Medical Device Engineering Market Size, Share, Trends, Industry Analysis Report

: By Service Type, Device Type (Diagnostic Imaging Equipment, Surgical Equipment, Patient Monitoring Devices & Life Support Devices, Medical Lasers, IVD Devices, and Other Medical Devices), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 128

- Format: PDF

- Report ID: PM5292

- Base Year: 2024

- Historical Data: 2020-2023

Medical Device Engineering Market Overview

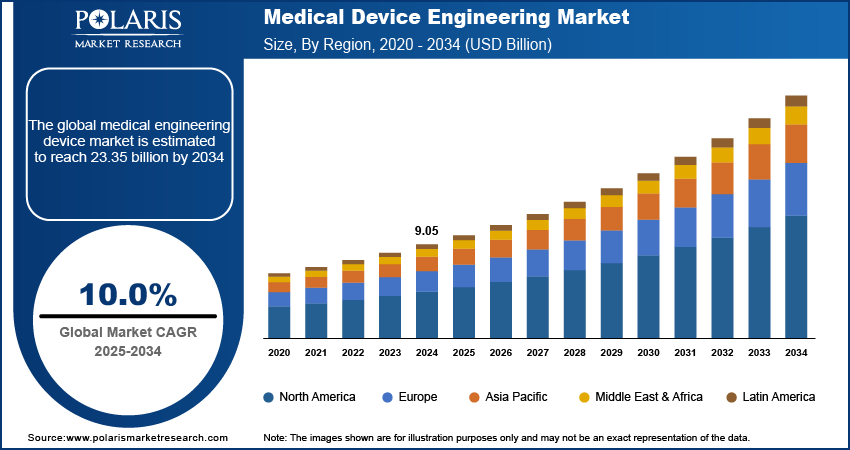

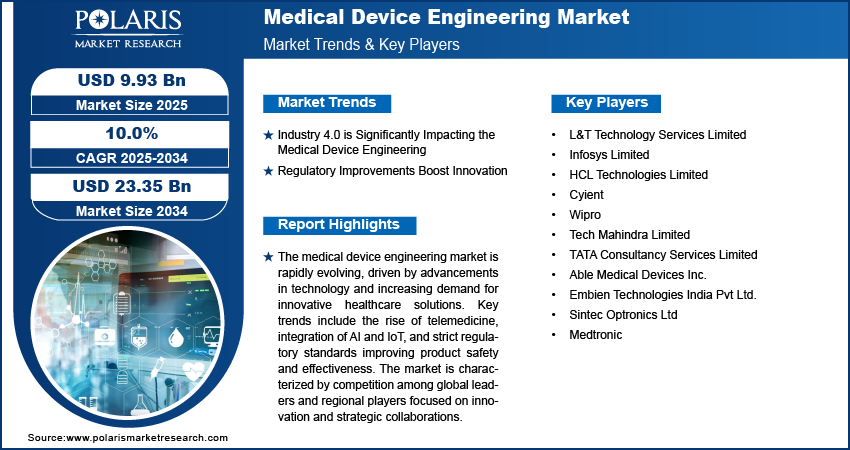

Global medical device engineering market size was valued at USD 9.05 billion in 2024. The market is projected to grow from USD 9.93 billion in 2025 to USD 23.35 billion by 2034, exhibiting a CAGR of 10.0% during the forecast period.

Medical device engineering involves the designing, development, and production of devices used in healthcare to diagnose, monitor, and treat medical conditions. This field integrates engineering principles with medical knowledge to create safe, effective, and innovative healthcare solutions that enhance patient outcomes.

The medical device engineering market is experiencing significant growth fueled by technological advancements and an increasing demand for innovative healthcare solutions. This sector encloses a wide range of services, including product design, prototyping, software development, and regulatory consulting, all aimed at improving patient care and safety. The integration of technologies such as artificial intelligence, the Internet of Things (IoT), and telemedicine is reshaping product development, enabling more efficient and effective healthcare delivery.

In December 2023, Impelsys launched a medical device testing lab in Mangalore. This facility improves the company's comprehensive offerings in the healthcare sector, which encompass advanced technologies such as data analytics, AI-driven platforms, cloud services, and educational solutions. Furthermore, stricter regulatory frameworks, such as the EU GDPR (General Data Protection Regulation) regulations, are fostering innovation while ensuring adherence to compliance and safety standards. Consequently, companies are making substantial investments in research and development to maintain their competitive edge in this dynamic market.

To Understand More About this Research: Request a Free Sample Report

Overall, the medical device engineering market is poised for continued expansion, driven by the need for advanced medical technologies that cater to the evolving healthcare needs of populations worldwide.

Medical Device Engineering Market Dynamics

Industry 4.0 is Significantly Impacting the Medical Device Engineering

Industry 4.0 is significantly impacting the medical device engineering market by driving the integration of advanced technologies such as IoT, artificial intelligence (AI), big data analytics, and automation. These technologies enable the development of smart, connected medical devices that can monitor, analyze, and report patient data in real-time, leading to more personalized and efficient healthcare. The use of digital twins and predictive maintenance in manufacturing also optimizes production processes, reducing downtime and improving product quality. Additionally, Industry 4.0 facilitates regulatory compliance by improving traceability and data management throughout the device lifecycle.

For instance, L&T Technology Services launched two design and prototyping centers in Peoria, Illinois, to support digital engineering. The 1DigitalPlace Center focuses on AI, robotics, 3D-vision, and digital twins for innovative manufacturing, while the Electrification & Prototype Center offers turnkey design services with advanced automation technologies.

Regulatory Improvements Boost Innovation

Regulatory improvements in the medical device engineering industry are boosting innovation by streamlining the approval processes and improving transparency. By adopting more flexible frameworks, regulatory bodies enable faster entry of new technologies into the market, encouraging companies to invest in research and development. Moreover, clearer guidelines reduce uncertainty, allowing manufacturers to focus on innovation rather than compliance issues. This shift is crucial as it helps in accelerating the development of advanced medical devices along with improving patient safety and efficacy. For instance, the FDA’s 510(k) program has been updated to expedite the approval of devices that demonstrate substantial equivalence to existing products, motivating companies to innovate while ensuring safety.

Medical Device Engineering Market Segment Insights

Medical Device Engineering Market Assessment by Service Type Outlook

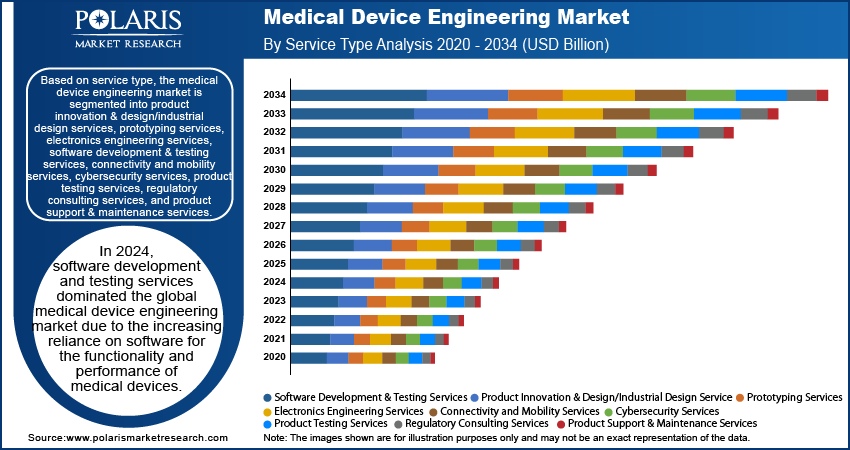

The global medical device engineering market segmentation, based on service type, includes product innovation & design/industrial design services, prototyping services, electronics engineering services, software development & testing services, connectivity and mobility services, cybersecurity services, product testing services, regulatory consulting services, and product support & maintenance services. In 2024, software development and testing services dominated the global medical device engineering market due to the increasing reliance on software for the functionality and performance of medical devices. The rapid advancements in technology, are making medical devices integrated with software solutions for data management, diagnostics, and patient monitoring. The demand for software that meets strict regulatory standards and assures cybersecurity has risen sharply as medical devices are more frequently connected to networks and databases, making them susceptible to cyber threats. Furthermore, the need for continuous updates and compliance with evolving regulations necessitates strict software testing and validation processes, thereby driving the growth of this service segment.

Medical Device Engineering Market Assessment by Device Type Outlook

The global medical device engineering market segmentation, based on device type, includes diagnostic imaging equipment, surgical equipment, patient monitoring devices & life support devices, medical lasers, IVD devices, and other medical devices. The diagnostic imaging equipment segment is expected to grow at the highest CAGR during the forecast period due to the increasing prevalence of chronic diseases and an aging population. The demand for advanced imaging solutions for accurate diagnosis and treatment monitoring is further driving growth. Additionally, technological advancements, such as the development of high-resolution imaging systems and portable devices, improve the capabilities and accessibility of diagnostic imaging. Furthermore, the growing emphasis on early detection and preventive healthcare contributes to the rising adoption of imaging models such as MRI, CT scans, and ultrasound. Thus, this segment is expected to experience significant growth during the forecast period.

Medical Device Engineering Market Regional Insights

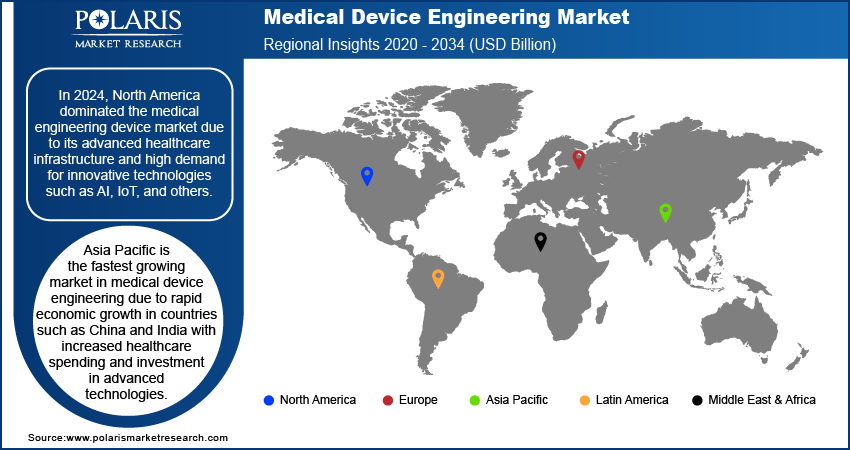

By region, the study provides medical device engineering market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America dominated the market due to its advanced healthcare infrastructure and high demand for innovative technologies such as AI, IoT, and others. The rising prevalence of chronic diseases and an aging population is fuelling the need for better diagnostic and therapeutic solutions. Moreover, investments in research and development by leading medical device manufacturers in North America, such as Medtronic, Siemens Healthineers, and others, contribute to the development of advanced technologies, improving the region's competitive advantage. Additionally, North America benefits from a high level of awareness and adoption of advanced medical technologies among healthcare providers and patients. This combination of factors positions North America as a leader in the medical engineering device market, with continued growth expected in the coming years.

For instance, in October 2024, Siemens Digital Industries Software launched Solid Edge 2024, improving intelligent product design. This version focuses on user experience and large assembly performance, introducing features to automate and accelerate design and collaboration.

Asia Pacific is the fastest-growing market in medical device engineering due to rapid economic growth and improvement in healthcare infrastructure in countries such as China and India. Factors assisting the market growth include increased healthcare spending and investment in advanced technologies. The rising prevalence of chronic diseases and an aging population drive demand for innovative diagnostic and therapeutic devices. Furthermore, the shift toward digital healthcare solutions, such as telemedicine and remote monitoring, necessitates the development of connected medical devices. Emerging companies such as Mindray and Weigao Group are also contributing to market growth through innovation, supported by favorable regulatory frameworks and government incentives.

For instance, The National Medical Products Administration of China (NMPA) has implemented a range of new initiatives aimed at improving the medical device regulatory framework and fostering technological innovations. These measures are designed to improve the safety, effectiveness, and accessibility of medical devices throughout the country.

Medical Device Engineering Market – Key Players and Competitive Insights

The medical device engineering market is highly competitive, with a blend of global industry leaders and emerging regional players vying for market share. Key global players such as Abbott, Baxter, Medtronic, Siemens Healthineers, and Johnson & Johnson dominate the market by leveraging their strong research and development (R&D) capabilities, large-scale production facilities, and extensive distribution networks. These companies are focused on continuous product innovation, improving safety, efficacy, and usability to meet the evolving demands of healthcare providers and patients across diagnostics, therapeutics, and patient monitoring sectors. In addition to these established players, smaller regional companies are gaining traction by developing specialized medical devices tailored to local market needs. These companies often focus on niche applications and offer customized solutions, enabling them to compete effectively in specific regions.

Key competitive strategies within the market include mergers and acquisitions, strategic partnerships with technology firms, and expanding product portfolios to strengthen their presence in emerging markets. As healthcare demands grow globally, these strategic initiatives are set to shape the future landscape of the medical device engineering market. A few key major players are L&T Technology Services Limited, Infosys Limited, HCL Technologies Limited, Cyient, Wipro, Tech Mahindra Limited, TATA Consultancy Services Limited, Able Medical Devices Inc., Embien Technologies India Pvt Ltd., Sintec Optronics Ltd, and Medtronic.

NVIDIA Corporation is a public limited company founded in April 1993 and is headquartered in California, United States. The company has employed around 26,196 employees in 35 countries, including research and development, sales, marketing, and operations. NVIDIA Corporation is a computer hardware manufacturing company that provides GPU-accelerated computing solutions, AI and Deep learning, gaming, self-driving cars, supercomputing, robotics, parallel computing, automotive technology, and professional graphics. The company offers a wide range of products in segments of gaming and entertainment, laptops and workstations, cloud and data centers, networking, GPUs, cloud and data centers, and embedded systems. The company offers graphics cards, gaming laptops, and G-sync monitors in the gaming and entertainment segment. In November 2023, NVIDIA partnered with L&T Technology Services Limited to jointly develop software-defined architectures for medical devices, specifically targeting endoscopy. This collaboration aims to enhance product scalability and improve image quality in endoscopic equipment.

ABLE, a Barcelona-based medical device startup, is at the forefront of developing robotic exoskeletons for the mobility impairments. Their 8 kg, battery-powered lower-body exoskeleton allows wheelchair users to stand, walk, and sit independently. Designed with smart device integration, it enables remote monitoring by healthcare professionals. Launched in mid-2021, this innovative home-use solution targets individuals with lower-limb paralysis, enhancing mobility and quality of life. In September 2023, ABLE partnered with SKYFI Sp. z o.o., for a new distribution, making its robotic exoskeleton available in Poland.

Key Companies in Medical Device Engineering Market

- L&T Technology Services Limited

- Infosys Limited

- HCL Technologies Limited

- Cyient

- Wipro

- Tech Mahindra Limited

- TATA Consultancy Services Limited

- Able Medical Devices Inc.

- Embien Technologies India Pvt Ltd.

- Sintec Optronics Ltd

- Medtronic

Medical Device Engineering Industry Developments

June 2021: ComeBack Mobility launched the “Smart Crutch Tip,” an advanced orthopedic device that integrates with a reliable app. This system facilitates real-time communication and data sharing between patients and healthcare providers, significantly improving the lower limb rehabilitation process. The design promises to improve patient outcomes through tailored feedback and tracking of progress, setting a new standard in rehabilitation technology.

March 2023: NVIDIA partnered with Medtronic to expand the integration of artificial intelligence within the healthcare ecosystem, aiming to improve patient care through the development of advanced AI-driven solutions. This collaboration aims to leverage NVIDIA's computational capabilities and Medtronic's expertise in medical technology to innovate and optimize clinical outcomes.

Medical Device Engineering Market Segmentation

By Service Type Outlook (Revenue, USD Billion, 2020–2034)

- Product Innovation & Design/Industrial Design Services

- Prototyping Services

- Electronics Engineering Services

- Software Development & Testing Services

- Connectivity and Mobility Services

- Cybersecurity Services

- Product Testing Services

- Regulatory Consulting Services

- Product Support & Maintenance Services

By Device Type Outlook (Revenue, USD Billion, 2020–2034)

- Diagnostic Imaging Equipment

- Surgical Equipment

- Patient Monitoring Devices & Life Support Devices

- Medical Lasers

- Ivd Devices

- Other Medical Devices

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Medical Device Engineering Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 9.05 billion |

|

Market Size Value in 2025 |

USD 9.93 billion |

|

Revenue Forecast by 2034 |

USD 23.35 billion |

|

CAGR |

10.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global medical device engineering market size was valued at USD 9.05 billion in 2024 and is projected to grow to USD 23.35 billion by 2034.

The global market is projected to register a CAGR of 10.0% during the forecast period.

In 2024, North America dominated the medical engineering device market due to its advanced healthcare infrastructure and high demand for innovative technologies such as AI, IoT, and others.

A few key players in the market are L&T Technology Services Limited; Infosys Limited; HCL Technologies Limited; Cyient; Wipro; Tech Mahindra Limited; TATA Consultancy Services Limited; Able Medical Devices Inc.; Embien Technologies India Pvt Ltd.; Sintec Optronics Ltd; Medtronic.

In 2024, software development and testing services dominated the global medical device engineering market.

The diagnostic imaging equipment segment is expected to grow at the highest CAGR during the forecast period.