Medical Devices Market Size, Share, Trends, Industry Analysis Report

: By Type (Orthopedic Devices, Cardiovascular Devices, Diagnostic Imaging, Minimally Invasive Surgery, Ophthalmic Devices, Dental Devices, Nephrology, General Surgery, and Others), Application, End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 118

- Format: PDF

- Report ID: PM3253

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

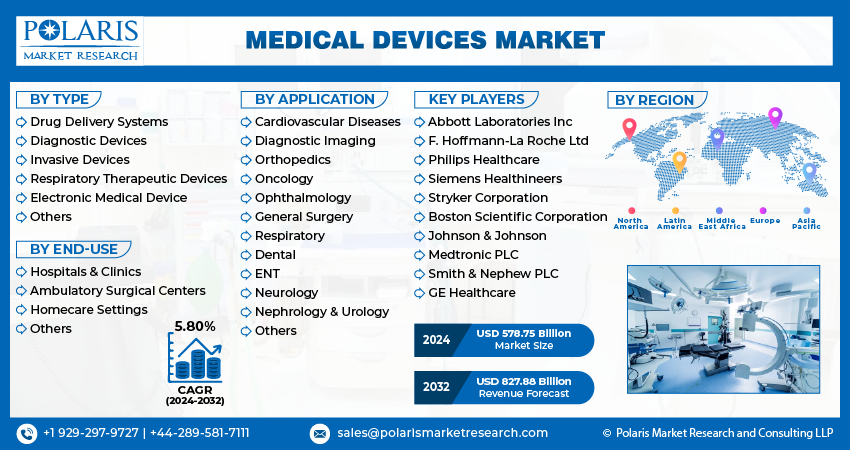

The medical devices market size was USD 545.22 billion in 2024 and is expected to grow at a CAGR of 6.4% during the period 2025-2034. A rising population influences the expansion, leading to an increase in chronic diseases, the introduction of new technologies such as AI and wearable devices, higher healthcare expenditures, and government encouragement of healthcare development.

Key Insights

- Orthopedic equipment leads the market because musculoskeletal diseases, such as osteoporosis and arthritis, are on the rise, and joint replacement surgeries are in higher demand.

- The clinics segment is experiencing rapid growth due to increased demand for outpatient services, diagnostics, and preventive care.

- North America holds the largest market share, primarily due to higher healthcare spending, robust infrastructure, and the presence of leading market players.

- Europe plays a key role in the global market, with Germany, France, and the UK leading due to their strong healthcare systems, aging populations, and rising demand for advanced medical technologies.

- Asia Pacific is among the fastest-growing medical device markets in the region, driven by increased healthcare infrastructure, the expansion of the middle class, and a growing focus on healthcare modernization.

Industry Dynamics

- The aging global population is driving demand for medical devices, especially for diagnostics, monitoring, and treatment.

- Advances in medical technology, including minimally invasive procedures, robotic procedures, and AI-based convergence, are driving the market for medical devices.

- Growing healthcare expenditure worldwide, particularly in emerging economies, is driving the demand for advanced medical technologies and boosting the medical device market.

- One of the key challenges in the market is the extremely high cost of advanced medical technologies, which can become a limiting factor, particularly in developing nations.

Market Statistics

2024 Market Size: USD 545.22 billion

2034 Projected Market Size: USD 1,011.97 billion

CAGR (2025-2034): 6.4%

North America: Largest Market Share

AI Impact on Medical Devices Market

- Artificial intelligence enhances the accuracy of diagnosis by delivering quick and accurate analysis of medical information compared to traditional approaches.

- It enables the monitoring of patients using wearable technologies that monitor vital signs and detect problems in real-time.

- Robotics controlled by AI drives surgeries, improving precision and cutting recovery time.

- Machine learning procedures help in predicting disease development and customizing treatment regimens for patients.

To Understand More About this Research: Request for Customized Report

The medical devices market includes a wide range of products used in the diagnosis, monitoring, and treatment of medical conditions. It encompasses devices such as diagnostic equipment, surgical instruments, and therapeutic devices. The medical devices market growth is driven by factors such as the aging global population, increasing prevalence of chronic diseases, advancements in medical technology, and rising healthcare expenditure. Key drivers include the growing demand for minimally invasive procedures, the adoption of smart medical devices, and the integration of artificial intelligence and wearable technology in healthcare. Additionally, the market is influenced by regulatory frameworks and innovations aimed at improving patient outcomes and enhancing operational efficiency in healthcare settings.

Market Dynamics

Aging Population and Increasing Prevalence of Chronic Diseases

The aging global population is a significant medical devices market driver. As life expectancy increases, the elderly population grows, which leads to higher demand for medical care, including diagnostic tools, monitoring equipment, and therapeutic devices. According to the United Nations, the number of people aged 60 years or older is projected to reach 2.1 billion by 2050, up from 1 billion in 2020. This demographic shift results in a rise in chronic conditions such as cardiovascular diseases, diabetes, and osteoarthritis, all of which require frequent medical monitoring and treatment. In particular, chronic disease management technologies such as glucose monitoring devices, blood pressure monitors, and respiratory care devices are seeing increased adoption to address the needs of the aging population.

Technological Advancements and Adoption of Smart Medical Devices

Advancements in medical technology continue to drive medical devices market growth. Innovations such as minimally invasive surgery techniques, robotic-assisted surgeries, and the integration of artificial intelligence (AI) and machine learning into medical devices are transforming healthcare delivery. The growing adoption of wearable medical devices, including smartwatches and fitness trackers, has enabled more personalized and continuous monitoring of health metrics such as heart rate, blood oxygen levels, and physical activity. These technological innovations improve patient outcomes and operational efficiency, as they allow for earlier detection and intervention in medical conditions.

Increased Healthcare Expenditure and Government Support

Rising healthcare expenditure globally has a direct impact on the medical devices market. Increased spending on healthcare infrastructure and services, particularly in emerging markets, supports the adoption of advanced medical technologies. Government initiatives and policies, such as the US Affordable Care Act (ACA) and funding for healthcare technology, encourage the use of innovative medical devices. For example, the US government has committed to significant investments in healthcare modernization, which includes promoting the use of medical devices in patient care. In 2022, as per WHO global healthcare spending reached an alarming $9.8 accounted for 10% of global GDP, indicating a strong financial commitment to the healthcare sector. This trend boosts demand for a wide range of medical devices from diagnostic equipment to therapeutic devices, as health systems aim to improve patient outcomes and reduce healthcare costs.

Segment Analysis

Market Assessment by Type

The medical devices market segmentation, by type, includes orthopedic devices, cardiovascular devices, diagnostic imaging, minimally invasive surgery, ophthalmic devices, dental devices, nephrology, general surgery, and others. The orthopedic devices hold the largest market share, owing to the increasing prevalence of musculoskeletal disorders, such as arthritis and osteoporosis, and the growing demand for joint replacement surgeries. The rise in the aging population and higher incidences of trauma and fractures also contribute to the robust growth of orthopedic devices.

The nephrology segment is expected to register the fastest growth. This is primarily due to the rising number of patients with chronic kidney disease (CKD) and the increased demand for dialysis machines and other nephrology-related devices. This trend is particularly noticeable in regions with high CKD prevalence and healthcare system advancements, such as North America and Europe.

Market Evaluation by End User

The medical devices market, market by end -user, is segmented into hospitals & ambulatory surgical centers (ASCs), clinics, and others. The hospitals & and ambulatory surgical centers (ASCs) segment holds the largest medical devices market market share in the medical devices industry due to the high volume of medical procedures conducted in these settings. Hospitals, particularly large ones, are equipped with advanced medical devices across various specialties, including surgery, diagnostics, and therapeutic care. The demand for medical devices in hospitals is driven by factors such as the increasing patient population, advancements in healthcare technology, and the requirement for comprehensive care. Hospitals and & ASCs also benefit from government healthcare programs, making them the primary consumers of medical devices, especially in critical care and complex surgical procedures. The significant investments in hospital infrastructure and the rising prevalence of chronic diseases continue to bolster growth in this segment.

The clinics segment is also experiencing notable growth, driven by increasing demand for outpatient care and diagnostic services, along with a growing emphasis on preventive care. With the rise in patient preferences for non-hospital settings, such as specialized clinics for cardiology, orthopedics, and diagnostics, the adoption of medical devices in clinics is expanding. Clinics are increasingly incorporating advanced diagnostic and monitoring equipment, contributing to the market's growth. The others category, which includes homecare settings, rehabilitation centers, and research labs, is also growing, driven by the rise in home healthcare devices and the need for personalized care solutions outside of traditional clinical environments. However, the hospitals & ambulatory surgical centers (ASCs) segment remains the dominant player, while clinics show the highest growth, reflecting the ongoing shift toward outpatient care and preventive health services.

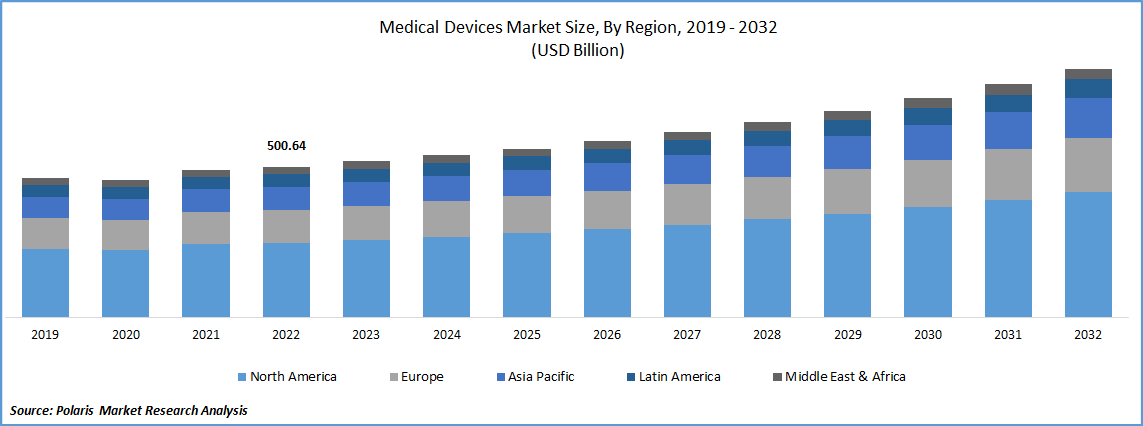

Market Share by Regional

By region, the study provides medical devices market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest market share, driven primarily by the high healthcare expenditure, advanced healthcare infrastructure, and the presence of key market players in the region. The US leads this growth due to its robust healthcare system, technological innovations, and a strong regulatory framework that supports the development and adoption of new medical devices. The aging population and the rising prevalence of chronic diseases further contribute to the demand for medical devices. Additionally, the region benefits from extensive government funding and insurance coverage, enabling greater accessibility to advanced medical treatments and devices. While Europe and Asia Pacific also show significant growth, particularly due to increasing healthcare investments in countries such as Germany and China, North America's market dominance remains prominent due to its leading role in healthcare technology and innovation.

Europe represents a significant portion of the global medical devices market, with countries such as Germany, France, and the UK being key contributors. The region benefits from strong healthcare systems, a growing elderly population, and increasing demand for advanced medical technologies. The European Union’s regulatory framework, including the Medical Device Regulation (MDR), ensures high standards for product quality and safety, which drives medical devices market demand. Moreover, Europe’s focus on preventive healthcare and early disease detection has spurred the demand for diagnostic imaging, orthopedic, and cardiovascular devices. The region is also witnessing increased adoption of minimally invasive surgical devices and smart medical technologies, further accelerating the market's expansion.

Asia Pacific is one of the fastest growing regions in the medical devices market, driven by rapidly improving healthcare infrastructure, an expanding middle class, and an increasing focus on healthcare modernization. Countries such as China, Japan, and India are key players in the region. The aging population, coupled with rising incidences of chronic diseases such as diabetes and cardiovascular conditions, is significantly boosting demand for medical devices, particularly in diagnostics, cardiovascular care, and orthopedic devices. Furthermore, Asia Pacific’s increasing emphasis on health insurance coverage and government support for healthcare initiatives is driving the adoption of advanced medical technologies. China, in particular, is experiencing significant growth due to its large population, growing healthcare investments, and rising demand for both domestic and imported medical devices.

Key Players & Competitive Analysis Report

Key players in the medical devices market include companies such as Medtronic, Abbott Laboratories, Siemens Healthineers, GE Healthcare, Johnson & Johnson, Philips Healthcare, Stryker Corporation, Boston Scientific, Zimmer Biomet, Smith & Nephew, Thermo Fisher Scientific, Becton Dickinson, Cardinal Health, Edwards Lifesciences, and Intuitive Surgical. These companies have a wide range of medical devices in their portfolios, including diagnostic imaging, surgical instruments, cardiovascular devices, orthopedic implants, and more. Medtronic, for example, is involved in a variety of therapeutic areas, including diabetes management and neuromodulation, while Abbott Laboratories focuses on diagnostics, medical devices, and nutrition. Siemens Healthineers and GE Healthcare are prominent in diagnostic imaging, and companies such as Stryker and Zimmer Biomet specialize in orthopedic devices.

The competitive landscape of the medical devices industry is shaped by innovation, technological advancements, and geographic expansion. Key players such as Medtronic and Johnson & Johnson consistently invest in research and development to introduce new technologies and maintain market relevance. For instance, companies are increasingly focusing on minimally invasive procedures, robotic surgeries, and AI-integrated devices, which improve efficiency and patient outcomes. Smaller companies often focus on niche segments, while large companies dominate the market through diversified product lines and global presence. As a result, the competition is not just based on product offerings but also on the ability to quickly adapt to market needs and leverage emerging technologies including artificial intelligence and remote monitoring systems.

Despite the robust competition, partnerships and collaborations are critical strategies for companies in this market. For example, partnerships between medical device manufacturers and technology companies are helping bring innovative solutions to the healthcare industry. Many companies are also focusing on expanding their reach into emerging markets, where there is an increasing demand for affordable and accessible healthcare solutions. As a result, key players are not only competing on technological advancements but also on market penetration and service delivery. These dynamics highlight the importance of strategic alliances and the ability to navigate regulatory landscapes across various regions.

Medtronic is a global company that develops and manufactures a wide range of medical devices. It offers products in areas such as cardiac care, diabetes management, and surgical technologies. The company operates across various regions, providing solutions for both hospitals and individual patients. Medtronic focuses on improving patient outcomes through innovation and technology integration.

Siemens Healthineers is involved in the production of diagnostic imaging and laboratory diagnostics, including MRI machines, CT scanners, and point-of-care testing systems. The company is also focused on providing solutions that aid in the early detection and treatment of diseases. Siemens Healthineers operates globally and works closely with hospitals and clinics to provide medical equipment that helps improve patient care.

List Of Key Companies

- Abbott Laboratories

- Becton Dickinson

- Boston Scientific

- Cardinal Health

- Edwards Lifesciences

- GE Healthcare

- Intuitive Surgical

- Johnson & Johnson

- Medtronic

- Philips Healthcare

- Siemens Healthineers

- Smith & Nephew

- Stryker Corporation

- Thermo Fisher Scientific

- Zimmer Biomet

Medical Devices Industry Development

February 2025: NX Taiwan becomes the first Japanese company to obtain QMS certification for medical devices at its NEXT3 warehouse in Taoyuan City.

February 2025: Esco Lifesciences Group and Allwin Medical Devices entererd into strategic partnership. Allwin’s IVF consumables will strengthen Esco Medical's IVF instrument portfolio and contribute to Esco’s expansion in the Indian market.

Medical Devices Market Segmentation:

By Type Outlook (Revenue-USD Billion, 2020–2034)

- Orthopedic Devices

- Cardiovascular Devices

- Diagnostic Imaging

- Minimally Invasive Surgery

- Ophthalmic Devices

- Dental Devices

- Nephrology

- General Surgery

- Others

By Application Outlook (Revenue-USD Billion, 2020–2034)

- Cardiovascular Diseases

- Diagnostic Imaging

- Orthopedics

- Oncology

- Ophthalmology

- General Surgery

- Respiratory

- Dental

- ENT

- Neurology

- Nephrology & Urology

- Others

By End User Outlook (Revenue-USD Billion, 2020–2034)

- Hospitals & Ambulatory Surgical Centers (ASCs)

- Clinics

- Others

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Medical Devices Market Report Scope:

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 545.22 billion |

|

Market size value in 2025 |

USD 579.02 billion |

|

Revenue Forecast in 2034 |

USD 1,011.97 billion |

|

CAGR |

6.4% from 2025 to 2034 |

|

Base year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Asia Pacific Latin America |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The medical devices market has been segmented into detailed segments of type, application, and end user. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy: The growth and marketing strategies in the medical devices market are focused on innovation, expanding product portfolios, and entering emerging markets. Companies invest heavily in research and development to introduce advanced technologies, such as minimally invasive procedures, robotic systems, and AI integration. Strategic partnerships, collaborations, and acquisitions are also common strategies to enhance capabilities and expand market reach. In addition, companies are focusing on digital marketing and e-commerce platforms to engage with healthcare professionals and customers directly. Furthermore, increasing attention is being given to regulatory compliance and offering products that meet the specific needs of different regions and demographics, especially in developing markets.

FAQ's

The medical devices market size was valued at USD 545.22 billion in 2024 and is projected to grow to USD 1,011.97 billion by 2034.

The market is projected to register a CAGR of 6.4% during the forecast period

North America had the largest share of the market.

Key players in the medical devices market include companies such as Medtronic, Abbott Laboratories, Siemens Healthineers, GE Healthcare, Johnson & Johnson, Philips Healthcare, Stryker Corporation, Boston Scientific, Zimmer Biomet, Smith & Nephew, Thermo Fisher Scientific, Becton Dickinson, Cardinal Health, Edwards Lifesciences, and Intuitive Surgical.

The orthopedic devices segment accounted for the larger share of the market in 2024.

The hospitals and ambulatory surgery centers segment accounted for the larger share of the market in 2024.

Medical devices are instruments, apparatus, machines, or implants used in the diagnosis, prevention, monitoring, or treatment of medical conditions. These devices range from simple tools, such as thermometers and bandages, to complex machinery like MRI machines, pacemakers, and surgical robots. They are designed to assist healthcare professionals in providing better care to patients, improving outcomes, and enhancing quality of life. Medical devices can be used in hospitals, clinics, outpatient settings, or at home, and they cover a wide variety of applications, including diagnostic imaging, patient monitoring, surgical procedures, and rehabilitation.

A few key trends in the market are described below: Minimally Invasive Procedures: Growing preference for devices that enable less invasive surgeries, resulting in shorter recovery times and reduced risks. Integration of Artificial Intelligence: AI is being integrated into diagnostic tools, surgical robots, and monitoring devices to improve accuracy and efficiency. Wearable Medical Devices: Increased adoption of devices like smartwatches and fitness trackers for continuous health monitoring, including heart rate and blood glucose levels. Personalized Medicine: Advancements in devices that support personalized treatment plans, including custom implants and precision diagnostics.

A new company entering the medical devices market could focus on emerging technologies such as AI-driven diagnostics, wearable health devices, and minimally invasive surgical tools to stay ahead of the competition. By prioritizing innovation in areas like personalized medicine and remote patient monitoring, the company can address the growing demand for tailored healthcare solutions. Additionally, focusing on regulatory compliance and establishing strong partnerships with healthcare providers could facilitate faster market penetration. Offering cost-effective, high-quality devices, particularly in developing regions, can also differentiate the company while meeting the global need for accessible healthcare solutions.

Companies manufacturing, distributing, or purchasing medical devices and related products, and other consulting firms must buy the report.