Medical Disposable Market Size, Share, Trends, Industry Analysis Report

By Product (Hospitals, Outpatient/Primary Care Facilities, Home Healthcare), By Raw Material Type, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 120

- Format: PDF

- Report ID: PM1572

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

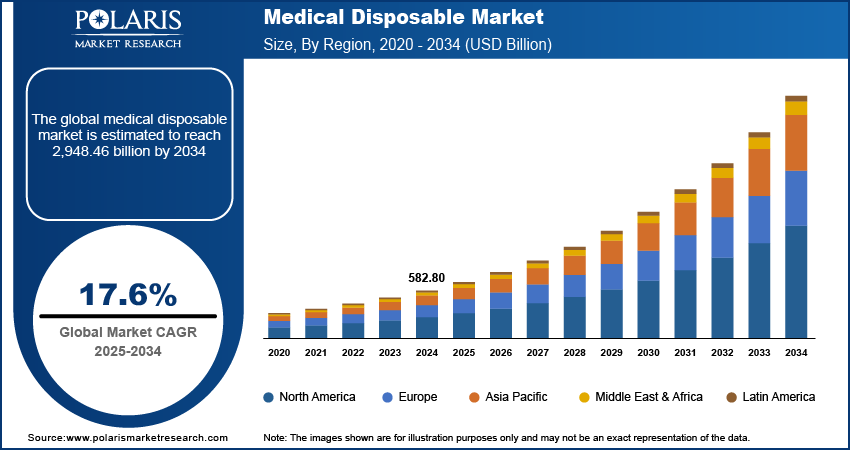

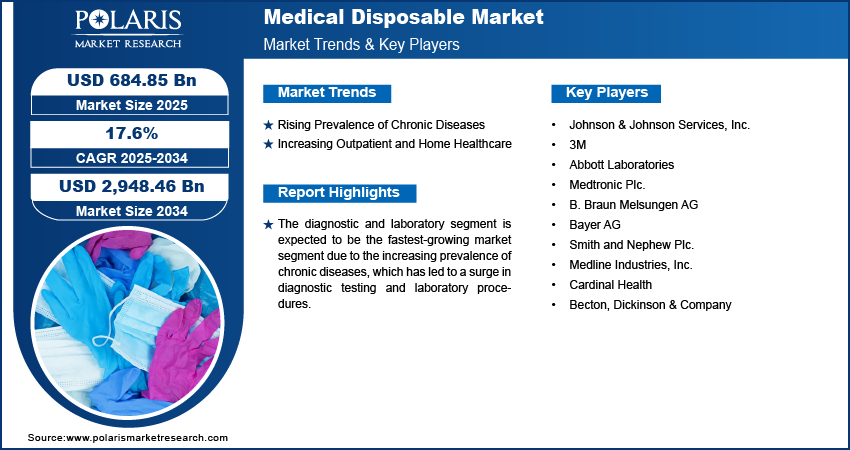

The medical disposable market size was valued at USD 582.80 billion in 2024 and is projected to register a CAGR of 17.6% from 2025 to 2034. The surge in demand for various disposable medical supplies, such as personal protective equipment (PPE) and testing kits, boosts the market growth. Supportive policies and increased healthcare spending are also fueling the industry growth

Key Insights

- The diagnostic and laboratory segment is expected witness the fastest growth during the forecast period. The growth is attributed to the increasing prevalence of chronic diseases, which has led to a surge in diagnostic testing and laboratory procedures.

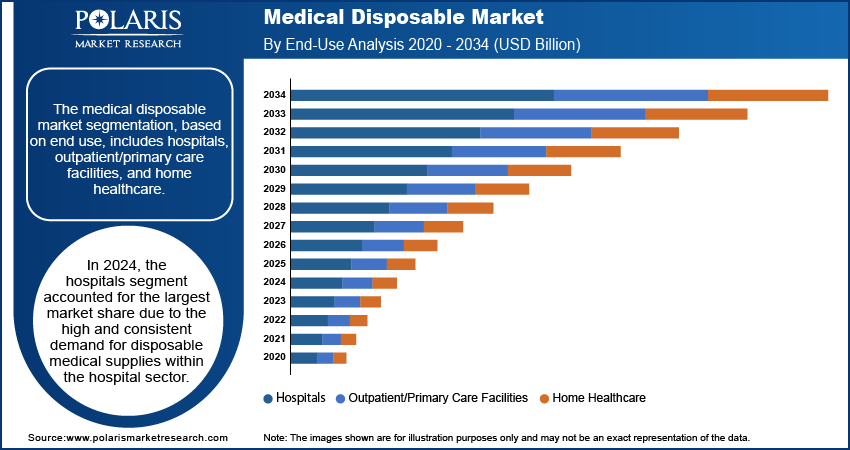

- In 2024, the hospitals segment accounted for the largest market share. It is due to the high and consistent demand for disposable medical supplies within the hospital sector.

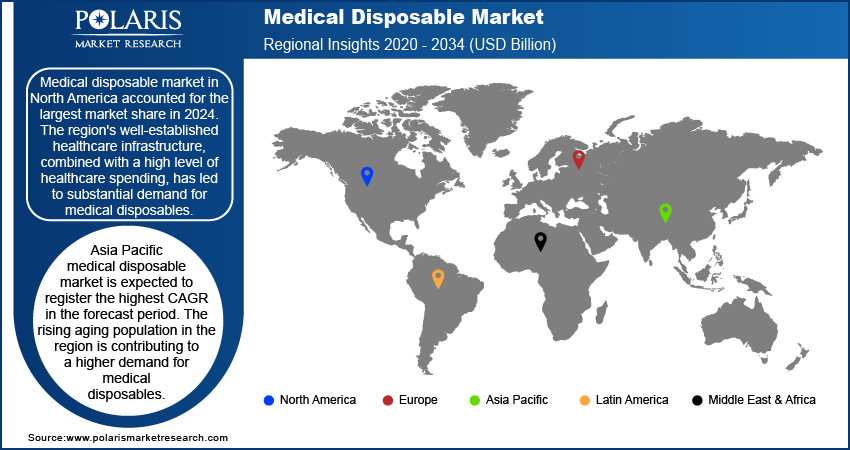

- North America held the largest global revenue share in 2024. The region's well-established healthcare infrastructure and a high level of healthcare spending propel the demand for medical disposables.

- The Asia Pacific medical disposable industry is expected to register the highest CAGR during the forecast period. The rising aging population in the region is driving the industry expansion.

Industry Dynamics

- Increasing prevalence of chronic diseases across the world propels the demand for medical disposables.

- The rising shift toward outpatient and home-based care fuels the growth of the market.

- Continuous advancements in medical technologies are expected to provide lucrative opportunities for the market during the forecast period.

- High costs of raw materials hinder the industry growth.

Market Statistics

2024 Market Size: USD 582.80 billion

2034 Projected Market Size: USD 2,948.46 billion

CAGR (2025–2034): 17.6%

North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

Medical disposables are single-use, non-reusable products used in healthcare settings to prevent cross-contamination, reduce the risk of infections, and ensure patient and healthcare worker safety. Medical disposables include a wide range of products, such as gloves, syringes and needles, surgical instruments, bandages and dressings, and others. The growth of the healthcare industry is significantly driving the demand for medical disposables. Advancements in medical technology, rising healthcare expenditures, and the ongoing development of healthcare infrastructure are further increasing the reliance on disposable medical products. Furthermore, increasing infectious diseases like the COVID-19 pandemic have highlighted the importance of medical disposables in healthcare. The surge in demand for personal protective equipment (PPE), testing kits, and other disposable medical supplies during such crises has increased the medical disposables market demand.

Continuous advancements in medical technology have led to the development of more efficient and cost-effective disposable products. For example, innovations such as pre-filled syringes, advanced wound care dressings, and disposable endoscopes are contributing to the medical disposable market expansion. Moreover, governments worldwide are implementing stringent regulations and guidelines to ensure the safety and efficacy of medical disposables. Thus, the supportive policies and increased healthcare spending are further driving the medical disposable market growth.

Market Drivers and Trends

Rising Prevalence of Chronic Diseases

The increasing prevalence of chronic diseases such as diabetes and cancer has led to a higher demand for medical disposables. For instance, according to the U.S. Centers for Disease Control and Prevention, in 2021, the United States reported 1.78 million new cases of cancer, with 439 new cases per 100,000 people. Patients with chronic conditions often require ongoing medical care, including the frequent use of disposable products like syringes, dressings, and catheters. Consequently, the rising incidence of chronic diseases is driving demand for medical disposables, thereby driving the medical disposable market growth.

Increasing Outpatient and Home Healthcare

The rising prevalence of outpatient and home healthcare is significantly driving the growth of the medical disposables market. For instance, in 2022, 83.4% of adults reported having consulted a physician or other healthcare professional. Healthcare systems are increasingly prioritizing cost-effective, patient-centric care models, leading to a growing demand for disposable medical products. These products are essential for ensuring safe and efficient care outside traditional hospital settings. These products, such as disposable wound dressings, syringes, catheters, and respiratory supplies, are crucial in facilitating high-quality care in outpatient clinics and home environments, where infection control and ease of use are paramount. Thus, this shift towards outpatient and home-based care is fueling the expansion of the medical disposables market.

Segment Insights

Market Breakdown by End Use Insights

The medical disposable market segmentation, based on end use, includes hospitals, outpatient/primary care facilities, and home healthcare. In 2024, the hospitals segment accounted for the largest market share due to the high and consistent demand for disposable medical supplies within the hospital sector. Hospitals are the frontline providers of healthcare services, dealing with a high volume of patients daily. This necessitates the frequent use of medical disposables such as gloves, syringes, gowns, and masks to maintain strict hygiene standards and prevent cross-contamination. The ongoing emphasis on infection control and patient safety further drives the demand for these products. Furthermore, the rise in hospital admissions, surgical procedures, and the need for emergency care services contributes significantly to the dominance of this segment in the market.

Market Breakdown by Products Insights

The medical disposable market segmentation, based on products, includes wound management, drug delivery, dialysis, nonwoven disposable, respiratory supplies, diagnostic and laboratory, and sterilization. The diagnostic and laboratory segment is expected to be the fastest-growing market segment due to the increasing prevalence of chronic diseases, which has led to a surge in diagnostic testing and laboratory procedures. The growing emphasis on early disease detection and regular health check-ups has intensified the demand for diagnostic tests, driving the need for disposable medical items such as test tubes, pipettes, specimen containers, and other laboratory supplies. Additionally, advancements in diagnostic technologies and the expansion of laboratory services, particularly in emerging markets, have further fueled the growth of this segment. The heightened awareness of infection control measures in laboratories, especially during the COVID-19 pandemic, has also contributed to the increased adoption of disposable products, thereby fueling the growth of the diagnostic and laboratory segment.

Market Breakdown by Regional Insights

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Medical disposable market in North America accounted for the largest market share in 2024. The region's well-established healthcare infrastructure, combined with a high level of healthcare spending, has led to substantial demand for medical disposables. Furthermore, the strong presence of leading medical device manufacturers in North America, coupled with ongoing advancements in medical technologies, has facilitated the widespread availability and adoption of high-quality disposable products. Furthetmore, the increasing investments and production expansion by key companies in the North America medical disposable market is driving market growth. For instance, For instance, Polymer Medical Inc. is investing USD 1.5 million to expand its Orchard Park, New York. This investment includes the acquisition of a 4,500-square-foot facility that will facilitate an expansion of their injection molding and assembly capabilities. Thus, the region is solidifying its position as a critical hub for medical disposable manufacturing to meet both domestic and global needs, thereby fueling the market growth in the region.

The US medical disposable market had the largest market share in 2023. The stringent regulatory standards by the US government ensure a steady demand for disposable items to maintain infection control and patient safety, thereby contributing to the medical disposable market growth in the US.

Asia Pacific medical disposable market is expected to register the highest CAGR in the forecast period. The rising aging population in the region is contributing to a higher demand for medical disposables. According to the World Economic Forum, Asia's population currently exceeds 4.5 billion, representing over half of the global population. Especially, China and India each have populations exceeding one billion. The age group experiencing the most rapid rise in Asia is individuals aged 65 and older, with projections indicating that this demographic will triple from 414 billion in 2020 to 1.2 billion by 2060. The aging population is more susceptible to chronic diseases, which requires superior medical facilities and products. Thus, there is an increasing need for medical disposable products such as pre-filled syringes, insulin needles, and others. This growing demand is driving the rapid growth of the medical disposable market in the region.

The China medical disposable market is expected to grow significantly during the forecast period due to increased healthcare investments, rising patient population, and rapid urbanization. The expansion of healthcare infrastructure and improvements in medical facilities, driven by government initiatives and growing healthcare expenditure, are fueling the demand for medical disposables.

Key Players & Competitive Insights

The competitive landscape of the medical disposable market is characterized by a diverse array of global and regional players striving to capture market share through innovation, strategic partnerships, and geographic expansion. Major players in the market, such as Medtronic, Johnson & Johnson, and Baxter International, leverage their extensive R&D capabilities and broad distribution networks to offer a wide range of advanced medical disposable products. These companies focus on product innovation, including improvements in safety, functionality, and cost-efficiency, to meet the evolving needs of healthcare providers. Additionally, smaller and regional companies are increasingly entering the market, offering specialized and niche products that cater to specific healthcare needs or local market demands. Competitive strategies often include mergers and acquisitions, partnerships with healthcare institutions, and investments in emerging markets to expand reach and enhance market presence. Major players include Johnson & Johnson Services, Inc.; 3M; Abbott Laboratories; Medtronic Plc.; B. Braun Melsungen AG; Bayer AG; Smith and Nephew Plc.; Medline Industries, Inc.; Cardinal Health; and Becton, Dickinson and Company.

Johnson & Johnson Services, Inc. is a multinational corporation based in New Brunswick, New Jersey, USA. The company operates through pharmaceuticals, medical devices, and consumer health products operations. The company's subsidiary, Janssen Pharmaceuticals, Inc., develops and markets drugs in various therapeutic areas, including neuroscience, oncology, infectious diseases, and immunology. In December 2022, Johnson Medtech launched a new production line for a custom-engineered disposable EKG patch with prepositioned electrodes. This design reduces prep time and minimizes placement errors, enhancing the efficiency and accuracy of cardiac monitoring.

3M Company is a global technology services provider with operations spanning the United States and international markets. Organized into four main segments—transportation and electronics, safety and industrial, health care, and consumer—the company offers a diverse array of products and solutions. The transportation and electronics segment focuses on ceramic solutions, tapes, films, and products for temperature management in transportation vehicles, as well as graphic films for advertising. It also provides interconnection and packaging solutions, and reflective signage for safety applications. In February 2024, 3M launched a medical adhesive that adheres for up to 28 days, double the previous standard. Designed for use with health monitors and long-term wearables, this innovation enhances patient comfort and compliance by reducing the need for frequent replacements.

List of Key Companies in Medical Disposable Market

- Johnson & Johnson Services, Inc.

- 3M

- Abbott Laboratories

- Medtronic Plc.

- B. Braun Melsungen AG

- Bayer AG

- Smith and Nephew Plc.

- Medline Industries, Inc.

- Cardinal Health

- Becton, Dickinson & Company

Medical Disposable Industry Developments

In January 2024, Medtronic secured CE Mark approval for its MiniMed 780G system with Simplera Sync, a compact, disposable CGM that requires no fingersticks or overtape. Simplera Sync features a simplified two-step insertion and is half the size of previous Medtronic sensors.

In January 2024, Inspira launched a single-use disposable blood oxygenation kit, targeting a new opportunity in the disposable perfusion market.

In March 2021, Indegene and ConTIPI Medical Ltd partnered to introduce a new device for women with Pelvic Organ Prolapse (POP). The new alliance will combine Indegene's health-tech expertise with ConTIPI's innovative non-surgical solutions.

Medical Disposable Market Segmentation

By Product Outlook

- Wound Management

- Drug Delivery

- Dialysis

- Nonwoven Incontinence

- Respiratory Supplies

- Diagnostic and Laboratory

- Sterilization

By Raw Material Type Outlook

- Paper and Paperboard

- Plastic Resin

- Nonwoven Material

- Metals

- Glass

- Rubber

By End Use Outlook

- Hospitals

- Outpatient/Primary Care Facilities

- Home Healthcare

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Medical Disposable Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 582.80 billion |

|

Market Size Value in 2025 |

USD 684.85 billion |

|

Revenue Forecast in 2034 |

USD 2,948.46 billion |

|

CAGR |

17.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The medical disposable market size was valued at USD 582.80 billion in 2024 and is projected to grow to USD 2,948.46 billion by 2034.

The market is projected to grow at a CAGR of 17.6% during 2025–2034.

North America had the largest share in the market due to the region's well-established healthcare infrastructure.

The key players in the market are Johnson & Johnson Services, Inc.; 3M; Abbott Laboratories; Medtronic Plc.; B. Braun Melsungen AG; Bayer AG; Smith and Nephew Plc.; Medline Industries, Inc.; Cardinal Health; and Becton, Dickinson and Company.

The hospital segment dominated the market in 2024 due to the high and consistent demand for disposable medical supplies within the hospital sector.

The diagnostic and laboratory category accounted for the largest share due to the increasing prevalence of chronic diseases, which has led to a surge in diagnostic testing and laboratory procedures.