Medical Devices Reimbursement Market Share, Size, Trends, Industry Analysis Report

By Payer (Public, Private); By Healthcare Setting (Hospitals, Outpatient Facilities, Others); By Regions; Segment Forecast, 2021 - 2028

- Published Date:May-2021

- Pages: 101

- Format: PDF

- Report ID: PM1888

- Base Year: 2020

- Historical Data: 2016 - 2019

Report Outlook

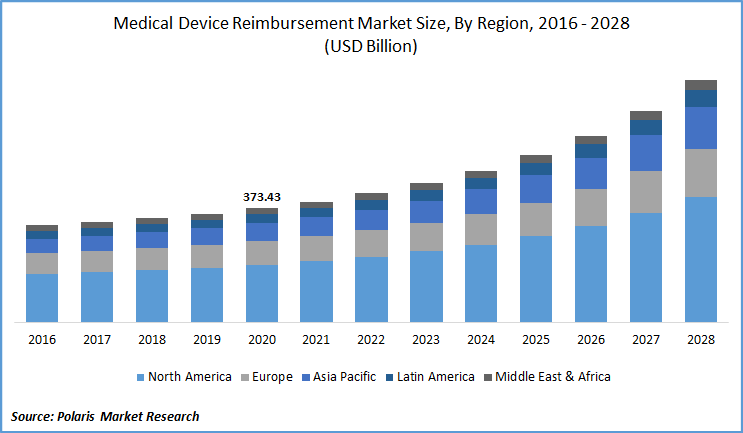

The global medical device reimbursement market was valued at USD 373.43 billion in 2020 and is expected to grow at a CAGR of 10.5% during the forecast period. Technological advancements in electronic medical records, the rising need for reimbursement scenarios, proper framework, and guidelines in the sector are primary factors driving the market growth for medical device reimbursement.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

In addition, an increase in the cases of chronic disorders and strong government push towards digital healthcare are few other factors responsible for the market growth for medical device reimbursement. The amount for reimbursement is usually decided by two methods such as complete reimbursement of certain medical devices, and the payment for the entire medical procedure, wherever the medical device is currently being used.

The U.S. Affordable Act is focused on decreasing the cost of healthcare service delivery at a reduced cost. The purpose of this act is to reduce the cost of medical devices and make healthcare affordable to all sections of society. Center for Medicaid and Medicare is working to provide high-quality medical devices and insurance available to billions of people.

Medicaid spending in the country has increased by around 4.5%, in 2019. Moreover, according to the study done by the Center for American Progress (CAP), more than 1.3 trillion was estimated to be already being spent on medical device reimbursement in the market.

Know more about this report: request for sample pages

Medical Device Reimbursement Market Report Scope

The market is primarily segmented on the basis of payer, healthcare setting, and geographic region.

|

By Payer |

By Healthcare Setting |

By Region |

|

|

|

Know more about this report: request for sample pages

Insight by Payer

The private medical devices reimbursement market segment accounted for the largest revenue share, in 2020. Such growth is attributed to the presence of a huge number of private players, an increase in the prevalence of cancer and diabetic patients, and a rising need for better treatment options. Current assessment criteria for the reimbursement also reflect the cost of using a device or performing a medical procedure, but not to the technology being implemented.

The public payer market segment is expected to witness a lucrative growth rate over the medical device reimbursement assessment period. The emergence of public players in both developed and emerging economies and the rising innovation to develop new innovative products are the prominent factors fostering the segment’s market growth in medical device reimbursement.

It is being estimated that NHS, in 2017, treated more than 8.5 million non-urgent patients and approximately 135,000 individuals have received long-term treatment, under the NHS. Hence, with a rise in the aging population and the prevalence of chronic disorders, the market is projected to grow.

Insight by Hospital Setting

In 2020, the hospital market segment accounted for the largest share of medical device reimbursement industry. Rising prevalence of chronic diseases in large scale healthcare settings such as specialized hospitals and clinics are driving the market segment’s revenues.

Most of the innovative medical devices are used in the public hospitals, before being sold to the private hospitals. Private healthcare settings usually have fixed budget, which include surplus revenue being taken from patients directly. Hence, they are better equipped with state of art medical devices.

However, out-patient healthcare facilities are projected to witness a lucrative market growth over the study period. This is primarily due to rise in investments of research and development, and the rise in incidence of the chronic disorders. Moreover, rising need for essential medicines and the cost-efficient production capabilities is further expected to foster the segment’s market growth for medical device reimbursement.

Geographic Overview

In 2020, the North America medical device reimbursement market accounted for more than 50% of the global market in 2020. The factors contributing to the region’s growth include a rise in the cases of deadly diseases and a proper reimbursement framework in the most advanced economies.

Two times in the year, the list of devices is being performed by the individual committee to incorporate the latest product within the list of the reimbursement system. Moreover, the changes in regulatory policies and rising pressure from the healthcare industry are expected to drive the market demand for medical device reimbursement.

Competitive Insight

The prominent market players operating in the medical device reimbursement market include Aviva, Nippon Life Insurance, CVS Health, WellCare Health Plans, BNP Paribas, Aetna, Allianz, Humana, Cigna, and UnitedHealth Group.