Medical Billing Market Size, Share, Trends, Industry Analysis Report: By Component (Software and Services), Facility Size, End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 120

- Format: PDF

- Report ID: PM5184

- Base Year: 2024

- Historical Data: 2020-2023

Medical Billing Market Overview

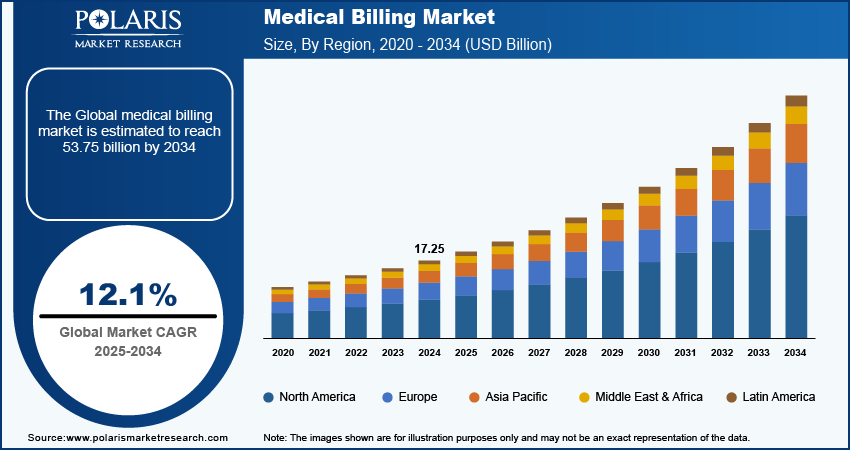

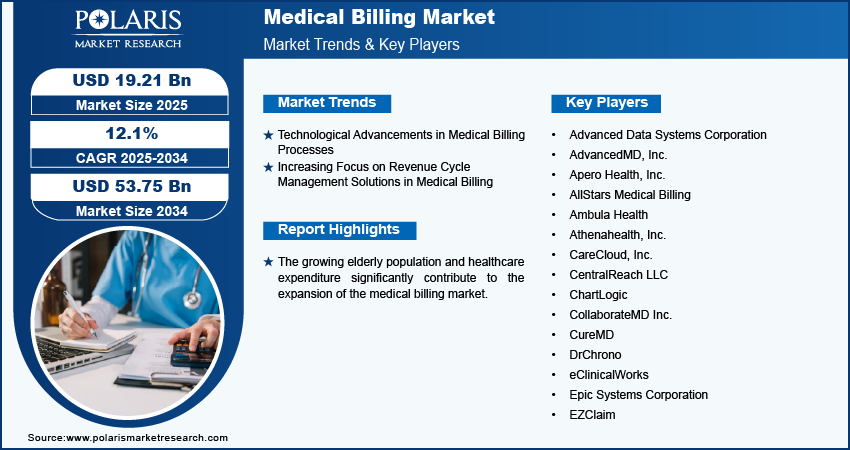

The medical billing market size was valued at USD 17.25 billion in 2024. The market is projected to grow from USD 19.21 billion in 2025 to USD 53.75 billion by 2034, exhibiting a CAGR of 12.1% during 2025–2034.

The medical billing market focuses on the systematic submission and processing of medical claims for reimbursement. This process is essential for healthcare providers to receive payments for services rendered to patients.

The growing elderly population significantly contributes to the expansion of the medical billing market, as older adults generally require more healthcare services. They are highly prone to chronic conditions that necessitate regular medical attention, including frequent visits to healthcare providers, specialized treatments, and long-term care.

According to the World Health Organization (WHO), 41 million deaths are reported annually due to noncommunicable diseases (NCDs), with 17 million premature deaths occurring mainly in low- and middle-income countries, where cardiovascular diseases account for 17.9 million deaths, followed by cancers (9.3 million), chronic respiratory diseases (4.1 million), and diabetes (2 million). This increase in healthcare utilization leads to a notable rise in medical billing activities, as healthcare facilities handle a higher volume of insurance claims and manage billing for various services provided to elderly patients.

To Understand More About this Research: Request a Free Sample Report

The global increase in healthcare expenditure is driving the growth of the medical billing market. As healthcare costs continue to escalate, more healthcare facilities are recognizing the need to invest in efficient billing systems to manage expenses and optimize their revenue cycle management effectively. In August 2023, FareMD, a health tech startup, launched an AI-driven platform to streamline medical billing in the US, targeting the US$ 300 billion in annual inefficiencies and addressing the 20% claim rejection rate due to documentation and coding errors.

By implementing advanced medical billing solutions, healthcare providers can streamline their billing processes, reduce administrative costs, and improve their overall financial performance in the face of rising healthcare expenditures worldwide, driving the medical billing market.

Medical Billing Market Driver Analysis

Technological Advancements in Medical Billing Processes

The medical billing market is experiencing significant growth due to technological advancements, particularly with the widespread adoption of electronic health records (EHR) and telehealth services. EHR systems enhance the billing process by providing healthcare providers with quick access to accurate patient information, which minimizes billing errors and speeds up claim submissions. In June 2023, Seneca Healthcare District implemented a new EHR system that replaced its outdated infrastructure with a more efficient patient portal and improved health information management.

The growth of telehealth has prompted updates in billing practices for remote consultations, ensuring that providers are fairly compensated for virtual services while improving patient access to care. Moreover, the integration of technologies such as artificial intelligence (AI) and machine learning is significantly driving the medical billing market growth. In April 2024, XpertDox collaborated with Positive Results Billing to introduce XpertCoding, an AI-driven medical coding platform that boosts operational efficiency in medical billing with rapid integration and a 98% accuracy rate.

These technological innovations are transforming the medical billing processes, leading to enhanced efficiency and accuracy in the market.

Increasing Focus on Revenue Cycle Management Solutions in Medical Billing

Healthcare organizations are increasingly prioritizing Revenue Cycle Management (RCM) solutions to enhance operational efficiency and optimize revenue recovery. This focus allows providers to streamline workflows, reduce billing errors, accelerate payment collections, and address the financial pressures they face. For instance, in September 2022, AGS Health launched the AGS AI Platform. The platform is an end-to-end revenue cycle management solution that combines AI and automation with expert support to enhance operational efficiency and financial performance for healthcare organizations.

RCM becomes a critical component of healthcare operations, and the demand for specialized billing services grows, driving organizations to seek expertise in areas such as coding, compliance, and claims management. Furthermore, the rising emphasis on RCM directly drives the growth of the medical billing market by creating opportunities for companies that offer tailored billing solutions. These specialized services incorporate advanced technologies such as automation and data analytics, further improving the efficiency of the revenue cycle. Also, healthcare organizations strive to maximize their revenue potential while ensuring high-quality patient care, and the rising demand for effective RCM solutions continues to fuel the expansion of the medical billing market.

Medical Billing Market Segment Insights

Medical Billing Market Breakdown, by Component Insights

The medical billing market segmentation, based on component, includes software and services. The services segment accounts for a larger share of the market and is further bifurcated into managed services and professional services. This segment's dominance is attributed to its essential role in providing comprehensive solutions and specialized expertise that streamline the billing processes for healthcare providers. A few key services are medical coding, claims submission, denial management, and revenue cycle management, all designed to maximize reimbursements and improve financial performance.

The services segment offers scalable solutions that can adjust to varying patient volumes and practice sizes while also ensuring compliance with stringent healthcare regulations such as HIPAA. Commitment to maintaining patient privacy and data security further solidifies its position in the market.

Medical Billing Market Breakdown, by Facility Size Insights

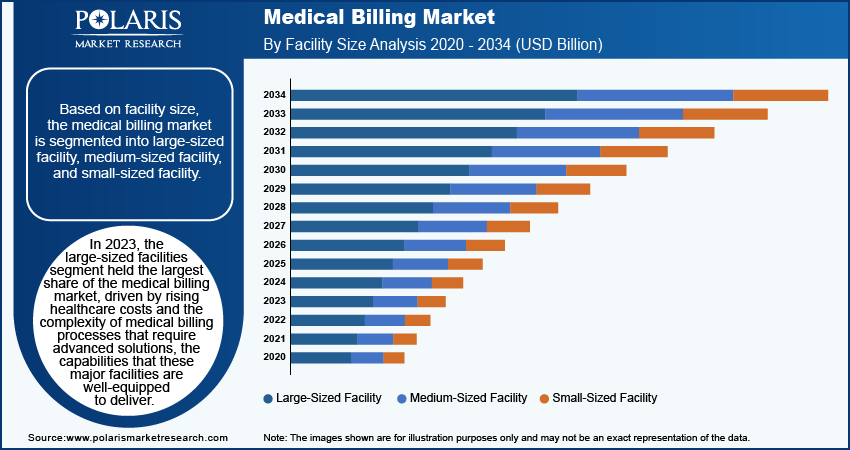

Based on facility size, the medical billing market is segmented into large-sized facility, medium-sized facility, and small-sized facility. In 2024, the large-sized facilities segment captured the largest share of the medical billing market. This growth was driven by rising healthcare costs and the complexity of medical billing processes, which require advanced solutions that these major facilities are well-equipped to deliver effectively. They provide a comprehensive array of services vital for efficiently managing large volumes of patient data and transactions, including revenue cycle management, coding, compliance, and claims processing. In October 2023, Omega Healthcare launched the Omega Digital Platform (ODP), aimed at enhancing revenue cycle management and financial performance for healthcare organizations through advanced technologies such as AI and robotic process automation.

The growth of large facilities in the medical billing market boosts operational efficiency and has a significant impact on the overall industry. By adopting technologies such as AI and automation, these facilities enhance the accuracy and speed of billing processes, thereby reducing errors and denial rates. This improvement boosts revenue recovery for healthcare providers and further fuels demand for specialized medical billing services.

Medical Billing Regional Insights

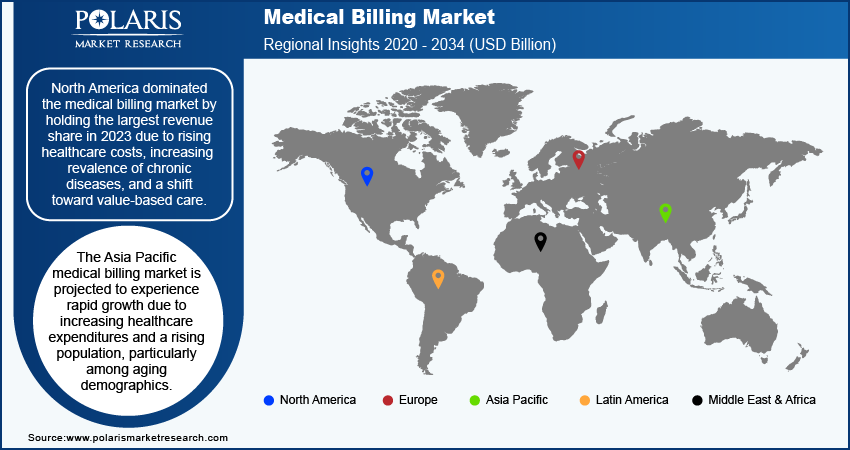

By region, the study provides the market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the medical billing market by holding the largest revenue share in 2024 due to rising healthcare costs, increasing prevalence of chronic diseases, and a shift toward value-based care. Key players such as Kareo, Athenahealth, and Cerner Corporation are driving this growth with the introduction of innovative billing solutions. Further, trends such as the integration of AI and cloud-based services are improving efficiency and accuracy. In July 2024, Maverick Medical AI expanded its presence in the US through a partnership with a national outpatient radiology provider, successfully implementing its real-time autonomous medical coding solution with an 85% direct-to-bill rate and over 93% accuracy.

Outsourcing billing services and focus on revenue cycle management are becoming more common as healthcare providers seek to streamline operations and enhance cash flow. For instance, in April 2021, Harris acquired Medi-Serv, Inc., strengthening its revenue cycle management solutions and streamlining administrative workflows for healthcare practices.

The Asia Pacific medical billing market is projected to experience rapid growth due to increasing healthcare expenditures and a rising population, particularly among aging demographics. This regional growth is further fueled by the rising prevalence of chronic diseases, which enhances the demand for medical billing services. Additionally, the expanding health insurance coverage generates a higher volume of claims, contributing to the market's overall expansion.

Technological advancements, such as cloud computing and AI, are enhancing the efficiency and accuracy of medical billing processes. Further, the rise of medical tourism in countries such as India, Thailand, and Singapore is driving demand for streamlined billing services as international patients seek affordable and high-quality care. Together, these factors propel the Asia Pacific medical billing market.

Medical Billing Market – Key Players and Competitive Insights

Leading market players are investing heavily in research and development to expand their product lines, which will boost the medical billing market growth during the forecast period. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments such as new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, market players must offer cost-effective solutions.

A few major players in the market are Advanced Data Systems Corporation; AdvancedMD, Inc.; Apero Health, Inc.; AllStars Medical Billing; Ambula Health; Athenahealth, Inc.; CareCloud, Inc.; CentralReach LLC; ChartLogic; CollaborateMD Inc.; CureMD; DrChrono; eClinicalWorks; Epic Systems Corporation; EZClaim, Harris, Kareo, Inc.; Mckesson Corporation; Meditab; NextGen Healthcare, Inc.; Oracle; Proclaim Billing Services; Quest Diagnostics Incorporated; RevenueXL Inc.; RXNT; TherapyNotes LLC; Veradigm LLC; WebPT; and TotalMD.

Apero Health, Inc. develops a technology-driven medical billing platform aimed at automating the billing process. This platform leverages machine learning and data science to facilitate automated claim submissions, integrated online patient billing, and a modern application programming interface, allowing users to benefit from a lower denial rate. In February 2023, Nabla partnered with Apero Health to streamline medical billing for clients, automating claim submissions and eligibility checks to enhance efficiency and reduce administrative burdens.

Athenahealth Inc. is a provider of cloud-based business services and mobile applications tailored for medical groups and health systems. The company offers a range of network-enabled services, including revenue cycle management, electronic health records (EHR), medical billing, population health management, patient engagement, and care coordination, along with Epocrates and other point-of-care mobile applications. It serves in medical practices, hospitals, and academic medical centers. It is headquartered in Watertown, Massachusetts, and operates in the US and India. In March 2021, Athenahealth introduced the athenaOne Medical Coding solution to alleviate clinician burnout by simplifying EHR coding processes and allowing for more patient-focused care.

Key Companies in Medical Billing Market

- Advanced Data Systems Corporation

- AdvancedMD, Inc.

- Apero Health, Inc.

- AllStars Medical Billing

- Ambula Health

- Athenahealth, Inc.

- CareCloud, Inc.

- CentralReach LLC

- ChartLogic

- CollaborateMD Inc.

- CureMD

- DrChrono

- eClinicalWorks

- Epic Systems Corporation

- EZClaim

- Harris

- Kareo, Inc.

- Mckesson Corporation

- Meditab

- NextGen Healthcare, Inc.

- Oracle

- Proclaim Billing Services

- Quest Diagnostics Incorporated

- RevenueXL Inc.

- RXNT

- TherapyNotes LLC

- Veradigm LLC

- WebPT

- TotalMD

- AdvancedMD, Inc.

Medical Billing Industry Developments

April 2024: Zentist launched Cavi AR, an RCM software designed for dental insurance claims management, which enhances operational efficiency for dental support organizations and significantly reduces accounts receivable days.

March 2024: DocStation partnered with CPESN USA to assist pharmacies in entering the medical billing space, enabling them to submit claims for clinical services and reduce administrative burdens.

February 2024: Anatomy Financial launched AI-powered financial automation solutions for healthcare organizations, streamlining back-office processes and providing real-time financial insights to improve efficiency and reduce reliance on manual systems.

Medical Billing Market Segmentation

By Component Outlook (Revenue – USD Billion, 2020–2034)

- Software

- Services

- Managed Services

- Professional Services

By Facility Size Outlook (Revenue – USD Billion, 2020–2034)

- Large-Sized Facility

- Medium-Sized Facility

- Small-Sized Facility

By End User Outlook (Revenue – USD Billion, 2020–2034)

- Hospitals

- Specialty Centers

- Ambulatory surgical centers

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Medical Billing Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 17.25 Billion |

|

Market Size Value in 2025 |

USD 19.21 Billion |

|

Revenue Forecast by 2034 |

USD 53.75 Billion |

|

CAGR |

12.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2024–2032 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global medical billing market size was valued at USD 17.25 billion in 2024 and is anticipated to reach USD 53.75 billion in 2034.

The global market is projected to register a CAGR of 12.1% during the forecast period.

North America accounted for the largest share of the global market in 2024.

A few key players in the market are Advanced Data Systems Corporation; AdvancedMD, Inc.; Apero Health, Inc.; AllStars Medical Billing; Ambula Health; Athenahealth, Inc.; CareCloud, Inc.; CentralReach LLC; ChartLogic; CollaborateMD Inc.; CureMD; DrChrono; eClinicalWorks; Epic Systems Corporation; EZClaim, Harris, Kareo, Inc.; Mckesson Corporation; Meditab; NextGen Healthcare, Inc.; Oracle; Proclaim Billing Services; Quest Diagnostics Incorporated; RevenueXL Inc.; RXNT; TherapyNotes LLC; Veradigm LLC; WebPT; and TotalMD.

The service segment dominated the market in 2024.

The large-size facility segment held the largest share of the global market in 2024.