing Advancements in Technology

Innovations such as improved battery efficiency, autonomous navigation systems, real-time tracking, and enhanced payload capacity make drones more efficient and versatile for medical use. These technological improvements enable drones to deliver critical supplies, such as medications, vaccines, and diagnostic services & tools, to remote or disaster-stricken areas with speed and precision. Additionally, advancements in sensors and artificial intelligence integration allow medical drones to perform tasks such as environmental monitoring and emergency response with greater accuracy, allowing medical drones to meet the growing needs of modern healthcare systems, thereby boosting their adoption globally. Thus, growing advancement in technology is projected to propel the global medical drones market demand during the forecast period.

Increasing Public Health Initiatives by Governments Worldwide

Governments worldwide are investing heavily in programs aimed at improving healthcare outreach, particularly in remote and underserved regions. Medical drones play a pivotal role in these initiatives by enabling rapid transportation of vaccines, medications, diagnostic kits, and emergency supplies to remote areas or areas with limited infrastructure. These public health initiatives are driving the adoption of drone technology to enhance public health outcomes. On October 31, 2024, the Prime Minister of India virtually launched Drone Services for Health Outreach, marking a transformative step in enhancing healthcare delivery across India. This innovative initiative aims to ensure timely access to essential medical supplies and services, particularly in remote areas. Therefore, increasing public health initiatives by governments worldwide are driving the global medical drones market development.

Medical Drones Market Segment Analysis

Medical Drones Market Assessment by Type

Based on type, the medical drones market is segmented into fixed wing, rotor drones, and hybrid drones. The fixed wing segment accounted for a major market share in 2024 due to their superior efficiency in long-distance medical deliveries. These drones are highly efficient in covering vast geographical areas due to their aerodynamic design, allowing for longer flight durations and higher speeds compared to the rotor and hybrid models. Fixed-wing designs are particularly advantageous for transporting critical supplies, such as vaccines, blood units, and diagnostic samples, to remote and underserved regions. The ability of fixed wing drones to operate in challenging terrains and adverse weather conditions further strengthens their dominance, making them the preferred choice for government health programs and large-scale healthcare third-party logistics initiatives.

Medical Drones Market Evaluation by Application

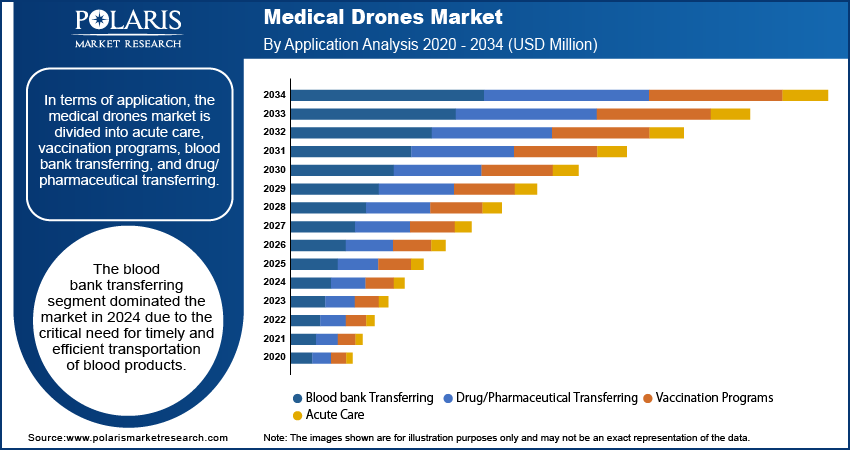

In terms of application, the medical drones market is divided into acute care, vaccination programs, blood bank transferring, and drug/pharmaceutical transferring. The blood bank transferring segment dominated the market in 2024 due to the critical need for timely and efficient transportation of blood products. Healthcare systems heavily rely on the rapid delivery of blood and plasma to save lives during emergencies, surgeries, and disasters. Drones optimized for this purpose offer unmatched speed and reliability, particularly in areas with poor road infrastructure or during crises where conventional transport methods face delays. The ability to maintain precise temperature control during transit has further fueled the adoption of drones for blood transport. Governments and nongovernmental organizations have supported this growth through initiatives aimed at improving access to blood supplies in underserved regions, ensuring their critical role in healthcare logistics.

The drug /pharmaceutical transferring segment is projected to hold a dominant market share in the coming years due to the increasing prevalence of chronic diseases and the growing need for rapid medication distribution. Drones efficiently deliver a variety of pharmaceutical products, including temperature-sensitive medications such as insulin and cancer drugs, to patients in remote locations. Technological advancements in payload capacity, navigation systems, and real-time monitoring have enhanced the reliability and scalability of drone deliveries for pharmaceutical applications. Additionally, the expanding adoption of telemedicine and home-based healthcare services amplifies the demand for drone-enabled drug delivery, positioning the segment for rapid growth.

Medical Drones Market Share by Region

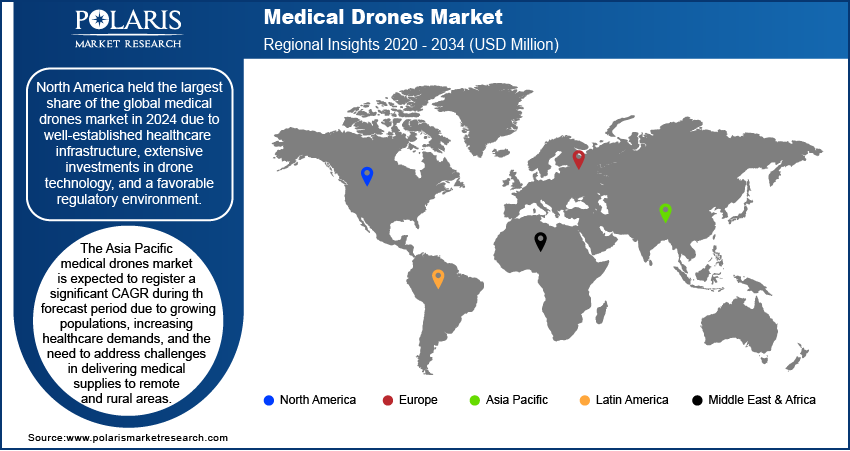

By region, the study provides the medical drones market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America held the largest market share in 2024 due to well-established healthcare infrastructure, extensive investments in drone technology, and a favorable regulatory environment. The US accounted for the largest market share in the region, driven by significant advancements in drone manufacturing, widespread adoption of innovative healthcare delivery models, and increasing partnerships between healthcare providers and logistics companies. Government initiatives such as integrating drones into emergency medical services and disaster response plans further boosted the market growth. Additionally, the presence of major technology firms and research institutions in the region facilitated continuous innovation, enhancing drone efficiency and reliability in healthcare applications.

The Asia Pacific medical drones market is expected to register a significant CAGR during the forecast period due to growing populations, increasing healthcare demands, and the need to address challenges in delivering hospital supplies to remote and rural areas. China and India, in particular, are emerging as key countries in the region, leveraging their strong manufacturing capabilities, technological advancements, and government-backed initiatives to expand drone use in healthcare logistics. Investments in drone pilot projects for vaccination programs, blood transport, and pharmaceutical deliveries are driving the market growth in the region. The rising focus on improving healthcare accessibility and overcoming infrastructure challenges positions Asia Pacific as a growing region in the market.

Medical Drones Market – Key Players & Competitive Analysis Report

Major market players are investing heavily in research and development to expand their offerings, which will help the medical drones market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations.

The medical drones market is fragmented, with the presence of numerous global and regional market players. Major players in the medical drones market include Zipline International Inc., Volocopter GmbH, Volansi, Embention, Matternet, Avy, Flytrex Inc., Airbus, EHang, Vaayu Drones, and DHL.

Zipline International Inc. is a US-based company that has emerged as a leader in the field of drone delivery, particularly in the healthcare sector. Founded in 2011 and headquartered in South San Francisco, California, Zipline designs, manufactures, and operates a fleet of drones specifically tailored for medical supply delivery. The company has completed over one million deliveries and flown more than 70 million autonomous miles as of April 2024, with operational hubs established in several countries, including Rwanda, Ghana, Nigeria, and Japan. The company claims that its drones can deliver a wide range of medical products, including whole blood, platelets, vaccines, and other essential medical commodities. In Rwanda, more than 35% of blood deliveries outside the capital city of Kigali are conducted using Zipline’s drones.

Vaayu Drones is an emerging technology company based in New Delhi, India. The company specializes in the design and development of unmanned aerial vehicles (UAVs). Founded in 2019, the company aims to provide innovative drone solutions across various sectors, including precision agriculture, mining, construction, and healthcare. Vaayu Drones is committed to leveraging drone technology to enhance operational efficiency and safety in industries that often involve high-risk tasks. The company's mission emphasizes solving critical problems through automation and reducing human intervention in hazardous environments.

List of Key Companies in Medical Drones Market

- Airbus

- Avy

- DHL

- EHang

- Embention

- Flytrex Inc.

- Matternet

- Vaayu Drones

- Volansi

- Volocopter GmbH

- Zipline International Inc.

Medical Drones Industry Developments

March 2023: Zipline, a US-based company that has emerged as a leader in the field of drone delivery, particularly in the healthcare sector, unveiled its new Platform 2 (P2), designed for quiet, fast, and precise autonomous deliveries in urban and suburban areas. This next-generation platform operates silently and can complete 10-mile deliveries in ∼10 minutes.

July 2022: Avy, a Netherland-based company, entered into a long-term partnership with Fundashon Mariadal, a healthcare institution on Bonaire, to develop an autonomous drone network connecting the islands in the Caribbean Netherlands

Medical Drones Market Segmentation

By Type Outlook (Revenue, USD Million, 2020–2034)

- Fixed Wing

- Rotor Drones

- Hybrid Drones

By Technology Outlook (Revenue, USD Million, 2020–2034)

- Fully Autonomous

- Semi-Autonomous

- Remotely Operated

By Application Outlook (Revenue, USD Million, 2020–2034)

- Acute Care

- Vaccination Programs

- Blood bank Transferring

- Drug/Pharmaceutical Transferring

By Package Size Outlook (Revenue, USD Million, 2020–2034)

- Less Than 2Kg

- 2–5 Kg

- More Than 5kg

By End User Outlook (Revenue, USD Million, 2020–2034)

- Government Organizations

- Emergency Medical Services

- Blood Banks

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Medical Drones Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 360.48 million |

|

Market Size Value in 2025 |

USD 420.25 million |

|

Revenue Forecast by 2034 |

USD 1,697.55 million |

|

CAGR |

16.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global medical drones market size was valued at USD 360.48 million in 2024 and is projected to grow to USD 1,697.55 million by 2034.

• The global market is projected to register a CAGR of 16.8% during the forecast period.

• North America held the largest share of the global market in 2024.

• A few of the key players in the market are Zipline International Inc., Volocopter GmbH, Volansi, Embention, Matternet, Avy, Flytrex Inc., Airbus, EHang, Vaayu Drones, and DHL

• The blood bank transferring segment dominated the market in 2024.