Medical Automation Market Size, Share, Trends, Industry Analysis Report: By Type, End Use (Hospital and Diagnostic, Pharmacy, Research Labs & Institute, and Others), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 125

- Format: PDF

- Report ID: PM5214

- Base Year: 2024

- Historical Data: 2020-2023

Medical Automation Market Overview

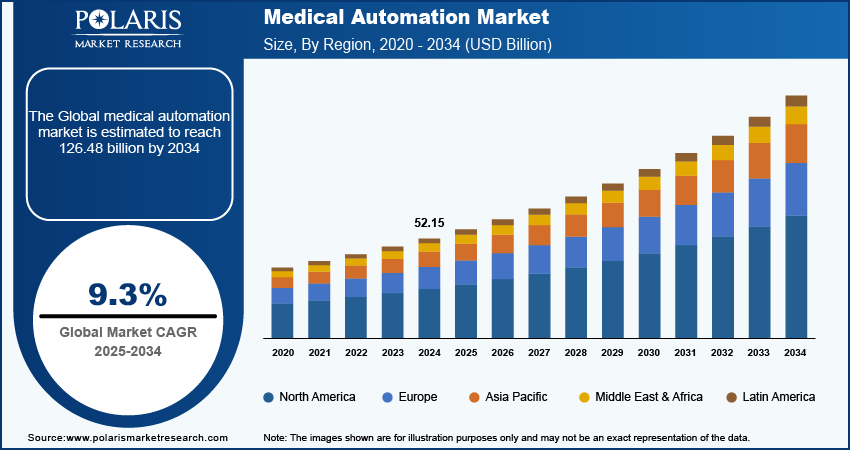

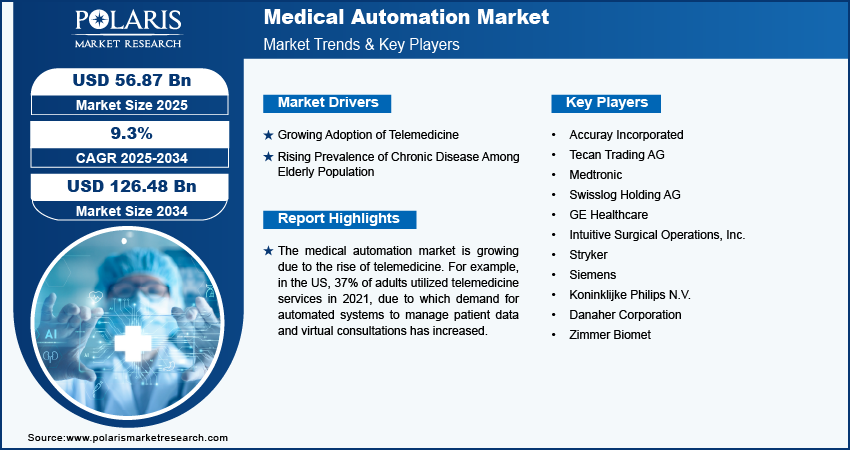

The medical automation market size was valued at USD 52.15 billion in 2024. The market is projected to grow from USD 56.87 billion in 2025 to USD 126.48 billion by 2034, exhibiting a CAGR of 9.3% during 2025–2034.

Medical automation involves the use of technology to improve healthcare processes, such as patient scheduling, medication dispensing, and diagnostic testing. Medical automation is utilized to reduce manual tasks and minimize human error.

The volume of patient data is increasing due to factors such as the surge in hospital admissions for several treatments, such as chronic disease treatments. According to the American Hospital Association, in 2023, the US recorded 33.69 million hospital admissions due to rising chronic diseases and others. This increase in volume is driving the demand for medical automation systems to avoid mismanagement, ensuring accurate data handling and quicker access to essential information.

To Understand More About this Research: Request a Free Sample Report

The medical automation market is expected to grow significantly due to technological advancements. Innovations in areas such as robotics, artificial intelligence, and machine learning are transforming healthcare processes, making them more efficient and accurate. In April 2024, Augmedix launched Augmedix Go, a generative AI-powered medical documentation product aimed to automate time-consuming documentation during the point of care. These technologies are expected to reduce the risk of human error and speed up processes, leading to an increase in the adoption of medical automation software during the forecast period.

Medical Automation Market Driver Analysis

Growing Adoption of Telemedicine

The increasing use of telehealth is driving the demand for automated systems to manage patient data and facilitate virtual consultations. According to the Centers for Disease Control, 37% of adults in the US utilized telemedicine in 2021, indicating a significant shift toward remote healthcare. More individuals are turning to telemedicine for its convenience and accessibility, which is consequently increasing the demand for advanced medical automation solutions. Thus, the medical automation market is growing due to the growing shift toward telemedicine services.

Rising Prevalence of Chronic Disease Among Elderly Population

The growing number of elderly patients requiring complex interventions and managing long medical data are creating a higher demand for automated systems. According to the National Institute of Library in India, ∼21% of older adults report having at least one chronic condition, which underscores the need for efficient healthcare solutions. Additionally, the growing focus on effective management of documentation during the point of care of the elderly population is propelling the automation software demand. Therefore, the rising prevalence of chronic diseases among the elderly population boosts the medical automation market expansion.

Medical Automation Market Segment Analysis

Medical Automation Market Breakdown by Type Outlook

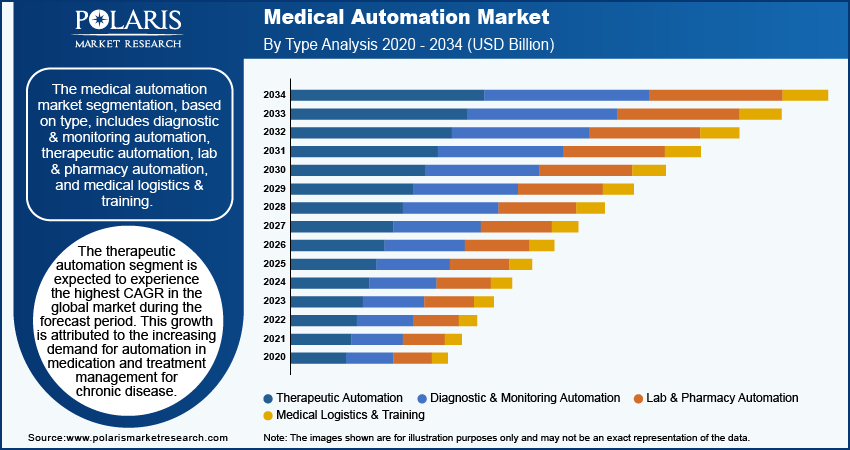

The medical automation market segmentation, based on type, includes diagnostic & monitoring automation, therapeutic automation, lab & pharmacy automation, and medical logistics & training. The therapeutic automation segment is expected to register the highest CAGR in the global market during the forecast period. This growth is attributed to the increasing demand for automation in medication and treatment management for chronic disease. Chronic disease management requires complex dosing and treatment structures. Healthcare providers utilize medical automation to ensure accurate medication dosing and to reduce the risk of errors in treatment. Therefore, the growing adoption of automation in medication and treatment management is leading to the growth of the global market for the therapeutic automation segment.

Medical Automation Market Breakdown by End Use Outlook

The medical automation market segmentation, based on end use, includes hospitals and diagnostics, pharmacies, research labs & institutes, and others. The hospital and diagnostics segment dominated the market in 2024. Hospitals are backed with a large number of resources, such as skilled professionals, to handle the complex system, which has raised the adoption of automation systems. Additionally, increases in capital investments are boosting the demand for medical automation systems in hospitals, leading to segmental dominance in the medical automation market.

Medical Automation Market Breakdown by Regional Outlook

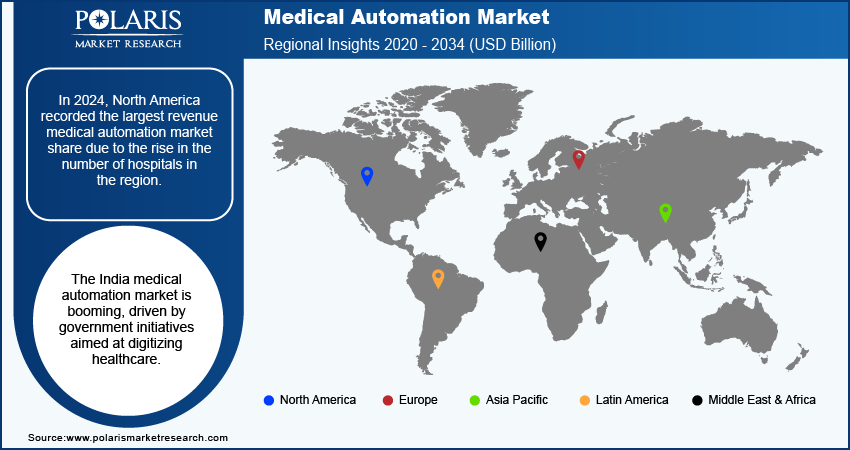

By region, the study provides the medical automation market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America held the largest revenue share in the market due to the rise in the number of hospitals in the region. According to the American Hospital Association, currently 6,120 hospitals are operating in the US, highlighting the significant expansion in hospitals. Additionally, growing hospital admissions are propelling the demand for medical automation systems for the management of complex surgeries and chronic diseases, leading to the medical automation market growth in North America.

The Asia Pacific medical automation market is experiencing significant growth due to an increase in government spending on healthcare. Government spending is aimed at improving treatment methods to reduce errors, thereby driving the demand for medical automation systems. According to the World Bank Group, Japan spends 10.8% of its GDP on healthcare, highlighting the large portion of government spending on healthcare.

The medical automation market expansion in India driven by government initiatives aimed at digitizing healthcare. The government, through various initiatives, is investing in digital health software, such as telemedicine and electronic health records, to improve accessibility and efficiency, due to which the demand for medical automation systems is rising. According to the Government of India, in August 2020, the country launched the National Digital Health Mission (NDHM) to provide an ecosystem for digital transformation. Additionally, the combination of policy support and technological advancements in telemedicine propels the medical automation market growth in India.

Medical Automation Market – Key Players and Competitive Insights

The medical automation market is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers and acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the industry by introducing innovative formulations to meet the demand of end users. This competitive environment is amplified by continuous progress in product offerings. A few major medical automation market players are Accuray Incorporated; Tecan Trading AG; Medtronic; Swisslog Holding AG; GE Healthcare; Intuitive Surgical Operations, Inc.; Stryker; Siemens; Koninklijke Philips N.V.; Danaher Corporation; and Zimmer Biomet.

Medtronic Plc is a medical device company with substantial capital investment and advanced research facilities. The company offers a wide range of medical devices for advanced surgeries, cardiac rhythm, cardiovascular diseases, diabetes, digestive and gastrointestinal diseases, as well as other common and rare conditions that require insulin pump, surgical robotics, surgical tools, patient monitoring systems, and cardiac devices. Medtronic operates globally, including in major countries such as the US, Canada, Australia, India, Japan, Germany, and other Asian countries. On February 2023, Medtronic's lifecycle management was automated to enhance patient engagement, marking a significant advancement in medical automation. This initiative aimed to streamline processes and improve interactions between healthcare providers and patients suffering from cardiovascular disease.

GE Healthcare Technologies, Inc., headquartered in Chicago, Illinois, is an American medical technology company specializing in diagnostic imaging and healthcare solutions. GE Healthcare operates in over 160 countries. The company's product portfolio is categorized into four primary segments—imaging, ultrasound, patient care solutions, and pharmaceutical diagnostics. In the imaging segment, GE Healthcare offers technologies such as magnetic resonance imaging (MRI), computed tomography (CT), ultrasound, and x-ray systems. The ultrasound segment features a range of solutions for various applications, including general imaging, cardiology, and women's health, with products such as the LOGIQ and Voluson series. The patient care solutions segment focuses on critical care environments, providing tools such as anesthesia delivery systems and patient monitoring solutions. Additionally, GE Healthcare manufactures imaging agents in its pharmaceutical diagnostics segment.

Key Companies in Medical Automation Market

- Accuray Incorporated

- Tecan Trading AG

- Medtronic

- Swisslog Holding AG

- GE Healthcare

- Intuitive Surgical Operations, Inc.

- Stryker

- Siemens

- Koninklijke Philips N.V.

- Danaher Corporation

- Zimmer Biomet

Medical Automation Industry Developments

September 2024: Abbott launched GLP systems track to enhance laboratory automation to address the rising diagnostic demands in India. These systems were installed in various cities to improve efficiency, reduce operational costs, and enhance patient care quality through streamlined workflows.

October 2023: Honeywell launched product quality review automation software for medical product manufacturers to simplify the annual product quality review process. This solution was designed to improve data collection and integrity, transforming a complex task into an efficient decision-support tool.

Medical Automation Market Segmentation

By Type Outlook (USD Billion, 2020–2034)

- Diagnostic & Monitoring Automation

- Therapeutic Automation

- Lab & Pharmacy Automation

- Medical Logistics & Training

By End Use Outlook (USD Billion, 2020–2034)

- Hospital and Diagnostic

- Pharmacy

- Research Labs & Institute

- Others

By Regional Outlook (USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Medical Automation Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 52.15 Billion |

|

Market Size Value in 2025 |

USD 56.87 Billion |

|

Revenue Forecast by 2034 |

USD 126.48 Billion |

|

CAGR |

9.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report End User |

|

|

Customization |

Report customization as per your requirements with respect to countries, Regions, and segmentation. |

FAQ's

The medical automation market size was valued at USD 52.15 billion in 2024 and is projected to grow to USD 126.48 billion by 2034.

The global market is projected to register a CAGR of 9.3% during 2025–2034.

North America accounted for the largest share of the global market in 2024.

A few key players in the market are Accuray Incorporated; Tecan Trading AG; Medtronic; Swisslog Holding AG; GE Healthcare; Intuitive Surgical Operations, Inc.; Stryker; Siemens; Koninklijke Philips N.V.; Danaher Corporation; and Zimmer Biomet.

The therapeutic automation segment is expected to experience a significant CAGR in the global market during the forecast period due to the increasing demand for automation in medication and treatment management for chronic disease.

• The hospital and diagnostics segment dominated the market in 2024 due to the availability of resources, such as skilled professionals to handle the complex system.