Medical Device Testing Services Market Share, Size, Trends, Industry Analysis Report, By Service (Microbiology and Sterility Testing, Chemistry Test, Biocompatibility Test, Package Validation); By Phase; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 119

- Format: PDF

- Report ID: PM4072

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

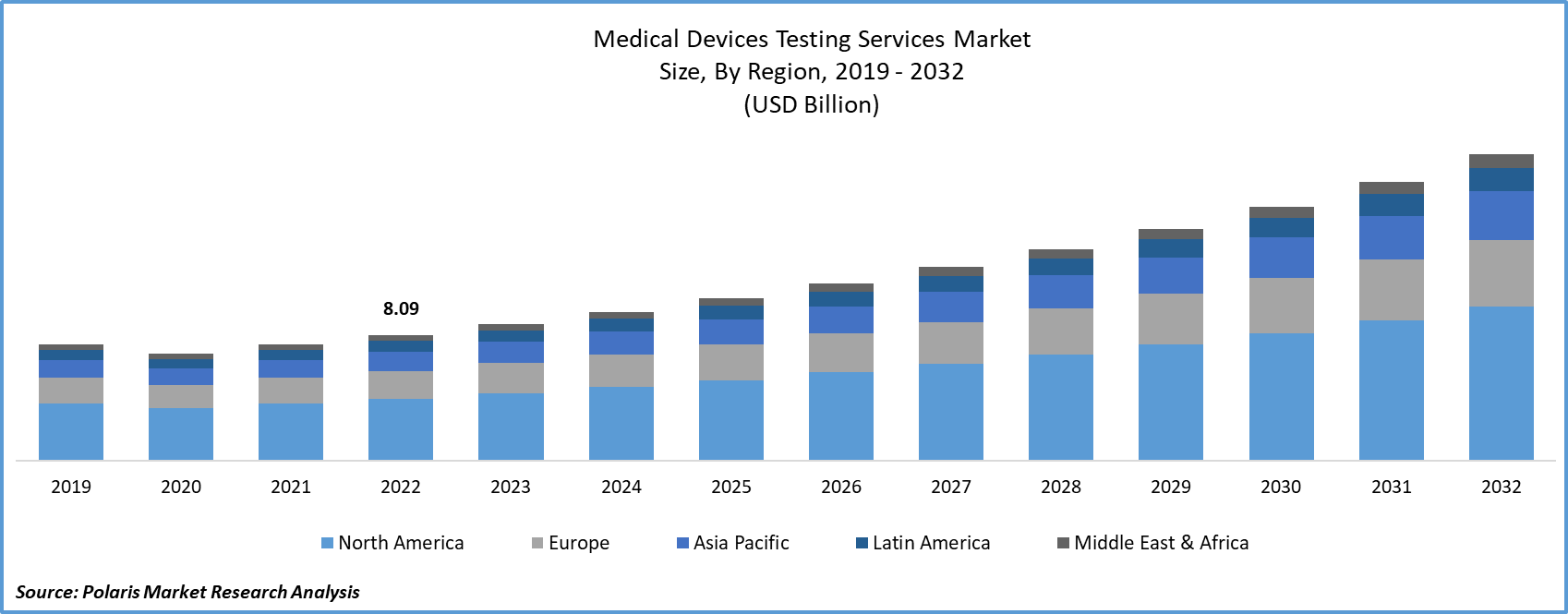

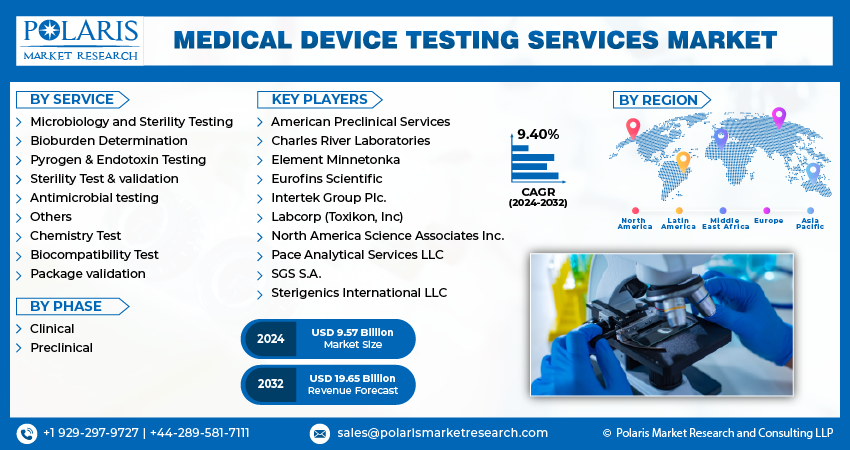

The global medical device testing services market was valued at USD 8.8 billion in 2023 and is expected to grow at a CAGR of 9.40% during the forecast period.

Medical device testing is a crucial process that ensures a device's reliability and safety during use. During new product development, thorough design validation testing is conducted, including toxicity tests, performance testing, chemical analysis, and sometimes even human factors or clinical testing.

To Understand More About this Research: Request a Free Sample Report

Cutting-edge technologies such as Artificial Intelligence and the Internet of Things are being applied to medical device testing services, with the aim of significantly enhancing market expansion. The growing adoption of wearable and portable medical devices is expected to be a primary factor driving this growth. Furthermore, government initiatives aimed at improving healthcare infrastructure and increasing resources for healthcare are further fueling the demand for testing services in this sector.

- For instance, Furthermore, individuals with diabetes often require ongoing medical attention due to increased hospitalization rates. It, in turn, contributes to the higher demand for coronary stents, as they are frequently used in treating diabetic patients with coronary artery disease.

Strict regulatory frameworks, such as those by the EMA and FDA, require thorough medical device testing to ensure safety and efficacy. Continual innovation requires comprehensive testing to minimize new risks and enhance patient outcomes. A growing demand for medical devices, driven by an aging population and rising healthcare costs, has led to significant growth in the testing industry. Many medical device companies now outsource testing to specialized firms.

The COVID-19 pandemic has had a significant impact on the market for testing medical devices. Due to the increasing demand of managing the pandemic, the healthcare system's focus shifted towards testing and validating medical devices used in the diagnosis and treatment of COVID-19. This resulted in a rise in demand for rapid diagnostic tests, ventilators, personal protective equipment (PPE), and other medical devices that are crucial in the fight against the virus.

The pandemic also accelerated the development and adoption of telehealth technologies and remote monitoring devices, which required new testing and validation protocols for these innovations.

On the other hand, the pandemic disrupted traditional supply chains, causing delays in testing and validation processes for non-COVID-19 related medical devices. Many clinical trials and in-person testing procedures were postponed or canceled, affecting the market's overall growth.

The long-term impact of COVID-19 on the medical device testing market is expected to lead to a more streamlined and technologically advanced approach to testing, with a focus on remote and virtual testing methods. Additionally, the importance of preparedness for future health crises is expected to shape the regulatory landscape, further impacting the medical device testing industry.

Continuous advancements in medical technology are expected to have a positive impact on the demand for testing services in the foreseeable future. The development and standardization of innovative in-vitro testing techniques, with a special emphasis on cytotoxicity, sensitization, and irritation assessments, are anticipated to be the driving forces behind the expansion of the market. These basic assessments are critical for evaluating all medical devices.

Industry Dynamics

Growth Drivers

- Amplification in Innovation & Technologies will drive the market growth

The market growth of medical device testing services market during the forecast period is primarily driven by the amplification in innovation & technologies. Technological progress in the healthcare sector has seen a remarkable surge in recent years. This progress is notably reflected in the development of advanced medical devices, which have greatly improved the ease and effectiveness of disease management. These innovations not only make treatment more painless and straightforward but also enable rapid and precise disease diagnosis. Additionally, these advancements in medical device technology contribute to cost-effective solutions for technology-based therapies in healthcare.

Furthermore, various governmental bodies and healthcare organizations are actively backing medical research centers with the overarching goal of enhancing healthcare innovations on a global scale. Consequently, the continuous growth of innovation and technological advancement is anticipated to drive the expansion of medical device testing in the forecast period.

Report Segmentation

The market is primarily segmented based on service, phase, and region.

|

By Service |

By Phase |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Service Analysis

- The microbiology and sterility segment held the largest revenue share

The microbiology and sterility test segment held the largest revenue share. Microbiology and sterility testing play a crucial role in mitigating contamination risks during the production process, thereby minimizing the potential for infections in patients or product users. Failure to conduct these tests can lead to regulatory delays for the devices in question. This segment encompasses various assessments, including Pyrogen and Endotoxin testing, sterility test validation, bioburden determination, and antimicrobial activity testing.

On the other hand, the chemistry test segment is expected to witness substantial growth throughout the forecast period. Chemical analysis is conducted to characterize, identify, and gain a comprehensive understanding of the substances employed in the production of medical devices. This chemical assessment is carried out in accordance with ISO 10993-17 and 10993-18T regulations. Meeting biocompatibility standards necessitates the acquisition of chemical data, leading to the chemical characterization of the vast majority of medical devices.

By Phase Analysis

- The clinical segment accounted for the highest market share during the forecast period

The clinical segment accounted for the highest market share during the forecast period. The clinical phase represents an essential stage within the development process, during which a medical device undergoes testing on human subjects to assess its safety and effectiveness in real-world scenarios. This phase entails subjecting the device to clinical trials, during which comprehensive data is gathered. This data is subsequently utilized to facilitate regulatory approval and the commercialization of the device. Clinical trials yield a substantial volume of data, necessitating precise data collection, management, and analysis. Testing services play a crucial role in upholding data quality and integrity throughout the clinical phase.

Moreover, clinical testing has the potential to unveil areas where device enhancement and optimization are needed. Testing services support manufacturers in refining the device's design based on the outcomes of these clinical trials. Furthermore, it is anticipated that this particular segment will experience the most rapid growth over the forecast period. The clinical stage incurs significantly higher costs for medical device testing services compared to the preclinical stage, making it a crucial factor in determining the clinical stage's dominant market position.

Regional Insights

- Asia Pacific is anticipated to dominate the market over the forecast period

Asia Pacific dominated the largest market contributor in the medical device testing services market. Regulatory bodies in the Asia Pacific region, including Japan's Pharmaceuticals and Medical Devices Agency (PMDA), China National Medical Products Administration (NMPA), and India's Central Drugs Standard Control Organization (CDSCO), have implemented strict standards for medical devices. These regulations require comprehensive testing and certification, resulting in a significant increase in demand for Medical Device Testing services. The Asia Pacific area is a hub for technological advancements, particularly in the medical device industry. The growing medical tourism sector requires compliance with global standards and regulations, emphasizing the need for reliable testing services. Moreover, governments in the region are actively improving healthcare infrastructure and accessibility. Their efforts to promote innovation, quality, and safety in medical devices are driving the demand for testing services.

North America is witnessing for the fastest growth over the forecast period. Due to the increasing complexity in product design and the ongoing drive to minimize expenses, along with the stringent oversight by regulatory authorities such as the FDA, are significant factors driving the expansion of the local market. Furthermore, the uptick in medical device production, aimed at meeting the surging demand for effective healthcare solutions in the region, is expected to enhance the regional market's growth further.

Key Market Players & Competitive Insights

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include:

- American Preclinical Services

- Charles River Laboratories

- Element Minnetonka

- Eurofins Scientific

- Intertek Group Plc.

- Labcorp (Toxikon, Inc)

- North America Science Associates Inc.

- Pace Analytical Services LLC

- SGS S.A.

- Sterigenics International LLC

Recent Developments

- In June 2023, NAMSA entered into a partnership with Terumo Aortic aimed at facilitating the market entry of Terumo Aortic's advanced aortic disease products. Within the framework of this partnership, NAMSA intended to provide Terumo Aortic with access to a network of clinical professionals and its highly specialized teams of experts in the field of cardiovascular healthcare.

- In February 2023, Eurofins Viracor LLC, a subsidiary of Eurofins Scientific, unveiled a groundbreaking test designed to evaluate the effectiveness and durability of Chimeric Antigen Receptor T-Cell (CAR-T) therapy for patients with B cell lymphomas and pre-B cell acute lymphoblastic leukemia. CAR-T therapy represents an innovative approach to immunotherapy, employing genetically engineered T-cells to target cancer cells, and has demonstrated promising outcomes in the treatment of various cancer types.

- In May 2022, Sterigenics unveiled its newly expanded electron beam facility in Indiana, which is dedicated to sterilizing medical and pharmaceutical products. This cutting-edge E-beam accelerator is custom-designed to eliminate microorganisms and potential contaminants from these items, guaranteeing their safety for use in medical settings.

Medical Device Testing Services Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 9.57 billion |

|

Revenue forecast in 2032 |

USD 19.65 billion |

|

CAGR |

9.40% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Service, By Phase, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |