Medical Batteries Market Size, Share, Trends, Industry Analysis Report: By Battery Type (Lithium-Ion Batteries, Nickel-Metal Hydride (NiMH) Batteries, Alkaline Batteries, Zinc-Air Batteries, and Others), Usage, End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 116

- Format: PDF

- Report ID: PM5249

- Base Year: 2024

- Historical Data: 2020-2023

Medical Batteries Market Overview

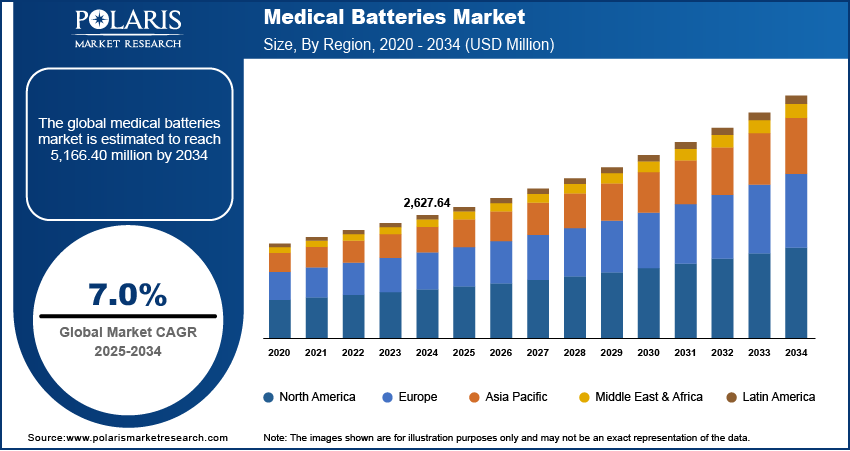

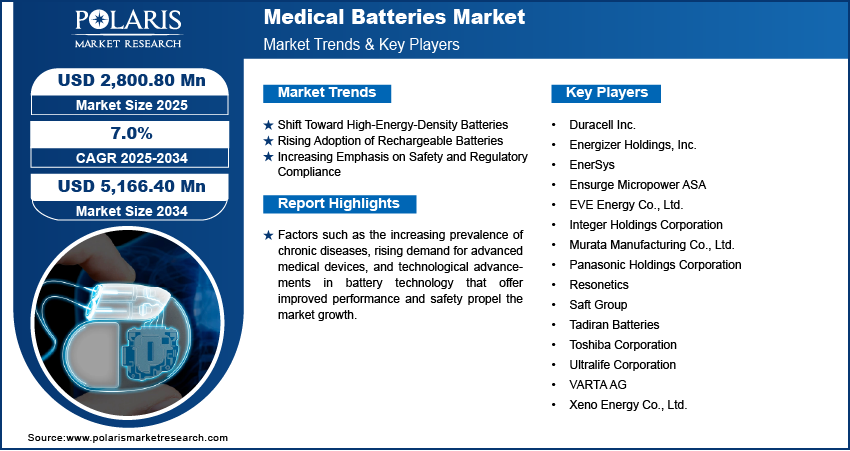

The global medical batteries market size was valued at USD 2,627.64 million in 2024. The market is projected to grow from USD 2,800.80 million in 2025 to USD 5,166.40 million by 2034, exhibiting a CAGR of 7.0% during 2025–2034.

The global medical batteries market encompasses batteries specifically designed for use in medical devices, including implantable devices, portable diagnostic equipment, and wearable health monitors. These batteries are crucial for ensuring the reliable operation of medical technologies.

Factors such as the increasing prevalence of chronic diseases, rising demand for advanced medical devices, and technological advancements in battery technology that offer improved performance and safety propel the market growth. Notable future trends include the shift toward miniaturized, high-capacity batteries to meet the demands of compact medical devices and the growing emphasis on sustainable and rechargeable battery solutions.

To Understand More About this Research: Request a Free Sample Report

Medical Batteries Market Drivers and Trends Analysis

Shift Toward High-Energy-Density Batteries

The rising focus on high-energy-density batteries is driven by the need for longer-lasting power sources in medical devices such as implantable cardiac devices and wearable health monitors. The batteries offer extended operational life, which is critical for devices that require reliable performance over long periods without frequent replacements. For instance, lithium-ion batteries, known for their high energy density, are increasingly used in medical devices. According to a 2023 report by the National Institutes of Health (NIH), lithium-ion batteries have improved energy density by ∼30% over the past five years, enhancing the functionality of medical implants and wearable health technology.

Rising Adoption of Rechargeable Batteries

Rechargeable batteries reduce waste and offer a more sustainable solution compared to single-use batteries. This trend is particularly evident in devices such as hearing aids and glucose monitors, where frequent battery replacement can be inconvenient and costly. A study published in the Journal of Power Sources in 2024 highlights that the market share of rechargeable batteries in medical devices has increased by 25% in the last three years, reflecting a growing preference for sustainable battery solutions. This shift is supported by advancements in battery technology that enhance the efficiency and longevity of rechargeable batteries. Thus, owing to environmental and economic concerns, the demand for rechargeable batteries is expected to rise in the medical industry during the forecast period.

Increasing Emphasis on Safety and Regulatory Compliance

Another prominent trend is the increased emphasis on safety and regulatory compliance in the medical batteries market. As medical devices become more sophisticated, ensuring that batteries meet stringent safety standards is paramount. Regulatory bodies, such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), have established rigorous guidelines to ensure battery safety and performance. Recent updates to these regulations have intensified the focus on testing and quality assurance processes for medical batteries. According to a 2024 report by the International Electrotechnical Commission (IEC), new safety standards have been implemented to address concerns related to battery overheating and chemical leakage, ensuring greater reliability and safety in medical applications.

Medical Batteries Market – Segment Analysis

Medical Batteries Market Assessment by Battery Type

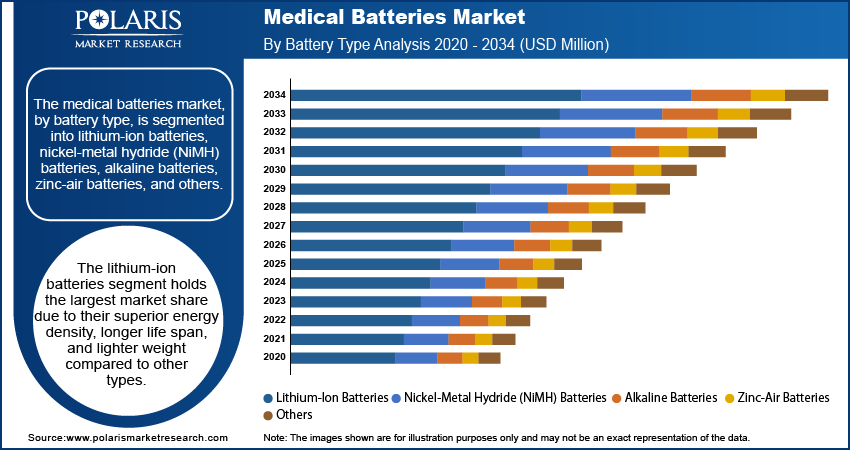

The medical batteries market, by battery type, is segmented into lithium-ion batteries, nickel-metal hydride (NiMH) batteries, alkaline batteries, zinc-air batteries, and others. The lithium-ion batteries segment holds ∼ 51% market share due to their superior energy density, longer life span, and lighter weight compared to other types. These batteries are predominantly used in advanced medical devices such as implantable cardiac devices and portable diagnostic tools, where reliability and extended operational life are crucial. The segment is also registering the highest growth, driven by continuous technological advancements and increasing demand for portable, high-performance medical equipment. The lithium-ion batteries segment is projected to grow at a significant rate as they become increasingly integral to modern medical technology.

Nickel-metal hydride (NiMH) batteries, alkaline batteries, and zinc-air batteries cater to niche applications within the market. NiMH batteries are often used in hearing aids and other smaller medical devices due to their rechargeable nature and relative cost-effectiveness. Alkaline batteries are typically employed in non-rechargeable medical devices, while zinc-air batteries are primarily used in hearing aids due to their high energy density and long shelf life.

Medical Batteries Market Evaluation by Usage

The medical batteries market, by usage, is segmented into implantable medical devices, non-implantable medical devices, and portable and wearable medical devices. The implantable medical devices segment holds ∼ 39 % market share, largely due to the critical need for reliable and long-lasting power sources in devices such as pacemakers, defibrillators, and neurostimulators. These devices require batteries that can operate effectively within the body for extended periods, driving the demand for advanced, high-energy-density batteries. The implantable segment is also experiencing substantial growth, supported by advancements in battery technology and the increasing prevalence of chronic diseases that necessitate such devices.

The portable and wearable medical devices segment is registering the highest growth rate, propelled by rising consumer demand for health monitoring tools and fitness trackers. This category includes devices such as glucose monitors and wearable ECG monitors, which benefit from advancements in battery technology that enhance their portability and efficiency. As wearable health technology becomes sophisticated and prevalent, the need for compact, high-performance batteries continues to rise in this segment. Non-implantable medical devices also contribute to market growth, though not at the same pace as the other two segments.

Medical Batteries Market Breakdown by End User

The medical batteries market, by end user, is segmented into hospitals, home healthcare settings, ambulatory surgical centers, and research institutes. The hospitals segment holds the largest market share, primarily due to the extensive use of medical devices that require reliable power sources. Hospitals employ a wide range of equipment, from life-support systems to diagnostic tools. All of these devices depend on high-performance batteries to ensure continuous and reliable operation. This segment benefits from the high volume of medical device usage and the critical need for uninterrupted power in clinical settings, contributing to its dominant market position.

The home healthcare settings segment is experiencing the highest growth rate, driven by the increasing preference for remote monitoring and management of chronic conditions. Advancements in portable medical devices and the growing trend of at-home patient care have amplified the demand for batteries suited to home healthcare applications. This growth is supported by innovations in battery technology that enhance the portability and efficiency of devices used in home settings. Ambulatory surgical centers and research institutes also contribute to market dynamics, but their impact is comparatively smaller than that of hospitals and home healthcare settings.

Medical Batteries Market – Regional Insights

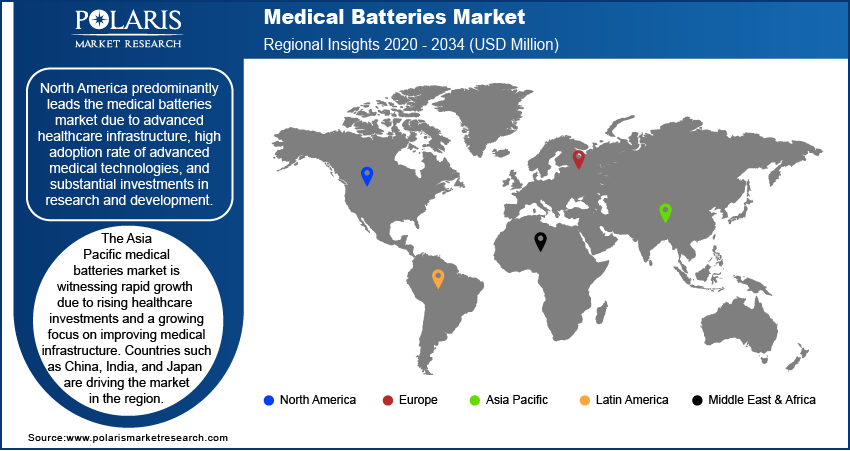

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The medical batteries market is predominantly led by North America, which holds the largest market share. This leadership is attributed to the region's advanced healthcare infrastructure, high adoption rate of advanced medical technologies, and substantial investments in research and development. The presence of major medical device manufacturers and a high prevalence of chronic diseases contribute to the robust demand for reliable and innovative battery solutions. North America's well-established regulatory framework and emphasis on technological advancements further support its dominant position in the market.

In Europe, the medical batteries market is characterized by a strong focus on regulatory compliance and technological innovation. The region benefits from a well-established healthcare system and high levels of investments in medical research, which drive the demand for advanced battery solutions in medical devices. Key countries such as Germany, France, and the UK focus on integrating new technologies into medical devices to enhance patient care. Additionally, Europe’s stringent regulatory standards ensure that medical batteries meet high safety and performance criteria, further supporting the growth of this sector. The increasing prevalence of chronic diseases and the rising geriatric population also contribute to the rising demand for reliable and efficient medical batteries across various healthcare applications.

The Asia Pacific medical batteries market is witnessing rapid growth due to rising healthcare investments and a growing focus on improving medical infrastructure. Countries such as China, India, and Japan are driving the market in the region, supported by their large populations and increasing prevalence of chronic diseases. The region is seeing significant expansion in the adoption of advanced medical devices, spurred by technological advancements and government initiatives to enhance healthcare access and quality. The growing trend of medical device innovation, coupled with increasing healthcare expenditure, is leading to a higher demand for high-performance medical batteries. Additionally, the burgeoning middle-class population and rising awareness about health management contribute to the market's expansion in this region.

Medical Batteries Market – Key Players and Competitive Analysis Report

A competitive analysis of the medical batteries market reveals that key players prioritize technological innovation and product expansion to meet the evolving demands of the medical sector. Companies invest heavily in research and development to enhance battery performance, safety, and energy density. Panasonic is renowned for its advanced lithium-ion technologies, which play a crucial role in high-performance medical devices. Saft and VARTA focus on providing reliable and long-lasting battery solutions to address the need for dependable power sources in critical medical applications. Major players in the market include Duracell Inc.; Energizer Holdings, Inc.; EnerSys; Ensurge Micropower ASA; EVE Energy Co., Ltd.; Integer Holdings Corporation; Murata Manufacturing Co., Ltd.; Panasonic Holdings Corporation; Resonetics; Saft Group; Tadiran Batteries; Toshiba Corporation; Ultralife Corporation; VARTA AG; and Xeno Energy Co., Ltd.

Strategic collaborations and partnerships shape the competitive landscape as companies seek to leverage technological advancements and expand their market presence. Joint ventures frequently emerge, enabling players to co-develop new battery technologies or refine existing ones. Manufacturers emphasize strict regulatory compliance to meet evolving safety and performance standards, ensuring their products align with industry requirements. Rising demand for portable and wearable medical devices drives companies to develop compact, high-capacity batteries that support this trend. The emphasis on miniaturization and efficiency fosters innovation, allowing medical batteries to provide reliable and long-lasting power solutions for a wide range of healthcare applications.

Panasonic Corporation is a global player in the medical batteries market, known for its extensive range of battery solutions used in medical devices. The company focuses on providing reliable and high-performance batteries, including lithium-ion technologies, which are crucial for various medical applications. Panasonic has recently been involved in expanding its battery technology capabilities to support the growing demand in the healthcare sector.

Ensurge Micropower ASA develops and produces solid-state lithium microbatteries for compact, efficient energy storage in applications such as hearables, wearables, and IoT devices, offering improved performance and long-lasting power solutions. In June 2024, Ensurge Micropower has supplied samples of its solid-state lithium microbattery to a client in the medical device sector. This delivery aligns with the terms of an evaluation agreement announced on October 25, 2023, facilitating the assessment of the microbattery's performance and integration into medical applications.

Key Companies in Medical Batteries Market

- Duracell Inc.

- Energizer Holdings, Inc.

- EnerSys

- Ensurge Micropower ASA

- EVE Energy Co., Ltd.

- Integer Holdings Corporation

- Murata Manufacturing Co., Ltd.

- Panasonic Holdings Corporation

- Resonetics

- Saft Group

- Tadiran Batteries

- Toshiba Corporation

- Ultralife Corporation

- VARTA AG

- Xeno Energy Co., Ltd.

Medical Batteries Market Developments

- In December 2024, Ultralife Corporation partnered with Karta to launch a new medical cart and power solution at HIMSS24. The carts operate plugged into an AC mains system or powered by two hot-swappable batteries (276Wh each) when AC is unavailable, allowing for continuous power to the IT systems during battery replacement.

- In September 2024, ABB signed a Memorandum of Understanding (MoU) with EVE Energy to collaborate on sustainable greenfield battery manufacturing, enhancing efficiency, safety, and productivity across new global battery production facilities.

- In June 2024, EnerSys signed the Memorandum of Understanding with Verkor SAS to explore developing a lithium battery gigafactory in the US

- In April 2024, Resonetics acquired EaglePicher Technologies, manufacturer of implantable batteries for critical medical devices.

Medical Batteries Market Segmentation

By Battery Type Outlook (Revenue – USD Million, 2020–2034)

- Lithium-Ion Batteries

- Nickel-Metal Hydride (NiMH) Batteries

- Alkaline Batteries

- Zinc-Air Batteries

- Others

By Usage Outlook (Revenue – USD Million, 2020–2034)

- Implantable Medical Devices

- Non-implantable Medical Devices

- Portable

- Wearable Medical Devices

By End User Outlook (Revenue – USD Million, 2020–2034)

- Hospitals

- Home Healthcare Settings

- Ambulatory Surgical Centers

- Research Institutes

By Regional Outlook (Revenue – USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Medical Batteries Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2,627.64 million |

|

Market Size Value in 2025 |

USD 2,800.80 million |

|

Revenue Forecast by 2034 |

USD 5,166.40 million |

|

CAGR |

7.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global medical batteries market size was valued at USD 2,627.64 million in 2024 and is projected to grow to USD 5,166.40 million by 2034.

The global market is projected to register a CAGR of 7.0% during the forecast period.

North America accounted for the largest share of the global market.

Key players in the medical batteries market include Duracell Inc.; Energizer Holdings, Inc.; EnerSys; Ensurge Micropower ASA; EVE Energy Co., Ltd.; Integer Holdings Corporation; Murata Manufacturing Co., Ltd.; Panasonic Holdings Corporation; Resonetics; Saft Group; Tadiran Batteries; Toshiba Corporation; Ultralife Corporation; VARTA AG; Xeno Energy Co., Ltd.

The lithium-ion batteries segment accounted for the largest share of the global market.

The non-implantable medical devices segment accounted for the largest share of the global market.